-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

Tickmill Broker Review

Last Updated On April 26, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on Tickmill

A trustworthy broker with MT4 and MT5 support and two of the lowest-cost trading accounts in the industry, Tickmill provides a perfect trading environment for serious beginners and more experienced traders. However, although Tickmill is regulated by the South African FSCA, South African traders will be onboarded through Tickmill’s Seychelles-based entity, which offers less protection.

With two account types on offer, the Raw has market-leading trading conditions, leaving the fixed-fee Classic Account feeling out of place. The Raw account has a spread from 0 pips on the EUR/USD, a 100 USD minimum deposit, and a commission of 6 USD (round turn) per 1 lot traded. The commission-free Classic Account, also with a 100 USD minimum deposit, has a spread of 1.6 pips (EUR/USD), which is higher than the industry average.

Overall, while Tickmill’s standard account is more expensive than other similar brokers, the two low-cost commission accounts make it an excellent choice of broker for Metatrader users looking for a new broker.

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | CySEC, FCA, FSCA, DFSA |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, MT5 |

| 💱 Instruments | Bonds, Cryptocurrencies, Stock CFDs, Forex, Futures, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Tight spreads

- Well regulated

- Fast and free withdrawals

Cons

- Limited base currencies

Tickmill’s Overall Rating

Tickmill offers a trading environment supported by MT4 and MT5 platforms. It features a commission-based account with competitive costs, including 0.0 pips spreads on EUR/USD and a modest 4 USD round-turn commission. The minimum deposit is 100 USD, with leverage up to 500:1. While its standard account’s trading cost is above average, its Pro Account provides some of the industry’s lowest trading fees, catering well to MetaTrader enthusiasts.

Despite a more limited selection of trading assets than some competitors, Tickmill covers a broad spectrum, including Forex, indices, and share CFDs. The broker’s commitment to trader education and support is notable, offering extensive materials and analysis resources. With exceptionally low costs and comprehensive education for beginners, FxScouts gives Tickmill a high rating of 4.58 out of 5

Is Tickmill safe?

Tickmill maintains regulation from several top-tier authorities, including the FSCA in South Africa, the UK’s FCA and CySEC of Cyprus, but South Africans will be onboarded through Tickmill’s Seychelles-based entity, which offers less protection.

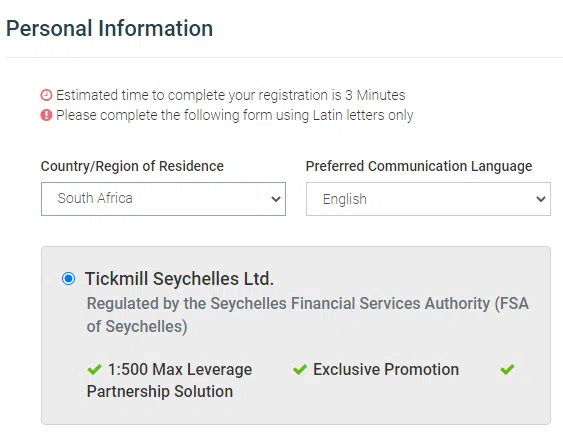

Regulation: Although Tickmill maintains a licence from the Financial Services Conduct Authority of South Africa, South African clients will be onboarded through its Seychelles-based entity. This is disappointing for South African traders as it means that they will not benefit from local regulation and that their money will not be segregated at South African banks. See below for Tickmill’s sign-up notice:

Safety Features: Although the lack of FSCA oversight on their trading account may be off-putting for some South African traders, we still consider Tickmill a safe broker to trade with. Firstly, it holds licences from a number of other regulators worldwide:

Secondly, South African clients can be sure that their funds will be segregated from Tickmill’s operating capital at top-tier banks, and finally, it provides all clients with negative balance protection, which means that traders cannot lose more than their initial deposit.

Company Details:

![]()

![]()

Tickmill’s Trading Assets

Tickmill offers many different types of assets for trading and a large range within each asset class.

Trading Instruments and Leverage:

![]()

![]()

Forex: Tickmill offers 62+ currency pairs for trading, including majors (EUR/USD, GBP/USD, and USD/JPY) and minors (NZD/CAD, EUR/JPY, and GBP/NZD), and exotics (EUR/NOK, USD/SEK and EUR/ZAR). At Tickmill, there are more pairs to trade than most other Forex brokers.

