-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

FxPro Broker Review

Last Updated On April 11, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on FxPro

FxPro is a well-regulated broker with a wide range of accounts, reasonable minimum deposits, and an excellent selection of trading platforms. South African traders should be aware that even though FxPro is regulated by the South African FSCA, they will be onboarded through FxPro’s Bahamas-based entity. This means that South African traders have few legal rights in the event of a dispute with the company.

Its education and market analysis are good for beginners, but lack the depth sought by more experienced traders. However, we were impressed with how easy-to-use FxPro’s mobile trading app was and the quality of customer support we received. Support is available in a range of languages, 24 hours a day, seven days a week.

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | FCA, CySEC, FSCA, DFSA |

| 💵 Trading Cost | USD 14 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, cTrader, FxProEdge |

| 💱 Instruments |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Great platform choice

- Tight spreads

Cons

- Limited education

Is FxPro Safe?

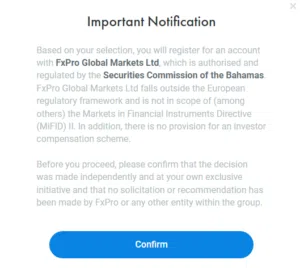

Although FxPro holds a licence from the South African FSCA, South African traders are on boarded through FxPro’s Bahamas-based entity, regulated by the SCB. This arrangement means that South Africans have little recourse in the case of a dispute with FxPro.

No more FSCA protection: Until recently, FxPro clients were still protected by FSCA regulation. But now FxPro is on-boarding all new South African clients through its SCB-based entity. This means that South Africans will not benefit from local regulation and that their money will not be segregated at South African banks. See below for FxPro’s sign-up notice:

Safety Features: Although the lack of FSCA oversight may be off-putting for some South African traders, we still consider FxPro a safe broker to trade with. It is regulated by multiple top-tier regulators from around the world, it segregates client money at top-tier banks, and offers negative balance protection to all clients so that traders cannot lose more than is in their trading account.

Company Details:

![]()

![]()

Financial Instruments

FxPro’s range of financial instruments is broad compared to other brokers, including a large range of cryptocurrencies, share CFDs, and Forex pairs.

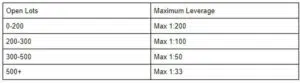

Leverage: Because South African traders are onboarded through the SCB, leverage is limited to 200:1. Many other brokers offer leverage of up to 500:1 for Forex trading. Leverage also reduces with increasing trading volume, as per the table below:

Full list of instruments and leverage:

![]()

![]()

- Forex: FxPro has a broad range of currency pairs available for trading, including majors (EUR/USD, GBP/USD, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics.

- Share CFDs: FxPro offers a broad range of share CFDs compared to other brokers. The selection available includes some of the major US companies, including Mcdonald’s, Adobe, Mastercard, and Facebook, among others.

- Futures: Futures are limited in scope compared to other brokers.

- Indices: Also limited compared to other brokers, there are only 19 indices available at FxPro. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

- Spot Metals: FxPro offers trading on an average range of spot metals, including gold, silver, and platinum.

- Cryptocurrencies: FxPro’s range of crypto pairs competes well with other large international brokers.

Overall, FxPro offers a limited selection of financial assets compared to other similar brokers, but it excels in its Forex offering.

Accounts and Trading Fees

FxPro offers a broad range of account options and its trading fees are around the industry average.

Trading Fees: Our review found that FxPro offers eight live account types. Trading fees vary depending on the platform chosen by the trader. The Standard, MT4, MT5, and FxPro Edge accounts have trading costs included in the spread, while the cTrader, Raw, and Elite Accounts offer tight spreads in exchange for a commission.

Account Trading Costs:

![]()

![]()

As you can see from the table above, the trading costs on the commission-based accounts are lower than the commission-free accounts, which all have spreads of 1 pip (EUR/USD). More competitive brokers tend to have trading costs that average around 9 USD on their commission-free accounts, and around 8 USD on accounts on which commissions are charged.

MT4 Account

The MT4 account is a market execution account that allows trading on forex, metals, shares, indices, energies, and futures. Fees are included in the spreads, averaging at 1.40 pips on the EUR/USD, which is significantly wider than other brokers.

MT4 Fixed Account

The MT4 Fixed Account is similar to the MT4 Account, except that it employs instant execution. Fees are included in the spread, which average at 1.84 pips on the EUR/USD, and trading is offered in micro-lots. These fees are high for the industry.

