-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

BDSwiss Broker Review

Last Updated On March 11, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on BDSwiss

Founded in 2012, BDSwiss is a responsible and well-regulated broker with a large international customer base. It offers trading on multiple instruments, including CFDs in Forex, commodities, shares, indices, and over 26 cryptocurrencies.

BDSwiss’s trading fees are industry-average across most of its account types. The Cent Account requires a minimum deposit of 10 USD and spreads start at 1.5 pips on the EUR/USD, but no commissions are charged for Forex trading. Trading fees are significantly lower on the Zero-Spread Account, down to 0.0 pips (EUR/USD) with a commission of 6 USD, and a minimum deposit of 100 USD/1,800 ZAR.

With full support for both the MT4, MT5, and its own proprietary trading platforms, traders can access various trading tools, including Autochartist and built-in trend analysis tools. Additionally, its award-winning educational and analytical materials cater to traders of all experience levels, and BDSwiss allows all trading strategies, including hedging, scalping, and algorithmic trading.

| 🏦 Min. Deposit | ZAR 150 |

| 🛡️ Regulated By | FSCA, FSC, FSA-Seychelles, MISA |

| 💵 Trading Cost | USD 13 |

| ⚖️ Max. Leverage | 2000:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, BDSwiss WebTrader |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Tight spreads

- Good for beginners

- Excellent education and market analysis

Cons

- High inactivity fees

- Limited number of assets

Is BDSwiss Safe?

With a long history of responsible behaviour and local and international regulation, we consider BDSwiss a safe broker to trade with.

BDSwiss was founded in 2012 and is regulated by the Mauritius Financial Securities Commission (FSC), the Financial Sector Conduct Authority (FSCA), the Mwali International Services Authority (MISA) and the Financial Services Authority (FSA) of Seychelles. See below for more details:

- BDS Markets is authorised and regulated as an Investment Dealer by the Mauritius FSC on 06/12/2016 (License No. C116016172)

- BDS Ltd is authorized and regulated by the Financial Services Authority (FSA) Seychelles under license number SD047.

- BDS Investments LTD is authorized and regulated by the MISA authority in Mwali with license number T2023244.

- BDSwiss Markets SA (Pty Ltd) is authorized and regulated by the FSCA with license number 49479

South African clients will be trading under BDSwiss Markets SA (Pty Ltd), authorized and regulated by the Financial Sector Conduct Authority (FSCA) in South Africa.

However, at BDSwiss all client funds are placed in segregated tier one bank accounts and are offered negative balance protection. If a client falls into a negative trading balance, BDSwiss will adjust the total negative amount so that the client does not suffer any loss.

In terms of industry recognition, BDSwiss outshines many of its competitors. Recent awards include:

- “Broker of the Year” (Mindanao Traders Expo 2023)

- “BEST FX Educational Broker 2023” (Forex Expo Dubai Awards)

- “Best Global Partnership Programme & Best Forex Research & Education Provider” (UF AWARDS GLOBAL 2023), “Best IB/Affiliate Programme – APAC, 2023” (UF Awards);

- “Fastest Growing Forex Broker Dubai 2023” (Global Banking & Finance Awards)

- “Best IB/Affiliate Program Africa, 2023” (FAME Awards)

- “Fastest Growing Multi-Asset Broker LATAM, 2023” (Gazet International Magazine)

Our sister site, FXScouts, also awarded BDSwiss the award for Best Market Research Provider 2020, citing BDSwiss’s “exceptionally detailed and thoughtful market analysis for traders of all experience levels.”

Overall, because of its history of responsible behaviour, strict auditing processes, and wide industry acclaim, we consider BDSwiss a trustworthy broker.

Trading Fees

BDSwiss’ trading fees are average compared to other similar brokers.

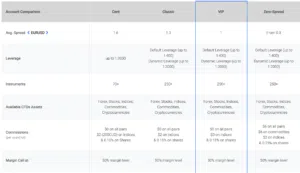

Like most other brokers, BDSwiss offers four account types (for more details on BDSwiss’ trading accounts, click here).

BDSwiss’ fee structure is transparent, and it publishes all the spread and commission costs associated with each account.

The average cost for trading one lot of EUR/USD among similar brokers is about 9 USD per lot. This is different in the Zero-Spread Account, with 6 USD commission round trip on all Forex pairs and 2 USD on indices.

