-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Skilling Broker Review

Last Updated On July 26, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Skilling

Founded in 2016, Skilling is an innovative broker with regulation from CySEC of Cyprus and Seychelles’ FSA. It has four simple account options, excellent trading conditions, a broad range of tradable assets, and a great range of trading platforms. Its main drawback is the lack of educational materials, which could see beginner traders looking elsewhere for support.

Skilling’s Standard Accounts require a minimum deposit of 100 EUR and have spreads starting at 0.8 pips (EUR/USD), tighter than the spreads on other brokers’ entry-level accounts. On the Premium Account, spreads tighten to 0.1 pips (EUR/USD) with a commission of 6 USD (round turn), but the minimum deposit is 5000 EUR – out of reach for most beginners.

MT4, cTrader, and Skilling’s proprietary trading platform are all supported, with seamless integration provided between cTrader and Skilling’s own platform – an industry first.

Overall, Skilling is a good all-round broker with a transparent and client-centred approach that will appeal to both beginners and more experienced traders.

| 🏦 Min. Deposit | EUR 100 |

| 🛡️ Regulated By | CySEC, FSA-Seychelles |

| 💵 Trading Cost | USD 7 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, cTrader, Skilling Trader |

| 💱 Instruments |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Copy trading accounts

- Tight spreads

- Great platform choice

Cons

- No swap-free account option

- Limited education

Is Skilling Safe?

Yes, Skilling is a safe broker for South Africans to trade with. It maintains regulation from CySEC in Cyprus and the FSA of Seychelles.

Skilling is a Scandinavian-owned broker founded in 2016 that has been offering services across Europe since 2018 and worldwide since April 2020.

Regulation: CySEC currently regulates Skilling in Europe, and the Seychelles FSA regulated the company across the rest of the globe, including South Africa. The FSA’s rules are not as strict as those of the FCA or CySEC, but it does allow Skilling to provide its clients with higher leverage.

Safety Features: Although South Africans will have little recourse should they enter a dispute with Skilling, the FSA does ensure that Skilling holds all client funds in segregated accounts at major European banks. It also provides negative balance protection, which means that clients can never lose more than is in their trading accounts.

Company Details:

![]()

![]()

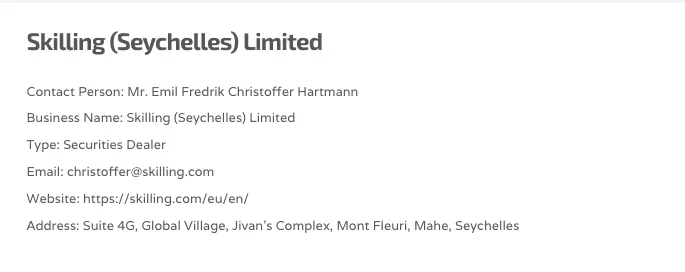

We confirmed each of the licences and regulations on the regulator’s online register. See below for details of Skilling’s Seychelles-regulated entity:

Skilling’s Trading Instruments

Skilling offers a wider range of trading instruments than most other brokers, and we were particularly impressed with the number of cryptocurrencies available for trading.

Skilling’s ever-expanding range of financial instruments for CFD trading includes Forex, share CFDs, indices, futures, cryptocurrencies, and commodities.

Full List of Instruments and Leverage:

![]()

![]()

- Forex: Skilling has over 73 currency pairs available for trading, a broader range than most other brokers. These include majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/JPY, GBP/JPY, and USD/ZAR), and exotics. Note that traders can only trade with 53 pairs on the MT4 platforms.

- Share CFDs: Skilling offers over 750 share CFDs for trading, a broader range than other large international brokers. The selection available includes some of the major US, UK, and European Exchanges.

- Indices: There are 16 indices available for trading at Skilling, which is around the average available at other similar brokers. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies. Indices available include the S&P 500, the UK 100, the NASDAQ 100, and the Dow Jones 30, among others.

- Commodities: Skilling offers trading on 6 commodities, which is limited compared to other brokers. Commodities include silver, gold, and Brent Crude Oil.

- Cryptocurrencies: Skilling offers trading on 57 cryptocurrencies, an impressive range compared to most other brokers. These include Bitcoin, Ethereum, Tron, Dash, and Ripple, among others. The spreads vary significantly compared to other traditional Fiat currencies. For example, it is not unusual for spreads to be as wide as 75 pips on Bitcoin, so if you trade these currencies, watch your margins.

Dynamic Leverage:

Skilling uses a dynamic leverage model on Forex, indices, commodities, and shares:

Overall, Skilling offers a wider range of assets than is usually seen at other brokers. The number of Forex pairs, share CFDs, and cryptocurrencies is notable.

Skilling’s Accounts Trading Fees

Skilling’s trading fees are average compared to other similar brokers.

Trading Fees: Skilling offers two commission-free accounts with trading costs included in the spreads and two accounts with tighter spreads and a commission per lot. The commission-free accounts have lower minimum deposits than the commission-based accounts.

