-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Vantage Broker Review

Last Updated On January 29, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Vantage

Vantage is a well-regulated broker with low-cost, low-minimum deposit accounts and a range of excellent trading tools and platforms. The only issue South African traders may face is that although Vantage is regulated by the FSCA, they will be onboarded through the VFSC of Vanuatu, which provides little regulatory oversight.

Regarding fees, Vantage makes it easy for beginners to get started, with 50 EUR minimum deposits on its Standard and Raw accounts. The commission-free Standard Account has a spread of 1.0 pip (EUR/USD), which is about average for an entry-level account, while the Raw Account offers spreads that start at 0 pips (EUR/USD) in exchange for a commission of 6 USD.

We were impressed that in addition to MT4 and MT5, TradingView and Vantage’s in-house user-friendly trading app are also available. Vantage also provides an excellent range of trading tools, including Trading Central, VPS services, Smart Trader Tools for MT4 and MT5, and three social trading platforms, alongside comprehensive educational and market research materials.

| 🏦 Min. Deposit | USD 50 |

| 🛡️ Regulated By | FCA, FSCA, ASIC, CIMA |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, ProTrader |

| 💱 Instruments | Commodities, Energies, Stock CFDs, Forex, Indices, Metals, ETFs, Bonds |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Tight spreads

- Fast and free withdrawals

- Great platform choice

Cons

- Limited assets

- High minimum deposit on Pro Account

Is Vantage Safe?

Although Vantage is regulated by reputable regulators, including the Australian Securities and Investment Commission (ASIC), Financial Conduct Authority (FCA) of the UK, and the FinancialSector Conduct Authority (FSCA) of South Africa, South African citizens will be trading under the subsidiary Vantage Global Limited, authorised by the Vanuatu Financial Services Commission (VFSC), which provides little regulatory oversight.

VFSC Regulation: Although Vantage holds an FSCA licence, South Africans are onboarded through the VFSC, meaning they will not benefit from local regulation and their money will not be segregated at South African banks. However, Vantage has a good reputation, and unlike Vantage’s ASIC and FCA-regulated entities, which have a leverage limit of 30:1, traders that are onboarded through the VFSC entity can access leverage of up to 500:1.

Safety features: Under the VFSC, South African traders are not granted negative balance protection, which in combination with leverage of 500:1, could mean that traders end up owing the broker money. However, their funds are segregated from company funds, and Vantage is a member of the Financial Commission, an international organisation operating within the Forex market to aid the resolution of disputes between brokers and traders. Vantage also conducts regular audits and has professional indemnity insurance that covers its employees, representatives, and other authorised representatives, but it does not participate in a compensation scheme.

Company Details:

Vantage Trading Instruments

Vantage offers a limited range of trading instruments compared to similar brokers, but it has a good range of speciality instruments, including ETFs and bonds.

Complete list of instruments and leverage:

Forex: Vantage has an average range of currency pairs compared to most other brokers. These include majors, minors and exotics.

Share CFDs: Vantage offers a slightly limited range compared to other large international brokers. The selection available includes some of the major US, UK, European, and Australian Exchanges.

Indices: Vantage’s indices offering is similar to other brokers. The most popular indices include a combination of the shares of some of the largest and globally acknowledged companies.

Energies: Vantage has an average energy range compared to similar brokers. Energies include oil, gas, gasoline and heating oil.

Metals: Traders can find the most popular metals for trading, including silver and gold with USD and AUD crosses, and copper.

Soft commodities: Like other brokers, Vantage offers a range of soft commodities, including orange juice, cocoa, coffee, cotton, and sugar.

EFTs: Exchange Traded Funds have rapidly gained in popularity in recent years, and Vantage offers a wide range of ETFs compared to other brokers.

Bonds: Vantage offers trading on an impressive range of bonds, including the Euro Bund, Euro Schatz, UK Long Gilt Futures, and the US 10 YR T-Note Futures Decimalised.

Accounts and Trading Fees

Vantage offers three accounts, which is average for the industry. Two of its accounts cater to beginner traders with low minimum deposits and average trading fees, while its Pro Account has a high minimum deposit but very low ongoing trading costs.

Trading Fees: Vantage’s trading fees are generally lower than other brokers. The Standard Account’s trading costs are included in the spread, while the Raw Spread and Pro accounts offer tighter spreads in exchange for a commission per lot. The minimum deposit on the Standard and Raw accounts is 50 USD, making them accessible to beginner traders, but traders will have to pay a hefty 10,000 USD to open a Pro Account.

