-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Khwezi Trade Broker Review

| 🏦 Min. Deposit | ZAR 500 |

| 🛡️ Regulated By | FSCA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 400:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT5 |

| 💱 Instruments | Commodities, Forex, Indices |

Last Updated On May 8, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Khwezi Trade

Founded in 2013, Khwezi Trade is an FSCA-regulated local broker with low deposit ZAR accounts and fast trade execution and is renowned for its customer-focused approach to traders.

Khwezi Trade’s commission-free ZAR account accommodates beginner traders with a minimum deposit of 500 ZAR and spreads starting at 0.7 pips on the EUR/USD, which is much tighter than other brokers. Its USD account also has very competitive spreads – down to 0.1 pips on the EUR/USD with no commissions – and has a minimum deposit of 50 USD. Both accounts come with a personal account manager, which benefits both beginners just getting started and experienced traders looking for flexibility in their trading conditions.

Khwezi Trade’s CFD assets outside of its Forex offering are limited compared to other brokers, with only 11 indices, and 7 commodities available, restricting traders who wish to diversify their trading strategy. We hope that with the recent addition (October 2022) of MT5, Khwezi Trade may add some specialty instruments, such as stock CFDs or cryptocurrencies.

Overall, Khwezi Trade appeals to South African traders looking for an MT5 broker with personalised customer support, ZAR trading accounts, and low trading costs.

| 🏦 Min. Deposit | ZAR 500 |

| 🛡️ Regulated By | FSCA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 400:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT5 |

| 💱 Instruments | Commodities, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- ZAR Accounts

- Fast and free withdrawals

- Great customer support

Cons

- Local regulation only

- No swap-free account option

Is Khwezi Trade Safe?

Yes, with regulation from the South African FSCA, Khwezi Trade is a safe broker for South Africans to trade with.

Regulation: Founded in 2013, Khwezi Trade is a well-respected South African broker based in Cape Town. It is regulated by the South African Financial Services Conduct Authority and received its ODP licence in November 2021, the second broker in South Africa to do so. This is a huge achievement, considering the regulatory changes and complexity of the local laws.

Safety Features: Although the FSCA’s rules are not as strict as regulators in the UK or Australia, South Africans will benefit from having their money segregated from Khwezi Trade’s company funds at local South African banks. Local bank accounts also mean that bank transfers between South African clients and brokers are faster and cheaper.

According to regulation, Khwezi Trade is also required to keep accurate records and accounts, distinguishing the assets held for one client from the assets of any other client and the company assets. The company is also regularly audited by external auditors, and the auditor’s report is sent directly to the FSCA.

We confirmed Khwezi Trade’s FSCA licence, see below:

Company Details:

Khwezi Trade’s Financial Assets

Khwezi Trade’s range of financial instruments to trade is smaller than most other brokers, with no shares nor specialty CFDs such as ETFs or cryptocurrencies.

Khwezi Trade offers trading on Forex, commodities, and indices. See below for details on its assets and leverage:

![]()

![]()

Forex: Khwezi Trade offers 39 currency pairs for trading, including majors (EUR/USD, GBP/USD, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and GBP/NZD). This offering is limited compared to what’s available at other brokers.

Indices: Khwezi Trade offers trading on 11 indices, which is limited compared to other similar brokers, and includes the likes of the AUS200, UK100, Nasdaq, and the Dow Jones.

Commodities: Khwezi Trade offers trading on seven commodities, including metals such as silver and gold, and energies such as Brent, oil, and natural gas.

Khwezi Trade has a relatively disappointing range of CFDs available for trading, but we hope that with the introduction of the MT5 platform, it may increase its offering.

Khwezi Trade’s Accounts and Trading Fees

Khwezi Trade has two live accounts, which is average compared to other brokers and it has low trading fees.

Trading Fees: Khwezi Trade has two very similar commission-free accounts, a ZAR account with a 500 ZAR minimum deposit and a USD Account with a 50 USD minimum deposit. Unfortunately, Khwezi Trade does not publish the spreads for each account on its website, but when we opened our account at Khwezi Trade, we found that spreads average at about 1 pip (EUR/USD).

