-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Forex.com Broker Review

Last Updated On March 13, 2024

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Our verdict on FOREX.com

Founded in 2001, Forex.com is a well-regulated broker with low fees and a wide range of trading platforms.

It offers four account types, each with a minimum deposit requirement of 100 USD, two of which have trading costs included in the variable spreads, and two commission-based accounts. Spreads start at 1.0 pip (EUR/USD) on the spread-only accounts, and down to 0 pips (EUR/USD) on the commission-based accounts in exchange for a commission of 10 USD per lot traded.

Forex.com provides support for MT4, MT5, TradingView, and its own Forex.com trading platform and experienced traders will appreciate the range of trading tools on offer, including Trading Central, SMART Signals, and subsidised VPS hosting.

Education and market analysis are both excellent and experienced traders will appreciate the wide range of tradable assets, including over 91 currency pairs, 4500 share CFDs, commodities, indices, precious metals, and cryptocurrencies.

Overall, Forex.com ticks all the boxes for those looking for a wide range of assets to trade and a choice of trading platforms.

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | FCA, ASIC, CySEC, CIMA |

| 💵 Trading Cost | USD 7 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5, FOREX.com Web Trader, TradingView |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Wide range of assets

- Excellent education

Cons

- High inactivity fees

- Limited demo account

Is Forex.com Safe?

Yes, Forex.com is a safe broker for South Africans to trade with. It is regulated by multiple top-tier regulators, including the FCA in the UK, ASIC in Australia, and MAS in Singapore. However, South Africans will be trading with Forex.com’s entity based in the Cayman Islands, which provides less regulatory protection.

Founded in 2001, Forex.com is a popular broker and has over 500,000 customers worldwide. Its parent company, StoneX Group Inc., is regulated by eight national authorities and is publicly listed on the NASDAQ, providing further regulatory oversight.

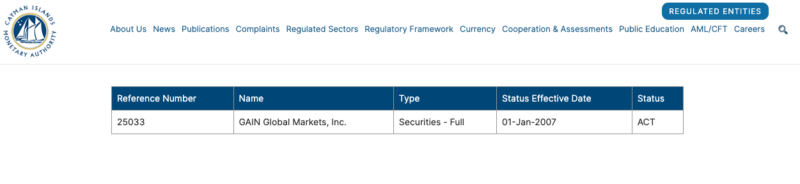

CIMA Regulation: South African traders will be trading with Forex.com’s Cayman-Islands-based subsidiary, GAIN Global Markets, which has less regulatory supervision than the EU, UK, or Australia. This allows Forex.com to provide higher levels of leverage to South African traders, but traders will not have negative balance protection or any legal recourse in the event of a dispute with the company. See below for details of GAIN Global Market’s regulatory status:

Safety Features: All Forex.com client funds are kept in segregated bank accounts and, unlike many brokers operating in South Africa, maximum leverage is kept relatively low at 200:1 – providing a lower-risk trading environment for beginner traders.

Forex.com’s Trading Instruments

Forex.com offers a very wide range of tradable assets compared to its competitors, including 80+ Forex pairs and over 5,500 stock CFDs.

Forex.com offers trading on Forex, indices, shares, commodities, and cryptocurrencies.

- Forex pairs: Forex.com offers 88 Forex pairs to trade, including majors, minors, and exotics. This is an extremely broad range of Forex pairs compared to other brokers.

- Commodities: Forex.com offers trading on 26 commodities, including precious metals, energies, and agriculture, a broader range than most other brokers.

- Stock CFDs:Forex.com’s stock CFD offering is extremely diverse compared to most of its competitors, with over 5,500 stock CFDs available to trade, including popular US tech companies, ASX stocks, those listed on the NASDAQ, the Hong Kong Stock Exchange, the NYSE, and more. Traders should note that stock CFD trading is only available on MT5 and the Forex.com trading platforms.

- Indices:Forex.com offers cash and futures contracts on 18 international indices, including the Wall Street, S&P500, FTSE100, and the UK100. This is an average range of indices compared to other brokers.