Indices: Tickmill offers trading on 27 indices, which is average compared to other similar brokers, but includes the likes of the AUS200, UK100, US30, and US500. Both Index Futures and Index Cash CFDs are available.

Metals: Tickmill offers three metals, whereas most brokers only offer trading on between 5 – 10 Metals. These include gold and silver.

Bonds: Tickmill offers four bonds for trading, which is average compared to other similar brokers.

Share CFDs & ETFs: Tickmill offers over 500 share CFDs and ETFs, a good range compared to other brokers.

Cryptocurrencies: Tickmill only offers eight cryptocurrencies for trading, including Bitcoin, Ethereum, and Litecoin. This offering is also limited compared to what’s available at other brokers.

Tickmill’s Accounts and Trading Fees

Tickmill offers two live accounts, which is average compared to other brokers, and its trading fees are lower than those of other brokers on its Raw account.

Trading Fees: The ongoing trading costs at Tickmill are extremely competitive on its commission-based account, but higher than average on its commission-free Classic Account. However, at 100 USD, the minimum deposits on the Classic and Pro accounts make them accessible to most traders.

Low Non-trading Fees: At Tickmill no fees are charged for deposits or withdrawals, and Tickmill does not charge inactivity fees on dormant accounts. This is remarkable for an industry that charges fees for most transactions.

Tickmill’s Account Trading Costs:

![]()

![]()

As you can see from the table above, the trading costs on the Pro Account are highly competitive, and it only requires a minimum deposit of 100 USD. It should be noted that Tickmill charges some of the lowest commissions in the industry – the commissions at most other brokers tend to be 7 USD (round turn) per lot traded.

Account Information

Classic Account

This commission-free entry-level account requires a minimum deposit of 100 USD. Fees are included in the spreads, which start at 1.6 pips on the EUR/USD, which is wider than other similar brokers.

Raw Account

This account requires a 100 USD minimum deposit and is an entry-level account for professional traders. Tight variable spreads (starting at 0.00 pips) are available in exchange for a commission of 6 USD (round turn) per lot. Note that the stop-out and limit levels for Raw account users are zero.

Deposits and Withdrawals

Tickmill offers a wide range of funding and withdrawal methods, its processing times are fast, and no fees are charged for deposits or withdrawals.

A well-regulated broker, Tickmill ensures that all Anti-Money Laundering rules and regulations are followed, and as such, all withdrawals are returned to the deposit source.

Trading Account Currencies: At Tickmill, traders can only choose from four base currencies: USD, GBP, ZAR, and EUR. This means that South Africans can avoid currency conversion fees.

Deposit and Withdrawal Fees: Tickmill offers commission-free deposit and withdrawal options that can be performed on the broker’s trading platform. The minimum withdrawal amount for all payment methods is 25 USD. Tickmill also has a Zero Fee policy and will reimburse traders for any third-party fees charged up to 100 USD on deposits of over 5,000 USD.

- Visa/Mastercard: Deposits are instant and free. Withdrawals are free and are processed within one day.

- Bank transfers: Deposits and withdrawals are free and are processed within one day.

- Neteller/Skrill: Deposits are instant and free. Withdrawals are free and are processed within one day.

- STICPAY: Deposits are instant and free. Withdrawals are free and are processed within one day.

- Fasapay: Deposits are instant and processed within 1 – 2 hours. Withdrawals are free and are processed within one day. Accounts are denominated in USD/IDR.

- QIWI: Deposits are instant and free. Withdrawals are free and are processed within one day. Accounts are denominated in USD/RUB/GBP.

- WebMoney: Deposits are instant and free. Withdrawals are free and are processed within one day. The minimum withdrawal amount is 25 USD, and accounts are denominated in USD/RUB/GBP.

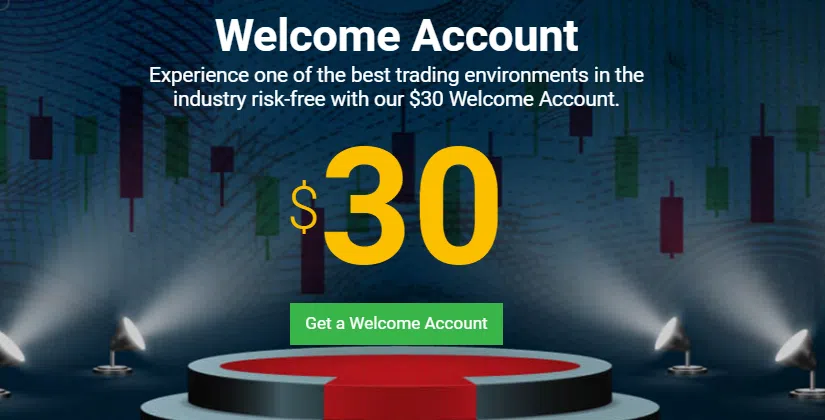

Bonuses

Tickmill offers a range of bonuses and promotions for new traders. These include a 30 USD Welcome Account, a Non-Farm Payroll prediction competition, and a Trader of the Month competition. See Tickmill’s website for more details.