Account Trading costs:

As you can see from the table above, the Standard Account has trading fees included in the spread, which start at 1.0 pip (EUR/USD), which is around the industry average. Trading costs improve significantly on its Raw ECN and Pro ECN Accounts, which have spreads that start at 0 pips (EUR/USD) and commissions of 6 USD and 3 USD, respectively.

Standard Account: Vantage’s commission-free Standard Account caters to beginner traders, with a minimum deposit requirement of 50 USD. Spreads start at 1.0 pips on the EUR/USD, and there are no commission fees for Forex trading. These trading costs are what you would expect on a commission-free entry-level account.

Raw Account: Like the Standard account, the minimum deposit is 50 USD, and spreads start at 0.0 pips (EUR/USD) in exchange for a commission of 6 USD (round turn). These trading fees are considered low for the industry for such a reasonable minimum deposit.

Pro Account: To access a Pro Account, traders must make a minimum deposit of 10 000 USD, putting it out of the reach of most traders. Spreads start at 0.0 pips (EUR/USD), and a commission of 1.5 USD per lot per side is charged. Trading fees on this account are some of the lowest in the industry.

Deposits and Withdrawals

Vantage offers a wide range of payment methods, with free deposits and withdrawal methods available. Additionally, processing times are average for the industry.

As a well-regulated broker, Vantage ensures that all Anti-Money Laundering rules and regulations are followed.

Vantage offers a range of deposit and withdrawal methods, including bank wire transfers, local bank transfers, credit/debit cards, Skrill, Neteller and International EFT.

Deposits for all payment methods are free, although clients may have to absorb fees charged by their various banking institutions. Clients can withdraw funds online by logging into the secure Vantage client portal and selecting the withdraw tab from the menu. Please see the following list of payment methods for further details:

Accepted Deposit Currencies: Vantage has a limited range of base currencies compared to other brokers but allows you to deposit some of the most popular currencies, including EUR, AUD, USD, GBP, CAD, SGD, NZD, HKD and JPY. Because we were depositing funds from a EUR-based bank account into a EUR trading account, we weren’t charged any currency conversion fees.

Funding Methods: Vantage offers a good range of payment methods and does not charge fees for deposits or withdrawals, but be aware that some payment providers will apply additional charges.

See below for a complete list of payment options and withdrawal times:

Bonuses

Through its VFSC-regulated entity, South African traders can access different kinds of bonuses or rewards. By trading a certain amount, they can accumulate so-called “V-Points”, Vantage’s reward system points. These can be used to redeem rewards such as cash redemption or loss protection vouchers.

Vantage also offers bonuses on trades and deposits. For example, they provide a 100 % trading bonus up to 30,000 USD and a 50% bonus on traders’ first deposit, following a 10% on the subsequent ones.

Vantage’s Mobile Trading Platforms

We found that Vantage’s mobile support is superior compared to other similar brokers. All the trading platforms supported by Vantage are also available as mobile and tablet downloads – allowing traders to keep track of their open positions while on the move.

Vantage App

Vantage’s in-house app features a clean, modern look and is user-friendly – and we really enjoyed using it. Setting up an account is easy, and if you need assistance, a tutorial is available to help. The app is available for both Android and iOS.

Vantage App features: The Vantage app has an excellent interface, and it’s easy to place orders, and set stop-losses and take-profits. It also has a range of technical charting tools and indicators. Traders can transfer, withdraw, and deposit funds and it has an integrated economic calendar. Traders can also access Vantage’s educational materials and news based on their favourite instruments. Another nice feature is FXTv by Trading Central, which updates you with daily market commentary.

|  |  |

MetaTrader 4 and MetaTrader 5

MT4 and MT5 are available for both Android and iOS through Vantage. Although there is slightly limited functionality compared to the desktop versions of the platforms, with reduced timeframes and fewer charting options, traders will still have access to analytics with technical indicators, graphical objects, and a full set of trading orders.

Other Trading Platforms

Vantage offers a great range of trading platforms, including MT4, MT5, and its ProTrader platform powered by TradingView.

ProTrader

When using ProTrader, which is powered by TradingView, clients have access to over 50 technical drawing tools, hundreds of the most popular indicators, and a comprehensive suite of tools for in-depth market analysis.

ProTrader also provides built-in market news headlines for over 400 forex pairs, indices, commodities, share CFDs, and more, so traders can stay up-to-date on upcoming economic and risk events.