See below for account details:

![]()

![]()

As you can see from the table above, Khwezi Trade’s minimum spreads are very competitive – most other brokers tend to charge around 9 USD per lot of EUR/USD. However, traders should note that spreads are variable, and they will change with volatility and trading volume.

Accounts:

- ZAR Account: Khwezi Trade’s ZAR account requires a minimum deposit of 500 ZAR. The spreads on this account start at 0.7 pips on the EUR/USD, which is tighter than the spreads on other brokers’ entry-level accounts.

- USD Account: Khwezi Trade recently introduced a USD account with a minimum deposit of 50 USD. Spreads start at 0.1 pips (EUR/USD), and there is no commission for forex trading. These are some of the lowest account fees in the industry, but it is unclear how often traders will see spreads this low.

Leverage is up to 400:1 on both accounts, and traders with funded accounts have access to various educational materials and regular market analysis. They also benefit from the services of a dedicated account manager.

Mobile Trading

Khwezi Trade’s mobile trading platforms are limited compared to other brokers – it only offers MT5.

In October 2022, Khwezi Trade added MT5 to its platform offering but no longer offers MT4. MetaTrader 5 (MT5) is available on Android and Windows mobile phones and tablets*. The app will connect to the same account as the desktop software, allowing a synchronised and mobile trading experience.

Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options. Still, traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

* Traders should note that as of 23 September 2022, MT5 was removed from the app store. It is unclear when or whether it will again be available for download on iOS devices.

Trading Platforms

Khwezi Trade’s platform support is limited compared to other similar brokers.

Like mobile trading, Khwezi Trade only provides support for the MetaTrader 5 platform, which is available on Windows, and as an Android-downloadable app.

Metatrader 5

MT5 comes with Expert Advisors, automated trading support, strategy backtesting, depth of market, customisable charting, indicators, and copy trading functionality. Although MT5 is an excellent trading platform, many other CFD brokers also offer their own web-based platforms, which tend to be easier to use for beginner traders.

On the other hand, the benefit of Khwezi Trade offering a third-party platform such as MT5 is that traders can take their own customised version of the platform with them should they choose to migrate to another broker.

Platform Overview:

![]()

![]()

Deposits and Withdrawals

Khwezi offers a limited number of funding methods compared to most other brokers. While it charges no fees for deposits or withdrawals, withdrawals can only be processed by bank transfer to a South African bank account.

A well-regulated broker, Khwezi Trade ensures that all Anti-Money Laundering rules and regulations are followed. As such, all withdrawals are returned to the deposit source.

Trading Account Currencies: Khwezi Trade offers accounts denominated in ZAR and USD, which is limited compared to large international brokers, but much the same as other brokers operating in South Africa. Should traders choose the USD account, the broker will convert the client’s Rand deposit at a fair rate obtained from Standard Bank to Dollar before depositing the funds into the Dollar trading account. Traders should note that withdrawals from the USD account will also be made in ZAR – Khwezi Clients cannot request withdrawals to be paid in Dollars.

Deposits and Withdrawals: Khwezi Trade does not charge any fees for deposits or withdrawals and even absorbs any third-party charges. Deposits can be made via bank transfer and credit or debit card, but unfortunately, this information is not published on its website. Withdrawals are processed daily, but only to South African bank accounts, and on the same day if a request is made before 3 pm.

See below for more details:

![]()

![]()

Account Opening

The account opening process at Khwezi Trade is easy, hassle-free, and fast.

All South African traders can open an account at Khwezi Trade.

Opening a live account at Khwezi Trade is easy and fast, and while it also offers Corporate Accounts and Joint Accounts, we will focus on opening an Individual Account:

- Initially, you will need to click on “Open Account” and register your name, email address, phone number, and country of residence. You will also have to agree to Khwezi Trade’s terms and conditions.