MT5 Account

The MetaTrader 5 account is for those who want to use the popular trading platform’s latest generation. This account offers market execution, and variable spreads starting at 1.20 pips, which is wider than other similar brokers. All fees are included in the spreads, and no commissions are charged.

cTrader Account

A market execution account, spreads average at 0.2 pips on the EUR/USD, and a commission of 7 USD round turn per lot traded is charged. These trading costs are lower than those found on other accounts. Trading is offered on Forex, metals, indices, and energies.

FxPro (EDGE)

The FXPro Edge Account is also a market execution account that allows for trading on all instruments (Forex, metals, indices, cryptos, energies, equities, and shares). Spreads are the same as for the MT4 market execution account, averaging at 1.40 pips on the EUR/USD, and no commissions are charged. As this account is only available on FxPro’s proprietary platform, algorithmic trading is not available.

FxPro recently added another range of accounts for the MT4 and MT5 trading platforms:

Standard Account

This account is very similar to the MT5 account. The minimum deposit is 100 USD, spreads start at 1.2 pips (EUR/USD), and no commissions are charged.

Raw Account

This account has a minimum deposit of 500 USD, which is higher than other similar brokers. Spreads start at 0 pips (EUR/USD) – averaging at around 0.2 pips, and a commission of 7 USD (round turn) is charged. These fees are low for the industry.

Elite Account

This account requires a balance of 30,000 USD over 2 months, which is high for the industry. Trading fees are the same as the Raw account, with spreads down to 0 pips (EUR/USD) in exchange for a commission of 7 USD (round turn), but traders get a rebate of around 1.5 USD per lot traded.

Islamic Swap-Free Accounts

FxPro only offers Swap-free accounts for religious purposes as per the Shariah law. In order to open an account, traders will need to provide an official document such as a Birth or Marriage certificate or an official letter from the leader of their local Muslim community. In lieu of the interest charged on overnight positions, Islamic traders will be charged a commission of 7.50 USD per lot, but this only applies after the 8th night of trading.

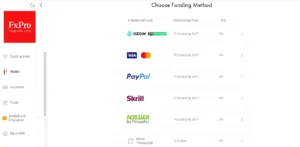

FxPro Deposits and Withdrawals

FxPro’s deposit and withdrawal fees are low compared to other brokers, though FxPro charges a fee on certain withdrawal methods if no trading has occurred.

A well-regulated broker, FxPro ensures that all Anti-Money Laundering rules and regulations are followed, and as such, all non-profit withdrawals are returned to the deposit source.

Accepted Deposit Currencies: When we opened our account, we noticed that the FxPro client portal allows traders to choose between eight base currencies, including USD, EUR, GBP, CHF, PLN, AUD, JPY, and ZAR. Because we were depositing ZAR from our South African bank account into our ZAR-based trading account, we weren’t charged any currency conversion fees.

Funding Methods: We were pleased to find that FxPro offers a good range of payment methods and it does not charge fees for deposits or withdrawals. See below for a complete list of payment options and withdrawal times:

![]()

![]()

Clients are not charged a fee for withdrawals via e-wallets such as Skrill and Neteller, but there are conditions:

- Skrill: a fee of up to 2.6% will be charged if a withdrawal is requested without having traded.

- Neteller: a fee of up to 2% will be charged if withdrawal is requested without having traded.

Overall, FxPro provides a decent range of deposit and withdrawal methods, and its fees are low compared to other similar brokers.

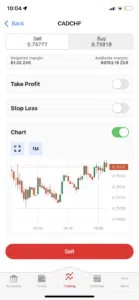

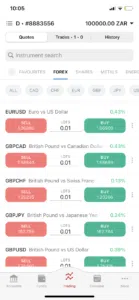

FxPro’s Mobile Trading Platforms

Available on both Android and iOS, FxPro’s mobile platform support is excellent compared to other similar brokers.

FxPro Mobile Trading

User-friendly: We found that the app was very easy to set up and use. It uses a biometric login, which is convenient, and we could easily search for and monitor our assets and trades, and create watchlists. The app comes with an interactive economic calendar, and we could also transfer, deposit, and withdraw funds.

|

|  |  |

Drawbacks: Disappointingly, unlike the web trader version of the platform, there are no technical indicators or graphical objects, a reduced number of timeframes, and only four chart types as opposed to six. Additionally, the FxPro mobile trading app does not support automated trading, but FxPro offers MT4, MT5, and cTrader for these purposes.

