A pip is one of the most basic concepts in Forex trading, and it is essential that traders understand what a pip is before they start trading.

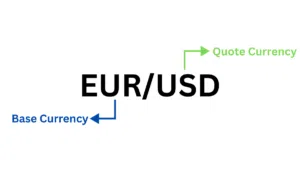

Forex trading involves the buying and selling of currencies, which are expressed as pairs. One currency is the base currency and the other is the quote currency, displayed as:

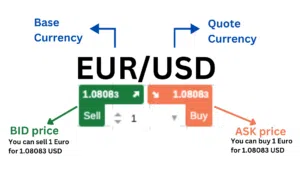

As strange as it sounds, you don’t have to own the currency in order to sell it. When you sell a currency pair, you are buying the quote currency. In the case of the EUR/USD, the EURO is the base currency and the USD is the quote currency. When you buy the EUR/USD, you are buying the EURO because you think the EUR will rise in relation to the USD. And when you sell the EUR/USD, you are buying the USD because you believe the EURO will fall in relation to the USD. The numbers you see next to or below the EUR/USD are the bid and ask prices and represent the exchange rate.

The unit of measurement to express the change in value between two currencies is called a “pip.”

What is a pip?

Pip is an abbreviation for point in percentage and the smallest change in value a currency (or the exchange rate between the two currencies) can make. In most FX pairs, a pip is equivalent to a single-digit move in the fourth decimal point of a currency pair’s price. For example, if EUR/USD moves from 1.0717 to 1.0718, it has moved up one pip.

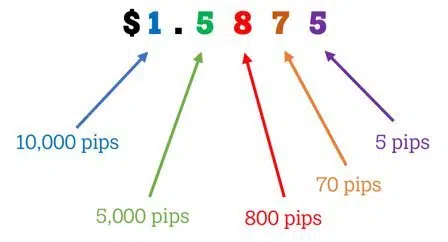

Take a look at the following image:

In this example, the GBP/USD is trading at 1.5875, which means that one pound is worth $1.5875. Here is an example of how a price movement of 1 pip (up or down) would influence the price of the EUR/USD:

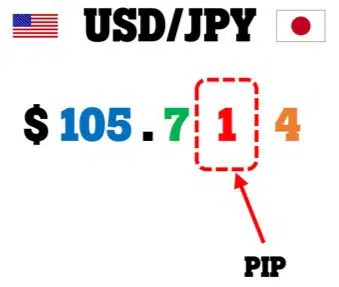

One important exception to this rule is where the Japanese yen (JPY) is the quote currency (or the second currency pair). Here, a pip is equivalent to a single-digit move in the second decimal point. Look at this example:

This is because the yen is worth comparatively little to other major currencies.

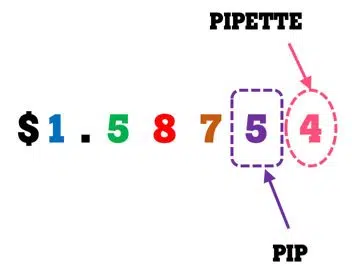

Pips, Points, and Pipettes

Most forex brokers use a 5-decimal quotation system on pairs like the GBP/USD, EUR/USD, USD/CAD, etc. The fifth decimal place denotes 0.1 or 1/10 of a pip, which is also called a pipette or a point. Here is a visual example:

How are pips used?

Essentially, pips reflect the fluctuations in the quoted value of a trading position. To illustrate, let’s consider a scenario: Suppose you purchased a currency pair at a rate of 1.1356 and later sold it at 1.1360. This change in rate signifies a gain of 4 pips in your trade. To determine the monetary value of this gain, you would need to calculate the worth of a single pip and then multiply it by the size of your trading lot, resulting in the dollar value of your profit.

How to calculate Forex pip value

A pip is worth 0.0001 (or 0.01%) of a single unit of the quote currency. That means you have to trade 10,000 units of the base currency to earn one unit of the quote for each pip movement. The amount of the base currency you trade is known as your lot size.

