-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

easyMarkets Broker Review

Last Updated On July 17, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on easyMarkets

Founded in 2001, easyMarkets was the first Forex broker to introduce negative balance protection and a guaranteed stop-loss. It has continued to innovate with unique tools such as easyTrade, Freeze Rate, and dealCancellation to help traders manage their risk.

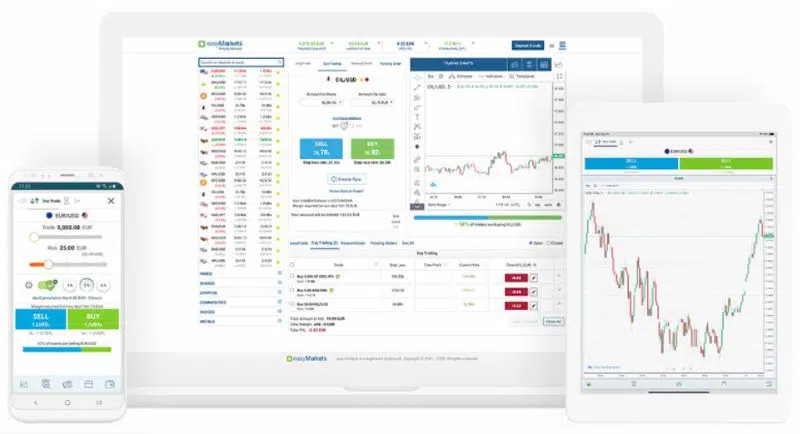

The main draw for beginner traders is easyMarkets’ well-designed trading platform, which integrates with TradingView and comes with all the tools mentioned above. easyMarkets’ also offers the MT4 and MT5 platforms, providing traders with ample choice.

easyMarkets offers seven live accounts with higher-than-average minimum deposits and trading costs that vary between 0.7 and 1.8 pips (EUR/USD), which is high for the industry. However, traders will appreciate that easyMarkets offers fixed spreads on most of its accounts, making it easy to calculate its trading costs.

Other than its trading costs, the only other drawback we found with easyMarkets is the lack of focus on more experienced traders. While easyMarkets provides good educational materials, it provides no advanced trading tools and virtually no market analysis.

| 🏦 Min. Deposit | USD 25 |

| 🛡️ Regulated By | CySEC, ASIC, FSA-Seychelles, B.V.I FSC |

| 💵 Trading Cost | USD 18 |

| ⚖️ Max. Leverage | 400:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Wide range of assets

- Innovative trading tools

Cons

- Limited platform choice

- Limited account options

Is easyMarkets safe?

A popular and well-regulated broker, easyMarkets has a very high trust rating and has been a reliable trading partner for South African traders since 2001. However, traders should be aware that they will be onboarded through the British Virgin Islands-based entity, which provides less regulatory oversight than regulators in the EU or UK.

FSC Regulation: South African traders will be trading under the subsidiary, EF Worldwide, regulated by the British Virgin Islands FSC. The FSC’s rules are somewhat relaxed compared to those of regulators in the EU and the UK, and South African traders will not be as well-protected as their European counterparts.

Safety features: Despite the comparatively weak regulatory oversight, easyMarkets segregates all client funds at top-tier banks worldwide. This segregation of client funds ensures that only clients have access to these funds and that they cannot be used in company operations. easyMarkets also provides traders with negative balance protection, ensuring they cannot lose more than the balance of their trading accounts.

easyMarkets is frequently audited by its regulators and uses these opportunities to identify areas of potential risk in its operations, ensuring constant improvement of internal processes.

Company Details:

We confirmed the licence on the FSC register. See the licence below:

EasyMarkets’ Financial Instruments

easyMarkets offers a limited range of assets compared to similar CFD providers, but it excels in the number of currency pairs available for trading.

Forex: easyMarkets offers 103 currency pairs for trading, more than most other Forex brokers.

Full List of Instruments and Leverage:

- Forex: easyMarkets sets itself apart from competitors by the number of currency pairs it has to trade. Where most brokers will provide between 40-60 pairs, easyMarkets offers 103. While the additional pairs are exotic pairs and not for the day trader, these currency pairs would work well for a position trader or others holding open trades for extended periods.