- Cryptocurrencies:Forex.com offers trading on 8 popular cryptocurrencies. These include Bitcoin, Bitcoin Cash, Ethereum, Ripple, and Litecoin. Spreads on these currencies are variable and are significantly higher than Fiat currencies, but in line with other brokers.

Overall, Forex.com provides a very wide range of tradable assets, which should leave most traders satisfied.

Accounts and Trading Fees

Forex.com offers four trading accounts and trading fees are average compared to other brokers.

Required Minimum Deposit: All trading accounts at Forex.com require a minimum deposit of 100 USD, GBP, or EUR – depending on your choice of account currency. Unfortunately, Forex.com does not offer ZAR trading accounts.

Recommended Minimum Balance: Forex.com’s trading accounts have a recommended minimum deposit of 1000 USD, GBP, or EUR.

Account Platforms: Trading is offered on the Forex.com mobile app, the Forex.com web platform, MT4, MT5, and TradingView.

Account Trading Costs:

Standard Account: The Standard Account has a minimum deposit of 100 USD, variable spreads (as low as 0.70 pips on the EUR/USD), and no commission. The Standard Account is available on the Forex.com platform, MT4 and MT5.

Raw Spread Account: The Raw Spread Account also has a minimum deposit of 100 USD and variable spreads but charges a commission of 10 USD round turn per lot traded. Spreads on the EUR/USD can be as low as 0.0 pips with this account. The Raw Spread Account is available on the Forex.com and MT5 platforms.

MetaTrader Accounts: Similar to the Standard Account, the MetaTrader Accounts are commission-free accounts with a minimum deposit of 100 USD, and spreads that start at 1 pip (EUR/USD). However, as the name suggests, traders can only trade on MT4 and MT5. Be aware that choosing MT4 will limit the assets that you can trade.

Demo Accounts: The Standard and Raw Spread Accounts are available as demo accounts, but demo accounts will expire after 30 days, and you will be required to open a live account. The demo account also gives traders a real-time feel for market conditions.

Overall, Forex.com’s trading fees are around the industry average.

Deposits and Withdrawals

Forex.com offers a limited number of deposit and withdrawal options compared to other similar brokers, but it does not charge any additional fees.

Accepted Deposit Currencies: At Forex.com, you can only choose from three base currencies: USD, GBP, and EUR. This is limited compared to most other international brokers operating in South Africa.

Funding Methods: Forex.com only accepts deposits and withdrawals via credit/debit card, e-wallets such as Skrill and Neteller, and bank transfers. See below for more details:

- Credit/debit cards: No fees are charged for deposits or withdrawals. Deposits are processed instantly and withdrawals are processed within 24 hours. The minimum amount per transaction is 100 USD and the maximum is 50,000 USD.

- Bank Transfer: Forex.com does not charge fees for deposits or withdrawals via bank wire transfer, but clients should be aware that banking service fees may apply. Deposits and withdrawals are processed within 48 hours.

- Skrill/Neteller: No fees are charged for deposits or withdrawals via Skrill or Neteller and both are processed immediately.

Overall, Forex.com has a limited range of funding methods compared to other large international brokers, but no fees are charged, and its processing times are fast.

Forex.com’s Mobile Trading App

FOREX.COM’s mobile trading platforms are better than other similar brokers.

All four of Forex.com’s trading platforms are available on both Android and iOS mobile devices and tablets. Beginner traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced timeframes and fewer charting options.

Forex.com Mobile App

The Forex.com app offers the best features available on the desktop version including the complete range of order types, trade analysis, and watchlists. Other features include advanced Trading Tools, which tracks both the performance analytics and provides market insight.

MT4 and MT5

The MT4 and MT5 mobile apps allow traders to close and modify existing orders, calculate profit and loss in real-time and allow tick chart trading.

TradingView

TradingView is available on mobile and desktop for both Android and iOS. One of the most advanced charting platforms available, the mobile app allows traders to open and close positions, modify their stop-losses and take profits, deposit and withdraw funds, and analyse their trades. For more information on TradingView, see the section below.

Overall, Forex.com’s mobile apps are user-friendly and well-designed and offer most of the features available on the desktop versions.

Other Trading Platforms

Forex.com offers three desktop trading platforms which are excellent compared to other brokers.

