-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Capital Index Broker Review

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | FCA, BaFin, Fi, SCB |

| 💵 Trading Cost | USD 14 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Forex, Indices |

Last Updated On March 18, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Capital Index

Founded in 2014, Capital Index appeals to traders looking for a well-regulated MT4 broker with a substantial Forex offering and a low deposit entry-level account with no commissions.

A multi-asset broker, Capital Index offers trading on commodities, indices and 53 Forex pairs, including majors, minors, and exotics. Minimum deposits start at 100 USD on its entry-level Advanced Account, but spreads average at 1.4 pips on the EUR/USD, which is wider than other similar brokers. Spreads tighten to 1.0 pips (EUR/USD) on its Pro Account, but this is in exchange for a minimum deposit of 10,000 USD, putting it out of the reach of most traders.

Although Capital Index is an MT4-only broker, it provides fast execution and allows all trading strategies, including hedging, scalping, and algorithmic trading. A significant drawback is that Capital Index provides a limited selection of educational and market analysis materials, making it a poor choice for beginner traders.

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | FCA, BaFin, Fi, SCB |

| 💵 Trading Cost | USD 14 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Tight spreads

- Fast and free withdrawals

- Wide range of assets

Cons

- Limited platform choice

- Limited education

- No swap-free account option

Capital Index Overall Rating

Capital Index is regulated by the FCA, CySEC, and SCB. It focuses on commodities, indices, and 53 Forex pairs including majors, minors, and exotics. The platform’s entry-level account has a 100 USD minimum deposit, and average spreads at 1.4 pips on EUR/USD, relatively wide compared to other similar brokers. For those seeking tighter spreads, the Pro Account offers 1.0 pips on EUR/USD but requires a substantial minimum deposit of 10,000 USD. Also, the lack of educational content restricts its appeal, especially for beginners. Considering these factors, FxScouts rates Capital Index 3.88 out of 5.

Is Capital Index Safe?

Founded in 2014 and headquartered in the United Kingdom, Capital Index is an international financial broker offering CFD trading and spread betting.

It is authorised and regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Securities Commission of Bahamas (SCB). See below for more details:

- Capital Index has been regulated by the FCA licence 709693 since 2015.

- Capital Index (Global) Limited is authorised and regulated by the Securities Commission of the Bahamas (registration number SIA-F199).

- Capital Index (Cyprus) Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission (Licence number 249/14.

South Africans will be trading under the subsidiary, Capital Index (Global), authorised and regulated by the Securities Commission of the Bahamas (SCB).

Recently, the SCB tightened its restrictions on CFD trading to better protect traders. As a result, Capital Index clients in South Africa will have a leverage limit of 200:1 (from 500:1) for Forex trading and will be provided negative balance protection, meaning that traders can never lose more money than they have in their trading accounts. Additionally, because the SCB banned all marketing tactics, Capital Index clients will not be offered any promotions or bonuses. Brokers regulated by the SCB will also need to ensure a retail client account’s net equity does not fall below 50 percent, and in line with this requirement, Capital Index sets its Stop Out levels at 50%.

Overall, considering the strong international regulation, and robust internal processes, Capital Index is considered a safe and trustworthy broker.

Trading Fees

Capital Index’s trading fees are higher than other similar brokers.

Unlike other brokers that offer at least three trading accounts, Capital Index offers two commission-free accounts with tighter spreads linked to higher minimum deposits.

Capital Index publishes the average spreads associated with each account alongside the various financial assets on its website.

Capital Index’s accounts were assessed to compare the costs to those of other forex brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spreads and commission.

When making this calculation, we used one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As you can see from the table above, trading costs are included in the variable spreads, which widen or tighten depending on trading volume and market volatility.

The trading costs on the Pro Account are lower than those of Advanced Account, but the Pro Account requires a minimum deposit of 10,000 USD, putting it out of the reach of most traders.

Additionally, the costs on both accounts are higher than the average charged by other brokers, which tend to be around 9 USD per lot of EUR/USD traded.