- You will then have to upload two different documents via a digital KYC:

- A clear photo or scanned copy of ID (preferably colour photo, facial features and ID number should be visible. If you have an ID card we require a copy of the front and back of the card)

- A clear photo or scanned copy of proof of address, no older than 3 months (no PO Box, registered address must match proof of address). Valid documents include a utility bill showing your name and address, or a verified bank or credit card statement, a municipal rates and taxes account, or a rental or mortgage statement.

- Khwezi Trade will then send you an email confirming the receipt of documents, and you will be able to continue with the account-opening process.

- If you register for a live account, you will be directed to fill in the KYC (know your customer) information, including date of birth, identity number, place of residence. You will also have to fill in your financial details so that Khwezi Trade can assess your suitability for trading. This is a responsible move on the part of the broker in an industry that is often accused of an irresponsible approach to consumer protection.

- Once this step is complete, you must make at least the minimum required deposit for your chosen account via one of Khwezi Trade’s deposit methods. For more on Khwezi Trade’s withdrawal and deposit methods, click here.

- We advise you to read Khwezi Trade’s risk disclosure, customer agreement, and terms of business before you start trading.

Overall, the account opening process at Khwezi Trade is hassle-free, and accounts are usually ready for trading within one day.

Trading Tools

Khwezi Trade offers fewer trading tools than other similar brokers.

Khwezi Trade offers traders two third-party tools: Flexi Analysis and Dynamic Outcomes. Both tools are available for a monthly subscription fee of 395 ZAR each.

Flexi Analysis: Khwezi Trade offers its clients access to a third-party tool, Flexi Analysis, which provides live technical analysis updates and signals. This tool is available on the trader’s dashboard and covers Fundamental News, Technical Analysis, Candle Pattern Identification Signals, and Indicator Identification Signals.

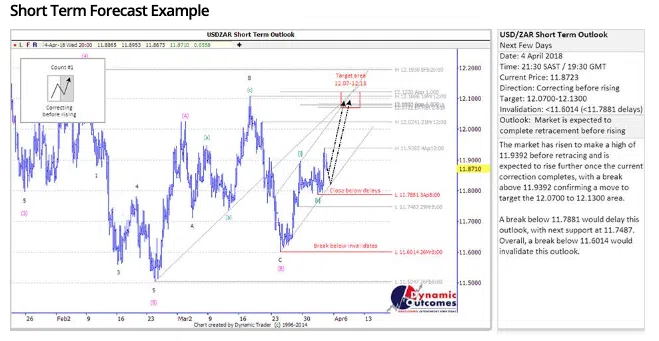

Dynamic Outcomes: Khwezi Trade offers its clients access to Elliott Wave Analysis information on the Rand through a trusted third-party provider, Dynamic Outcomes Rand Forecasting Service. This tool covers the major Rand-based financial markets such as the ZAR/USD (Dollar vs Rand) and GBP/ZAR (Pound vs Rand). The forecasts are delivered via an online portal and are updated twice a week, on a Wednesday and a Friday evening (USA close). These forecasts come in four timeframes for each market. While this information is useful, it is limited to Rand-based instruments.

Most other brokers offer a range of trading tools free of charge to help traders make better trading decisions, which is not available at Khwezi Trade.

Trading Tools Comparison:

![]()

![]()

Khwezi Trade for Beginners

Khwezi Trade is well suited to beginner traders, with a strong educational section in both video and text format and responsive customer support via phone and email.

Educational Material

Khwezi Trade’s educational materials are limited compared to what’s available at most other brokers, but what is available is of a high standard.

While Khwezi Trade does not offer a vast amount of educational material, what it does have is of a high standard and useful for new traders. The video tutorial section covers the basics, such as MT5 setup, charting, and tips and tricks for MT5. If you have any trouble with these tutorials, support staff can also offer assistance via telephone and email.

Khwezi Trade also has a short but excellent Trading Basics article covering questions commonly asked by new traders. Another article, Trading Products, presents the tradeable instruments available at Khwezi Trade, with impressively detailed descriptions. Khwezi Trade also runs a frequent blog on topics of importance to beginner traders, such as Why You Should Invest in a Trading Mentor and Is Your Broker Legitimate?

Khwezi Trade also offers monthly educational webinars.

