-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

FP Markets Broker Review

Last Updated On March 20, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on FP Markets

FP Markets is a well-regulated Forex broker with two low-cost, low-minimum deposit accounts, and a range of excellent trading tools and trading platforms. We were also impressed with how easy the FP Markets Trading App was to use and the quality of FP Markets’ customer service.

In terms of fees, FP Markets has an “ECN pricing” model, which it claims provides “extremely competitive” costs. Unfortunately, we found that the fees on its standard trading accounts were higher than most of its ECN competitors. But FP Markets does make it easy for beginners to get started, with 100 AUD minimum deposits and unlimited demo accounts.

We are also impressed that in addition to MT4, MT5, and cTrader, TradingView is also available. FP Markets is now one of a handful of brokers that has such a good platform offering. TradingView has been added in January 2024 and we believe it brings a lot of advantages to an already comprehensive tech portfolio.

South African traders will also be pleased to note that as of January 2023, FP Markets acquired a licence from the national authority, the Financial Sector Conduct Authority (FSCA), and will soon be onboarding clients through this entity. This means that SA client funds will be segregated at South African banks, and that traders benefit from local protection.

| 🏦 Min. Deposit | AUD 100 |

| 🛡️ Regulated By | ASIC, CySEC, FSCA, CMA |

| 💵 Trading Cost | USD 7 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, cTrader, IRESS |

| 💱 Instruments |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Trusted since 2005 with top-tier regulation

- 100 USD minimum deposit amount

- Supports MT4 MT5 cTrader and TradingView

- Spreads start at 1.0 pip and narrow to 0 pips with higher trading volumes

- Welcoming South African traders with specific regulatory compliance

Cons

- Notably higher withdrawal fees than competitors

- Stock CFDs are Limited on MT4/MT5 and primarily available through IRESS

- High leverage up to 500:1

- posing risks for inexperienced traders

Is FP Markets Safe?

A popular and well-regulated broker, FP Markets has a very high trust rating and has been a reliable trading partner for South African traders since 2005. We were pleased to find it is now FSCA-licenced as of December 2023.

FSCA Regulation: As of December 2023, FP Markets (Pty) Ltd is now a Financial Services Provider authorised and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa (FSP Number 50926). This is quite an achievement considering the complex South African regulatory environment.

While FP Markets is in the process of setting up its South African-regulated entity, clients in South Africa will be trading with First Prudential Market, registered in Seychelles (Seychelles FSC). The Seychelles FSC is an offshore regulator but requires Forex brokers to segregate client funds from their own and submit to frequent audits.

Safety Features: FP Markets segregates all funds from the company’s operating capital at AA-rated Australian banks and provides negative balance protection to all its clients.

While South Africans may be apprehensive about trading under the Seychelles-regulated entity, FP Markets’ subsidiaries in Australia and Europe are also regulated by ASIC and CySEC, which are both top-tier authorities. Its awarding of an FSCA licence also means that it is committed to providing a secure environment for South African traders. Additionally, FP Markets offers its clients account statements that external audit firms regularly audit.

Company Details

![]()

![]()

FP Markets’ Trading Instruments

We were disappointed that most FP Markets’ stock CFDs are only available on the IRESS trading platform (only through the ASIC-regulated entity). Traders using the MT4 and MT5 platforms will find their options limited.

Stock CFD Trading: Traders looking for stock CFDs will face a tough choice. FP Markets offers 10,000+ stock CFDs, but most of these are only available on the IRESS trading platform, a sophisticated direct market access (DMA) platform that beginner traders may find intimidating (and not available for South African traders). With our MT5 and cTrader trading accounts, we had about 1000 stocks to trade, which isn’t terrible, but with our MT4 account, this was limited to just 8. This makes sense given MT4’s focus on Forex trading, but it may catch some traders by surprise.

Forex and Cryptocurrencies: Forex traders will be happy with FP Markets’ 60+ currency pairs, but it only has 11 cryptocurrencies to trade. Until December 2021, FP Markets had just 4 cryptocurrencies, so expect more to be added soon, given the interest in all things crypto.

Full List of Instruments and Leverage:

![]()

![]()

- Forex: FP Markets has over 60 currency pairs available for trading, which is a broader range than is offered at other CFD providers, including majors (EUR/USD, GBP/USD, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics.