Swap Fees

Another important cost to consider is the swap rate charged on positions held overnight. Interest is paid (or received) for each night a position is held. The exact charge is based on the underlying rates charged by our liquidity providers plus a mark-up of 2% for long positions and mark-down of 2% for short positions. For example, the current swaps on the EUR/USD for a long position are -8.66712, and for a short position are -5,031.

Overall, the trading fees at Capital Index are higher than average on both of its account options.

Non-trading Fees

Capital Index’s non-trading fees are lower than other similar brokers.

Capital Index does not charge account, deposit, or inactivity fees, and only charges for withdrawals under certain circumstances.

A fee of 15 EUR/GBP/USD will be charged for same-day bank transfers.

Overall these non-trading fees are low for an industry where fees are charged for almost every transaction.

Opening an Account at Capital Index

The account opening process at Capital Index is quick and fully digital.

All South African residents are eligible to open an account at Capital Index but have to meet the following minimum deposit requirements:

- Advanced Account: 100 USD

- Pro Account: 10,000 USD

Creating an account is easy, the process is fully digital, and accounts are usually ready within one day. Capital Index offers individual, joint, and corporate accounts, but we will focus on opening an individual account:

- New traders will have to click on the “Create Account” button at the top of the page where they will be directed to fill in their personal details (including name, email address, nationality, and telephone number).

- Next traders will have to fill in details regarding their physical address and country of residence.

- Once this step is complete, clients are required to fill out a questionnaire that helps Capital Index assess the trader’s investment knowledge, experience, and expertise to deem the suitability and relevance of the services on offer. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- Traders are then required to fill out a form regarding their financial status.

- Once this step is complete, traders are required to create a password, choose their preferred base currency (click here for more on capital Index’s base currencies), and trading product type (either Forex or CFDs).

- Capital Index requires at least two documents to accept you as an individual client:

- Proof of Identification – Capital Index accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the trading account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

After the application is approved, traders can login and fund their accounts We advise that you read Capital Index’s risk disclosure, customer agreement, and terms of business before you start trading.

Overall, Capital Index’s account-opening process is fully digital and accounts are generally ready for trading within one business day.

Capital Index Account Types

Capital Index offers a limited number of trading accounts compared to other large international brokers and its accounts are more suitable for beginner traders.

An STP/ECN Capital Index offers trading on multiple assets, including Forex, indices, and commodities (click here for more on Capital Index’s tradable assets).

Capital Index offers trading on two live commission-free accounts, with higher minimum deposits linked to tighter spreads. With a minimum deposit of 100 USD, the Advanced Account is suitable for beginner traders.

We define beginner traders as inexperienced traders who have never traded before or have been trading for less than a year. Beginners often do not want to risk trading large sums of money, and will generally not be able to trade full-time during the workweek.

Experienced traders generally prefer paying higher minimum deposits and a commission per trade in exchange for tighter spreads. While Capital Index’s Pro Account is geared towards more experienced traders with a minimum deposit of 10,000 USD, the spread of 1.0 pips (EUR/USD) is far less competitive than what is on offer at other brokers.

In line with the SCB regulatory requirements, leverage is restricted to 1:200 (from 1:500) and minimum trade sizes vary depending on the instrument chosen. Accounts are denominated in GBP, EUR, and USD (click here for more on base currencies), and Capital Index allows all trading strategies, including hedging, scalping, and copy trading.

Capital Index also offers Islamic swap-free accounts, which incur a handling fee of 5 USD per night, charged every third night for open positions on major pairs like the EUR/USD, but varies according to the instrument being traded. This information is not published on Capital Index’s website, and traders can contact customer support for more details on swap-free accounts.

Advanced Account

The minimum deposit on the Advanced Account is 100 GBP/EUR/USD and spreads start at 1.40 pips on the EUR/USD, which is much wider than the spreads on other brokers’ entry-level accounts.

Pro Account

The minimum deposit on the commission-free Pro Accounts is 10,000 GBP/EUR/USD. Spreads average at 1.0 pips on the EUR/USD, which is also wider than the those found at other brokers.