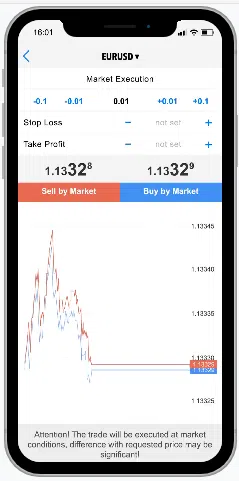

Mobile Trading Apps

Tickmill’s offers MT4, MT5, and its own inhouse mobile trading app, a good range of mobile trading platforms compared to other similar brokers.

Tickmill Mobile App

Tickmill’s mobile app is essentially a dashboard that connects traders to MT4 and MT5. It allows traders to:

- Create, manage and monitor accounts.

- Deposit and withdraw funds through one user-friendly interface.

- Upload documentation.

- Complete transaction history.

- Contact customer support through a Live Chat feature and access a support team in 16 languages.

- Manage and monitor legal documentation.

MT4 and MT5

MetaTrader4 (MT4) and Metatrader 5 (MT5) are available on IOS, Android, and Windows mobile phones and tablets. The app will connect to the same account as the desktop software, allowing a synchronised and mobile trading experience.

Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Tickmill’s Other Trading Platforms

Tickmill offers full support for the MT4 and MT5 trading platforms, which is average compared to other similar brokers.

All platform choices are free to use, all can be downloaded to your PC and all have web versions of the platform. All platforms are also available on mobile Android and iOS devices.

Metatrader 4

Having established itself as the industry-leading platform, Metatrader 4 (MT4) is the most reliable and popular platform in existence. Its intuitive interface and user-friendly environment provide essential tools and resources for successful online trading. It is also widely recognised for its fast execution speeds, range of charting tools, algorithmic trading, and customisability.

Tickmill’s MT4 platform is the standard version of MT4, and while numerous upgrades are available, most of them come at a price.

While MT4 has great customizability, the platform feels outdated, and some of the features may be hard to find. In addition, only the basic orders are available, including Market, Limit, Stop, and Trailing Stop.

Metatrader 5

Developed in 2010, MT5 is the newer version of its predecessor, MT4. MT5 is more powerful and faster than MT4 when it comes to back-testing functionality for automated trading algorithms. It also has a built-in news feed, market depth indicator, economic calendar, and trades can be made on the charts.

Again, only the standard version of MT5 is available at Tickmill. However, support for MT5 means that Tickmill can enhance its asset offering, making it more appealing to experienced traders.

While MT4 and MT5 are both excellent trading platforms, many other CFD brokers also offer their own web-based platforms, which tend to be easier to use for beginner traders. On the other hand, the benefit of Tickmill offering third-party platforms such as MT4 and MT5 is that traders can take their own customised version of the platform with them should they choose to migrate to another broker. Additionally, there are thousands of plugins and tools available for the MetaTrader platforms.

Trading Platform Comparison:

![]()

![]()

Opening an Account at Tickmill

Tickmill has a fast and hassle-free account opening process, with quick verification.

South African traders can open an account at Tickmill but need to meet the minimum deposit requirement of 100 USD to do so.

We tested the account opening process, which took approximately 10 minutes to complete, and once our documentation had been submitted, our accounts were ready for trading within a few hours.

Tickmill offers both corporate and individual accounts, but we will outline the four-step process for opening an individual account:

- Register an account. This can be done by clicking on the “Create Account” button. Traders are required to fill in their personal information (name, email address, telephone number, and date of birth), and trading knowledge, and create a password.

- The next step is to confirm your identity. Tickmill will need two documents from you:

- A photo ID (passport, driver’s license, or national ID card) and;

- A secondary ID (a bank or utility statement with your full name and address dated in the last three months).

