-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

XTB Key Features

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | CySEC, FCA, DFSA, FSC |

| 💵 Trading Cost | USD 7 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | xStation5 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

Last Updated On February 12, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on XTB

A well-regulated broker, XTB will appeal to traders looking for a wide choice of tradable instruments, top-class educational materials, and excellent market analysis. However, traders should note that support is only offered for XTB’s in-house platform, xStation5.

XTB has two accounts with no minimum deposit requirements, but trading costs are slightly higher than most other brokers. XTB offers trading on over 2100 financial assets, a wider range than is typically seen at other brokers, including 57 Forex pairs. Educational support for beginners is excellent, and XTB also publishes frequent market commentary and trading ideas in its Market News section.

One drawback is that XTB no longer supports the MT4 trading platform, so all clients have to use XTB’s in-house platform, xStation 5 – though it has won awards for its functionality, fast execution speeds, and intuitive design.

XTB Key Features

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | CySEC, FCA, DFSA, FSC |

| 💵 Trading Cost | USD 7 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | No |

| 🖥️ Platforms | xStation5 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, ETFs, Forex, Indices |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Tight spreads

- Low minimum deposit

- Good for beginners

Cons

- Limited platform choice

Is XTB Safe?

With regulation from some of the world’s top regulators and a listing on the Warsaw stock exchange, XTB has a high trust rating.

Regulation: Founded in 2002 in Poland, XTB Group is an umbrella group for many subsidiaries regulated by different national authorities across the globe. Residents of South Africa will be onboarded through its Belize-based entity regulated by the Financial Services Commission of Belize. The IFSC’s regulatory oversight is less strict than regulators in the UK and Europe, but XTB does hold licences from several top-tier authorities, including the FCA of the UK.

Safety Features: XTB segregates all client money from its operating capital but does not offer negative balance protection. Additionally, XTB offers high leverage to its clients – up to 1:500 on some of its account types. It also has no minimum deposit requirements, which means for traders who deposit small amounts, it will be difficult to hold a substantial trading position without getting stopped out and losing the money in their trading account, and possibly going into a negative balance.

On a positive note, since XTB is a publicly listed company, it adheres to strict capital requirements and external audits, adding another layer of security. Additionally, all funds are insured through Lloyd’s of London, one of the world’s leading specialist insurance providers, providing coverage of up to 1 million euros, GBP, or AUD (depending on the region). The insurance is available to all XTB clients, including those regulated under the IFSC.

We confirmed the licence on IFSC’s register. See the licence below:

Company Details:

XTB’s Financial Instruments

We were impressed that XTB offers a much wider range of tradable instruments than other similar brokers.

- Forex: XTB has 57 currency pairs available for trading, which is around the industry average. These include majors (EUR/USD, GBP/USD, and USD/JPY), minors (NZD/CAD, EUR/JPY, and USD/ZAR), and exotics.

- Share CFDs: XTB offers 1894 share CFDs, which is a broader range than is seen at other brokers. The selection available includes some of the major US, UK, and European Exchanges. Note that XTB charges a commission of 0.08% on share CFDs.

- Indices: There are 35 indices available for trading at XTB, which is a much larger range than is usually seen at other brokers. The most popular indices are those that combine the shares of some of the largest and globally acknowledged companies in Germany, China, and the US.

- Commodities: XTB offers trading on 26 commodities, which is a much broader range than is commonly available at other brokers. Most other brokers offer between 5 and 10 commodities. Commodities include metals such as gold and silver, energies such as oil, and softs such as sugar, cocoa, and cotton.

- ETFs: XTB offers trading on 150 ETFs, which is much more than is typically available at other brokers.

- Cryptocurrencies: XTB offers 49 crypto pairs, which is a much broader range than what is available at other brokers. These include Bitcoin, Ethereum, Litecoin, Ripple, and more. Leverage on crypto pairs is also higher than other brokers, at 1:20.

Overall, the range and depth of tradable instruments available at XTB are more extensive than that of other brokers and should leave most traders satisfied.

XTB’s Accounts and Trading Fees

XTB offers two live accounts, and its trading fees are slightly higher than the industry average.