Demo Account

Prospective traders can open an MT4 demo account that comes loaded with virtual currency. Demo accounts are a great way to familiarise oneself with the markets and practice trading strategies.

Deposits & Withdrawals

Capital Index offers a limited number of funding methods compared to other similar brokers and its processing times are slow.

In line with Anti-Money Laundering policies, deposits and withdrawals at Capital Index cannot be made to/from third-party accounts. No deposit or withdrawal fees are charged on any of the payment methods and payments can be made via bank wire transfer and credit or debit cards. See below for details:

- Bank Wire Transfers: No fee is charged, and deposits and withdrawals take an average of 3 – 5 days to be processed. If requested, a Bank Transfer can be processed on the same day, but an expediting fee of 15 GBP/EUR/USD will be charged.

- Credit/Debit cards: Deposits are instant and free, but withdrawals may take 3 – 5 to reach your account.

Base Currencies (Trading Account Currencies)

Capital Index offers a limited number of base (trading account) currencies compared to other similar brokers.

Trading accounts can only be denominated in three base currencies – EUR, USD, and GBP, which is limited compared to other brokers. Most other brokers denominated accounts in at least five to ten currencies. Additionally, Capital Index does not offer ZAR trading accounts, which is a disadvantage for South Africans who will likely have bank accounts denominated in ZAR, and who will have to pay currency conversion fees on deposits and withdrawals.

For traders that trade in large volumes (more than 10 lots a month), it is better to open an account denominated in USD at a digital currency bank, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with a ZAR account, there will be a small conversion fee for every trade made.

Overall, Capital Index offers fewer trading account currencies than most other large international brokers and doesn’t offer accounts denominated in ZAR.

Trading Platforms

Capital Index’s platform support is severely limited compared to other similar brokers.

While most other brokers offer support for a range of platforms, including MT5, cTrader, and their own proprietary trading platforms, Capital Index only offers support for MT4. MT4 is the usual choice for traditional STP brokers, not only because it is the overall industry-leading platform but also for its high-quality execution.

Metatrader 4

Capital Index relies solely on the industry-standard MT4 platform for trading, a reliable software option founded on high-speed execution and reliable data feed imports. Users generally find the software flexible, convenient, and adaptable. A prominent feature of the MT4 platform is algorithmic trading through Expert Advisors. Trading signals and technical analysis, and vast numbers of indicators and analytical objects are also fed into the platform, offering traders a vast amount of trading support on one easy-to-use platform.

Features of Capital Index’s MT4 platform include:

- Customisation to the trader’s style.

- Trading from the charts

- One-click trading

- Complete suite of trading tools and operations

- MarketWatch

- The creation, modification, and utilisation of automated trading strategies.

- Superior charting tools in nine timeframes.

- Technical Analysis with over 50 technical indicators.

- Algorithmic trading, which allows any trading strategy to be formalised and implemented as an Expert Advisor.

While MT4 has great customizability, the platform feels outdated, and some of the features may be hard to find. In addition, only the basic orders are available, including Market, Limit, Stop, and Trailing Stop. However, the benefit of Capital Index offering such a popular third-party platform is that traders can take their own customised version of MT4 with them should they choose to migrate to another broker.

Mobile Trading

Capital Index’s mobile platform support is limited compared to other brokers.

Capital Index offers support for the MT4 mobile trading apps for Android and iOS. Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Trading Tools

Capital Index offers virtually no trading tools. Most other brokers offer a range of trading tools, including various technical analysis tools such as Autochartist or Trading Central, or VPS services to help prevent downtime and improve execution speeds. Capital Index only offers a basic Economic Calendar.

Capital Index’s Financial Instruments

Capital Index’s range of tradable instruments is severely limited compared to other similar brokers, with no specialty CFDs such as shares or cryptocurrencies.

Capital Index’s range of financial instruments for CFD trading (click here for more details on CFD trading), includes Forex, commodities, and indices.