- Share CFDs: FP Markets offers 10,000 share CFDs, which is a wider range than most other brokerages, but this is only on the IRESS platform (unavailable for South African traders). There are 1000 share CFDs available on MT4/MT5. The selection available includes some of the major US, UK, and European Exchanges.

- Indices: Limited compared to other brokerages, there are only 14 indices available for trading at FP Markets. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

- Commodities: FP Markets offers trading on a range of commodities, including metals such as gold, silver, lead, zinc, nickel and copper, energies such as natural gas and oil, and softs such as cotton and wheat.

- Cryptocurrencies: FP Markets offers only 11 cryptocurrencies for trading, including Bitcoin, Ethereum, Litecoin, and Ripple, which is a limited range than is available at other brokers.

FP Markets offers a limited range of instruments on the MT4, MT5, cTrader and TradingView trading platforms. But this range expands massively on the IRESS trading platform. FP Markets also has more Forex pairs than is usually available at other brokers.

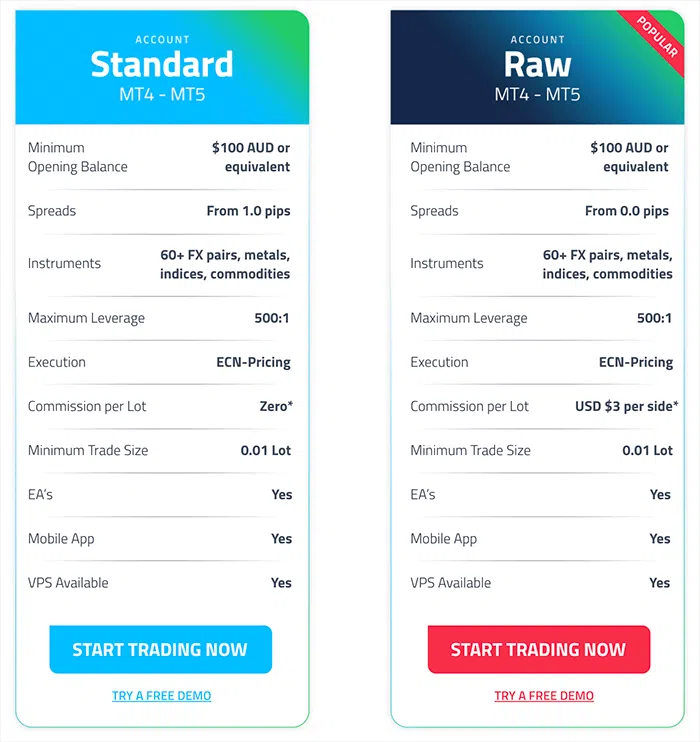

Accounts and Trading Fees

FP Markets has two standard accounts and three IRESS accounts. Fees on the standard accounts are generally low compared to other brokers. The IRESS accounts have much higher minimum deposits and are more suited to serious stock traders.

Trading Fees: The Standard and Raw Metatrader accounts require a minimum deposit of 100 USD and have trading costs around or below the industry average. The three IRESS Accounts have much higher minimum deposits: Starting at 1000 USD for the Standard Account and up to an eyewatering 50,000 USD for the Premier Account. These accounts are aimed at experienced or professional stock traders and will charge commissions per trade.

Account Trading Costs:

![]()

![]()

Trading costs at other brokers tend to be around 9 USD per lot of EUR/USD, so the trading costs on the Standard Account are about average. But the costs are low on the Raw Account, which has a round turn commission of 6 USD and much tighter spreads.

Standard Account

The Standard Account is the best option if you are looking for commission-free trading. Spreads are wider than on the Raw Account, usually starting at 1.0 pip, although they can come down to 0 pips with high trade volumes. The minimum deposit is 100 AUD (or equivalent), and 60+ Forex pairs, metals, commodities, and indices are available for trading. Note that traders can’t trade on this account on the cTrader platform.

Raw Account

This account has tighter spreads (0.10 pips on the EUR/USD), but a commission of 6 USD round turn per standard lot is charged. The minimum deposit is also set at 100 AUD (or equivalent), so the only real difference between this account and the Standard Account is whether the broker’s fee is charged on the commission or in the spread, although the costs on the Raw Account are substantially lower. Raw accounts are generally more suited to scalpers and day traders. Traders can use this account to trade on cTrader.

