-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Plus500 Broker Review

| 🏦 Min. Deposit | ZAR 1500 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, FMA |

| 💵 Trading Cost | USD 8 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | Plus500 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

Last Updated On March 13, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Plus500

A trustworthy CFD provider with regulation from eight national authorities and a listing on the London Stock Exchange, Plus500 is a good choice for traders looking for a simple account structure, reasonable trading fees, a wide range of tradable assets, and a well-designed mobile trading app.

Plus500 only offers one trading account, but its trading costs are low compared to many brokers, with spreads starting at 0.8 pips* on the EUR/USD and a minimum deposit of 1500 ZAR. Most traders will also be satisfied with the number of financial assets available, including over 70 Forex pairs and 1900 share CFDs.

Unlike other CFD providers that provide support for a variety of trading platforms – such as MT4, MT5, or cTrader – Plus500 only offers support for its own in-house platform. However, the platform is sleek and well-designed. Available as a mobile app or on the web with no need for any downloads, the platform is equipped with a number of useful risk management tools.

We were disappointed that Plus500’s education and market analysis materials are virtually non-existent, but its award-winning customer service is available 24/7, which is exceptional for an industry where the norm is 24/5.

*spreads correct as of 09:00, 21/06/2022

| 🏦 Min. Deposit | ZAR 1500 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, FMA |

| 💵 Trading Cost | USD 8 |

| ⚖️ Max. Leverage | 30:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | Plus500 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Wide range of assets

Cons

- Limited education

- Limited account options

Plus500 Overall Rating

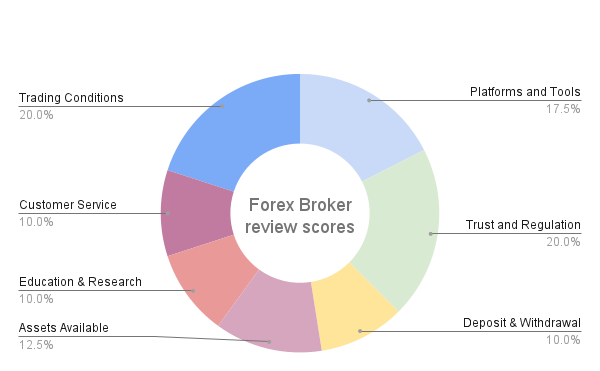

While the lack of different account types and educational materials may deter some traders, Plus500 makes up for this with a highly secure trading environment, supported by regulation from several leading authorities. It offers competitive trading conditions, along with a low minimum deposit that makes trading accessible to more people. The proprietary trading platform, while lacking customization options found in third-party platforms like MT4/MT5, is praised for its simple design and functionality. FxScouts rates Plus500 4.09 out of 5.

Is Plus500 regulated?

One of the best-regulated CFD providers, Plus500 maintains regulation from no less than eight authorities, and is listed on the London Stock Exchange,

ASIC Regulation: South Africans will be onboarded through Plus500AU Pty Ltd, regulated by the Australian Securities and Investments Commission (ASIC). Although it is an Authorised Financial Services Provider (FSP: 47546), it is still awaiting its ODP licence from the South African regulator – the Financial Sector Conduct Authority (FSCA). As a result, ASIC will oversee Plus500’s operations in South Africa:

Features: Although South Africans may be disappointed by the lack of FSCA oversight, ASIC has a good reputation when it comes to regulating Forex brokers. It ensures that Plus500 segregates client money from its operating capital and that Plus500 offers all traders negative balance protection so that they cannot lose more than their initial deposit. Additionally, in early 2021, ASIC tightened its restrictions on CFD trading to protect traders better. Plus500 clients in South Africa will have a leverage limit of 30:1 for Forex trading.

Plus500 is also listed on the London Stock Exchange.

Company Details:

Financial Instruments

We found that Plus500 offers a wider range of assets compared to other similar CFD providers, including over 70 currency pairs.

See below for Plus500’s range of instruments and corresponding leverage:

![]()

![]()

- Forex: Plus500 has over 70 currency pairs available for trading which is a much broader range than is offered at other CFD providers, including majors (EUR/USD, GBP/USD, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics.

- Share CFDs: Plus500 offers 1900 share CFDs, which is a wider range than most other CFD providers. The selection available includes some of the major US companies, such as Facebook, Apple, Microsoft, and Alphabet, among others.