- Share CFDs: easyMarkets only offers trading on 50 share CFDs, which is much fewer than most other brokers. The selection available includes some of the major US, EU, AU, JA, and HK shares on the market.

- Precious metals: easyMarkets offers an extensive range of precious metals compared to other CFD providers, with 19 available for trading.

- Indices: easyMarkets offers trading on 15 Indices, which is very limited compared to other brokers, and only the most basic names are listed.

- Commodities: easyMarkets offers trading on 12 commodities, including metals such as gold and silver, energies such as natural gas and oil, and softs such as cotton and wheat. Most brokers only offer trading on between 5 – 10 commodities, so this is a decent offering.

- Cryptocurrencies: easyMarkets offers six cryptocurrencies for trading, which is around the industry average.

Overall, the range and depth of assets available to trade are limited compared to other similar brokers, but easyMarkets excels in its Forex offering.

Trading Fees

easyMarkets offers seven different account types, with trading conditions that vary depending on the platform chosen.

Trading Fees: easyMarkets’ Accounts have higher trading fees than other similar brokers, but unlike other brokers, most of easyMarkets’ accounts have fixed spreads, which makes it easier for traders to calculate trading costs.

Account Trading Costs:

As you can see from the table above, easyMarkets’ trading costs are built into the spreads.

The account with the lowest ongoing trading costs on offer is the VIP MT4 account, with trading costs of 7 USD per lot of EUR/USD, which is tighter than other similar brokers, but it has a high minimum deposit of 10,000 USD. The average cost of trading one lot of EUR/USD at similar Forex brokers tends to be 9 USD.

See below for account details:

Each account has trading conditions that vary depending on the platform chosen – either easyMarkets’ in-house platform, MT4, or MT5. Leverage is up to 1:200 on easymarkets’ proprietary platform, 1:400 on MT4, and up to 1:500 on MT5 for Forex trading (see the screenshot below for more details). All account types give traders access to an account manager, a platform tour, education on the basics of Forex trading, and fundamental and technical analysis through TradingView. Note that the guaranteed stop loss, freeze rate, and easyTrade tools are only available on easyMarkets’ in-house platform.

Demo Account

For new registrations, the demo is unlimited and will never expire. Demo accounts are suitable for beginners but also for testing easyMarkets’ in-house trading platform. Demo accounts come loaded with 10,000 USD in virtual funds, which can be topped up.

easyMarkets Web/App and TradingView VIP Account

The minimum deposit for this account is 10,000 USD, putting it out of the reach of most traders. Spreads are fixed at 0.8 pips (EUR/USD), which is lower than other similar brokers, and no commissions are charged for Forex trading. VIP account holders also have access to same-day deposits and withdrawals.

easyMarkets Web/App and TradingView Premium Account

This account has a minimum deposit of 2000 USD, making it accessible to most traders. Spreads are fixed at 1.5 pips (EUR/USD), which is wider than the industry average, but no commissions are charged for Forex trading.

easyMarkets Web/App and TradingView Standard Account

This account has a minimum deposit of 25 USD, making it accessible to most traders. Spreads are fixed at 1.8 pips (EUR/USD), which is wider than the industry average, but no commissions are charged for Forex trading.

MT4 VIP Account

The MT4 VIP Account has a minimum deposit of 10,000 USD, and spreads are fixed at 0.7 pips (EUR/USD), making it one of the lowest-cost accounts in the industry. However, because this account is only available on MT4, traders may experience slippage on this account, and the Guaranteed Stop Loss tool is unavailable.

MT4 Premium Account

The MT4 Premium Account has a minimum deposit of 2000 USD, and spreads are fixed at 1.2 pips (EUR/USD), which is average for the industry. However, because this account is only available on MT4, traders may experience slippage on this account, and the Guaranteed Stop Loss tool is unavailable.

MT4 Standard Account

The MT4 Standard Account has a minimum deposit of 25 USD, and spreads are fixed at 1.7 pips (EUR/USD), which is average for the industry. However, because this account is only available on MT4, traders may experience slippage on this account, and the Guaranteed Stop Loss tool is unavailable.

