-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

FXPRIMUS Broker Review

Last Updated On May 8, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on FxPrimus

FXPRimus does NOT accept South African clients. This review is for educational purposes only.

With a strong focus on customer satisfaction, FXPrimus is renowned for its personalised customer support, free deposits and withdrawals, and provision of negative balance protection for all clients. However, trading fees on its entry-level accounts are significantly higher than other brokers.

Globally acclaimed for offering one of the fastest and most secure online trading environments, FXPrimus’s trading platform support is one of the best in the industry, with MT4, MT5, and cTrader all available. It also offers a number of trading tools, including a VPS service at an extra cost, FIX API, and premium trader tools.

FXPrimus’s entry-level accounts accommodate beginner traders with minimum deposits of 15 USD, spreads averaging at 1.50 – 1.7 pips on the EUR/USD, which is wider than other brokers, but with no commissions. Its other accounts offer very competitive spreads which will appeal to more experienced traders, but these have higher minimum deposits.

A multi-asset broker, FXPRIMUS offers trading on Forex, commodities, indices, share CFDS, and cryptocurrencies, but the number of assets in each class is limited compared to what’s available at other brokers. It also lacks in educational and market analysis content, forcing traders to self-educate with other third-party materials.

| 🏦 Min. Deposit | USD 15 |

| 🛡️ Regulated By | CySEC, VFSC |

| 💵 Trading Cost | USD 15 |

| ⚖️ Max. Leverage | 1000:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, cTrader |

| 💱 Instruments |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Tight spreads

- Wide range of assets

- Fast and free withdrawals

- Great customer support

Cons

- High commission

- Limited education

- Limited market analysis

Is FXPRIMUS Safe?

Yes, FXPrimus is a safe broker to trade with. While FXPrimus’s regulation is not as strong as that of other brokers, FXPrimus does segregate client funds from its operating capital and provides its clients with negative balance protection.

Although global clients will be trading through FXPrimus’s Vanuatu-based entity, which has less regulatory oversight than regulators of the UK or Australia, FXPrimus also maintains regulation from CySEC in Cyprus. Additionally, FXPrimus segregates its client funds from company funds and provides all traders with negative balance protection. On this basis, we consider FXPrimus a safe broker for clients to trade with. Click here for more details on FXPrimus’s regulatory oversight.

Trading Fees

FXPrimus’s trading fees are higher than average on its instant execution accounts and lower than average on its market execution accounts.

FXPrimus offers two commission-free instant execution accounts with low minimum deposits, but wide spreads, and two market execution accounts with higher minimum deposits but tighter spreads and a commission per lot traded. While FXPrimus offers three trading platforms, not all accounts are available on all three platforms (click here for more on FXPrimus’s trading platforms).

Unfortunately, FXPrimus’s fee structure is not transparent, and it does not publish the spread and commission costs associated with each account.

FxPrimus’s accounts were assessed to compare the costs to those of other brokers. The costs were evaluated based on the trading fees on one lot (100 000 USD) on the EUR/USD, including the spread and commission, as published on its accounts page.

When making this calculation, we use one lot of EUR/USD as a benchmark as it is the most commonly traded currency pair and it usually has the tightest spread.

Trading Cost Formula: Spread x Trade Size + Commission = Cost in Secondary Currency (USD):

As you can see from the table above, the trading costs on the PrimusZERO Account are lower than those of the other three accounts, but this account has a minimum deposit requirement of 1000 USD.

Trading costs on the PrimusCENT, PrimusCLASSIC and PrimusPRO accounts are higher than average – most other brokers offer trading costs of 9 USD per lot traded on their entry-level accounts. Additionally, traders should be aware that spreads are variable at FXPrimus, meaning that they will get wider or tighter depending on trade volume and market volatility.

Swap Fees

The other main trading cost to consider is the overnight swap fee. It is determined by the overnight interest rate differential between the two currencies involved in the pair and whether the position is a buy ‘long’ or sell ‘short’. Unfortunately, FXPrimus’s swap rates are not published on its website.