- Forex: Capital Index has over 53 currency pairs available for trading, a broader range than is available at other similar brokers, including majors (EUR/USD, GBP/USD, and USD/JPY), minors (CAD/CHF, CAD/JPY, and USD/SGD), and exotics. The leverage on Forex pairs is up to 200:1.

- Indices: A limited range compared to other brokerages, there are 11 indices available for trading at Capital Index. These include the US30, UK 100, Germany 30, & the SP500. Leverage is up to 1:100 on indices.

- Commodities: Capital Index offers trading on 5commodities, also limited compared to most other brokers. Commodities include metals such as gold and silver, and energies such as natural gas and oil. Leverage is up to 1:200 on commodities.

Overall, Capital Index offers a disappointing range of tradable assets compared to other brokers, but its Forex lineup is decent.

Capital Index for Beginners

Although we feel that Capital Index caters more to beginners than experienced traders with its low deposit Advanced Account, its educational and analysis materials are minimal, forcing beginners to self-educate with other third-party materials.

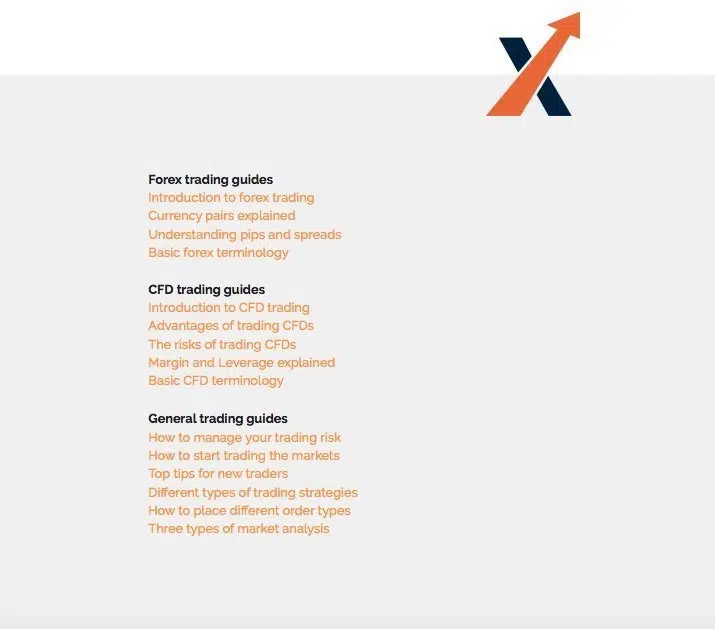

Educational Material

Capital Index offers little in the way of educational materials to get new traders started.

Capital Index only offers a selection of basic trading guides. These guides introduce traders to basic trading concepts like currency pairs, risk management, leverage and margin, top tips for new traders, and order types. Capital Index leaves the advanced trading education, videos, and webinars to other brokers.

Analysis Material

As with the educational material, Capital Index produces in-depth reporting every month, but nothing significant comes from its analysts.

Customer Support

Capital Index’s customer support is average compared to other brokers.

Customer support is available 24/5 via telephone, email, and live chat in English and Russian. A robust complaints procedure is in place, as per regulation, and the customer support team operates under a mantra of treating clients fairly.

For the purposes of this review, we found the customer support polite and responsive.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Capital Index offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Capital Index Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Capital Index would like you to know that: CFDs and spread bets are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs and spread bets with this provider. You should consider whether you understand how CFDs and spread bets work and whether you can afford to take the high risk of losing your money.

Overview

Capital Index is a traditional well-regulated broker with a limited range of tradable assets that only offers support for the MT4 platform. Its account choices are also limited, with a low deposit Advanced Account with wide spreads and a high deposit Pro Account with tighter spreads. However, the trading costs of both accounts are above the industry average. Capital Index also offers no trading tools, and with virtually no analysis or educational materials available, traders are forced to self-educate elsewhere. Overall, it feels as if Capital Index has not kept up with the developments in the industry. It is a rather disappointing broker, with little to offer beginners or more advanced traders.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Capital Index stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.