Swap Fees

BDSwiss charges swap fees for positions that are held overnight. Interest is paid (or received) for each night a position is held. In the case of Forex instruments, the amount charged depends on both the positions taken (i.e. long or short) and the rate differentials between the two currencies traded. BDSwiss’ swap rates are published on its website for each financial instrument. For example, BDSwiss charges swap fees of 10 USD on the EUR/USD on a long position, and traders earn 2 USD on a short position.

On the whole, compared to other similar brokers BDSwiss’ initial and ongoing costs are average. The minimum deposit on the entry-level account is low and average on the other accounts. Additionally, spreads are reasonable on all account types and 0.0 when trading through BDSwiss’ Zero-Spread account.

BDSwiss’ Non-trading Fees

BDSwiss’ non-trading fees are average compared to other similar brokers.

While BDSwiss charges no deposit fees, it charges 10 USD (or the ZAR equivalent) for bank wire withdrawals below 100 USD (or ZAR equivalent). For more on BDSwiss’ deposit and withdrawal methods and fees, click here.

In addition, a monthly inactivity fee of 30 USD is charged to all accounts with no trading for over 90 days. These charges cover the maintenance/administration expenses of inactive accounts, but these fees are much higher than those of other brokers.

Overall, BDSwiss’ non-trading fees are similar to other market maker brokers.

Opening an Account at BDSwiss

The account opening process at BDSwiss is fully digital, fast, and hassle-free compared to other brokers.

All South African traders are eligible to open an account at BDSwiss, as long as they meet the minimum deposit requirements of each account.

Creating an account is straightforward, the process is fully digital, and accounts are usually ready within one day. BDSwiss notes the online application process takes less than 49 seconds to complete. BDSwiss offers joint and individual accounts, but we will focus on opening an individual account:

How to open an account at BDSwiss:

- New traders will have to click on the “Sign Up” button at the top of the page where they will be directed to register an account.

- BDSwiss’ intake form requires clients to fill in their personal details (including name, country of residence, email address, birth date, and level of education).

- BDSwiss needs at least two documents to accept you as an individual client:

- Proof of Identification – BDSwiss accepts all government-issued identification documents such as Passport, national ID card, driving license, or other government-issued ID. The document must be valid and must contain a trader’s full name, date of birth, a clear photograph, issue date, and if it has to have an expiry date, that should be visible as well. A passport is the preferred proof of identity, as it is the document that will be the quickest for the BDSwiss Back Office team to process. If the document has two sides, then scans of the front and back sides must be uploaded.

- Proof of Address – Proof of residence/address document must be issued in the name of the BDSwiss account holder within the last 3 months and must contain a trader’s full name, current residential address, issue date, and issuing authority. BDSwiss accepts any bills that are issued by a financial institution, a utility company, a government agency, or a judicial authority.

- Once this step is complete, traders are asked to complete two questionnaires that will help BDSwiss assess the state of their finances and trading knowledge. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- After the application is approved, traders can login and fund their accounts

- We advise you to read BDSwiss’ risk disclosure, customer agreement, and terms of business before you start trading.

Overall, BDSwiss account-opening process is quick, efficient, and accounts are generally ready for trading within one business day.

BDSwiss’ Account Types

BDSwiss offers four account types, which is more than is typically available at other STP/market maker brokers, and the account types are suitable for beginners and more experienced traders.

Although it is an STP/market maker, BDSwiss offers its clients direct liquidity, routing all client orders directly to top global banks and exchanges so that they benefit from direct market prices and the best possible trading conditions.

With four live accounts, trading is offered on multiple CFD assets, including forex, commodities, shares, indices, and cryptocurrencies (click here for more on BDSwiss’ financial assets). BDSwiss offers maximum default leverage of up to 400:1 and dynamic leverage of up to 2000:1 (Dynamic leverage is offered to clients residing in certain jurisdictions). It allows all trading strategies, including hedging, scalping, and copy trading. All account-holders can access basic education material and can make use of trading tools such as Autochartist and various trend analysis tools. Islamic Accounts are available on all accounts.

Notably, BDSwiss publishes all its execution data, showing that 96.5% of trades are executed in less than 0.08 seconds (with an average speed of 0.01 seconds) with no requotes of rejections. These speeds are remarkable for the industry.

BDSwiss’ Cent account is suited to beginner traders, with a low minimum deposit requirement of 10 USD, but wider than average spreads, starting at 1.5 pips on the EUR/USD. While the minimum deposit requirement is reasonable, most brokers will offer an average spread of 1 pip (EUR/USD) or lower on their entry-level accounts.

