-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Many South African forex traders are not sure what their legal tax obligations are towards the South African Revenue Service (SARS). Many trading accounts are overseas, and the gains made from their trading are not visible to SARS, some traders open trading accounts with forex brokers located in South Africa, or with brokers who have branches in South Africa. In this case, these traders’ capital won’t leave the country.

Trader Must Pay Tax On Earnings

It is a common misperception that traders don’t need to pay income tax on profits made in offshore trading accounts. If a South African resident generates profit from trading in an offshore trading account while residing within the borders of South Africa, the profit is regarded as normal taxable income and needs to be declared in South African Rand in their tax returns. In this case, it doesn’t matter where the income originates from, but rather where the person resides while generating that income.

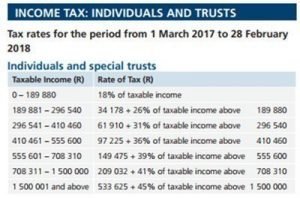

Tax Rates for Individual Traders and Special Trusts

Forex traders who trade in their individual capacity and special trusts are subject to the following income tax rates:

SARS Pocket Tax Guide 2017/2018

However, traders are only required to pay income tax if their total income exceeds a certain annual threshold which is determined by their age.

SARS Pocket Tax Guide 2017/2018

For example, traders younger than 65 will only start paying tax when their total taxable income exceeds R75,750 per annum (an average of R6,312.50 per month). However, a trader who is the sole member of a closed corporation (CC), for example, can legally reduce their tax liability by utilizing his individual tax threshold plus his close corporation’s tax threshold. This is done by ‘employing’ the individual by the close corporation. This raises the trader’s tax threshold from R75,750 per annum to R151,500. In this case, the trader will only pay income tax when his profits exceed R151,500 per annum. Only one close corporation’s ‘tax threshold benefit’ may be used by an individual.

Tax Rates Business Entities

Forex traders should be aware that different South African business entities are subject to different tax rates. Here is a brief explanation:

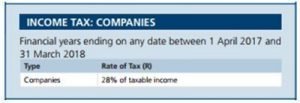

Companies

Forex trading which is done through a registered South African company is subject to a flat tax rate of 28% of its taxable income:

SARS Pocket Tax Guide 2017/2018

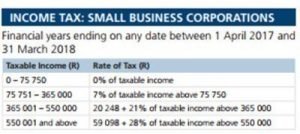

Small Corporations

Small business corporations enjoy more leeway than companies and only start paying tax when their taxable income exceeds R75,750. Only after their taxable income exceeds R550,001 will they pay the same rate as companies (28%) but only on the portion of income that exceeds R550,001. The first R550,001 is taxed according to this table:

SARS Pocket Tax Guide 2017/2018

Trusts Other than Special Trusts

Trusts other than special trusts are taxed at a flat rate of 45%:

SARS Pocket Tax Guide 2017/2018

Tax Deductible Expenses

South African forex traders are entitled by the law to deduct from their taxable income, any expenses incurred in producing that income. Therefore, local forex traders should keep records of all expenses related to their trading activities, including staff remuneration, forex trading courses, money spent on trading software, office equipment, stationery, office rental, cleaning services, computer repairs, bank fees, etc. Traders can also deduct asset depreciation (wear and tear) from their taxable income. For example, the value depreciation of a forex trader’s computer used for trading or trading related tasks may be deducted from the income derived from his trading activities. Whether forex trading is done through a registered company, small business corporation, trust, or in someone’s personal capacity, all expenses incurred in producing the income may be deducted from the taxable income.

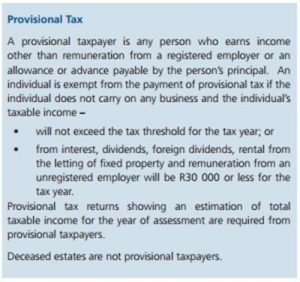

Provisional Tax

SARS Pocket Tax Guide 2017/2018

Forex trading is usually conducted as a business, and most South African traders usually don’t receive remuneration from a registered South African employer for their forex trading activities. These traders, therefore, need to register for provisional tax and make two provisional tax payments annually (one payment 6 months into the financial year and the other payment at the end of the financial year). Another payment, commonly known as the third or top-up payment, may be made to cover a potential shortfall in the second payment. Provisional tax payments are calculated on estimated taxable income and the estimates are submitted to SARS on an IRP6 return. Companies are also required to pay provisional tax. For more information on provisional tax please visit this page: Guide for Provisional Tax.

This article is a general guide only and is not intended as individual legal tax advice. For more specific information on South African tax legislation please consult a registered tax practitioner or the South African Revenue Service.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.