For the most up-to-date Forex swap rates, please refer to the Market Watch panel in the MetaTrader 4 (MT4) platform. Simply follow the steps outlined below:

-

Locate the product in the ‘Market Watch’ window. Right-click, and select ‘Symbols’.

-

Select the product to view from the list. Select ‘Specifications’.

-

Here you can view the Forex swap rates for both long and short positions.

Overall, FXPrimus has a range of accounts, two with low minimum deposits and higher-than-average trading costs and two high deposit accounts with lower trading costs. Unfortunately, FXPrimus does not publish its average spreads or swap rates on its website.

Non-trading Fees

FXPrimus’s non-trading fees are average compared to other similar brokers.

Some of the most overlooked trading costs are the non-trading fees that are charged by brokers. These fees can significantly affect your profitability and so should be carefully scrutinised.

Unlike other brokers that charge fees for deposits and withdrawals, FXPrimus absorbs these fees. It does, however, charge higher-than-average inactivity fees. For example at the end of a three-month period in which an account remains inactive, an initial fee of 30 USD will be charged, and at the end of every subsequent month that it remains inactive, a fee of 10 USD will be charged. Overall, these inactivity fees are higher than other similar brokers.

Opening a Trading Account with FXPrimus

The account opening process at FXPRimus is fast, fully digital, and hassle-free.

South African traders are not eligible to open an account at FXPrimus. However, the five-step account opening process is fully digital and accounts are generally ready for trading in one day. FXPrimus offers individual, joint, and corporate accounts, but we will focus on opening an individual account.

How to open an account at FXPrimus:

-

Click on the “Sign Up” button where you will be directed to fill in your personal details, including name, surname, physical address, country of residence, email address, telephone number, and gender.

-

Next, you will be required to fill in your account details, including trading platform, trading account type, level of leverage, and deposit currency.

-

The third step requires detailing your financial background, including your level of education, employment status, and source of funds.

-

Traders can then fund their accounts.

-

The last step is to confirm your identity. FXPrimus will need two documents from you:

-

A photo ID – this must be a government-issued ID with a photograph and your names on it, such as a valid passport, a national identification card (front and back), a driving licence, or any other government-issued form of ID. and;

-

A proof of residence – this can be a utility bill or a bank/card statement, in your name, and issued within the last 6 months.

-

We suggest you read FXPrimus’s risk disclosure, customer agreement, and terms of business before you start trading.

Compared to other similar brokers, FXPrimus’s account opening process is fast, generally hassle-free, and fully digital.

FXPrimus’s Trading Accounts

FXPrimus offers four different trading accounts, which is average compared to other brokers, and some are suitable for beginners and others for more experienced traders.

Although FXPRIMUS is a market maker, it provides STP execution and offers two ECN accounts with raw spreads derived directly from liquidity providers.

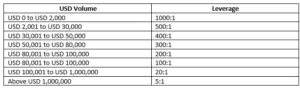

With four live accounts, trading is offered on multiple trading instruments, including forex, energies, metals, shares, indices, futures, and cryptocurrencies (click here for more on FXPrimus’s financial assets). FXPrimus offers maximum leverage of up to 1000:1, though this is on a sliding scale and leverage will decrease with the size of your trade (1:500 for trades over 1000 USD and down to 1:100 for trades over 100,000 USD). See below for more details:

FXPrimus allows all trading strategies, including hedging, scalping, and copy trading. All account-holders can access basic education material and can make use of the MT4 Premium trading tools.

Two of FXPrimus’s accounts are suitable for beginner traders. Beginner traders are inexperienced traders who have never traded before, or who have been trading for less than a year. Beginner traders often do not want to risk trading large sums of money and generally will not be able to trade full-time during the workweek.