Account Types

Demo Account

The demo account is a USD 1,000,000 live market playground to practice trading and analysis. The demo expires after 30 days of inactivity.

Cent Account

BD Swiss has added the Cent Account to its offering. The Cent Account is a micro-lot trading account (measured in smaller trade sizes), which is suitable for beginner traders who don’t want to risk high amounts of capital. The minimum deposit on the Cent Account is 10 USD, and variable spreads start at 1.30 pips on the EUR/USD, which is wider than average. Traders can also only trade on over 70 of the 250 financial instruments available at BDSwiss.

Classic Account

The minimum deposit on the commission-free Classic Account is 10 USD/ 150 ZAR, with variable spreads starting at 1.3 pips on the EUR/USD (which is normal compared to the industry average). Traders have access to the trading academy, live webinars, but limited access to built-in trends analysis tools. Traders can access Autochartist with a minimum account balance of 500 USD/9000 ZAR.

VIP Account

The minimum deposit on the VIP Account is 250USD/4,500ZAR, and spreads are average at best, starting at 1.0 pips on the EUR/USD. In addition to the tighter spreads, the VIP Account comes with access to several trading and educational tools, including AutoChartist, a personal account manager, and VIP access to built-in trend analysis tools.

Zero-Spread Account

The Zero-Spread Account is an account offering zero spreads in exchange for a minimum deposit of 100USD/1,800ZAR. Spreads are down to 0 pips on major pairs at times, though they average at 0.3 pips on the EUR/USD. A reasonable commission of 6 USD/lot round turn is charged on Forex pairs.

Deposit & Withdrawal fees

BDSwiss charges no deposit fees but charges withdrawal fees for certain payment methods. It also offers a wide range of funding methods.

In line with Anti-Money Laundering policies, deposits and withdrawals at BDSwiss cannot be made to/from third-party accounts. BDSwiss does not charge for making deposits to a live trading account, and it charges fees for withdrawals under certain conditions. See below for a list of BDSwiss payment methods:

- Bank Wire Transfer: Deposits are free, but BDSwiss charges a fixed fee of 10 USD (or ZAR equivalent) for bank wire withdrawals below 100 EUR (or equivalent). Deposits and withdrawals are processed within one day, but may take four to seven days to reach the account.

- Crypto Payments: Deposits are instant and free. Withdrawals are processed within 24 hours and are free.

For international bank transfers, the minimum withdrawal amount is 60 USD (or ZAR equivalent) after the deduction of fees. For amounts that remain below the required 60 USD, an alternative withdrawal method must be used.

Overall, BDSwiss provides a decent range of payment methods to its traders and BDSwiss ensures traders will not have a hard time depositing and withdrawing their funds.

BDSwiss Base Currencies (Trading Account Currencies)

BDSwiss offers ZAR, USD, GBP, and EUR accounts, fewer than most other brokers.

At BDSwiss, traders can choose from four base currencies: ZAR, USD, GBP, and EUR.

However, it should be noted that for traders that trade in large volumes (more than 10 lots a month), it is better to open an account denominated in USD at a digital currency bank, especially for trading on assets such as the EUR/USD. This is because when trading a USD quoted currency pair with a ZAR account, there will be a small conversion fee for every trade made.

Overall, BDSwiss offers several trading account currencies including the ZAR.

BDSwiss’ Trading Platforms

With MT4, MT5, and BDSwiss’ own proprietary platforms available, BDSwiss offers support for more trading platforms than most brokers.

BDSwiss trading platform arsenal includes both MT4 and MT5 and its own BDSwiss Webtrader platform, which provides beginner traders an excellent trading experience.

The advantage of brokers offering third-party platforms such as MT4 and MT5 is that traders can take their own customised versions with them should they decide to migrate to another broker. Additionally, there are thousands of plugins and tools available for the MetaTrader platforms. However, these platforms are not as beginner-friendly as the proprietary platform offered by BDSwiss. See below for more details.

Metatrader 4

Having established itself as the industry-leading platform, Metatrader 4 (MT4) is the most reliable and popular platform in existence. Its intuitive interface and user-friendly environment provide essential tools and resources for successful online trading. It is also widely recognised for its fast execution speeds, range of charting tools, algorithmic trading, and customisability. MT4 is available in over 31 languages. Features of the MT4 include:

- A built-in library of more than 50 indicators and tools to streamline the analysis process

- An impressive array of analytical tools, available in nine timeframes for each financial instrument.