For example, if you trade 10,000 USD worth of EUR/USD (where the USD is the quote currency), then each pip movement would be worth 1 USD. If you were trading one lot of EUR/USD, then each pip movement of EUR/USD would equal 10 USD.

To keep it simple for now, let’s assume the base currency of your trading account is the US dollar and you’re trading micro lots (0.01 lots). Let’s look at three different types of currency pairs:

- Currency pairs wherein the US dollar is the quote (2nd) currency.

For example, the EUR/USD, GBP/USD, AUD/USD, and the NZD/USD. With each of these pairs, the pip value is always 0.10 USD for a micro lot (0.01 lots).

How do we know this? The pip value on these pairs is situated in the fourth decimal place at $0.0001. The volume of a micro lot is 1,000 units of the currency pair. To calculate the lot size in U.S. dollar, multiply the volume (1000) by the pip value ($0.0001) to get $0.10:

1000 x 0.0001 = 0.1 USD or 10 US Cents

- Currency pairs wherein the U.S. dollar is the base (1st) currency

For example, the USD/JPY, USD/CHF, USD/ZAR, USD/CAD, USD/NOK, USD/SEK, etc. In this case, the pip value in USD is not constant but fluctuates with the exchange rate.

With pairs like these, you can take the following steps:

- Calculate the pip value in the quote currency (the second currency).

- Convert this pip value to the US dollar with the exchange rate of that pair.

Here is an example of how to calculate the pip value of the USD/JPY when the exchange rate is 125.00 Japanese yen for one U.S. dollar:

Step 1: One micro lot is 1,000 units of the pair. This is the volume. With the USD/JPY, a pip is situated in the second decimal place at 0.01. To calculate the pip value in yen, multiply the volume (1000) by the pip value (0.01) to get 10 yen.

Step 2: Convert the pip value of 10 yen to the equivalent U.S. dollar value by dividing 10 yen by the current exchange rate of 125.

10/125 = 0.08 U.S. dollars per pip.

- Pairs that don’t contain the U.S. dollar

For example, the EUR/JPY, GBP/JPY, EUR/NZD, CAD/JPY, CHF/JPY, EUR/SEK, EUR/GBP, etc.

With pairs like these, you can take the following steps:

- Calculate the pip value in the quote currency (the second currency)

- Convert this pip value to the US dollar with the specific currency pair that combines the USD and the quote currency of the pair you’re trying to get the pip value of.

Here is an example of how to calculate the pip value (in USD) of the GBP/NZD when the exchange rate is 1.95000 New Zealand dollar for one British pound and the NZD/USD exchange rate is 0.70000:

Step 1: One micro lot is 1,000 units of the pair. This is the volume. With the GBP/NZD, a pip is situated in the fourth decimal place at 0.0001. To calculate the pip value in NZD, multiply the volume (1000) by the pip value (0.0001) to get 0.10 NZD. Because the NZD is the quote currency, the pip value remains constant at 0.10 NZD.

Step 2: Convert the pip value of 0.10 NZD to the equivalent U.S. dollar value. To do this, keep in mind that we now need the NZD/USD exchange rate to determine how many U.S. dollars we can get for 0.10 New Zealand dollars.

The NZD/USD exchange rate is 0.70000 USD for one NZD, which means that our pip cost of 0.10 NZD is equal to 0.07 US dollars. (We simply multiply 0.1 by 0.7).

Can you see that the GBP/NZD exchange rate doesn’t affect its pip value in USD but that the pip value in USD is determined by the NZD/USD exchange rate? Keep in mind that with some other pairs, the calculation is different if the USD is not the quote currency in the secondary currency pair (the pair used in step 2).

Conclusion

Price fluctuations in the currency market are measured in pips. It is the smallest movement the exchange rate can make. When trading, this movement determines whether a trader makes a profit or loss at the end of the day. Knowing what a pip is and how to calculate pip values are therefore valuable to you as a trader.