MT4

The MetaTrader 4 Platform (MT4) is the world’s most popular online Forex trading terminal. It has a straightforward interface and is considered easy-to-use for novice and experienced traders. It is also widely recognised for its fast execution speeds, range of charting tools, algorithmic trading, and customisability. However, only basic orders are available, such as Market, Limit, Stop, and Trailing Stop.

MT5

MT5 is the newer version of MT4 and is also available at Vantage. We recommend using MT5 if you want a more powerful and faster trading platform for back-testing functionality for automated trading. Additionally, traders prefer MT5 for its depth of market display, additional technical indicators, and analytical tools.

Platforms Overview:

How to open an account

The account opening and verification process at Vantage is seamless, and accounts are ready within 24 hours, which is about the industry average.

All South African residents are eligible to open an account at Vantage as long as they meet the following minimum deposit requirements:

- Standard Account: 50 USD

- Raw ECN Account: 50 USD

- Pro ECN Account: 10,000 USD

Vantage offers both corporate and individual accounts. For the purposes of this review, we will outline the process for opening an individual account:

- From the Vantage homepage, you will have to click on the ‘Live Account’ tab where you will be directed to register an account with a name, email address, telephone number, and country of residence.

- Vantage’s registration form requires traders to fill in their personal details, including their physical address, date of birth, and ID number.

- Next, traders must fill in their financial details, employment status, and trading knowledge.

- Traders will then have to choose their preferred trading platform (MT4 or MT5), choose their account type and account currency.

- Verification usually takes less than 24 hours, and Vantage will need:

- Proof of Identification – Vantage accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

Overall, Vantage FX’s account-opening process is fully digital and hassle-free, and accounts are ready for trading within 24 hours.

Vantage’s Research and Trading Tools

Vantage offers an excellent range of trading tools compared to other brokers.

Vantage offers several useful trading tools, including Mt4/MT5 smart Trader Tools, Forex VPS services, sentiment indicators, and Pro Trader tools.

MT4/MT5 Smart Trader Tools

The MT4/MT5 Smart Trader Tools consist of three additional MetaTrader plugins, Alarm Manager, Correlation Matrix and Correlation Trader and Excel RTD Link. These tools dramatically improve the trading environment with sophisticated alarms, messaging systems, and correlation tracking.

Forex VPS

VPS services ensure that trades are never disrupted by technological or connectivity issues and are available for customers that deposit at least 1 000 USD and trade a minimum monthly notional value of 1 million USD on closed trades.

Sentiment Indicators

Vantage’s sentiment page displays the overall long and short positions of Vantage’s clients. The sentiment ratio of long to short positions is a percentage and displayed as a sliding scale where orange represents clients’ shorts, and teal represents their longs. Sentiment indicators are available for Forex, commodities, and indices.

Pro Trader Tools

Pro Trader Tools are available for all customers with a trading account fund of at least 200 USD. Pro Trader tools include Market Buzz, Featured Ideas, Economic Calendar and Analyst Views to provide trading ideas, insights into what is currently moving the markets, and actionable technical trade setups and real-time news events.

Trading Tools Overview:

![]()

![]()

Vantage’s Educational Material

Overall, Vantage offers an excellent range of educational and market analysis materials. The materials are comprehensive, well-presented, and suitable for new and more experienced traders.

Vantage Academy – A section dedicated to news articles and guides, including analysis and frequent financial updates.

Guide: The Basics of Forex Trading – A beginner’s guide for those interested in starting with Forex. The guide answers all the basic questions like “What”, “Why”, and Where” in a short and understandable way. Once done, you can move on to other guides to learn more.

Live webinars – Vantage offers weekly free webinars to help customers stay updated with the latest market events and sharpen their trading skills. If you missed out on any earlier webinars, they are available on Vantage’s Youtube channel.

Demo Account – Vantage allows customers to start trading on a free demo account. That way, they can familiarise themselves with the platform and learn how the market works without taking any real risks. Therefore, a demo account suits beginners and traders who want to experiment with new asset classes. Virtual funding is 100 000 USD and expires after 30 days. However, if you open a live trading account, you can open an unlimited demo account that does not expire.

Pro Trader Video Tutorials – Customers who open a live account with 1 000 USD or more get exclusive access to 130+ Advanced Forex and Stock trading tutorials.

Education Overview:

Social Trading

We found that Vantage offers an excellent and varied social trading experience compared to other brokers and were pleasantly surprised by the fact that they offer two copy trading platforms and their own social trading platform.

Vantage Social Trading

Vantage Social Trading allows traders to generate income by letting others copy their trades. To join, users must create a Social trading account, then set their profile as public. As others start copying their trades and a user attracts more followers, they will earn higher commissions (up to 3,5 %). Please note that this feature only is available on the Vantage Mobile App.