- The third step requires choosing your trading account, preferred base currency, and level of leverage.

- Lastly, you can download the trading platform (MT4/MT5), and start trading.

Overall, Tickmill’s account-opening process is quick and efficient, and accounts are generally ready for trading within a matter of hours.

Trading Tools

Tickmill offers an excellent range of trading tools compared to other similar brokers.

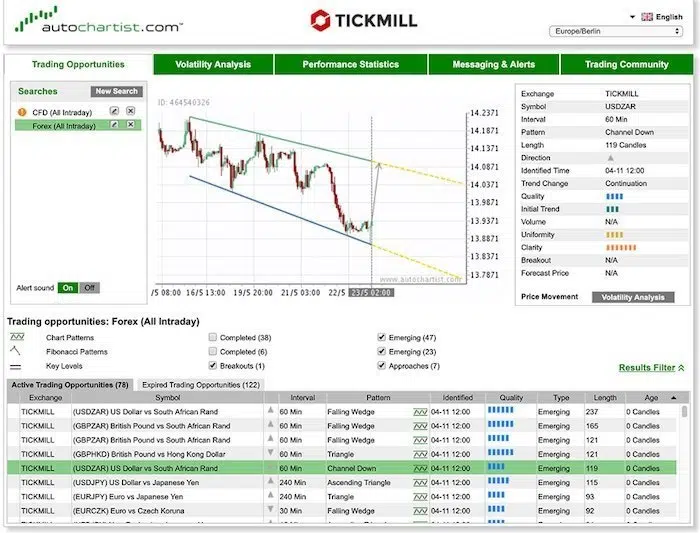

Tickmill offers a number of excellent trading tools, including Autochartist, Myfxbook, PelicanTrading, a VPS service, an advanced trading toolkit, and a one-click trading plugin. Autochartist is free of charge for all registered users, while other third-party tools such as myfxbook, Pelican Trading, and VPS hosting incur an extra cost on the part of the trader.

AutoChartist

AutoChartist is a third-party automated chart analysis tool that scans the markets for volatility and notifies traders of relevant trading opportunities. Since it integrates into MT4, information is available inside the trading view and simplifies the platform while providing additional analysis. Autochartist is a common technical analysis tool among traders, so training videos are easy to find online. Autochartist is one of the best analytics tools on the market, and Tickmill does well to provide this service to its clients. Tickmill offers AutoChartist free of charge to all live and demo account holders.

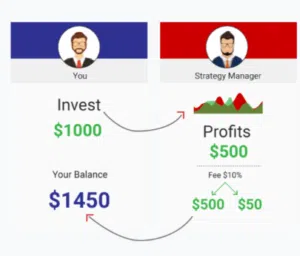

Myfxbook

Another common third-party trading tool available on Tickmill is Myfxbook AutoTrade, a cross-broker social trading platform that allows for copy trading without additional software. Myfxbook is available at an extra cost, and traders will have to contact myfxbook directly to find out more. Myfxbook is lauded as one of the best social trading platforms available.

Pelican Trading

Like Myfxbook Auto Trade, Pelican is an innovative all-in-one mobile auto-copying application that allows traders to follow and copy trades from other successful traders. Pelican has a user-friendly interface that provides a platform to learn from and chat to other traders and mentors. Users can also track and analyse the performance of other traders. This platform is ideal for beginners starting out in the trading space. Again, traders will have to contact Pelican directly to find out about the costs associated with using the service.

VPS Service

Tickmill VPS has partnered with BeeksFX to provide a discounted VPS service to clients. As one of the largest Forex VPS providers, BeeksFX gives users access to very low latency networks and expert advisors.

Tickmill clients are entitled to the following exclusive benefits with BeeksFX:

- 20% discount on all packages.

- Quick setup and a 24/7 live chat and email support.

- Negligible latency due to VPS servers’ adjacent location to Tickmill.

- 100% uptime guarantee.

No shared resources, and increased control.

Advanced Trader Toolkit

Free to all Tickmill clients, the Advanced Trader Toolkit gives traders access to institutional quality technology, including advanced trading tools, user-configurable news and information, and trade analysis. It also includes an array of sophisticated alarms and messaging systems, and live sentiment and correlation tracking. This tool is appropriate for more experienced traders refining their trading strategies. Some of tools in the package include:

- Trade Terminal: A feature-rich professional trade execution and analysis tool, providing several trading features and order controls that are not included in MT4 or MT5.