Accounts with lower minimum deposits and which allow trading in micro-lots are generally more suited to beginner traders. Spreads on these accounts are often wider than those with higher minimum deposits. FXPrimus’ beginner-friendly Cent Account has a minimum deposit of only 15 USD and allows trading in Micro-lots. Its Classic Account also has a minimum deposit of 15 USD and wider spreads. While the minimum deposit requirements are low, most brokers will offer an average spread of 1 pip (EUR/USD) or lower on their entry-level accounts. Additionally, leverage on these accounts is up to 1000:1, which in combination with the low deposits could see traders’ accounts quickly wiped out.

In general, experienced traders tend to prefer accounts with higher minimum deposits and tighter spreads. FXPrimus’s Zero Account has a minimum deposit of 1000 USD and offers competitive spreads (0 pips EUR/USD) in exchange for a low commission, making it appealing to experienced traders. See below for more details:

- PrimusCENT Account: This account is only available on the MT4 trading platform. With a minimum deposit requirement of 15 USD, spreads start at 1.50 pips on the EUR/USD, which is wider than other similar brokers, but no commissions are charged for Forex trading. As the name suggests, this account allows trading in micro-lots or smaller trade sizes, perfect for beginner traders who don’t want to risk too much capital upfront. Leverage on this account is up to 1000:1.

- PrimusCLASSIC Account: This account is available on all three trading platforms (MT4, MT5, and cTrader). In fact, it is the only account that cTrader users can open. Like the CENT account, it is commission-free and has a minimum deposit requirement of 15 USD, but spreads that start at 1.7 pips on the EUR/USD. This is a disadvantage for traders who prefer to use the cTrader platform, as there is no account choice. Leverage is up to 1000:1 on this account.

- PrimusPRO: Available on both the MT4 and MT5 platforms, this account has a minimum deposit of 500 USD. Spreads average at around 0.3 pips on the EUR/USD, but a commission of 8 USD (round turn) is charged if traders elect to use the MT5 trading platform, while traders who elect to use the MT4 trading platform are charged 10 USD per lot. Despite the higher minimum deposit, these trading costs remain uncompetitive. Leverage is up to 500:1 on this account.

- PrimusZERO: Only available on MT4, the ZERO account has a minimum deposit of 1000 USD, putting it out of the reach of most beginner traders. Spreads start at 0 pips on the EUR/USD, and it has a low commission of only 5 USD per lot traded. Overall, this is the best value account, but its minimum deposit requirement is high. Leverage is up to 500:1 on this account.

Deposit and Withdrawal Fees

FXPrimus offers a wider range of deposit and withdrawal methods than other brokers, and both deposits and withdrawals are free of charge.

A regulated broker, FXPrimus ensures that all Anti-Money Laundering rules and regulations are followed. As such, all non-profit funds are returned to the original deposit source. No matter your deposit method, the withdrawal of all profits must be made by bank transfer to a bank account in your name.

Deposits and withdrawals can be made securely at FXPrimus using major debit and credit cards, bank wire transfer, and leading payment services such as Neteller, Skrill, and Unionpay. FXPrimus does not charge deposit or withdrawal fees and absorbs the merchant fees charged by its banking institutions. However, funds received in an alternative currency to the trading account will automatically be converted into the account base currency and currency conversion fees will apply. Traders should note that funding is processed during working hours: Monday to Friday, 7:00 – 21:00 GMT+2. See below for more details:

- Banks Transfer (Bank wire and local transfers): Deposits and withdrawals are free and FXPRIMUS will cover any bank fees charged by its bank. It will not, however, cover any fees charged by your bank or any intermediary banks involved in the fund transfer. The minimum deposit and withdrawal amount for bank transfers is 100 USD and the processing time is in 2-5 business days.

- Credit Cards or Debit Cards: FXPRIMUS accepts both Visa and Mastercard and no fees are charged for deposits or withdrawals. The minimum deposit and withdrawal amounts are 100 USD. Processing time for deposits is 5 minutes or less and for and withdrawals will take about 24 hours.