MT5 Account

The MT5 Account is, as the name suggests, only available on MT5. This is the only account with variable spreads, which means that spreads fluctuate with market volume and volatility. As published on the website, spreads start at 0.3 pips (EUR/USD), which is very tight, and there are no commissions for Forex trading. Like the MT4 VIP Account, there may be slippage, and the Guaranteed Stop Loss tool is unavailable.

Deposit & Withdrawal fees

easyMarkets charges low deposit and withdrawal fees compared to other similar brokers.

A well-regulated CFD provider, easyMarkets ensures that all Anti-Money Laundering rules and regulations are followed. As such, all non-profit funds are returned to the original deposit source. No matter your deposit method, the withdrawal of all profits must be made by bank transfer to a bank account in your name.

Trading Account Currencies: easyMarkets offers trading in 19 base currencies, including EUR, CAD, CZK, JPY, NZD, SGD, CHF, MXN, GBP, AUD, PLN, TRY, CNY, HKD, NOK, SEK, ZAR, and Bitcoin-based accounts (BTC), a much broader range than other similar brokers. However, because it does not offer accounts denominated in NGN, South African traders will have to pay currency conversion fees on both deposits and withdrawals.

Non-Trading Fees: easyMarkets does not charge any deposit or withdrawal fees, but it charges an inactivity fee of 25 USD after 12 months of account dormancy. If the account remains dormant, a fee of 25 USD will be charged every six months. Thereafter, accounts with a zero-free balance will be closed. These inactivity fees are around the industry average.

Deposits and Withdrawals: easyMarkets offers many deposit and withdrawal methods, bank wire transfers, credit and debit cards, Skrill, and Neteller, and several regional-only options. All deposit and withdrawal methods are commission-free. See below for processing times:

- Credit card/Debit cards (Visa, Mastercard, or Maestro): Deposits are instant, and withdrawals are processed within one day.

- Online Banking (Local Bank Transfer): Deposits and withdrawals are processed within three to five days.

- eWallets (Skrill, Neteller, Sticpay): Skrill and Neteller deposits are instant. Withdrawals take one working day.

- Bank Wire Transfer: Deposits and withdrawals are processed within three to five days.

Overall, easyMarkets offers a wider range of deposit and withdrawal methods than most other brokerages, and all deposits and withdrawals are free. Additionally, easyMarkets’ processing times are around the industry average.

Mobile Trading Apps

easyMarkets offers three mobile trading apps, more than other similar brokers, and its in-house trading platform integrates seamlessly with TradingView.

easyMarkets Platform

The easyMarkets mobile app has more features than the standard MT4 and MT5 equivalents. It is intuitive, powerful, and simplified, making it suitable for beginner traders. While the user interface looks modern and clean, it doesn’t support automated trading or allow the introduction of third-party plugins, which many traders find helpful. However, additional trading features that set easyMarkets apart from its competition, like dealCancellation, Freeze Rate, and Inside Viewer are only available on this platform.

Additional features like zero slippage, fixed spreads, and trading charts are also available free of charge through easyMarkets’ in-house platform, and traders can choose between all the financial instruments on offer.

TradingView

TradingView is free of charge for traders who open a live account. It is an excellent tool for researching, charting, and screening any instrument. Additional features of easyMarkets’ TradingView tool include:

- 50+ intelligent charting tools

- Over 100,000 custom user-built indicators and scripts

- Synchronised layout for multiple charts

Traders should note that TradingView is only available on easyMarkets’ trading platform.

One drawback for traders that choose easyMarkets’ proprietary platform, is that Forex traders are charged higher costs in the form of wider spreads, but using the easyMarkets’ platform is the only way to access all the products and services on offer.

