-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

IC Markets Broker Review

Last Updated On March 15, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on IC Markets

An excellent all-round broker with a very high trust rating, IC Markets was founded in 2007 in Australia and holds licences from some of the strictest regulators in the world. IC Markets is well-known for its low trading costs, choice of trading platforms, and wide range of trading tools.

IC Markets offers a lower-cost trading environment than almost any other broker, with average spreads of 0.10 pips (EUR/USD) on its Raw Spread Account in exchange for a low commission of 6 USD (round turn) per lot.IC Markets is one of the few Forex brokers to support all four major trading platforms, including MetaTrader4, MetaTrader5, TradingView, and cTrader; and offers numerous trading tools for each, including VPS services, Trading Central, and various copy trading services.

Beginner traders will benefit from IC Markets’ exceptional customer support, which is available 24/7 to help with any account or technical queries. While its education section is more comprehensive than most other brokers’, it offers a fairly limited selection of market analysis materials.

| 🏦 Min. Deposit | USD 200 |

| 🛡️ Regulated By | CySEC, ASIC, FSA-Seychelles, SCB |

| 💵 Trading Cost | USD 8 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, cTrader, TradingView |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Stock CFDs, Forex, Futures, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Tight spreads

- Wide range of assets

- Great platform choice

Cons

- High minimum deposit

- Limited market analysis

IC Markets Overall Rating

IC Markets stands out with competitive spreads averaging at 0.10 pips (EUR/USD) on its Raw Spread Account in exchange for a low commission of 6 USD (round turn) per lot. It offers a seamless experience for both beginners and advanced traders, with negative balance protection for all clients, 24/7 customer service and support for all four major trading platforms, including MetaTrader4, MetaTrader5, cTrader, and TradingView.

FxScouts rates IC Markets 4.56 out of 5.

Is IC Markets Safe?

Although IC Markets is well-regulated, South African traders will be trading under the Seychelles-based entity, which provides less regulatory oversight than regulators of the EU or Australia.

FSA Regulation: IC Markets has an excellent reputation and is regulated by some top-tier authorities, including ASIC of Australia. However, South African traders will be onboarded through IC Markets’ Seychelles-based entity, regulated by the Financial Services Authority of the Seychelles, which provides little regulatory oversight.

Safety Features: IC Markets segregates all funds from the company’s operating capital, and offers negative balance protection to all its clients.

Company Details:

![]()

![]()

IC Markets’ Financial Instruments

IC Markets offers an average range of tradable assets compared to its competitors.

See below for IC Markets’ range of instruments and corresponding leverage:

![]()

![]()

- Forex pairs: IC Markets offers 64 Forex pairs to trade, including majors, minors, and exotics such as USD/ZAR and ZAR/JPY. This is around the average offered by its closest competitors.

- Commodities: IC Markets offers trading on 13 commodities, including metals, energies, and agriculture, which is around the average offered by most other brokers.

- Stock CFDs: IC Markets’ stock CFD offering is broad compared to most of its competitors, with 1,600 stock CFDs available to trade, including popular US tech companies, ASX stocks, those listed on the NASDAQ, and NYSE, and more. Traders should note that stock CFD trading is only available on MT5.

- Indices: IC Markets offers cash and futures contracts on 23 international indices, including the NASDAQ, S&P500, FTSE100, and the Nikkei. This is an average range of indices compared to other brokers.

- Bonds: IC Markets offers trading on 11 bonds, which is a broader range compared to most other brokers.

- Futures: IC Markets offers trading on 4 global futures, including the DXY, VIX, BRENT, and WTI, which is average compared to most other brokers.

- Cryptocurrencies: IC Markets offers a reasonably wide range of cryptocurrencies including Bitcoin, Bitcoin Cash, Ethereum, Dash Coin, Ripple & Litecoin. Spreads on these currencies are variable and are significantly higher than Fiat currencies but in line with other brokers.

Overall, the range and depth of financial instruments at IC Markets is broad compared to other brokers.

IC Markets’ Accounts and Trading Fees

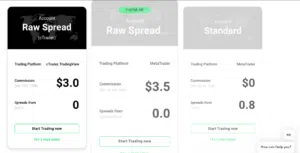

IC Markets offers three accounts which is average compared to other brokers, and all accounts have a minimum deposit requirement of 200 USD.