- E-wallets: FXPRIMUS supports withdrawals and deposits from Bitcoin, Neteller, Skrill, Fasapay, Unionpay, and ecoPayz wallets. No fees are charged for deposits or withdrawals. Deposits will take less than 5 minutes to be processed, but withdrawals can take up to 24 hours.

Base Currencies

FXPrimus has an average range of base currencies compared to other brokers.

At FXPrimus, you can choose from six base currencies: USD, EUR, GBP, SGD, PLN, and THB, which is average compared to other brokers.

For traders that trade in large volumes (more than 10 lots a month), it is better to open an account denominated in USD at a digital currency bank, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with another currency account, there will be a small conversion fee for every trade made.

Trading Platforms

With MT4, MT5, and cTrader all available, FXPrimus offers support for more trading platforms than most other brokers.

Clients can choose between the MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. All platforms offer fast trading and advanced charting tools, including Expert Advisors, automated trading support, strategy backtesting, customisable charting, indicators, and copy trading functionality.

All platform choices are free to use and can be downloaded to your PC and all have web versions of the platform. They are also available on mobile Android and iOS devices. Note that cTrader is not available on Apple Mac operating systems.

Third-party platforms such as MT4, MT5, and cTrader are sometimes less user-friendly and more difficult to set up than the proprietary platforms available at other brokers. However, traders can take their customised versions of these platforms with them should they choose to migrate to another broker.

Metatrader 4

MetaTrader 4 (MT4) is still undoubtedly the world’s most popular trading platform for forex traders due to its ease of use, feature-rich environment, and automated trading ability. Features of FXPrimus’s MT4 platform include:

- 50+ preinstalled technical indicators

- 24 analytical charting tools

- Three chart types

- Nine timeframes

- One-click trading.

- Traders can also add custom EAs and indicators.

- Ability to trade on all the available accounts at FXPrimus

While MT4 has great customizability, the platform feels outdated, and some of the features may be hard to find. In addition, only the basic orders are available, including Market, Limit, Stop, and Trailing Stop.

MetaTrader 5

The newer version of the MetaTrader platform suite, MT5 is being adopted by more traders all the time. MT5 incorporates all of the key features of MT4 and an optimised environment for EA trading.

Features of FXPrimus’s MT5 platform include:

- 38+ preinstalled technical indicators

- 44 analytical charting tools

- Three chart types

- 21 timeframes

- Additional pending order types

- Detachable charts

- Depth of Market

- An integrated Economic Calendar

- Traders can trade on the CLASSIC and PRO accounts on MT5

cTrader

cTrader provides an added level of market analysis and access to full market depth on a fully customisable user interface. Alongside superior order execution with no dealing desk intervention, it provides one of the industry’s most innovative trading experiences. It also features a unique tool called cTrader cCopy. The tool allows traders to access the successful trading strategies of traders worldwide and duplicate them on their accounts.

Other features of FXPrimus’s cTrader include:

- 55+ preinstalled technical indicators

- Six chart types

- 28 timeframes

- Level 2 Depth of Market

- No restrictions on stop/limit levels

- Detachable charts and linked charts

- Advanced order protection

- Market sentiment

- An integrated Economic Calendar

- The ability to add custom cBots and indicators.

cTrader is one of the most beginner-friendly third-party trading platforms available. It has a modern interface, integrated educational content, and innovative risk-management features. One drawback is that traders can only open a CLASSIC account if they select the cTrader platform.

Overall, FXPRimus’s trading platform support is one of the best in the industry. However, traders can only open certain accounts on certain platforms, which is disadvantageous.

FXPrimus’s Mobile Trading Platforms

FXPrimus’s mobile trading platform support is better than other similar brokers.

All three of FXPRimus’s trading platforms are available on both Android and iOS mobile devices and tablets. Beginner traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced timeframes and fewer charting options.