MT4 and MT5

The easyMarkets’ MT4 and MT5 apps allow traders to work from anywhere, although there is slightly limited functionality compared to the desktop versions of the platforms, with reduced timeframes and fewer charting options. However, traders will still have access to analytics with technical indicators, graphical objects, a full set of trading orders, and functionality to close and modify existing orders.

easyMarkets’ Other Trading Platforms

With MT4, MT5, and its own in-house platform all available, easyMarkets offers support for more trading platforms than most brokers. Additionally, easyMarkets’ in-house platform integrates with TradingView, adding advanced functionality.

easyMarkets supports MT4 and MT5 and the mobile suite of the MetaTrader tools, along with its proprietary platform, developed in-house. The easyMarkets platform comes with a set of unique risk management tools that are not available on MT4 or MT5.

MT4 and MT5

Developed by Metaquotes, MT4 and MT5 are still considered the most popular and customisable trading platforms in the industry. Although the platforms’ interfaces are dated, they are still widely recognised for their fast execution speeds, a wide range of charting tools, algorithmic trading, and customisability. The benefit of easyMarkets offering third-party platforms such as MT4 and MT5 is that traders can take their own customised versions of the platform with them should they migrate to another broker.

However, using MT4 and MT5, traders may experience slippage, but negative balance protection is guaranteed. Traders can also only choose between 80 financial instruments, including currencies, metals, commodities, indices, and cryptocurrencies.

easyMarkets’ Platform and TradingView

For traders who wish to trade from a browser, easyMarkets’ web-based platform is offered. We really liked that the platform integrates directly with TradingView. Like the mobile trading application, the easyMarkets’ platform is user-friendly, fast, easy to navigate, and comes standard with all additional trading features offered on easyMarkets’ mobile platform.

Trading Platforms Overview:

Opening an Account at easyMarkets

The account opening process at easyMarkets is fast, hassle-free, and fully digital.

All South African residents are eligible to open an account at easyMarkets as long as they meet the minimum deposit requirements.

The account-opening process is quick, and accounts are usually ready for trading within a few hours. easyMarkets offers Corporate and Individual accounts, but we will focus on opening an Individual account:

- Prospective traders will have to click on the “Sign Up” button at the top of the page, where they will be directed to register an account with an email address and a password.

- Traders can choose between opening a demo or a live account.

- On choosing the live account option, traders will be directed to fill in their personal details and select the account type that suits them. Thereafter, they will have to submit the Know Your Customer (KYC) documentation:

- easyMarkets requires proof of identification (including a current passport, ID card, or driver’s licence.

- Proof of address, such as a utility bill or bank statement that is less than six months old.

- The account will be ready for trading once documentation has been verified, which usually takes a couple of hours.

- We advise you to read easyMarkets’ risk disclosure, customer agreement, and terms of business before you start trading.

Overall, easyMarkets’ account opening process is efficient and hassle-free, and all documents can be uploaded digitally.

Trading Tools

easyMarkets offers a limited range of trading tools compared to other brokers, but it provides excellent risk management and technical analysis tools.

One of easyMarkets’ unique selling points is the number of innovative tools it offers. Having been the first broker to offer negative balance protection, easyMarkets now offers a number of helpful risk management tools, but these are only available on its in-house platform.

The easyMarkets platform offers the following tools:

- dealCancellation – unique to easyMarkets, this tool allows clients to cancel an order within six hours of making a trade. Traders are charged a fee for using this service, based on the market volatility of the instrument being traded.

- Freeze Rate – another unique tool, Freeze Rate allows you to freeze a price you see for a few seconds. This tool is especially useful in volatile markets.

- Inside Viewer – this tool shows people what percentage of traders are buying or selling a specific instrument. A relatively standard tool now, this was the first of its kind when it launched in 2009.

- easyTrade – In 2018, easyMarkets launched its latest trading innovation – easyTrade. This simplified platform allows easyMarkets clients to trade without margin requirements, high leverage and features zero spreads. It also simplifies trading to just three steps – choose your maximum risk and the duration of your trade, and decide whether the rate will go up or down. Simplified trading allows novice traders to trade without distractions or extra functions. Experienced traders benefit from the ability to place a trade quickly when markets move and use easyTrade as an effective hedging tool. Traders should note that easyTrade is only available on 20 financial instruments.