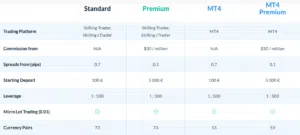

Account Trading Costs

![]()

![]()

As you can see from the table above, the trading costs on the Premium accounts are lower than those on the Standard and MT4 accounts. However, traders should know that these trading costs are based on the minimum spreads available at Skilling. Trading costs average at around 9 USD on the Premium accounts, which is around the industry average, and 10 USD on the Standard accounts, which is slightly higher than average.

Standard Account: The Standard Account requires a minimum deposit of 100 EUR, offers maximum leverage of 500:1, and is available through the Skilling Trader platform or cTrader. Spreads here start at 0.70 pips on the EUR/USD. No commission is charged.

Premium Account: The Premium Account is a commission-based, raw spreads account, with spreads starting at 0.1 pips, but a 30 USD/10 lot trading commission charged. Leverage is also 500:1 but the minimum deposit is 5000 EUR, so this is probably not an account for beginner traders. Trading is also offered on the Skilling Trader platform and cTrader.

MT4 Account: The MT4 Account requires a minimum deposit of 100 EUR, offers maximum leverage of 500:1, and as the name suggests, is only available on the MT4 platform. Spreads start at 0.70 pips on the EUR/USD and no commissions are charged.

MT4 Premium Account: This account is similar to the Premium account outlined above, but trading is only offered on the MT4 platform. Leverage is up to 500:1, and spreads start at 0.1 pips with a commission of 30 USD/10 lots traded. The minimum deposit on this account is also 5000 EUR.

Deposits and Withdrawals

Skilling states that all Anti-Money Laundering rules and regulations are followed. Deposits can only be made using a bank account or card registered in the trader’s name, and no third-party deposits are allowed. Withdrawals must be made to the same account or method that the funds originated.

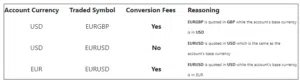

Trading Account Currencies: Trading accounts can only be denominated in five base currencies – EUR, USD, NOK, SEK, and GBP, which is average compared to other brokers. However, Skilling does not offer ZAR trading accounts, which is a disadvantage for South Africans who will likely have bank accounts denominated in ZAR and who will have to pay currency conversion fees on deposits and withdrawals. Skilling charges a currency conversion fee of 0.7% in addition to the fees that your banking institution will charge. See below for an example of when currency conversion fees apply:

Deposits and Withdrawals: Skilling offers a range of deposit and withdrawal methods and charges no fees for either type of transaction. Be aware that your bank or card issuer may charge you for international transfers. Deposits are generally instant (except deposits via bank transfer and debit/credit cards), and withdrawals are processed within 24 – 48 hours. Additionally, the minimum deposit amount is 100 USD, and the minimum withdrawal amount is 50 USD.

Deposits and withdrawals can be made via:

![]()

![]()

Overall, Skilling offers many payment methods, charges no fees for deposits or withdrawals, and has average payment processing times.

Skilling’s Mobile Trading Platforms

Skilling’s mobile trading platform support is excellent compared to other similar brokers.

Skilling offers support for a good range of trading platforms, including the proprietary Skilling Trader, MT4, and cTrader. An industry first, Skilling has also completed seamless integration between Skilling Trader and cTrader, a unique feature dubbed One Account. Two Platforms. This allows traders to choose which platform they wish to use while having a single trading account with the same margin, same wallet, and same trading conditions.

Skilling Trader

Available on both Android and iOS devices, Skilling Trader has a great design. It is easy to use and set up and has a host of features, including a Trading Assistant that walks you through the app. The app allows traders to easily transfer, withdraw and deposit funds, search for instruments, and create watchlists. It also has a huge range of technical indicators and charts in multiple time frames and comes with various drawing tools. We also enjoyed how easy it was to execute orders and all Skilling’s educational materials and market news are available on the app.

|  |  |

Skilling cTrader

cTrader is an advanced trading platform designed specifically to work with market execution accounts. As mentioned previously, Skilling is unique in that it has teamed up with Spotware, cTrader’s creators, to seamlessly integrate cTrader with Skilling’s own trading platform.

The cTrader mobile app carries over most of the best parts from the desktop version, including the complete range of order types, price alerts, trade analysis, and symbol watchlists. Chart types have been reduced to 4, however.

MT4 Mobile App

We found that the MT4 app allows traders to work from anywhere, with nine timeframes, 30 indicators, and interactive currency charts. We were able to close and modify existing orders and calculate profit/loss in real-time. We also find it easier to search for instruments than on the web trader versions of the platforms.

Traders should note that as of 23 September 2022, MT4 and MT5 have been removed from the app store. It is unclear when or whether they will again be available for download on iOS devices. Watch our youtube below for more news on the subject:

Other Trading Platforms

Skilling’s platform support is excellent compared to other similar brokers.