Trading Fees: IC Markets’ trading accounts are available on three different platforms, including MT4, MT5, and cTrader. The Standard Account’s trading costs are included in the spread, while the Raw Spread and cTrader accounts offer tighter spreads in exchange for a commission per lot.

IC Markets’ Account Trading Costs:

![]()

![]()

As you can see from the table above, the trading costs on the cTrader Raw Spread Account are lower than those of the other two accounts. Most other brokers offer trading costs of 9 USD, making IC Markets one of the lowest cost brokers in the industry.

See below for account details:

Standard Account

The Standard Account is a commission-free account with spreads that start at 0.8 pips on the EUR/USD, which is tighter than other similar brokers. It is available on the Metatrader 4 and Metatrader 5 platforms, and traders can access leverage of up to 500:1. The Standard Account is ideal for discretionary traders.

Raw Spread Account

The True ECN Account is for high-volume trading or professional traders, with a minimum deposit requirement of 200 USD. Spreads are tight, averaging at 0.10 pips on the EUR/USD, but a commission of 7 USD round turn per lot is charged, and leverage is up to 500:1. This account is also only available on the Metatrader platforms.

c-Trader Raw Spread Account

Suitable for day traders and scalpers, the cTrader Raw Spread Account is only available on the TradingView and c-Trader platforms. Spreads start at 0.0 pips on the EUR/USD, and a commission of 6 USD (round turn) is charged per lot. Leverage is also up to 500:1 on this account, and the minimum deposit requirement is 200 USD. Traders should note that some of the tools available at IC Markets are not compatible with the cTrader platform.

Deposits and Withdrawals

IC Markets offers a wide range of deposit and withdrawal methods, and while no fees are charged for most methods, withdrawals by bank wire transfer are expensive.

In line with Anti-Money Laundering rules, IC Markets does not process payments to third-party accounts. All withdrawal requests from a trading account will be funded to a bank account or source in the trader’s name.

Trading Account Currencies: IC Markets offers trading in ten base currencies, including EUR, USD, GBP, AUD, SGD, NZD, JPY, CHG, KHD, and CAD. While South African traders may be disappointed that IC Markets does not offer accounts denominated in ZAR, they have the option of opening multiple accounts with different base currencies to avoid paying conversion fees. The wide range of base currencies available at IC Markets makes this possible.

Deposits and Withdrawals: IC Markets offers a range of account funding and deposit methods, including bank transfer, debit cards/credit cards, and various eWallets. Deposits are free on all funding methods and are processed immediately, or within 12 hours, except broker-to-broker transfers, which may take up to five days.

Withdrawals received before noon AEST/AEDT are processed the same day and IC Markets does not charge any additional withdrawal fees, except on international bank wire transfers. Other fees may apply depending on the payment method:

- Credit/debit card withdrawals – No withdrawal fees, but it can take up to five days to reach your account.

- Domestic Bank Wire Transfers – These do not incur any processing fees and will typically reach your local Australian bank account the following working day.

- International bank transfers – A withdrawal fee of 20 AUD or another currency equivalent will be charged by IC Market’s bank. Withdrawals may take up to 14 days to be processed.

- eWallet (Paypal/Neteller/Skrill) withdrawals: No fees are charged for withdrawals, and they are instant.

Overall, IC Markets offers a wide range of deposit and withdrawal methods, but it charges a 20 AUD fee on withdrawals for international bank transfers, which is relatively expensive.

IC Markets’ Mobile Trading Platforms

IC Markets does not have its own trading app, but MT4, MT5, TradingView, and cTrader are all available as mobile apps.

All four of IC Markets’ trading platforms are available on both Android and iOS mobile devices and tablets. Beginner traders should be aware that there is some loss in functionality when compared to desktop trading platforms, including reduced timeframes and fewer charting options.

TradingView

TradingView is not only a trading platform with detailed information to help you make trading decisions: it also includes one of the biggest social trading communities, with plenty of EAs (Expert Advisors) that beginner traders, or those too busy to trade manually, will appreciate.

There’s a lot you can achieve with TradingView, but these are just a few of its advantages:

- Unmatched charting capabilities, suitable for beginners and advanced traders

- Large social trading community of more than 50 million users

- The ability to design your own indicators and strategies using TradingView’s Pine Script

programming language - The option to validate trading ideas using TradingView’s bar-by-bar replay function

- Wide selection of fundamental data

- Real-time global news coverage

On the whole, the toolbox is sophisticated yet simple to use and allows traders to analyse the fast-moving global financial markets with accuracy.

cTrader App

cTrader is one of our favourite trading platforms, and IC Markets is one of a handful of brokers that supports it. It is one of the most beginner-friendly third-party trading platforms available, with a modern interface, integrated educational content, and innovative risk-management features. The cTrader mobile app offers the best features available on the desktop version including the complete range of order types, trade analysis, and watchlists.