Islamic Swap-free Accounts

Also known as swap-free accounts, Islamic accounts are ideally suited to Muslim clients, and in line with Islamic law, they incur no swaps or interest charges on overnight positions. Instead, the account holder is charged an administration fee that is deducted from the account’s balance.

How to open an Islamic swap-free account at FP Markets:

- Open a MetaTrader 4 or MetaTrader 5 account.

- Send a request to customer service to convert your account to an Islamic swap-free option.

- Include an official document showing confirmation of your faith (e.g., a Proof of Faith document from your local mosque) if the evidence is not already included in your ID document.

An admin fee of 5 USD per lot on major currency pairs is charged per night. However, fees are not charged for the first ten nights of trading and will only be applicable from the eleventh night.

Deposits and Withdrawals

FP Markets charges low deposit fees, but withdrawal fees are higher than most other brokers.

Due to Anti-Money Laundering policies, FP Markets does not accept payments from third parties and only accepts funds received directly from the named trading account holder. The first time you make a withdrawal, you must complete a downloadable form and return it with a photographic ID.

Accepted Deposit Currencies: The FP Markets client portal allows traders to deposit funds in 10 currencies, including AUD, USD, EUR, GBP, SGD, CAD, CHF, HKD, and JPY. South African traders will be disappointed that ZAR is not an option, as they will have bank accounts denominated in ZAR and will have to pay conversion fees, which may affect profitability.

High Withdrawal Fees: FP Markets does not charge fees for deposits but has high withdrawal fees for e-wallets and bank transfers:

- Visa/Mastercard: The following currencies are accepted: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, and USD. No deposit or withdrawal fees are charged. Deposits are instant, and withdrawals take up to one business day to be processed.

- Bank Transfer: The following currencies are accepted: AUD, USD, EUR, GBP, SGD, and HKD. No deposit fees are charged, and FP Markets will cover international fees up to 50 USD for deposits greater than 10,000 USD. Deposit times are one business day. A withdrawal fee of 10 AUD is charged, and withdrawals are processed within one business day.

- Neteller: The following currencies are accepted: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, and USD. No fees are charged on deposits, and deposits are instant. A withdrawal fee of 2%, up to 30 USD, and country fees (if applicable) are charged, and withdrawals are processed within one business day.

- Skrill: The following currencies are accepted: AUD, CAD, EUR, GBP, INR, and USD. No deposit fees are charged, and deposits are instant. A withdrawal fee of 1% and country fees (if applicable) are charged. Withdrawals are processed within one business day.

- Local Bank Transfer: The following currencies are accepted: EUR, USD, GBP, and local African currencies such as ZAR. No deposit fees are charged, and deposit times are one day. A 1.5% fee is charged on withdrawals, and withdrawals are processed within one business day.

- Broker-to-broker: The following currencies are accepted: AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, and USD. No deposit fees are charged, and international fees up to 50 USD for deposits greater than 10,000 USD will be covered by FP Markets.

The first time you make a withdrawal, you must complete a downloadable form and return it with a photographic ID.

Overall, FP Markets offers a wide range of funding methods, and while it does not charge any fees for deposits, its withdrawal fees are high.

Mobile Trading Apps

FP Markets has its own mobile trading app on iOS and Android, and we liked the layout and how easy it was to use. FP Markets also supports the MT4, MT5, Trading View and cTrader mobile apps.

FP Markets Mobile App

We found that the FP Markets Trading App connected to our MT4 account easily, and its clean interface made it very simple to use. It ran smoothly, even on older Android phones, and beginner traders will like the simplified layout compared to the MT4 and MT5 apps.

Key Features:

- Deposit and withdraw funds.

- Make, monitor, and review trades.

- Use the ‘Favourites’ menu to create a faster and seamless trading experience.

- Change settings via the Client Portal

- Access real-time pricing

- Conduct research and analysis using a range of trading tools

- Log in to their MetaTrader 4 account using the same credentials

MT4 and MT5 Mobile Trading

FP Markets offers support for MT4 and MT5 mobile trading apps for Android and iOS. Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

cTrader App

cTrader is one of our favourite trading platforms, and we are glad that FP Markets has added it to its offering. FP Markets is one of a handful of brokers that supports it. Its clean design makes it easy for beginners to pick up, but it also has the advanced order types and automation options required by more experienced traders. The FP Markets’ cTrader app keeps most of the best parts of the desktop version, including the complete range of order types, price alerts, trade analysis, and symbol watchlists.