- Options: Plus500 offers an extensive range of options compared to other CFD providers, with 504 options available for trading. Maximum leverage on all futures is up to 5:1.

- ETFs: Plus500 offers trading on 95 ETFs, which is a broader range than is available at other CFD providers.

- Indices: Average compared to other CFD providers, there are 32 indices available for trading at Plus500. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies.

- Commodities: Plus500 offers trading on 25 commodities, including metals such as gold and silver, energies such as natural gas and oil, and softs such as cotton and wheat. Most CFD providers only offer trading on between 5 – 10 commodities, so this is an impressive offering.

- Cryptocurrencies: Plus500 offers 19 cryptocurrencies for trading, which is a wider range than is available at other CFD providers.

Overall, we found the range and depth of assets available to trade impressive and it excels in its Forex offering.

Plus500’s Accounts and Trading Fees

Plus500’s trading conditions are broadly similar to other CFD providers, with a single account type, but tight spreads.

Trading Fees: Plus500’s account has a minimum deposit requirement of only 1500 ZAR, making it accessible to most traders. Although the CFD trading account is commission-free, spreads start at only 0.8 pips* on the EUR/USD, which is tighter than other similar CFD providers. Most other good CFD providers have an average spread of 0.9 pips (EUR/USD).

*spreads correct as of 09:00 GMT on 20/06/2022.

Plus500’s Account Trading Costs:

![]()

![]()

Spreads on other Major Forex Pairs

Plus500 also offers trading on other major pairs, including the GBP/USD, USD/JPY, AUD/USD, and USD/CHF. As with the EUR/USD above, the costs* in the table below are based on the trading fees of one lot (100 000 USD), including the spread and commission:

![]()

![]()

As you can see, trading costs are close to the industry average on most major pairs.

*Note that these costs are correct as of 09:00 GMT, 21/06/2022.

Overall, we found that Plus500 offers a single trading account with competitive trading costs and a reasonable minimum deposit requirement.

Plus500’s Deposits & Withdrawals

We found that Plus500 charges low deposit and withdrawal fees compared to other CFD providers, but that its payment methods are limited.

A well-regulated CFD provider, Plus500 ensures that all Anti-Money Laundering rules and regulations are followed. As such, all non-profit funds are returned to the original deposit source.

Trading Account Currencies: When we opened our account, we noticed that the Plus500 client portal allows you to choose from a large range of base currencies, including USD, GBP, EUR, CHF, AUD, JPY, PLN, HUF, CZK, CAD, TRY, SEK, NOK, ZAR, and SGD. Because we were depositing in ZAR from a ZAR bank account, we weren’t charged any currency conversion fees. Plus500’s currency conversion Fee is up to 0.7% of the trade’s realised net profit and loss, which is higher than the currency conversion fees charged by other CFD providers.

Deposits and Withdrawals: We found that deposits and withdrawals can be made securely at Plus500 using major debit cards and credit cards (including Visa and MasterCard), bank wire transfer, and Skrill. See below for details on the payment methods:

![]()

![]()

Although deposits and withdrawals are generally commission-free, Plus500 requires a minimum withdrawal amount of 100 USD for Skrill and credit cards; and 500 USD for bank transfers. Withdrawals below this amount incur a fee of 10 USD, which is relatively expensive.

We tested deposits via credit card and found that our payment was processed almost instantly, but it took three days for our withdrawal to arrive in our account, which is longer than average.

Overall, we were disappointed in the limited variety of payment methods and that Plus500’s processing times are slower than other CFD providers. Additionally, while no commissions are charged on deposits, withdrawals below certain minimum amounts will incur a fee of 10 USD.

Plus500’s Mobile Trading Platform

We found that, unlike most other CFD providers, Plus500 only provides its own mobile trading platform, which cannot be customised and does not allow for algorithmic trading, but the platform has a sleek design and is easy to use.

We rigorously tested the trading platform. See below for more details:

Easy to Use: We found that the platform offers a streamlined trading experience, appealing to traders who want to avoid the complexity of third-party platforms. The platform looks fantastic, is very easy to use, and has a solid reputation in the trading community.