- Connect: A customisable news feed aggregator and interactive economic calendar.

- Mini Terminal: Tailored to the MT4, manage your execution with context in a specific trading chart.

- Correlation Matrix and Correlation Trader: These tools work together to show correlations between pairs of trading symbols. It functions with any symbols available in the trading platform, allowing a calculation of the correlation between multiple asset classes against Forex. The Correlation Trader will then allow for detailed inspection of the correlation between any two instruments.

- Sentiment Trader: Allows traders to feel the markets out with real-time long and short positioning data, historic sentiment, and a dashboard for multiple instrument sentiment analysis.

One-Click Trading

The One-Click Trading MT4 Expert Advisor (EA) is designed to make common trading mechanisms more accessible, facilitating trading and removing unnecessary navigation between windows and charts. This EA does not overly simplify MT4, but it does make trading on the platform less complicated.

Overall, Tickmill offers some of the best trading tools in the industry, with tools to suit both beginners and more experienced traders.

Trading Tools Comparison:

Tickmill for Beginners

Tickmill has a world-class selection of educational materials, in addition to webinars and seminars to help new traders get their footing. It also offers an Analysis Blog and Trading View Analysis Tools, offering new perspectives on currency markets.

Educational Material

Tickmill offers an excellent selection of educational materials. Most of it is focused on beginners, but there are sections that will appeal to more experienced traders. It also offers a free demo account so traders can practice using the trading platforms before opening a real account.

Tickmill offers a range of educational resources, including free downloadable e-books, video tutorials, infographics, and a Forex glossary. It also hosts regular seminars and webinars.

Ebooks: The e-books cover Forex Trading Basics and how Forex trading works, introducing the Major Currency Pairs, Trading Strategies, an Introduction to Fibonacci Analysis, and the major types of Forex analysis.

Video Tutorials: Tickmill offers a range of video tutorials, some of which can only be accessed through registering a live account. Video tutorials cover various topics, including Forex Trading, Market Analysis, Trading Psychology, Trading Strategies, Social Trading, CFDs, Managed Accounts, and Technical Indicators.

Infographics: Tickmill provides excellent infographics that detail key facts and possible scenarios of various events, and how these impact the markets.

Webinars: Webinars are run in four languages (English, Arabic, Italian, and German), and all previous webinars are available in an archive. The webinar subjects vary from more fundamental concepts like News Trading Strategies to Technical Analysis and Chart Theories like Standard Elliot Wave Models.

Seminars: Tickmill has a schedule of free seminars worldwide, which introduce clients to trading concepts, and provides networking opportunities.

Demo Accounts: Demo accounts allow prospective traders to practice trading in real-time. One can test tools and strategies and sharpen trading skills completely risk-free. New traders can also explore the full suite of customisable tools and features that the MT4 platform offers to enhance trading performance. Demo accounts expire if there is no login for seven consecutive days.

The brokerage also offers a trading glossary which acts as another source of education, and where basic terms are described in short sentences.

Education Comparison:

![]()

![]()

Analysis Material

Tickmill’s analysis material is excellent compared to other similar brokers.

The in-house Tickmill research team of eleven experts runs a regular blog covering both fundamental and technical analyses. The research provides information on market-moving events outside of conventional news sources. These articles are updated throughout the day and are multi-format, including charts, videos and written articles.

The blog is publically available, and Tickmill allows traders to contact authors with questions about various articles. This is a unique offering, as brokers typically shy away from one-to-one contact with traders.

Customer Support

Tickmill offers high-quality customer support, however, it is only available from Monday to Friday during business hours.

Customer support is available in 17 different languages, via email, telephone, and live chat. Telephone support is also available locally in South Africa. It does not, however, offer a call-back service. Traders should note that customer service is only available from Monday to Friday during business hours.

For the purposes of this review, we found the customer service extremely responsive and very knowledgeable. It is clear that Tickmill has invested in training the customer service team as they were able to answer all our questions without hesitation.