TradingView

TradingView is not only a trading platform with detailed information to help you make trading decisions: it also includes one of the biggest social trading communities, with plenty of EAs (Expert Advisors) that beginner traders, or those too busy to trade manually, will appreciate. This addition to FP Markets’ tech portfolio and we believe traders of all backgrounds will enjoy TradingView access

There’s a lot you can achieve with TradingView, but these are just a few of its advantages:

- Unmatched charting capabilities, suitable for beginners and advanced traders

- Large social trading community of more than 50 million users

- The ability to design your own indicators and strategies using TradingView’s Pine Script

programming language - The option to validate trading ideas using TradingView’s bar-by-bar replay function

- Wide selection of fundamental data

- Real-time global news coverage

On the whole, the toolbox is sophisticated yet simple to use and allows traders to analyse the fast-moving global financial markets with accuracy.

Other Trading Platforms

With MT4, MT5, cTrader and TradingView all available, FP Markets offers support for more trading platforms than most brokers.

FP Markets used to only offer traders MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, each of which offers Expert Advisors, automated trading support, strategy backtesting, customisable charting, indicators, and copy trading functionality.

All platform choices are free to use, all can be downloaded to your PC or Mac, and all have web versions of the platform. Traders who want more EAs to use, and don’t mind the dated interface, should consider using one of the MetaTrader products. cTrader is often a favourite for beginner traders as it requires less setup, has a more modern interface, and offers more advanced order types.

However, that’s not all. FP Markets partnered with TradingView in January 2024, a top tool that is now available to all traders with a live account on FP Markets. From Forex, Equities and Indices to Commodities, Bonds and Digital Currencies, TradingView is a world-renowned charting provider that delivers the financial markets from one platform and unlocks the door to the largest social trading community in the world. Combining Trading View with FP Markets’ consistently tight spreads, rapid market execution, and Institutional-grade liquidity, will help FP Markets clients maximise their trading potential.

All four trading platforms offered are considered among the best in the industry. While FP Markets does not have its own proprietary desktop platform, which is usually easier for beginners to learn, the choice of any of the four major platforms will keep most traders satisfied.

Trading Platforms Comparison:

![]()

![]()

Opening an Account at FP Markets

The account opening process at FP Markets is fully digital, fast, and hassle-free compared to other brokers.

All South African traders are eligible to open an account at FP Markets as long as they meet the minimum deposit requirement of 100 AUD (or equivalent).

Creating an account is straightforward; the process is fully digital, and accounts are usually ready within one day. FP Markets offers joint and individual accounts, but we will focus on opening an individual account:

How to open an account at FP Markets:

- New traders will have to click on the “Start Trading.” button at the top of the page, where they will be directed to register an account.

- FP Markets’ intake form requires clients to fill in their personal details (including name, country of residence, email address, birth date, and level of education).

- Prospective traders are then required to select the account type, trading platform, and chosen base currency.

- Once this step is complete, traders are asked to complete a short form that will help FP Markets assess the state of their finances and trading knowledge. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- FP Markets needs at least two documents to accept you as an individual client:

- Proof of Identification – current (not expired) coloured scanned copy (in PDF or JPG format) of your passport. If no valid passport is available, a similar identification document bearing your photo such as an ID card or driving licence will work.

- Proof of Address – a Bank Statement or Utility Bill. Please ensure, however, that the documents provided are not older than 6 months and that your name and physical address is clearly displayed.

We advise you to read FP Markets’ risk disclosure, customer agreement, and terms of business before you start trading.

Once the application is approved, traders can log in and fund their accounts.

FP Markets’ account opening process is fast, generally hassle-free, and fully digital compared to other similar brokers, and accounts are ready for trading in one day.

FP Markets’ Trading Tools

FP Markets offers an excellent range of trading tools compared to other similar brokers.

FP Markets’ range of trading tools includes Autochartist, a free VPS service, MAM/PAMM accounts, Myfxbook Autotrade, and a Traders Toolbox consisting of 12 online trading tools. Most of the tools are free of charge, except for the VPS and Traders Toolbox, which require traders to deposit a minimum of 1,000 AUD (or currency equivalent).

Autochartist

Free for all FP Markets clients, Autochartist is one of the best technical analysis tools on the markets. It is an automated technical analysis tool that plugs into MT4 and MT5 and scans all available CFD markets for trading opportunities.