Overall, the education section could be improved with a greater variety of materials and providing sections for beginner and more experienced traders.

Education Comparison:

![]()

![]()

Analysis Material

Khwezi Trade offers little in the way of research and analysis compared to other brokers.

Khwezi Trade sends daily analysis emails to all clients – it also offers its client access to a portal showing analysis on all pairs. Further analysis is also available via a 395 ZAR monthly subscription – analysis includes Multi-Timeframe Elliott Wave South African Rand Forecasts and technical and fundamental analysis and buy/sell suggestions (as mentioned in the trading tools section).

Overall, Khwezi Trade would do well to add a new section frequently updated by an in-house team of experts.

Customer Support

Khwezi Trade’s customer support is excellent compared to other brokers.

Khwezi Trade’s customer support is available 5 days a week from 7 am to 6 pm via email, telephone, and a call-back service. While it advertises a live chat feature, the queries are responded to by email.

Client service is excellent at Khwezi Trade – requests are answered quickly and efficiently, and Khwezi Trade offers South Africans a very personalised experience. Once we had signed up for an account, we received a call from one of its agents to see if we needed help setting up our account or if we had any questions.

Help is available in English, Afrikaans, Zulu, Sotho, and Xhosa.

Safety and Industry Recognition

Regulation: Founded in 2013, Khwezi Trade is a well-respected South African broker based in Cape Town. Its parent company, Khwezi Financial Services, is regulated by the Financial Services Conduct Authority of South Africa. It also recently received its ODP licence, the second broker to do so in South Africa. See below for details on its authorisation:

- Khwezi Trade is a division of Khwezi Financial Services, an authorized financial services provider (FSP: 44816.)

Kwhezi Trade has been recognized by the wider Forex industry – winning the award for Best Broker in the 2019 and 2020 Global Brand Awards.

On the whole, because of its strict internal processes, history of responsible behaviour, and strong local regulation, we consider Khwezi Trade a safe broker to trade with.

Evaluation Method

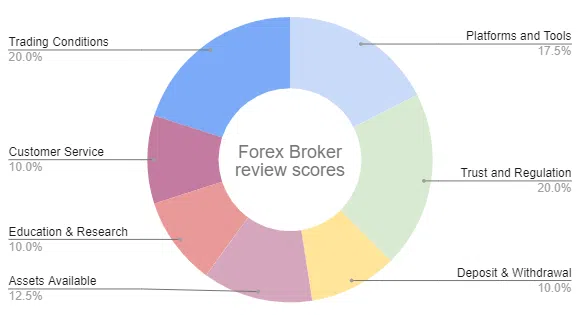

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process which includes a detailed breakdown of the Khwezi Trade offering. Central to that process is the evaluation of the broker’s reliability, the broker, the platform offering of the broker, and the trading conditions offered to clients, summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Warning

Trading Forex is risky, and each broker must detail how risky the trading of Forex CFDs is to clients. Khwezi Trade would like you to know that: Contracts for Difference (‘CFDs’) are complex financial products, most of which have no set maturity date. Therefore, a CFD position matures on the date you choose to close an existing open position. CFDs, which are leveraged products, incur a high level of risk and can result in the loss of all of your invested capital. As a result, CFDs may not be suitable for all individuals. You should not risk more than you are prepared to lose. Before deciding to trade, you should ensure that you understand the risks involved and take into account your level of experience. You should seek independent advice, if necessary.

Overview

Khwezi Trade is a locally-based and locally-regulated broker with accounts based in ZAR and USD. With two live accounts and low trading costs, account holders have the service of a personal account manager. Leverage is limited to 1:200 and increases to 400:1 once a trader has proved they know what they are doing – this is a responsible move on the broker’s part to reduce exposure. While trading is only offered on the MT5 platform, and Khwezi Trade offers few trading tools, deposits and withdrawals are free. Additionally, Khwezi Trade provides excellent, personalised customer support.

Overall, Khwezi Trade is a good choice for a South African beginner trader looking for a local broker with local regulation, local offices, local support, and local banks.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Khwezi Trade stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.