- Algorithmic trading, which allows any trading strategy to be formalised and implemented as an Expert Advisor.

- Customisable alerts

- Access to MetaTrader market and MQL4 community.

Metatrader 5

The MT5 trading platform is being adopted by more Forex brokers all the time. It has a more modern interface, allows for an unlimited number of charts to be used, shows Depth of Market, and has a built-in Economic Calendar. It also has a larger number of pending order types than MT4 and features an embedded chat system. The MQL5 scripting language is more efficient than its precursor, and MT5 has more advanced charting tools than MT4. Additional features of BDSwiss’ MT5 include:

- Over 80 Technical Indicators and over 40 Analytical Objects

- Ability to display 100 charts simultaneously

- Depth of market display and technical indicators

- 6 pending stop order types, including Buy Stop Limit and Sell Stop Limit

- Improved strategy tester for algorithmic trading and expert advisors (EAs)

MT4 and MT5 are available on PC and MAC, in addition to Android and iOS.

BDSwiss WebTrader

The BDSwiss WebTrader does not require downloading, is available on both MAC and PC, and is fully synchronised with the downloadable versions of MT4, allowing for live price monitoring via an advanced market watch. Translated in more than 24 languages, the BDSwiss WebTrader is designed to accommodate traders’ needs from around the globe.

The BDSwiss WebTrader is a user-friendly platform that delivers an array of tools, including unique indicators, and an intuitive order window that automatically calculates position size, leverage, and required margin. However, the platform lacks many of the features available on MT4 and MT5 such as automated trading and does not cater for third-party tools.

Overall, BDSwiss offers a wider range of platforms than is available at other brokers. With support for third-party platforms such as MT4 and MT5, in addition to its own proprietary platform, this choice will keep most traders satisfied.

BDSwiss Webtrader

BDSwiss Mobile Trading Apps

BDSwiss’ mobile trading platforms are good when compared to other brokers. BDSwiss offers mobile versions of MT4 and MT5 in addition to its proprietary mobile trading app.

MT4/MT5 Mobile Trading App

BDSwiss offers support for MT4 and MT5 mobile trading apps for Android and iOS. Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

BDSwiss’ Proprietary Mobile App

The award-winning mobile application from BDSwiss is more user friendly than the standard MT4 mobile application. Featuring an intuitive and user-friendly trading interface, it is designed to be compatible and sync with the desktop MT4 application.

The mobile app offers basic trading, research, and account management functionality. Traders can open/close/edit positions, add stops to open positions and delete working orders. Research and analysis are available on real-time charts, and automated alerts are used to identify trading opportunities.

Overall, BDSwiss’ mobile trading experience exceeds that offered by other brokers.

Trading Tools

BDSwiss offers an average range of trading tools compared to other similar brokers.

BDSwiss’ trading tools include Autochartist and BDSwiss’ in-house Trend Analysis tool that integrates with the web trader platform. These tools are offered free of charge to all BDSwiss registered clients.

Autochartist

Autochartist is an automated analysis tool offered for free to all BDSwiss registered users. Autochartist monitors 250+ CFDs 24 hours a day and automatically alerts traders on key trading opportunities and forming trends with the highest probability of hitting the forecast price. Some of Autochartist’s key features are:

- Chart pattern recognition

- Fibonacci pattern recognition

- Key level analysis

- Pattern quality indication

Autochartist is one of the best technical analysis tools on the market, and BDSwiss does well to offer this tool to its clients.

Trend Analysis

The Trend Analysis tools are exclusively available on BDSwiss’ web trader platform.

Developed in partnership with AutoChartist exclusively for BDSwiss traders, Trend Analysis is a unique tool that enables traders to spot some of the biggest trading opportunities directly on BDSwiss’ WebTrader. Traders can view emerging and recently completed trends for hundreds of assets, in addition to pattern overlays and projected price trends applied live on a chart.

Overall, BDSwiss trading tools are slightly limited compared to what is offered by other large international brokers, but the tools it does offer are some of the best in the industry.

BDSwiss’ Financial Instruments

The choice of financial assets offered by BDSwiss is slightly limited compared to other large international brokers, and more advanced traders looking for particular instruments may be disappointed. However, BDSwiss’ cryptocurrency offering far exceeds that of other brokers.