Autochartist’s advanced pattern recognition engine identifies the strongest potential trading opportunities and predicts future price movements. Some of Autochartist’s key features are:

- Chart pattern recognition

- Fibonacci pattern recognition

- Key level analysis

- Pattern quality indication

VPS

FP Markets offers a free VPS service to traders who deposit a minimum of 1000 USD or currency equivalent. The service is also subsidised for high-volume traders who trade over 10 lots a month on the Standard Account, or 20 lots on the Raw Account. VPS services ensure trades are never disrupted by technological or connectivity issues. Other benefits of the VPS service include:

- 24/6 VPS email support

- 24/7 Redundant power to your VPS

- 24/7 Redundant internet connectivity to your VPS

- Low latency connectivity to FP Markets trading servers for precision trading

- Uninterrupted EA trading

Trader’s Toolbox

Only available on MT4, FP Markets offers a Trader’s Toolbox to clients who deposit more than 1,000 USD or equivalent. The toolbox is a suite of 12 online trading tools, including market insights, an economic calendar with relevant breaking news that impacts market prices, risk management tools, correlation matrices, tick charts, session maps, sentiment indicators, analysis tools, and more. A few of the tools are highlighted below:

- Mini terminal: Allows traders to adapt MT4’s deal tickets and charts to their preferences with a host of highly configurable new features.

- Session Map: A map that tracks the global financial markets and an economic calendar that offers the latest key information.

- Stealth orders: This allows traders to keep their trades anonymous.

- Correlation matrix: Enables you to see how correlated your watched markets are and limit your risk accordingly.

- Sentiment trader: This allows traders to analyse market sentiment or view a historic price vs. sentiment chart.

MAM/PAMM Accounts

FP Markets offers an account management service to its clients, which allows account managers to trade on their behalf. In order to perform this service, bespoke technology or software is required, also known as MAM/PAMM.

MAM stands for Multi-Account Manager, which permits a range of customisable ways to sub-allocate trades. PAMM stands for Percentage Allocation Module Manager, which means investors can be part of a set of sub-accounts that are traded together by a money manager or trader who has permission from clients to trade on their accounts. Account Managers take a portion of the profits generated by the trades.

Managed accounts are great for beginner traders who have limited experience with trading.

Copytrading

FP Markets offers an excellent copy trading service through third-party provider, Myfxbook Autotrade, available on MT4. It allows traders to find, follow and copy successful traders automatically.

In order to use the service, traders need to open a Standard Account and make a minimum deposit of 1,000 USD. Traders are charged a service fee of an additional 0.5 pips on top of the standard spreads, which is relatively high compared to other brokers.

With Myfxbook Autotrade, traders do not need to build their own strategy or conduct research on the forex markets. This tool provides the opportunity to copy a wide selection of systems directly to FP Markets MT4 trading accounts. One of the other benefits of FP Markets’ copy trading platform is its functionality. It offers multiple copy trading modes, and there is no limit on the number of Strategy Providers that can be followed.

On the whole, copy trading is useful for traders who are interested in the financial markets but lack experience and knowledge.

FP Markets for Beginners

We expect that beginners will feel comfortable starting their trading career with FP Markets. The demo account never expires, the education section is varied, and market analysis is available both in video and article formats. Customer service is available 24/7, and we were impressed by the quality of support we received.

Demo Account

FP Markets offers a demo account that comes loaded with 100,000 virtual funds of your chosen base currency. The FP Markets’ demo accounts won’t expire unless they remain inactive for over 30 days.

Education

FP Markets’ education section is pretty good compared to most other large international brokers. However, some of it is reserved for registered clients only. The content available is suited to both beginner and more experienced traders.

FP Markets provides a range of educational materials, including ebooks, tutorials, video tutorials, webinars, and a glossary. The educational material focuses on the wider CFD industry, including tutorials on trading stocks, indices, and commodities:

- eBooks: FP Markets offers a range of comprehensive ebooks that provide detailed information on the important aspects of forex, including money management, trading systems, and volatility. Other topics include technical and fundamental analysis, along with tips on how to spot trading opportunities.

- Video Tutorials: FP Markets provides a number of videos to introduce forex traders to the MetaTrader platforms. These videos serve as a step-by-step guide for those who want to learn to trade on MT4, MT5, TradingView and cTrader.

- Glossary: The glossary provides comprehensive definitions and explanations of various financial terms.