Additionally, the costs on IC Markets’ cTrader Raw Spread Account are lower than those on the other two accounts.

MT4 and MT5 Apps

MetaTrader 4 (MT4) is still undoubtedly the world’s most popular trading platform for forex traders due to its ease of use, feature-rich environment, and automated trading ability. The newer version of the MetaTrader platform suite, MT5 is being adopted by more traders all the time. MT5 incorporates all of the key features of MT4 and an optimised environment for EA trading.

The IC Markets MT4 and MT5 apps allow traders to work from anywhere, with nine timeframes, 30 indicators, and interactive currency charts. Functionality to close and modify existing orders, calculate profit/loss in real-time, and tick chart trading further assists traders while on the move.

Overall, IC Markets’ mobile apps are user-friendly and well-designed, and offer most of the features available on the desktop versions.

Other Trading Platforms

With MT4, MT5, TradingView, and cTrader all available, IC Markets offers support for more trading platforms than most brokers.

IC Markets offers traders MetaTrader 4 (MT4), MetaTrader 5 (MT5), TradingView, and cTrader, each of which offers Expert Advisors, automated trading support, strategy backtesting, customisable charting, indicators, and copy trading functionality.

All platform choices are free to use, all can be downloaded to your PC or Mac, and all have web versions of the platform. Traders who want more EAs to use, and don’t mind the dated interface, should consider using one of the MetaTrader products. cTrader and TradingView are often favourites for beginner traders as they require less setup, have a more modern interface, and offer more advanced order types.

While IC Markets does not have its own proprietary platform, which is usually easier for beginners to learn, the choice of any of the three major platforms will keep most traders satisfied.

Trading Platform Comparison:

![]()

![]()

Opening an Account at IC Markets

We found IC Markets excels in its account opening process. It is straightforward and hassle-free, and accounts are generally ready for trading within a day.

All South African residents are eligible to open an account at IC Markets as long as they meet the minimum deposit requirement of 200 USD for each account.

The five-step account opening process is fully digital and accounts are generally ready for trading in one day. IC Markets offers individual, joint, and corporate accounts, but we will focus on opening an individual account.

How to open an account at IC Markets:

- Click on the ‘Open a Live Account button and register your email address and password.

- Next traders are required to fill in their personal details, including date of birth and physical address etc.

- The third step requires choosing your preferred base currency and account type.

- Traders are then required to fill out a short questionnaire detailing their level of trading experience. This is a responsible move on the part of the broker in an industry that is often accused of an irresponsible approach to consumer protection.

- The last step is to confirm your identity. IC Markets will need two documents from you:

- A photo ID (passport, driver’s license, or national ID card) and;

- A secondary ID (a bank or utility statement with your full name and address dated in the last three months).

We suggest you read IC Markets’ risk disclosure, customer agreement, and terms of business before you start trading.

Once your documents have been verified by the customer support team, you can login and fund your account with the base currency of your choosing.

Compared to other similar brokers, IC Markets’ account opening process is fast, generally hassle-free, and fully digital.

Trading Tools

IC Markets’ trading tools are excellent compared to other similar brokers.

IC Markets offers a number of useful trading tools, including a free VPS service, MAM/PAMM accounts, Training Central, and advanced MT4 trading tools. Zulutrade, myfxbook Autotrade, and Autochartist are available through the IC Markets’ partner programme, but there is an extra cost associated with using these services. See below for more:

VPS

IC Markets offers a VPS service through three providers, namely ForexVPs.net, Beeks FX VPS, and New York City Servers. All services are available as a monthly subscription, but IC Markets will cover the costs if a client’s trading volume exceeds 15 lots (round turn) per month.

VPS hosting allows traders to run automated algorithmic strategies, including expert advisors 24 hours a day 7 days a week on a virtual machine. VPS services have the advantage of never suffering connectivity issues and have extremely low latency due to their proximity to major international exchanges.