Trading Fees: XTB’s accounts have no minimum deposit requirements making them accessible to all traders. The Standard Account and the Swap-free Account have no commission. Trading fees start at 0.5 pips (EUR/USD) on its Standard Account, but average at about 1.4 pips, which is slightly higher than average. Most other brokers have an average spread of 1 pip (EUR/USD) on their commission-free accounts. The Swap-Free Account has spreads that start at 0.7 pips (EUR/USD), but average spreads on this account are not published.

See below for account details:

Account Details:

Standard Account

XTB’s Standard Account is a commission-free account with variable spreads starting at 0.70 pips on the EUR/USD. Traders should be aware that spreads average closer to 1 pip.

Islamic Swap-Free Account

Islamic accounts are commission-based swap-free accounts, with variable spreads starting at 0.7 pips on the EUR/USD.

Following a decision to move away from MT4, XTB now only provides its own xStation 5 trading platform. Traders should note that XTB does not allow hedging, scalping, or copy-trading.

Mobile Trading Apps

XTB’s mobile trading apps are limited because it only offers support for xStation5, but it offers an excellent mobile trading experience.

Following a move away from MT4 (customer service was unable to give us details on why this is the case), XTB has focused its efforts on developing its proprietary xStation5 platform. Winning Best Mobile App for Investing 2019 & 2020 (Rankia Awards), XTB has successfully built an intuitive, powerful, and fast trading platform.

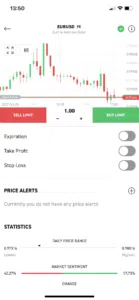

A mobile version of the xStation5 application is available, which seamlessly connects to the application’s desktop version and is available on Android and iOS mobile devices and tablets. The mobile app is well-designed, has excellent search functionality, and allows traders to work from anywhere, close and modify existing orders, and calculate profit/loss in real time.

xStation 5 offers many of the same advanced trading features found in MetaTrader 4, but the xStation5 platform adds the XTB touch. It introduces XTB sentiment data directly into the platform, so traders can view the percentage of clients trading long or short and on which instruments. It also offers powerful charting tools, one-click trading, stop-loss functionality, multiple order types, price alerts, and real-time performance statistics so you can evaluate your trading moves and identify areas for improvement:

|  |  |

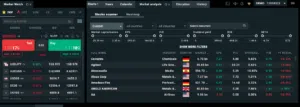

Traders can also access market news, educational materials, and the economic calendar from within the app, which is very convenient:

|  |

Overall, XTB’s mobile trading app provides an excellent trading experience.

Trading Platforms

With only XTB’s in-house platform, xStation5, available, XTB’s trading platform support is limited compared to most other online brokers. And traders should be aware that automated trading is not an option.

Many other brokers offer support for third-party platforms such as Metatrader 4 and Metatrader 5, which is an advantage for forex traders who want to take their own customised versions of the platform with them should they choose to migrate to another broker. Additionally, third-party platforms tend to have many additional plugins and offer the use of expert advisors, which are unavailable on xStation5.

This will probably be more of an issue for experienced traders who trade algorithmically, but beginner traders will likely find that the platform caters well to their needs.

Like the mobile app, traders have access to powerful charting tools and indicators, can receive price alerts, and it has excellent stop-loss functionality:

Another useful feature of the platform is the economic calendar, which highlights the key economic events which can be filtered by country and impact:

Overall, while XTB’s platform support is limited, xStation5 has won many awards, offers some great features, and is beginner-friendly.

Platform Comparison:

Deposit and Withdrawal Fees

XTB provides a limited range of funding options compared to other big brokers, and it charges fees on some deposit and withdrawal methods.

A well-regulated broker, XTB does not process payments to third parties. All withdrawal requests from a trading account must go to a bank account or a source in the trader’s name.

Trading Account Currencies: XTB only allows trading accounts to be denominated in USD, which limits traders with accounts denominated in other currencies. Currency Conversion Fees are charged for all trades on instruments denominated in a currency different from the currency of a trader’s account.

Deposits and Withdrawals: There are several ways to deposit funds into your trading account, and some of these methods may incur additional charges. All deposits except for bank transfers are instant; you will see this reflected in your account balance immediately. Bank transfers can take 2-5 days to arrive, depending on the country you send money from. Unfortunately, this depends on your bank and any intermediary bank.

The standard processing time for withdrawal requests is one business day, and withdrawals of less than 50 USD will be charged an additional commission of 30 USD.