ZuluTrade

Through the ZuluTrade social trading platform, Vantage clients can gain exclusive access to a vast pool of professional traders and trading systems. It lets users locate successful traders and follow their trades, which are translated into real trades in their accounts. Note that traders will have to contact Zulutrade directly about possible platform costs.

MyFXBook Autotrade

As one of the most popular copy trading platforms on the market, MyFXBook Autotrade is a service where you can copy trades from top successful FOREX trading systems. It allows you to copy the trades of any system you select directly into your Vantage MetaTrader 4 account.

DupliTrade

Vantage clients can diversify their portfolio by duplicating the trades of proprietary traders. When traders connect to DupliTrade, they gain access to a portfolio of hand-picked proprietary traders. Then, you simply choose the traders you want to copy based on their performance, strategy, and trading style, and their trades will be duplicated on your Vantage FX MT4 or MT5 account. Note that traders have to have a minimum account balance of 2000 USD to access Duplitrade.

Customer Service

Available 24/7 in various formats, Vantage’s customer service is excellent compared to other brokers.

Vantage offers support via telephone, email, messenger services, and live chat 24/7. When contacting Vantage via their live chat, the waiting time was around 10 minutes, which is longer than average for a first response, but we received polite and correct answers to the questions asked.

Vantage offers phone support in six languages, including English, Spanish, Romanian, Lithuanian, French and Italian.

You can find answers to your questions in their extensive FAQ Section.

Safety and Industry Recognition

Regulation: Vantage is authorised and regulated by the Australian Securities and Investments Commission (ASIC), the Cayman Islands Monetary Authority (CIMA), the Financial Conduct Authority (FCA), the Financial Sector Conduct Authority of South Africa (FSCA) and the Vanuatu Financial Service Commission (VFSC).

- Vantage International Group Limited is authorised and regulated by CIMA (No.1383491)

- Vantage Markets (Pty) Ltd is authorised and regulated by FSCA (No. 51268)

- Vantage Global Limited is authorised and regulated by VFSC (No. 700271)

- Vantage Global Prime Pty Ltd is authorised and regulated by ASIC (No. 428901)

- Vantage Global Prime LLP is authorised and regulated by FCA (No. 590299)

Industry Recognition:

Vantage has received a wealth of industry recognition. Some recent awards include:

- Best Trading Platform and Best Trading App 2022 (Professional Trader Awards)

- Best MT4/MT5 Broker & Lowest Trading Costs 2020 (EMG Publishing (M&A Today))

- Best CFDs Retail Broker 2022 (Finance Magnates London Summit)

Evaluation Method

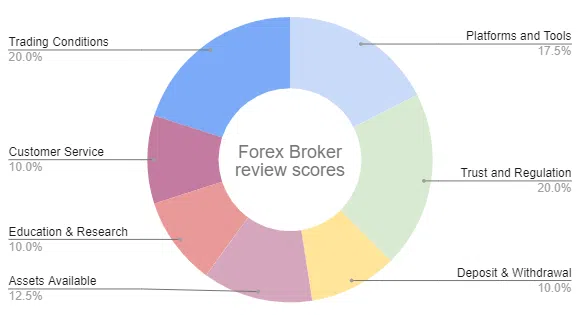

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the broker’s reliability, the broker’s platform offering, and the trading conditions offered to clients, which are summarised in this review.

Each one of these is graded on 200+ metrics across seven areas of interest, and an overall score is calculated and assigned to the broker according to the diagram below:

Risk Statement

Trading Forex is risky, and each broker must detail how risky the trading of Forex CFDs is to clients. Vantage Markets would like you to know that: Trading derivatives carries significant risks. It is not suitable for all investors, and if you are a professional client, you could lose substantially more than your initial investment. When acquiring our derivative products, you have no entitlement, right or obligation to the underlying financial assets. Past performance does not indicate future performance, and tax laws are subject to change.

Overview

Overall, Vantage is a trustworthy STP/ECN broker but with a limited range of financial instruments compared to other similar brokers. We are impressed that in addition to MT4 and MT5, TradingView and the Vantage app are also available. Vantage is now one of a handful of brokers that has such a good platform offering. Vantage has decent trading conditions on all its accounts. Most notable are its two ECN accounts that offer raw spread pricing in exchange for low commissions. The education and market analysis sections are excellent, and it has a great range of trading tools and offers 24/7 customer service. The only drawback of an otherwise excellent offering is its lack of regulatory oversight for South African traders.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Vantage stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.