Forex.com offers four platforms to choose from, its own Forex.com platform, MetaTrader 4, MetaTrader 5, and TradingView. All platforms offer fast trading and advanced charting tools, including Expert Advisors, automated trading support, strategy backtesting, customisable charting, and a number of indicators.

The platforms are free to use and can be downloaded to your PC and all have web versions of the platform. They are also available on mobile Android and iOS devices.

The benefit of Forex.com offering third-party platforms such as MT4 and MT5 is that traders can take their customised versions of these platforms with them should they choose to migrate to another broker. See below for more details on forex.com’s trading platforms:

Forex.com Platform: The most powerful version of the Forex.com platform is the downloadable desktop client which offers professional analytics tools, over 100 predefined indicators, 15 time frames, and trading directly on charts. It also allows 6 order types, including Market Order, Entry Order, Stop Order, Limit Order, One Cancels Other, and Guaranteed Stop Loss Orders. The desktop version of the platform is better suited to more experienced traders. The Forex.com platform is also available in your browser, with slightly decreased functionality, sacrificing customisability for simplicity.

MetaTrader 4: The MT4 trading platform is the most widely used Forex trading platform and can also be used to trade other instruments like commodities, cryptocurrency, stock index, and stock CFDs. Though it now shows its age, MT4 is still very popular for its auto trading features that enable algorithmic trading and strategy backtesting with expert advisors (trading robots).

Unlike most standard MetaTrader 4 platforms you will find at other brokers, Forex.com’s MT4 comes with fully integrated Reuters news, Forex.com’s research and analysis, and Trading Central.

MetaTrader 5: The MT5 trading platform is being adopted by more Forex brokers all the time. It has a more modern interface, allows for an unlimited number of charts to be used, shows Depth of Market and has a built-in Economic Calendar. It also has more pending order types than MT4 and features an embedded chat system. In addition, the MQL5 scripting language is more efficient than its precursor and MT5 has more advanced charting tools than MT4.

Trading View: Forex.com recently added TradingView to its arsenal of trading platforms. TradingView is free of charge for traders who open a live account. It is an excellent platform for researching, charting, and screening instruments. Additional features of Forex.com’s TradingView include:

- 50+ intelligent charting tools

- Over 100,000 custom user-built indicators and scripts

- Synchronised layout for multiple charts

- Advanced drawing tools

- Ten chart types.

Overall, Forex.com’s trading platform support is one of the best in the industry. It offers a proprietary platform, which is more beginner-friendly and easier to use and has enough choice to keep most traders satisfied.

Opening an Account at Forex.com

Forex.com’s account-opening process is seamless and hassle-free compared to other market makers.

All South African residents are eligible to open a trading account at Forex.com but will have to meet the minimum deposit requirement of 100 USD.

The account opening process is fully digital and fast – most traders will have an account open within one day.

How to open an account at Forex.com:

- On the front page of the website, traders can click on a button marked “Open an Account”

- Traders will be directed to a page that requires them to choose their preferred trading account (Standard, Raw Spread or MetaTrader).

- Once traders have selected their account, they will be required to enter all their personal data.

- The next step requires filling in your physical address details, country of residence, tax information, and identity number.

- Traders will then have to detail their trading experience, including their financial status, and their trading history. Traders can also choose their preferred base currency (EUR, USD, or GBP).

- Before submitting this information, traders are required to agree with all Forex.com’s Terms and Conditions, and privacy policy.

- As part of the Know Your Customer (KYC) process, newly registered users are required to provide confirmation of residence (e.g. a valid utility bill dated within the last 6 months), as well as proof of identity such as a valid passport, or another form of officially issued photo ID.

The verification process can sometimes take a few days, and you will be notified once your account is verified. You can also follow your verification status on the Forex.com platform.

Compared to other brokers, Forex.com’s account opening process is fast, fully digital, and hassle-free.

Forex.com’s Research and Trading Tools

Forex.com’s trading tools and market research are excellent compared to other similar brokers.

Forex.com has one of the best market research and analysis sections we have reviewed. Posts by the in-house research team and detailed and cover all aspects of the financial markets. Full of trading opportunities and insightful analysis, it is no surprise that the Forex.com Twitter feed has over 170k followers.