MetaTrader Mobile Trading

The MT4 and MT5 apps allow traders to work from anywhere, with nine timeframes, 30 indicators, and interactive currency charts. Functionality to close and modify existing orders, calculate profit/loss in real-time, and tick chart trading further assists traders while on the move.

cTrader Mobile Trading

The cTrader mobile app carries over most of the best parts from the desktop version, including the complete range of order types, price alerts, trade analysis, and symbol watchlists. Chart types have been reduced to 4 however.

FxPro’s Other Trading Platforms

With support for MT4, MT5, cTrader, and the FX Pro Edge, FxPro has more trading platforms than most other brokers.

FxPro Edge

We think that the FxPro Platform is a great option for those who wish to conveniently manage their funds and trade the full range of CFD asset classes directly from the FxPro App, without having to install any other applications. It offers 50+ technical indicators and charting tools, detachable chart windows, useful trading widgets, a customisable layout, and 6 chart types with 15 timeframes. We found that the FxPro platform is also generally easier to use and set up than the Metatrader platforms, but unlike the other platforms, it does not integrate with Trading Central, lacks algorithmic trading and doesn’t have the execution speeds of MT4/5. Additionally, unlike cTrader, the FxPro trading platform does not offer access to full market depth.

MT4, MT5, and cTrader

MT4, MT5, and cTrader are considered some of the best trading platforms in the industry. While MT5 is a newer and upgraded version of the MT4 platform, the MT4 platform remains the industry standard. For beginners, MT4 and MT5 can be tricky to set up, but there are numerous guides in both text and video format to guide you through this process. cTrader is more beginner-friendly and needs fewer tweaks to optimise it for Forex trading, but there is less guidance freely available on the internet.

Overall, FxPro’s trading platform support is one of the best in the industry. In addition to its excellent Metatrader offering, it provides cTrader and a proprietary platform that are generally easier to set up and use.

Platform Comparison:

![]()

![]()

Opening An Account at FxPro

We found that FxPro excels in its account opening process. It is straightforward and hassle-free, and accounts are generally ready for trading within two hours.

As a trader from South Africa, you can open an FxPro account but will be assessed to ensure you have sufficient trading knowledge and/or experience to understand the risks associated with trading leveraged products. Although this may seem like a hassle, it is a responsible move on the part of the broker to ensure customer protection.

The account-opening process is as follows:

- FxPro’s intake form requires clients to fill in their email address, name, telephone number, country of residence, and date of birth. A confirmation pin will be sent to the listed email address.

- FxPro then requires prospective traders to answer questions regarding their financial knowledge and level of trading experience.

- Traders will then select a trading platform (MT4, MT5, FxPro Edge, or cTrader), default leverage, base currency, and their preferred language of communication.

- In order to verify their identity, individuals are required to submit a copy of their National ID or Passport with the signature page, and a copy of a recent utility bill or bank statement displaying the customer’s name and address that is not older than three months.

- Following the “Account Opening Application Form,” FxPro will use the information to conduct further inquiries about prospective traders to determine their suitability. FxPro reserves the right to conduct an assessment at any stage of the relationship with its clients.

Compared to other similar brokers, FxPro’s account opening process is fast and generally hassle-free and accounts are generally available for trading within two hours.

Trading Tools

FxPro’s trading tools are average compared to other similar brokers, but it provides access to Trading Central, a world leader in technical and fundamental analysis, and a VPS service.

FxPro’s suite of trading tools includes access to Trading Central, a VPS service at an extra cost, an Economic Calendar, and various calculators.

Trading Central

Trading Central is provided free of charge to all FxPro clients. A third-party tool, Trading Central’s professional analysts use the most advanced technical analysis tools in the industry to gather all of the comprehensive and in-depth information. Their decisions are based on building price corridors and resistance levels, digital and graphical indicators for various classes, as well as recognizing candlestick patterns. This tool essentially supports traders without the technical know-how in making trading decisions. This dynamic product suite is available to traders through the MT4/MT5 platforms. Trading Central is considered one of the best trading tools in the industry, and FxPro does well to offer this tool to its clients.

VPS

The FxPro Virtual Private Server (Forex VPS) enables you to upload and run your MT4 Expert Advisors and cAlgo Robots 24 hours a day, without needing to keep your trading terminal running. Available at 30 USD per month, FxPro’s VPS services are provided by a third-party, Beeks FX VPS. VPS services have the advantage of never suffering connectivity issues and have extremely low latency due to their proximity to major international exchanges.