Platform Features: As you can see below, the simple interface allows users to create watchlists (or favourites), analyze charts, and place and monitor trades. Additionally, technical analysis charts offer more than 100 technical indicators available in multiple timeframes:

|  |

Alert: You can also set automated price and percentage alerts that will inform you when a certain price has been reached or when a price has increased or decreased by a chosen percentage. Another great feature of the platform is that you can view trader sentiment and set alerts to inform you when a predefined percentage of traders are buying or selling an instrument. All of these alerts can also be sent via email and SMS:

|  |

Other Trading Platforms

The Plus500 platform is exclusively web-based and is not available as a downloadable desktop app.

Functionality: We found that like the mobile trading platform, the web-based platform is similarly user-friendly and uncomplicated. It also has the same functionality, including the ability to make deposits and withdrawals, set alerts, view trader sentiment, analyse charts, place and monitor trades, and access over 100 technical indicators:

No Automated Trading: We found that Plus500 provides a superior trading experience compared to other similar CFD providers, but, unlike platforms such as MT4 and MT5, the Plus500 platform is not customisable, and traders who are used to setting up their own charts over a bespoke workspace will be disappointed. In addition, the platform does not offer the execution speeds of the Metatrader platforms, nor does it offer algorithmic trading.

Overall, we enjoyed using Plus500’s trading platform because of its intuitive interface and excellent support. However, compared to third-party platforms such as MT4 and MT5, it lacks the execution speeds and doesn’t allow for automated trading via expert advisors or other trading algorithms.

Opening an Account at Plus500

We found the account-opening process at Plus500 straightforward and our account was ready for trading within one day.

We tested the account opening process, which took approximately 10 minutes to complete, and once our documentation had been submitted, our accounts were ready for trading on the same day.

How to open an account at Plus500:

- First, we clicked on the “Start Trading” button.

- We were then required to fill in our personal details (including name, date of birth, country of residence, and physical address).

- Next, we were asked to complete a short form to help Plus500 assess the state of our finances and trading knowledge. While most CFD providers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- Plus500 required us to submit a copy of our National ID or Passport with the signature page, as well as a copy of a recent utility bill or bank statement. For your convenience, you can also use Plus500’s mobile apps to upload your documents. Documents can be scanned or sent through as a high-quality digital camera picture.

- We advise you to read Plus500’s risk disclosure, customer agreement, and terms of business before you start trading.

Our application was approved within 24 hours.

Overall, we found the account-opening process quick and convenient compared to other similar CFD providers.

Plus500’s Market Research and Trading Tools

Our review noted that Plus500’s market analysis materials are limited in scope compared to other similar CFD providers, and it offers fewer trading tools.

We found that although Plus500’s market research is written by an in-house research team, it is not as comprehensive as what is available at other CFD providers. The materials include a Market Insights blog and an Economic Calendar. The Market News is updated daily, providing traders with insight into various market events. The materials are well-written and useful, but the articles are short. However, we liked the fact that Plus500’s Economic Calendar has filters that can select for company or macro-events:

Plus500’s trading tools include unique risk management tools, some of which come at an extra cost. However, unlike other similar CFD providers, it does not offer any additional analytics services such as Autochartist or Trading Central, and the proprietary platform also does not integrate with any third-party tools. See below for more details on the various tools:

The risk management tools include:

- ‘Close at Profit’ [Stop Limit] or ‘Close at Loss’ [Stop loss] rates: These orders allow you to set a specific rate at which your position will close, in order to protect your profit, in the case of Close at Profit order or minimise your loss, in the case of Close at Loss order. Traders can access this tool for free.

- Guaranteed Stop: Adding a Guaranteed Stop order to your trading position puts an absolute limit on your potential loss. Even if the price of the instrument moves significantly against you, your position will automatically be closed at the specified price, with no risk of Slippage. Guaranteed Stop is only available for some instruments. If an instrument supports the Guaranteed Stop order, a checkbox will be available for use in the platform (after you select the ‘Close at Loss’ checkbox). Traders are charged a spread markup for using this tool.

- Trailing Stop: Placing a Trailing Stop order helps you lock in a certain amount of profits. When you open a position or pending order with a Trailing Stop, it will remain open as long as its price moves in your favour, but will automatically close if its price changes direction by a specified amount of pips. This tool is available free of charge.

Overall, while the market analysis provided is updated daily, we found the materials brief and limited compared to most other large international CFD providers. It also provides a limited range of trading tools to help traders make trading decisions, but its risk management tools are excellent. Plus500 should consider partnering with some third-party providers to offer a more comprehensive market analysis.