See below for more details on payment methods:

- Bank Transfers: No fees are charged, but your bank may charge you a transfer fee. A fee of 30 USD is charged for withdrawals below 50 USD.

- Credit Cards/Debit Cards: Deposits are free.

- Skrill: A fee of 2% is charged on your deposit amount; withdrawals are free.

- SafetyPay: A fee of 1.5% and free withdrawals are charged on your deposit amount.

How do you withdraw money from XTB?

- Log in to the xStation5 trading platform.

- On the bottom right-hand side of the platform, click ‘Deposit and withdraw funds.’

- Enter your bank account details and the amount you wish to withdraw.

- Click ‘Initiate the withdrawal.’

Overall, XTB provides a limited number of funding methods and account currencies, and charges fees for some deposit and withdrawal methods.

Opening an Account at XTB

The account opening process at XTB is user-friendly, and accounts are ready for trading within one day.

While there are no minimum deposit requirements to open an individual account, corporate accounts require a 15,000 EUR minimum deposit. See below for account-opening details:

- New traders will have to click on the “Create an Account” button at the top of the page, where they will be directed to register an account.

- XTB’s intake form requires clients to fill in their personal details (including name, country of residence, email address, and birth date).

- Next, traders need to select their preferred account base currency.

- Once this step is complete, clients must fill out a questionnaire that helps XTB assess the trader’s investment knowledge, experience, and expertise to determine the suitability and relevance of the services on offer. While most brokers don’t include this step in the account-opening process, it is a responsible move in an industry that is often accused of an irresponsible approach to consumer protection.

- XTB requires at least two documents to accept you as an individual client:

- Proof of Identification – XTB accepts all government-issued identification documents such as Passports, national ID cards, driving licenses, or other government-issued ID.

- Proof of Address – Proof of residence/address document must be issued in the name of the XTB’s account holder within the last 6 months and must contain a trader’s full name, current residential address, issue date, and issuing authority.

- After the application is approved, traders can log in and fund their accounts

- We advise that you read XTB’s risk disclosure, customer agreement, and terms of business before you start trading.

Trading Tools

XTB offers a limited number of online trading tools compared to other brokers, and these are only available from within the xStation5 platform.

Most other large brokers offer various technical analysis tools, such as Autochartist and Trading Central, in addition to copy trading tools and VPS services. XTB only provides a few tools through its xStation5 platform:

- Market Sentiment: The Market Sentiment feature shows the percentage of long and short positions among XTB’s clients for each financial asset.

- Heat Map: The Heat Map shows the number of people who have gained or lost money.

- Stocks Scanner: The Stocks Scanner is a tool that uses 15 factors to filter stocks you may want to trade, including market capitalization, P/E, beta, and debt-to-equity ratio.

Overall, the number of trading tools available at XTB is underwhelming compared to what is offered at other brokers.

Trading Tools:

XTB For Beginners

XTB has some of the best training materials available for beginners. It has various courses, and the material is clear, concise, and well-structured. One-to-one mentoring, dedicated account management, webinars, and 24/5 customer service present XTB traders with a fluid onboarding experience.

Educational Material

The educational materials available at XTB are some of the best in the industry and cater to traders of all experience levels.

XTB offers an extensive section of well-structured training material for beginner and intermediate traders in its Trading Academy. It also offers frequent webinars, a library of articles, one-to-one mentoring, and an unlimited demo account.

Courses: XTB provides a list of mini-courses that can be navigated by trading experience level or topic. It covers basic trading concepts, including How the Market Works, Basics of Forex Trading, and an overview of the risk associated with CFD trading, to topics that are appropriate for more experienced traders, such as Market sentiment and positioning and Intermarket correlation. It also offers tutorials on the xStation5 proprietary software platform. The beginner and intermediate sections are open to the public, but expert training courses are only available to members with live accounts.

Library: XTB’s library is comprehensive and comprises short articles covering Platform and Account tutorials in addition to trading-related subjects such as Fundamental Analysis, Technical Analysis, and Trader Questions.

One-to-one Mentoring: XTB also offers one-to-one mentoring by leading experts that can be arranged through your account manager. These sessions coach traders on market analysis, including risk management and trading psychology, and are tailored to the client’s needs. The broker also operates an open-door policy, meaning that anybody can visit their local branches.