BDSwiss’ range of financial instruments for CFD trading (click here for more details on CFD trading), include Forex, share, metals, commodities, cryptocurrencies, and indices.

- Forex CFDs: BdSwiss has over 50 currency pairs available for trading which is around the industry average. These include majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics. The leverage on Forex pairs is up to 1:2000.

- Share CFDs: BDSwiss offers 141 share CFDs, which is slightly limited compared to other large international brokers. The selection available includes some of the major US, UK, and European Exchanges. Leverage on share CFDs is up to 5:1.

- Indices CFDs: Limited compared to other brokerages, there are only 10 indices available for trading at BDSwiss. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies. Leverage is up to 1:200 on indices.

- Commodity CFDs: BDSwiss only offers trading on 6 commodities, which is limited compared to other brokers. Commodities include metals such as gold and silver and energies such as oil. The leverage is up to 1:200 on commodities.

- Cryptocurrency CFDs: BDSwiss offers trading on over 26 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and Ripple, which is an impressive offering compared to what is available at other brokers. Leverage is up to 5:1.

Overall, BDSwiss offers a limited range of tradable instruments, but it offers a wider range of crypto pairs than is usually available at other brokers.

BDSwiss for Beginners

BDSwiss offers excellent educational material for beginner and intermediate-experience traders, including structured training courses, daily webinars, and frequent live seminars.

Market analysis is also excellent and detailed, with market news and insightful daily analysis offered by the BDSwiss team.

Educational Material

Education is where BDSwiss has clearly invested time and effort, and they have created an outstanding selection of materials for beginners.

BDSwiss offers a comprehensive Trading Academy for those looking for structured courses. The Trading Academy is split into beginner, intermediate and advanced sections, though in truth, the advanced section is more suited to those with intermediate knowledge. Perhaps the better and more advanced educational material from BDSwiss comes in the form of weekly strategy webinars and frequent live seminars held at BDSwiss’ local offices around the world.

The Educational videos consist of five to six lessons with a quiz to summarize the content. It provides a great introduction to trading. Topics include CFD Trading, The Basics of Forex Trading, and Order Types, among others.

BDSwiss also provides a Forex Glossary in addition to a number of ebooks that are well-written and in-depth.

Webinars are free to non-clients and only require signup to participate.

Overall, the education provided by BDSwiss far surpasses that of most other international brokers.

Analysis Material

BDSwiss provides an award-winning market research section that is curated by some of the best analysts in the world.

Research and analysis materials at BDSwiss are detailed and well-structured. Financial commentary is split into numerous sections: Market Analysis Review, Market Insights, Technical Analysis, Daily Videos, Weekly Outlook, an Economic Calendar, and Special Reports. Webinars are also conducted on an almost daily basis in a range of languages.

BDSwiss’ market analysis is curated by a team of renowned markets analysts and professional traders that provide 24/5 market news coverage and actionable financial commentary. Recognised by the global industry community, its Research Team is frequently featured in world-leading publications and is viewed as a reliable, one-stop information hub of insightful market analyses.

BDSwiss’s Telegram channel is offered under the broker’s VIP and Zero-Spread account type. The channel provides real-time Trading Alerts, volatility alerts and upcoming live-trading webinars.

All analytical material, including webinars and forecasting reports, is available free of charge, and most of the video content is uploaded to YouTube. The analysis quality is world-class and will be of value to both technical and fundamental traders.

Lastly, the Daily Videos give traders insight into how to approach researching marketing opportunities and trader psychology. We particularly recommend the Daily Market Analysis, conducted by BDSwiss’ Market Analysts Team.

Overall, BDSwiss provides some of the best market analysis materials available in the industry.

Customer Support

Award-winning customer support is available 24/5 via live chat, and email.

Overall, we found the customer service responsive, polite, and able to answer all of our questions.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the BDSwiss offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

BDSwiss Disclaimer

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. BDSwiss would like you to know that: Trading in Forex/ CFDs and Other Derivatives is highly speculative and carries a high level of risk.

Overview

A well-regulated market maker/STP broker, BDSwiss offers trading on multiple instruments, including Forex, commodities, indices, shares, and 26 crypto pairs, which is a wider range than most other brokers. Trading costs are industry average across all account types and have improved significantly on the Zero-Spread account type. BDSwiss also offers support for a wide range of trading platforms, including MT4, MT5, its own proprietary platform, and an award-winning mobile application, alongside a world-class repository of educational and market analysis materials and excellent customer service.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how BDSwiss stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.