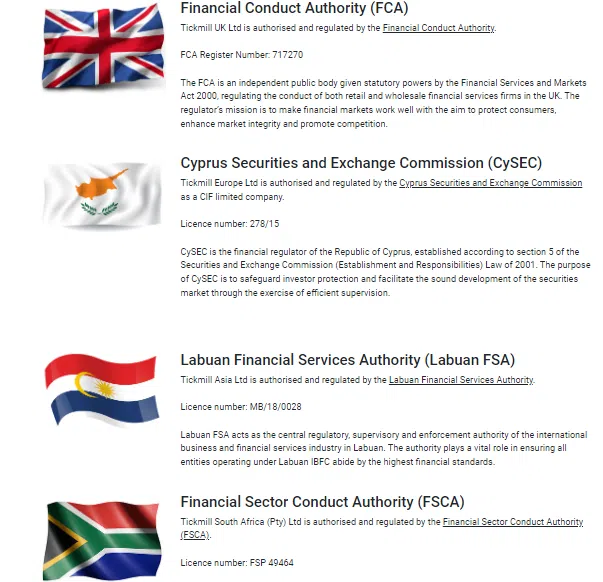

Safety and Industry Recognition

Regulation: Established in 2014 and headquartered in London, Tickmill has experienced extraordinary growth since its inception. It has over 110,000 traders on its books and an average monthly trading volume of over 120 billion USD. Tickmill is authorised and regulated by the Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority of South Africa (FSCA), the Financial Services Authority of Labuan Malaysia, and the Seychelles Financial Services Authority (FSA). See below for a list of Tickmill company registrations:

- Tickmill UK Ltd is regulated by the Financial Conduct Authority, 3rd Floor, 27 – 32 Old Jewry, London EC2R 8DQ, England Register number: 717270.

- Tickmill Europe Ltd is authorised and regulated by the Cyprus Securities and Exchange Commission, Kedron 9, Mesa Geitonia, 4004 Limassol, Cyprus. Licence number: 278/15.

- Tickmill Asia Ltd is authorised and regulated by the Labuan Financial Services Authority, Unit B, Lot 49, 1st Floor, Block F, Lazenda Warehouse 3, Jalan Ranca-Ranca, 87000 F.T. Labuan, Malaysia. Licence number: MB/18/0028.

- Tickmill South Africa (Pty) Ltd is authorised and regulated by the Financial Sector Conduct Authority (FSCA), The Colosseum, 1st floor, Century Way, Office 10, Century City, 7441, Cape Town. Licence number: FSP 49464.

- Tickmill Ltd Seychelles regulated by the Financial Services Authority of Seychelles and its 100% owned subsidiary Procard Global Ltd, UK registration number 09369927.

Awards

Tickmill’s quality and popularity amongst traders have been noticed and rewarded by its industry peers. In recent years the company has won awards for:

- Best MENA Dorex Broker 2021 (Cairo Virtual Expo)

- Best Customer Service (Cairo Virtual Expo)

- Best Commodities Broker 2020 (Rankia Markets Experience Expo)

- Best Trading Experience 2020 (Forex Brokers Award 2020)

- Most Reliable Broker 2020 (Online Personal Wealth Awards)

- Best Forex Education Provider (Global Brands Magazine)

- Best CFD Broker Asia 2019 (International Business Magazine

- Best Forex CFD Provider 2019 (Online Personal Wealth Awards)

Overall, although Tickmill’s South African clients are directed to the FSA-regulated entity, it is regulated by a number of strong international regulators, has a long track record of responsible behaviour, and has received wide industry recognition. On this basis, we deem Tickmill a trustworthy broker.

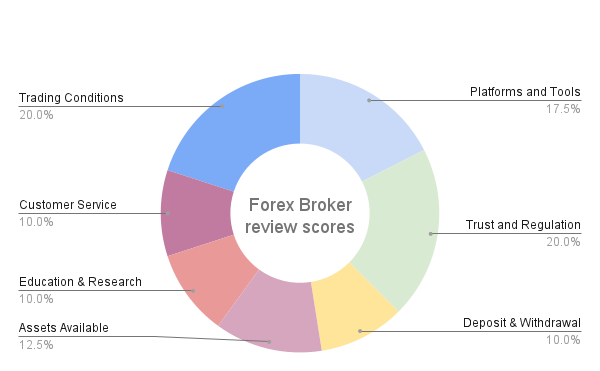

Evaluation MethodWe value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Tickmill Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. Tickmill would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71% of retail investor accounts lose money when trading CFDs with Tickmill Ltd.

Overview

Tickmill is an award-winning and trustworthy broker that relies heavily on industry-standard platforms to enable fast execution. With a strong education section, the availability of both MT4 and MT5, additional premium tools offered to traders at no extra cost, and excellent trading conditions on its commission-based account, Tickmill appeals to both serious beginners and more experienced traders.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how Tickmill stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.