However, the trading platforms are generally user-friendly and well-designed. The MT4 and MT5 mobile apps allow traders to close and modify existing orders, calculate profit and loss in real-time and allow tick chart trading.

The cTrader mobile app offers the best features available on the desktop version including the complete range of order types, trade analysis, and watchlists.

Overall, FXPrimus’s mobile apps are user-friendly and well-designed and offer most of the features available on the desktop versions.

Trading Tools

FXPrimus offers an average range of trading tools compared to other similar brokers.

FXPrimus offers support for a number of useful trading tools, including VPS hosting, premium tools to enhance the MT4 platform, PAMM Accounts, and FIX API.

VPS

The FXPRIMUS VPS Service is offered free of charge to clients that maintain equity (less credit) of 500 USD (or currency equivalent), and who trade a minimum of 5 standard lots round-trip on a monthly basis. Clients that do not meet these requirements may still use the FXPRIMUS VPS Service at a fee of 30 USD per month. The FXPrimus VPS provides optimal latency between a trader’s MT4 account and the FXPRIMUS servers.

Other benefits of FXPRimus’s VPS services include:

- It allows traders to run automated algorithmic strategies, including expert advisors 24 hours a day 7 days a week on a virtual machine.

- There are never connectivity issues – traders have permanent uptime.

- Rapid trade execution

Premium MT4 Tools

FXPrimus’s MT4 tools is a set of modules that transform MT4 into a state-of-the-art trading terminal. Premium Trader Tools give traders access to institutional quality technology, including advanced trading tools, user-configurable news and information, and trade analysis. It also includes an array of sophisticated alarms and messaging systems, and live sentiment and correlation tracking. Some of the tools in the package include:

-

Trade Terminal: A feature-rich professional trade execution and analysis tool, providing several trading features and order controls that are not included in MT4.

-

Connect: A customisable news feed aggregator and interactive economic calendar

-

Sentiment Trader: Tracks the bias or direction of traders using FXPRIMUS.

-

Market Manager: Allows you to keep tabs on the markets without keeping your platform open.

PAMM

FXPrimus offers an account management service to its clients which allows account managers to trade on their behalf. In order to perform this service, bespoke technology or software is required, also known as PAMM.

PAMM stands for Percentage Allocation Module Manager which means investors can be part of a set of sub-accounts that are traded together by a money manager or trader who has permission from clients to trade on their accounts. Account Managers take a portion of the profits generated by the trades.

Managed accounts are great for beginner traders who have limited experience with trading.

Platinum API

Clients who deposit a minimum of USD 50,000 are eligible to apply for the Platinum API. This technology is ideal for those using trading systems or developing their own custom-built system. It allows an increased ability to see the depth of market and access to multiple liquidity providers. The benefits of FIX API include:

- Faster overall execution speed

- Ability to design a personalised trading interface

- Automated or algorithmic trading systems outside of MT4

- Fully customisable liquidity

- Ability to use various order types such as Market Orders or Limit Orders

Other trading tools available at FXPrimus include a range of trading calculators, which can be used to calculate pip value, a Fibonacci calculator, and a currency converter.

Financial Instruments

FXPrimus offers a limited range of financial instruments compared to other similar brokers.

FXPrimus’s range of financial instruments for CFD trading includes Forex, share CFDs, energies, metals, indices, and cryptocurrencies:

-

Forex: FXPrimus has 43 currency pairs available for trading, an average range compared to most other brokers. These include majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/JPY, GBP/JPY, and USD/ZAR), and exotics.

-

Share CFDs: FXPrimus offers 110 share CFDs, which is slightly limited compared to other large international brokers. The selection available includes companies listed on some of the major Stock Exchanges.

-

Indices: There are 15 indices available for trading at FXPrimus, which is around the average available at other similar brokers. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

-

Energies: FXPrimus offers trading on 4 energies, which is average compared to other similar brokers. Energies include UK and US brent and crude oil.