- Webinars: FP Markets hosts regular webinars that are held by its team of in-house professional traders. The webinars cater to traders of all experience levels and include topics such as Trading Psychology, Chart Psychology, Advanced Fibonacci Strategies, and How to Backtest a Trading Strategy.

Education Comparison:

![]()

![]()

Market Research and Analysis

The market research and analysis at FP Markets is about what we would expect from a large international broker. The analysis is available in both article and video format and is published daily.

FP Markets’ analysis section covers both technical and fundamental analysis:

- Daily Report: FP publishes a daily market report covering all the financial markets and a weekly outlook (in video and text format). The daily market report is a brief look at the global markets, including commodities, indices, and Forex.

- Market Insights: FP Markets provides trading ideas for the most popular financial assets in various timeframes.

- Technical Report: A technical report is published weekly, covering the various market movements and how these affect the related financial assets. The report is in-depth and very detailed.

- Forex News: In this section, articles are published less frequently but cover all the major market events.

- Daily Analysis: Articles are published on a daily basis covering various global events and how they influence the markets.

- Currency Point: Articles are published on a weekly basis and cover the various currency movements.

Market Research Comparison:

![]()

![]()

Customer Support

Award-winning customer support is available 24/7 via live chat, email, and telephone. Weekend support is limited to 08:00 – 16:00. Support is available in Italian, English, Russian, French, Arabic, German, and Chinese.

The customer service was responsive (our questions were answered immediately), polite, and very knowledgeable.

Regulation and Trust

Regulation: Founded in 2005 and headquartered in Sydney, FP Markets is authorised and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission, the Capital Markets Authority (CMA) in Kenya and is registered in St Vincent and the Grenadines. See below for details of registered companies:

- First Prudential Markets Limited, a company authorized and regulated by the Financial Services Authority (FSA) in Seychelles with License Number SD130

- FP Markets (Pty) Ltd is now a Financial Services Provider authorised and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa (FSP Number 50926).

- First Prudential Markets Pty Ltd is authorised and regulated by ASIC,AFSL Licence 286354.

- First Prudential Markets Pty Ltd is authorised and regulated by CySEC,license 371/18.

- FP Markets LLC. is a registered company of St. Vincent and the Grenadines, Limited Liability Number 126 LLC 2019.

- FP Markets Limited has been granted a non-dealing Foreign Exchange Broker License by the Capital Markets Authority (CMA) of Kenya.

Industry Awards: FP Markets has also received extensive industry recognition, having won over 40 awards since its inception. Some of these awards include Highest Overall Client Satisfaction 2020, Best Trade Execution 2020, Best Customer Service 2020, and Best Educational Material (all from Investment Trends). FP Markets won numerous awards in 2019 for its customer service from the LiveHelpNow Challenge – an Australian Institution dedicated to recognising companies with excellent customer support.

Overall, because of its long history of responsible behaviour, ASIC, CySEC, and FSCA regulation, strict auditing processes, and wide industry acclaim, we consider FP Markets a trustworthy broker.

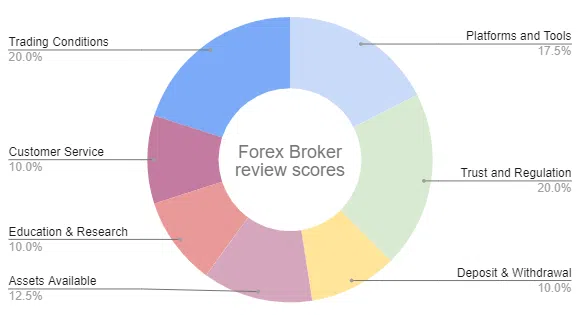

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, the broker’s platform offering, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

FP Markets Risk Statement

According to regulation, brokers are required to be transparent with Forex traders about the complexity of financial products and also disclose the extent to which traders can lose their money. FP Markets wants you to know: Contracts for Difference (CFDs) are derivatives and can be risky; losses can exceed your initial payment, and you must be able to meet all margin calls as soon as they are made. When trading CFDs you do not own or have any rights to the CFDs underlying assets.

Final Word

A well-regulated Australian broker, FP Markets offers two simple account options with low trading fees on MT4, MT5, TradingView and cTrader and an exciting set of tools for traders who deposit over 1,000 USD. FP Markets allows all trading strategies and provides good education and market analysis materials that cater to traders of all experience levels.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how FP Markets stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.