Economic Calendar

FxPro provides a good economic calendar, which helps traders plan their trading based on economic reports due to be released, previous economic events, consensus forecasts, and estimated volatility.

Trading Calculators

FxPro offers various calculators which help traders to calculate commissions, the margin required, and the total costs of their trades.

Overall, FxPro provides an average selection of tools compared to other similar brokers, and its VPS services are available at an extra cost.

Trading Tools Comparison:

![]()

![]()

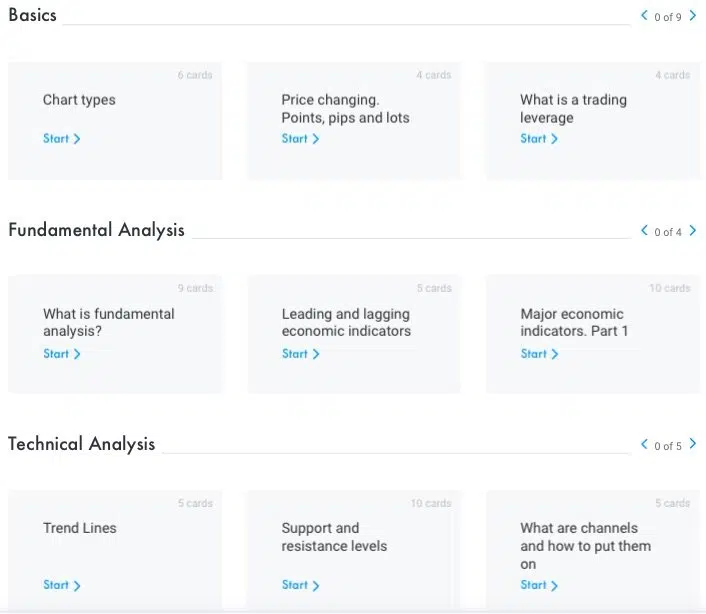

FxPro for Beginners

FxPro is one of the largest and most respected brokers in the industry and, as such, is an excellent choice for new traders – it now offers 24/7 customer support. However, FxPro provides a limited selection of educational and market analysis materials compared to other brokers. Materials are presented in written and video formats.

FxPro’s Educational Content

FxPro provides a limited selection of educational materials compared to other similar brokers, but it offers a good demo account.

FxPro offers a publicly available education library, including Forex education, technical analysis, fundamental analysis, and trading psychology. While there is little structure or depth to the material, the information is accurate.

Educational resources include a series of articles covering the basics of forex trading, which is limited, but helpful for beginners. It also offers a few resources for advanced traders, such as Fundamental Analysis 2.0. Its videos cover topics such as Trade Habits, Currency Pairs, and Market Players.

FxPro online webinars take place several times a week and can be attended live by registering an account. Webinars will also be uploaded to its YouTube channel to be watched at a later time. The webinar subjects vary from trading strategies to technical and fundamental analyses.

Demo Accounts

Prospective traders can open an FxPro demo account on any of the platforms supported. Loaded with 500,000 USD in virtual funds, demo accounts are available for all platforms. Demo accounts are a great way to familiarise oneself with markets and practice trading strategies.

![]()

![]()

Overall, FxPro’s education section is limited and provides little support for beginners or advanced traders.

Education Comparison:

![]()

![]()

Analysis Material

FxPro offers a limited selection of market analysis materials compared to other similar brokers.

FxPro offers a variety of news resources, including a market overview curated by its in-house team of analysts. Materials are updated daily, and the news blog supports readers with commentary, analysis, and daily stories related to future market movements and trading opportunities. However, other large international brokers offer regular commentary in video format, which is not available at FxPro.

FxPro also provides extensive technical analysis available in written format. The technical analysis section is updated multiple times per day, and these are short articles. Additionally, FxPro offers an economic calendar and a bank calendar so that traders can plan their trades.

Overall, FxPro’s market analysis is not as comprehensive or in-depth as what is offered at other large brokers, but it will certainly be enough to satisfy most traders.

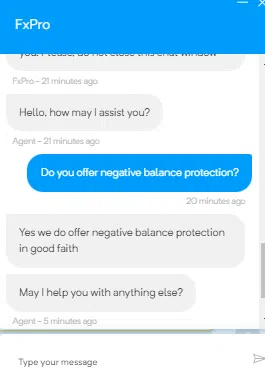

Customer Support

Global support is available 24/7, from a multilingual team at FxPro offices worldwide. This is exceptional for an industry where the norm is 24/5. Support is available in 18 languages, via email, live chat, a request call-back service, and telephone, but not locally in South Africa. Support teams at FxPro are available to help with technical and account-related questions but, as with all regulated brokers, cannot offer investment advice.