Trading Tools Comparison:

![]()

![]()

Educational Materials

We found that Plus500’s educational materials are limited compared to other CFD providers.

Plus500’s educational materials include a set of Trader’s guides covering topics such as ‘What is CFD Trading,’ ‘Slippage When opening a Position,’ and more. It also provides a set of ‘how-to’ videos to learn more about online trading with Plus500’s platform. All videos are accompanied by an article on the respective topic. Plus500 also recently launched a detailed 28-page eBook covering all aspects of CFD trading that traders will find helpful.

Many other CFD providers offer courses, quizzes, and more to help clients learn about the markets in which they are investing, which is not available at Plus500.

Demo Account

The demo account allows traders to practice trading and get used to the Plus500 platform before depositing real money. The Plus500 platform is different from that of other CFD providers, so we advise that new clients take the time to get comfortable with the platform before committing to a deposit. While we enjoyed the clean design of the Plus500 platform, some traders may prefer a more traditional layout. Demo accounts do not expire and are loaded with virtual funds that can be topped up by request.

Overall, we think that the education section could be improved with a greater variety of materials in addition to providing sections for more experienced traders. Traders would also benefit greatly from being able to attend webinars on CFD trading basics and risk management.

Education Comparison:

Customer Support

We found Plus500’s customer support excellent compared to other CFD providers – with support available 24/7 on live chat and via email.

Plus500 offers 24/7 customer support via email, online chat, and WhatsApp messages in 31 different languages. This is a much higher level of service than we usually find at other CFD providers. The only way we think customer support could be improved is by offering phone support for more complex queries and troubleshooting.

For the purposes of the review, we tested the live chat service. We found the live chat agents were knowledgeable and responsive. They also provided links and extra reading material where appropriate.

Regulation

We consider Plus500 a regulated broker to trade with. It maintains regulation from a number of top-tier regulators, including the FCA of the UK, ASIC of Australia, and the MAS of Singapore. It also maintains regulation from the FSA of Seychelles, through which global traders are onboarded.

Plus500 was founded in 2008 and has grown into one of the largest online CFD providers in the world – not only is the company publicly traded on the London Stock Exchange, meaning an additional level of scrutiny, but eight national authorities also regulate its subsidiaries:

- Plus500UK Ltd is authorised and regulated by the Financial Conduct Authority (FCA), licence number 509909.

- Plus500CY Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission (CySEC), licence number 250/14.

- Plus500AU Pty Ltd is authorised and regulated by the Australian Securities Investment Commission (ASIC), afsl # 417727. The Company is licenced by ASIC (AFSL #417727) to offer CFDs to Australian residents and the FMA (FSP #486026) to offer CFDs to New Zealand residents. Plus500AU Pty Ltd is an Authorised Financial Services Provider #47546 in South Africa.

- The Financial Markets Authority (FMA) New Zealand, licence number 486026.

- The Financial Sector Commission Authority (FSCA) South Africa, licence number 47546.

- Plus500SG Pte Ltd (UEN 201422211Z) holds a capital markets services license from the Monetary Authority of Singapore (MAS) for dealing in capital markets products, license number CMS100648-1.

- Plus500IL Ltd is registered in Israel and is licenced to operate a trading platform.

- Plus500SEY is registered and authorised by the Seychelles Financial Services Authority, FSA License Number SD039, Registration Number 8426415-1.

Awards

Plus500 does not highlight any industry recognition it has received, but it has won numerous awards for its services over the years.

Overall, considering the strict regulatory oversight, the long track history, and the fact that it is listed on a public stock exchange, we deem Plus500 a trustworthy CFD provider.

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the reliability of the CFD provider, the platform offering of the CFD provider, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the CFD provider.

Plus500 Risk Statement

79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Overview

Plus500 is a leading brand in the CFD trading industry and has a loyal following of traders. We found that it has low trading costs, a reasonable minimum deposit requirement, and a wide range of tradable assets.

Although some traders may be disappointed that trading is only offered on Plus500’s proprietary platform, the platform has a sleek, intuitive design, and is integrated with some excellent risk management tools.

We noted that the market analysis and educational materials are limited compared to other CFD providers, forcing traders to self-educate elsewhere, but customer support is available 24/7.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Plus500 stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.