MAM/PAMM Accounts

IC Markets offers an account management service to its clients which allows account managers to trade on their behalf. In order to perform this service, bespoke technology or software is required, also known as MAM/PAMM. The MAM software communicates all allocation settings directly with the IC Markets MetaTrader 4 server.

MAM stands for Multi-Account Manager which permits a range of customisable ways to sub-allocate trades. PAMM stands for Percentage Allocation Module Manager which means investors can be part of a set of sub-accounts that are traded together by a money manager or trader who has permission from clients to trade on their accounts. Account Managers take a portion of the profits generated by the trades.

Managed accounts are great for beginner traders who have limited experience with trading.

MT4 Advanced Trading Tools

IC Markets offers 20 exclusive trading tools that are available on the MT4 platform. The MT4 Advanced Trading Tools help traders manage their risk, control all trades from a single terminal and view the correlations between currency pairs and other CFDs. The full set of tools include sophisticated alarms and broadcast facilities, a correlation matrix, a sentiment trader, a session map, and up-to-date market data and functions, among others.

Myfxbook Autotrade

Myfxbook Autotrade is one of the most popular copy trading platforms on the market. This service allows you to copy the trades of any system you select directly into your IC Markets MetaTrader 4 account. Autotrade charges a 0.6 pip spread mark up on all account options, which is relatively expensive.

One of the benefits of using the Myfxbook Autotrade copy trading platform is its functionality. It offers multiple copy trading modes and there is no limit on the number of Strategy Providers that can be followed.

On the whole, copy trading is useful for traders who are interested in the financial markets but lack the experience and knowledge.

Zulutrade

Zulutrade, a third-party platform, is a peer-to-peer social trading application where traders can choose among thousands of registered traders from 192 countries. Traders are ranked using “ZuluRank” according to a number of different metrics, including their overall performance, stability, maturity, exposure, and minimum equity required.

In order to use this service, traders will have to pay a total of a 2.2 pip mark-up on the spread, which is relatively high.

Autochartist

Autochartist is an automated analysis tool offered through IC Markets’ partnership programme, so there is an additional cost for using the service. Traders will have to contact customer support for more details regarding these costs.

Autochartist monitors 250+ CFDs 24 hours a day and automatically alerts traders on key trading opportunities and forming trends with the highest probability of hitting the forecast price. Some of Autochartist’s key features are:

- Chart pattern recognition

- Fibonacci pattern recognition

- Key level analysis

- Pattern quality indication

Overall, Autochartist is one of the best technical analysis tools on the market.

Trading Central

Trading Central is available to clients who register a live account. A third-party tool, Trading Central’s professional analysts use the most advanced technical analysis tools in the industry to curate relevant information. This tool essentially supports traders without the technical know-how in making trading decisions. Trading Central is one of the most popular trading tools available and provides excellent market analysis, and IC Markets does well to offer this service to its clients.

On the whole, IC Markets provides an extensive number of trading tools compared to most other brokers, which should keep most traders satisfied. However, some of the tools are only available on the MetaTrader platforms.

IC Markets for Beginners

IC Markets is one of the few true ECN brokers accessible to beginner traders. Many other ECN brokers fail to provide education and analysis, forcing traders to self-educate with third-party material. With a full library of course material, independent market analysis, and webinars, IC Markets offers new traders a comprehensive education on Forex trading. IC Markets also supports all three of the top software options and provides 24/7 customer support.

Education Material

IC Markets’ educational materials’ are excellent compared to its competitors. The materials are well-structured and comprehensive and cater to both beginners and more experienced traders.

IC Markets provides an extensive free education hub open to everyone, whether they have an account with IC Markets or not. Unlike other brokers, where educational material is often unstructured, IC Markets offers a selection of blog posts connected by topics. Furthermore, it is obvious that IC Markets has invested heavily in educating traders of all experience levels. The principal elements of the education area are:

- Forex Basics

- Technical Analysis

- Fundamental Analysis

- Risk Management

- Trading Psychology

- Trading Plan

Instructional videos are available to help new clients set up trading software. Videos cover topics like How to Download a Demo Account, How to Use The One Click Trade Manager, How to Hedge an Order in MetaTrader 4, and Using the Trade Terminal. Videos also cover useful other topics such as technical analysis and risk management.

IC Markets also offers a set of previously recorded webinars hosted by knowledgeable educators who have a clear command of their expertise. The webinars principally cover technical analysis areas like Patterns, Fibonacci in Trading, Trading Candlesticks, and Fading and Scalping. There are also additional sessions on Market Structure, Market Dynamics, and Professional Trader Psychology.