Skilling Trader

Skilling Trader is Skilling’s proprietary trading platform. Designed to be intuitive and simple, but with a full suite of technical indicators and drawing tools, Skilling Trader is built to appeal to traders of all experience levels. With full integration with Skilling’s cTrader platform, web and mobile support and a trade assistant for beginners, the Skilling Trader platform is flexible enough to satisfy most traders.

cTrader

cTrader is a modern, intuitive, and powerful trading platform with advanced trading capabilities, such as fast entry and coding customisation, as well as a variety of indicators to help you make better trading decisions. It includes a complete charting package and Spotware hosts a library of indicators and robots, traders can also design their own algorithms using the Automate Editor.

Metatrader 4 (MT4)

Our review found that Skiling offers the standard version of MT4, which has 24 graphical objects and 30 built-in indicators. The main benefit of using third-party platforms such as MT4 is that traders can keep their own customised versions of the platforms should they choose to migrate to another broker. MT4 is available for Windows, Android, iOS, and web browser.

Opening an Account at Skilling

The account-opening and verification process at Skilling is seamless and easy and accounts are ready for trading immediately.

All South African residents are eligible to open an account at Skilling, as long as they meet the following minimum deposit requirements:

- Standard Account: 100 EUR

- Premium Account: 5000 EUR

- MT4 Account: 100 EUR

- MT4 Premium Account: 5000 EUR

- From the Skilling homepage, you will have to click on the ‘Sign Up’ tab where you will be directed to register an account with an email address and password. Next you will be asked for your name, date of birth, telephone number, country of residence, and street address.

- The next step requires completing one’s financial information, including employment status, industry, annual income and savings, and source of funds.

- Traders will then have to complete a form detailing their trading experience.

- Skilling requires the following documents to accept clients as individual traders:

- Proof of Identification – Skilling accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

- Traders can then deposit funds into their account and begin trading.

Overall, Skilling’s account-opening process is fully digital and hassle-free and accounts are ready for trading immediately.

Trading Tools

Skilling offers an average range of trading tools compared to other Forex brokers.

Skilling offers support for a social trading platform (Skilling Copy) and PAMM/MAM accounts.

Skilling Copy

Social trading is a service that allows investors to follow the trading strategy and copy trades of professionals, which are also known as signal providers. Available on the Skilling cTrader Copy platform, traders can choose from over 1000 different strategies and providers to follow and copy. The in-depth performance statistics available allow you to research Strategy Providers and their track record of investments as well as review their performance results and trading style to determine the strategy most suitable to you.

Usually, the actions of experienced Forex traders are used as a guide for beginners. It reduces the time for market research and analytics before trading on Forex. Social trading is useful for traders who have no time for training or making independent investment decisions.

PAMM/MAM Accounts

Skilling offers an account management service to its clients which allows account managers to trade on their behalf. In order to perform this service, bespoke technology or software is required, also known as MAM/PAMM. The MAM software communicates all allocation settings directly with the Skilling MetaTrader 4 server.

MAM stands for Multi-Account Manager which permits a range of customisable ways to sub-allocate trades. PAMM stands for Percentage Allocation Module Manager which means investors can be part of a set of sub-accounts that are traded together by a money manager or trader who has permission from clients to trade on their accounts. Account Managers take a portion of the profits generated by the trades.

Managed accounts are great for beginner traders who have limited experience with trading.

Trading Tools Overview:

![]()

![]()

Skilling for Beginners

While Skilling is very transparent and describes its product line-up in great detail, it offers little in the way of education. Its market analysis, however, is detailed and frequently updated, created by both its inhouse team and via third-party provider, Autochartist.

Education Material

Skilling’s educational materials are severely limited compared to other brokers.

Education is limited to a short section titled What is CFD Trading? This covers the basics of how contracts for difference function, with brief explanations of leverage, margin, and CFD costs.

Skilling’s own trading platform, Skilling Trader, also features the Skilling Trade Assistant – which is designed to explain the trading basics and help you place your first trade.

Education Overview:

Analysis Material

Skilling’s market analysis materials are average compared to what is offered at other similar brokers.

Skilling’s in-house team of analysts writes daily and weekly market analysis updates that are posted under its ‘Trading Articles’ tab. While the content is of high quality, we would expect Skilling to provide analysis in various formats.

However, we were pleased to see that Skilling also subscribes to Autochartist for some of its analysis because it is an excellent tool that has an advanced pattern recognition engine identifies the strongest potential trading opportunities and predicts future price movements.

Customer Support

Customer support is available via phone, live chat, and email in English, Swedish, Norwegian, German, and Malay. Phone support is available from 08:00-17:00 CET, Monday to Friday and live chat is available from 08:00-22:00 CET, Monday to Friday.

For the purposes of this review, we found the live chat agents responsive and knowledgeable.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the Skilling offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Skilling would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

Skilling is a leader of a new wave of brokers we have seen cropping up in the last few years. Four simple account options, excellent trading conditions, and a completely transparent approach are all hallmarks of a refreshingly client-focused business model. Free deposit and withdrawals, a responsible approach to leverage and a good range of trading platforms are all very welcome too. The lack of any serious educational section or market analysis is a disadvantage, though this will not matter much to experienced traders. We would also like to see longer customer service hours and a lower minimum deposit for the Premium Accounts.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Skilling stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.