Overall, easyMarkets offers a relatively limited suite of trading tools compared to its large international competitors, but it provides excellent risk management and technical analysis tools.

Trading Tools Overview:

Educational Materials

easyMarkets provides a good selection of educational materials for beginner traders but lacks materials for more advanced traders.

easyMarkets provides an average selection of educational materials, but most of these are geared toward new traders, making it a good choice for beginners. However, it lacks materials for advanced traders and doesn’t offer webinars or live education.

The easyMarkets educational material can be found in the easyMarkets Learn Centre and is split across six sections.

- The Getting Started section is an archive of videos on the fundamentals of trading and an introduction to easyMarket’s features and tools.

- The Discover Series video archive goes into more depth on the different instruments available to trade on easyMarket’s platform and the history and concepts behind them.

- The Free eBooks section is a repository of 10 eBooks available to easyMarkets clients – topics covered include technical analysis, trading psychology, MT4 guides, and vanilla options. If you are more accustomed to learning through reading, this is an invaluable resource.

- The Knowledge Base is a collection of articles on topics useful to new traders.

- Economic Indicators is an excellent interactive breakdown of the various economic indicators (e.g. TIC data, PMI, etc.) and their relative effect on markets.

- Finally, a trading glossary and FAQ sections are also available to support learning.

Overall, easyMarkets’ education section is helpful to get beginner traders started in their trading careers, but it would do well to add materials for more advanced traders.

Education Overview:

Analysis Material

The research and market analysis materials at easyMarkets are limited compared to most other brokers.

easyMarkets also provides a standard assortment of market analysis products, but only the blog section is curated by in-house analysts. easyMarkets also provides Trading Charts, which offer very little insight, a list of live currency rates, and a basic Economic Calendar.

On the whole, the research section lacks substance compared to other large international brokers.

Customer Support

easyMarkets’ customer support is excellent compared to other international brokers.

Support is offered 24/5 via email, live chat, messenger services, and telephone in various languages. We found the customer support responsive and polite. We contacted them at all times of the day, and they were able to answer our questions to our satisfaction.

easyMarkets Regulation and Industry Recognition

Due to robust internal processes, high industry recognition, and strong regulation from two primary international regulators, we believe that easyMarkets is a trustworthy broker for South African traders.

Regulation: easyMarkets is regulated by the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the Republic of Seychelles by the Financial Services Authority of Seychelles “FSA,” and in the British Virgin Islands by the Financial Services Commission “FSC.” See below for a list of easyMarkets’ registered companies:

- Easy Forex Trading Ltd is regulated by CySEC, license: 079/07, which has been passported in the European Union through the MiFID Directive.

- Easy Markets Pty Ltd is regulated by ASIC license: 246566.

- EF Worldwide Limited is regulated by the FSA Seychelles, license number SD056.

- EF Worldwide Limited is regulated by the BVI FSC, license number SIBA/L/20/1135.

Awards

With numerous industry awards and recognition, it is clear that easyMarkets is well-respected by both its peers and clientele. Some of easyMarkets’ recent awards include:

- Most Trusted Forex Broker in the Middle East 2022 (End of Expo Egypt)

- Best Forex Trading Innovation 2021 (com)

- Best Forex Trading App 2021 (Smart Vision Investment Expo)

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the easyMarkets offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each of these is graded, and an overall score is calculated and assigned to the broker.

easyMarkets Risk Statement

Trading Forex is risky, and each broker must detail how risky the trading of Forex CFDs is to clients. easyMarkets would like you to know that: CFDs and Options are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs and Options work and whether you can afford to take the high risk of losing your money.

Overview

easyMarkets is a well-regulated non-dealing desk market maker with a large Forex offering and a unique suite of risk management tools. Support is offered for its beginner-friendly in-house platform that integrates seamlessly with TradingView, MT4, and MT5. easyMarkets has seven live accounts, each linked to a different platform that caters to traders with differing experience levels. However, while easyMarkets provides a good educational library for beginner traders, its market research section lacks substance and leaves advanced traders looking to third-party resources for more comprehensive market analysis.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how easyMarkets stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.