Overall, ICMarkets’ education section is well-structured and in-depth and caters to traders of all experience levels.

Education Comparison:

![]()

![]()

Analysis Material

IC Markets’ market research materials are slightly limited compared to what’s available at other large international brokers, but it does offer the services of Trading Central to all clients who register an account.

IC Markets provides a daily, updated market analysis blog featuring all the latest market movements. It also provides daily technical analysis articles and fundamental analysis articles that provide an in-depth look at the most popular tradable instruments.

Clients who register an account will also gain access to Trading Central analysis. Trading Central is an independent company tool recommended for new traders wanting to learn technical analysis or those that want an independent opinion on their trades.

Overall, IC Markets’ market analysis section is good, but it could improve its market analysis materials by providing more comprehensive and multi-format content.

![]()

![]()

Customer Support

IC Markets’ customer support is excellent compared to other brokers, and is available 24/7 which is exceptional considering the norm is 24/5.

IC Markets has a dedicated support department operating 24/7 via live chat, email, and phone. Live chat and phone support can assist with any general questions and queries, however, queries addressed to specific departments such as the accounts department are only available via email. Additionally, it provides a comprehensive FAQ section providing relevant answers to the most commonly asked questions.

Support is available in multiple languages, including Arabic, Ukraine, Russian, Spanish, Urdu, English, Greek, Romanian, Italian, Portuguese, Chinese, Korean, Vietnamese, and Czech.

For the purposes of this review, we found the customer support polite, responsive, and knowledgeable – they were able to answer most of our questions.

Safety and Industry Recognition

History: IC Markets is an ECN-only Forex and CFD broker founded in 2007 and headquartered in Sydney, Australia. IC Markets has expanded rapidly since its inception and has become one of the most respected brands in CFD trading, with over 500,000 trades placed per day totaling 15 billion USD in daily volume.

Regulation: IC Markets is regulated by the Australian Securities and Investment Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Financial Services Authority of Seychelles (FSA), and the Securities Commission of the Bahamas (SCB). See below for details:

- International Capital Markets Pty Ltd (ACN 123 289 109), is regulated and authorised by the Australian Securities and Investment Commission, license 335692.

- IC Markets EU Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission with licence number 362/18.

- IC Markets Ltd, registered in The Bahamas with registration number 76823 C, is regulated by the Securities Commission of The Bahamas with License No. SIA-F214.

- Raw Trading Ltd (Trading as IC Markets Global) – regulated by the Financial Services Authority of Seychelles with a Securities Dealer Licence number: SD018.

Awards:

IC Markets has also won numerous industry awards over the years, including Best Forex MT5 Broker 2020 (FX Scouts) for its remarkable execution speeds and trading flexibility on the MT5 platform.

Overall, with over a decade of responsible behaviour and strong regulatory oversight from some of the strictest regulators in the world, IC Markets is considered a safe broker to trade with.

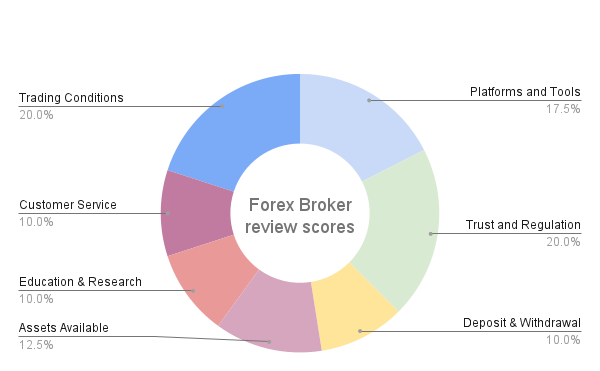

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

IC Markets Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. IC Markets would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74-89% of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Conclusion

A well-regulated broker, IC Markets is a cutting-edge ECN forex broker that leverages its network of liquidity providers to offer the best trading conditions for clients. IC Markets offers three live trading accounts that are suitable for beginners and more experienced traders alike on the MT4, MT5, TradingView, and cTrader platforms and provides a vast array of trading tools. For beginner traders, IC Markets offers high-quality 24/7 customer support to get traders started alongside a world-class repository of educational materials. Overall, IC Markets is a dependable choice for traders of all experience levels.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how IC Markets stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.