We found the live chat support responsive, polite, and quick to provide relevant answers. As you can see, our questions were answered within a matter of seconds:

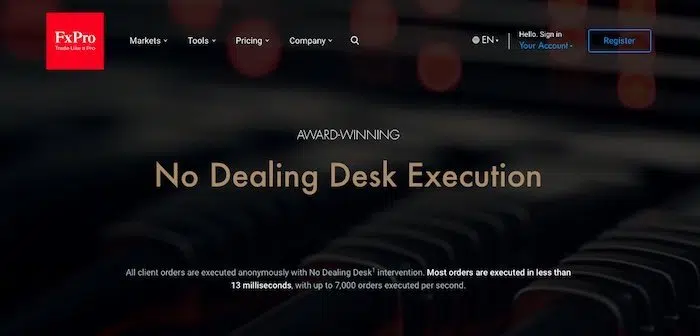

Safety and Industry Recognition

Regulation: A no-dealing desk (NDD) market maker, FxPro was founded in 2006 and is headquartered in London. It has a customer base of over 870 000 clients from 173 countries and is regulated by many top-tier regulators, including the UK Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) of South Africa, and the Securities Commission of the Bahamas (SCB). See below for a list of FxPro registered companies:

- FxPro UK Limited is authorised and regulated by the FCA (registration number 509956).

- FxPro Financial Services Ltd is authorised and regulated by CySEC (license number 078/07).

- FxPro Financial Services Ltd is authorized and regulated by the FSCA (authorisation number 45052).

- FxPro Global Markets Ltd is authorised and regulated by the SCB, license no. SIA-F184.

Awards

FxPro has collected over 80 awards from its industry peers. Recent awards include:

- Best Broker UK 2021 (Ultimate Fintech Awards)

- Best FX Provider 2021 (Online Personal Wealth Awards)

- Best Trading Platform (2020)

- Best Broker 2014-2020 (Financial Times and Investors Chronicles Awards)

- Best Forex Trading Experience 2018 (UK Forex Awards)

- Best Forex Provider 2014-2018 (Investors Chronicle & Financial Times Investment and Wealth Management Awards)

- Most Reliable Broker of the Year (Global Markets) 2018 (International Investor)

- Most Trusted Forex Brand, UK, 2017 (Global Brands Magazine).

Taken together, the long history of responsible behaviour, the strict banking standards, the first-class international regulation, and the industry praise, we deem FxPro a trustworthy and safe broker.

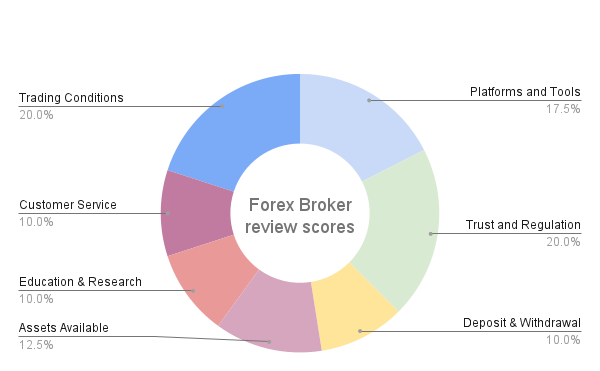

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Disclosure

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. FxPro would like you to know that: Trading CFDs carries a high level of risk and may not be suitable for all investors. Please ensure that you understand the risks involved as you may lose all your invested capital. 71.58% of retail investor accounts lose money when trading CFDs with this provider. Past performance of CFDs is not a reliable indicator of future performance. Most CFDs have no set maturity date, and a CFD position matures on the date an open position is closed.

Overview

FxPro is a well-regulated non-dealing desk market maker broker with a large international customer base that heavily promotes the accolades it has received over the years.

FxPro offers eight live accounts on a wider range of platform choices than is usually available at other brokers, and its trading costs are around the industry average.

FXPro’s marketing strategy includes an open approach to education, but account holders should not expect in-depth or well-structured materials. That said, customer support is accessible and responsive, a real benefit for beginners with many questions.

Overall, FxPro is a dependable choice for traders looking for a strong, traditional and safe broker.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how FxPro stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.