Webinars: XTB offers frequent webinars that are run every Wednesday at 5:45 pm for live market analysis, demonstrated on XTB’s trading platform xStation 5, followed by a live discussion, where traders get to chat with XTB’s market analyst and account managers.

Demo Account: XTB also offers a demo account with virtual funds that can be topped up on request. Demo accounts do not expire unless there is no activity on the account for more than three months, when they will be suspended. However, they can be reactivated at any stage. Demo accounts are a great way to practice trading in a risk-free environment, allowing traders to familiarise themselves with XTB’s platform.

Education Comparison:

Analytical Material

XTB’s market analysis materials are comprehensive and provide actionable trading ideas.

XTB provides frequent market commentary and trading ideas in its Market News section. Most market news is available to all visitors and provides actionable trading information. However, some of the premium education and market analysis materials are only available to live account holders.

Traders receive multiple updates throughout the trading day, consisting of brief fundamental summaries, technical trading alerts, and the Trade of the Day. Some content is text-only, and the rest includes charts and trading ideas.

XTB also offers an economic calendar, a comprehensive log of all scheduled macroeconomic releases, including a potential impact rating, and detailed historical data to help traders predict the results on corresponding markets.

A wide range of fundamental and technical analysis tools are also available within the xStation5 platform, giving traders a comprehensive charting package to identify potential trading opportunities.

Customer Support

XTB operates a 24/5 customer support desk, with contact available via email, live chat, and phone support. As mentioned, XTB also operates an open-door policy so customers can visit any of their offices. Notably, XTB has 20 local branches.

Customer support is offered in English, Spanish, Arabic, French, Italian, Portuguese, Russian, Chinese, German, Polish, Czech, Slovak, Romanian, and Hungarian.

Overall, we found the live chat support responsive, polite, and able to answer most of our questions.

Safety and Industry Recognition

Regulation: XTB is regulated by the Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC), the Belize International Financial Services Commission, and the Komisja Nadzoru Finansowego (KNF) in Poland. In addition, XTB is listed on the Warsaw Stock Exchange and is required to regularly disclose its financials. See below for a list of XTB-registered companies:

- XTB Limited is authorised and regulated by the FCA, license 522157, since 2011.

- XTB Europe has been regulated by CySEC, license 169/12 since 2012.

- XTB International is regulated by the Belize International Financial Services Commission (license IFSC/60/413/TS/17).

- X-Trade Brokers DM SA is authorised by the Polish Securities and Exchange Commission under license number DDM-M-4021-57-1/2005.

Awards

XTB has won many industry awards, including:

- Best NDD Forex Broker 2021 (Online Personal Wealth Awards)

- Best Mobile App for Investing 2019 & 2020 (Rankia Awards)

- Best Brokerage House in Europe 2019 (Global Banking & Finance Review)

- Best CFD broker, including Highest Rated FX & CFD Broker 2018 (Wealth and Finance Awards)

Overall, considering its long history of responsible behaviour, strong international regulation, and strict internal processes, XTB is a safe broker to trade with.

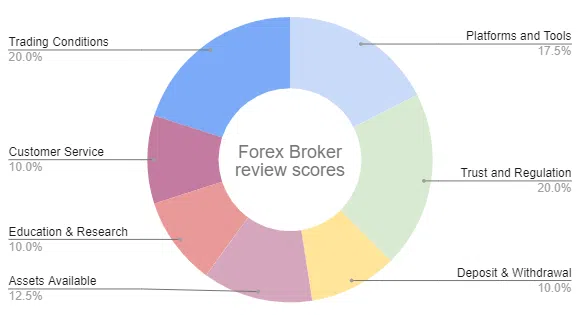

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process, which includes a detailed breakdown of the XTB offering. Central to that process is the evaluation of the broker’s reliability, the broker, the platform offering of the broker, and the trading conditions offered to clients, summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

XTB Disclaimer

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. XTB would like you to know that: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Overview

A well-regulated broker, XTB offers trading on a wider range of assets than other brokers, including Forex, share CFDs, ETFs, commodities, and indices. XTB offers only two live account types and higher than average trading costs and only offers trading on its in-house platform, xStation5. Additionally, XTB charges high fees for some deposit and withdrawal methods, but XTB excels in its support for beginner traders with an excellent education suite, comprehensive market analysis materials, and high-quality customer service, including one-to-one mentoring.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how XTB stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.