-

Metals: FXPrimus offers trading on 5 metals, although these include silver and gold with USD and EUR crosses. It also offers trading on copper.

-

Cryptocurrencies: At the time of writing, there are 4 crypto pairs available, including Bitcoin and Ethereum, among others, which is slightly limited compared to other brokers.

Overall, FXPrimus’s CFD offering is limited to other brokers, which may leave more experienced traders dissatisfied.

FXPRIMUS for Beginners

FXPRIMUS offers little in the way of educational support or market analysis but customer service is excellent.

Educational Material

FXPrimus’s educational content is limited, and some of it is only available for traders who register a live account.

Education material at FXPRIMUS is split into Educational Videos, Seminars, and Expert Guests:

- Educational Videos: The educational videos are essentially tutorials on how to open an account and set up the trading platforms.

- Seminars: Seminars are currently on hold (likely due to the pandemic), but an archive of previous seminars is available on FXPrimus’s website.

- Expert Guests: On its website, FXPrimus lists a panel of expert analysts who run the weekly webinars. Visitors to the site can register for the webinars.

Analysis Material

Analysis at FXPRIMUS is published on a blog and via the weekly outlook. Neither are detailed or particularly useful for new traders.

Customer Support

Customer support is excellent, responsive, and available 24/5 via WeChat, Zalo, Line, Telegram, Live Chat, WhatsApp, Facebook Messenger, Email, and telephone. For the purposes of this review, we conducted numerous support sessions and found that our questions were answered swiftly and accurately by people with a good knowledge of the company.

Safety and Regulation

FXPrimus is a safe broker for traders to trade with. It maintains regulation from CySEC in Cyprus and is authorised by the Vanuatu Financial Services Commission.

Founded in 2009 and headquartered in Cyprus, FxPrimus has grown to become a large multi-asset financial company. As an international broker, it is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Vanuatu Financial Services Commission (VFSC). See below for details:

FXPRIMUS is the brand name used by:

- Primus Global Ltd, regulated by the Cyprus Securities and Exchange Commission (CySEC) with licence no. 261/14.

- Primus Markets INTL Limited, regulated by VFSC, with registration no. 14595.

Global clients will be trading under the subsidiary, Primus Markets INTL Ltd, authorised by the VFSC.

Unlike more reputable regulators such as ASIC in Australia, or the FCA in the UK, VFSC-regulated brokers are not required to segregate client funds from their operating capital or offer their traders negative balance protection. Additionally, brokers only need to submit regular financial reports once a year.

Essentially, this means that the VFSC does not involve itself in the client protection business. At most, they may release warnings against companies that are found to have repeatedly violated the rules. But if you enter a dispute against VFSC-registered brokers, you cannot expect the agency’s assistance to mediate or get your money back.

However, although traders may be apprehensive about trading under a subsidiary that is unregulated, FXPrimus deposits all client funds in top-tier, well-capitalised banks, separate from the company’s operating funds. Additionally, FXPrimus is also regulated by a reputable regulator, CySEC, providing another level of regulatory oversight. All traders are also afforded negative balance protection, which means that they cannot lose more than their initial deposit.

Overall, because of its history of responsible behaviour, CySEC regulation, segregation of client funds, and provision of negative balance protection, we consider FXPrimus a safe broker for traders to trade with.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the FXPRIMUS offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

FXPRIMUS Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. FXPRIMUS would like you to know that: Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors. Trading in financial instruments may result in losses as well as profits, and your losses can be greater than your initial invested capital. Before undertaking any such transactions, you should ensure that you fully understand the risks involved and seek independent advice if necessary.

Overview

A well-established broker, FXPrimus caters well to beginners with its low-deposit accountsThough the only platform supported is MT4, there are several useful tools available to supplement the platform, such as a sentiment indicator and a market analysis plugin. Other advantages at FXPRIMUS are free deposits and withdrawals and negative balance protection, both of which really highlight FXPRIMUS’ commitment to their clients.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how FxPrimus stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.