Posts can be filtered by author, market, theme, or trending topics, and the site is updated multiple times a day. Also, in the analytical section, you can find a good economic calendar and a very helpful pivot point calculator for on-the-fly technical analysis.

Trading Tools

Forex.com offers several useful trading tools, including VPS services, Trading Central, SMART Signals, and TradingView.

Trading Central

Trading Central is available to clients who register a live account. A third-party tool, Trading Central’s professional analysts use the most advanced technical analysis tools in the industry to curate relevant information. This tool essentially supports traders without the technical know-how in making trading decisions. Trading Central is one of the most popular trading tools available and provides excellent market analysis, and Forex.com does well to offer this service to its clients.

SMART Signals

Forex.com offers SMART Signals, a technical analysis tool that provides live trade ideas by harnessing the power of trading algorithms. It also allows traders to see how SMART Signals have performed in the past so that they can decide how they may perform in the future.

VPS

For traders with a minimum 5000 USD balance, Forex.com supplies free VPS hosting, allowing for a more complete automated trading strategy. It allows traders to run automated algorithmic strategies, including expert advisors 24 hours a day 7 days a week on a virtual machine. VPS services have the advantage of never suffering connectivity issues and have extremely low latency due to their proximity to major international exchanges.

Forex.com Educational

Beginner traders will find Forex.com a welcoming environment, with comprehensive and well-structured education. The major downside for beginners is the limited demo account, which will expire after 30 days on all platforms.

The education section at Forex.com has obviously been designed by an experienced team of Forex educators. It is intended to slowly build confidence and help beginners learn how to trade forex with a wealth of educational tools and online resources.

The first thing new traders will find is a Self-assessment Quiz, which will help beginners identify where they are at in their trading journey. From here you can link off to three different sections of educational material: Beginner, Intermediate and Advanced. You can also check out individual themes, such as technical analysis and risk management.

Each section is clear, concise, and carefully tailored to the experience level of the trader. All the educational resources are free to all visitors of Forex.com’s site.

Customer Support

Forex.com’s customer support is average compared to other brokers.

Like most brokers, customer support is available 24/5 (from 10 am Sunday to 5 pm Friday) via phone, email, and live chat. While English is Forex.com’s main support language, support is also available in Arabic, Ukrainian, Polish, Russian, and Chinese, depending on the availability. You can also interact with the Forex.com teams via Facebook, Instagram, and X.

For the purposes of this review, we found the customer support responsive and well-informed.

Safety and Regulation

In operation since 2001, Forex.com was a subsidiary of GAIN Capital, an NYSE-listed company. In 2021 Forex.com was purchased by StoneX, a Fortune-100 company with a 100-year history. StoneX is also a NASDAQ-listed provider of online trading services.

StoneX’s subsidiaries are regulated by 8 national and regional authorities depending on their geographic location. All are separate but affiliated subsidiaries of StoneX Group Inc:

- Cayman Islands: GAIN Global Markets is regulated by the Cayman Islands Monetary Authority (CIMA)

- Europe: StoneX Europe is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC).

- US: GAIN Capital is regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA)

- Canada: GAIN Capital is regulated by the CIRO.

- UK: GAIN Capital UK is regulated by the Financial Conduct Authority (FCA)

- Australia: GAIN Capital Australia is regulated by the Australian Securities and Investment Commission (ASIC)

- Singapore: GAIN Capital Singapore is regulated by the Monetary Authority of Singapore (MAS)

- Japan: GAIN Capital Japan is regulated by Japanese Financial Services Agency (JFSA)

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process which includes a detailed breakdown of the Forex.com offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Forex.com would like you to know that: Foreign exchange and other leveraged trading involve a significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Overview

Forex.com benefits from being part of the publicly-listed StoneX Group and is able to offer excellent education and market research alongside competitive trading conditions. The wide range of platforms and tradeable assets makes Forex.com a tempting option for traders looking for a serious broker. While beginners will love the education and analysis available, they will be disappointed by the limited demo account.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how FOREX.com stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.