-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

CM Trading Broker Review

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | FSCA, FSA-Seychelles |

| 💵 Trading Cost | USD 15 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, WebTrader |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals |

Last Updated On March 11, 2024

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on CM Trading

Founded in 2012 in Johannesburg, CM Trading is an FSCA-regulated broker with a few drawbacks. It offers six accounts on two different trading platforms, but both its minimum deposits and ongoing trading costs are higher than other brokers.

Another drawback is the lack of ZAR trading accounts: Any Rand deposits are converted to USD or EUR, and profits will have to be converted again when withdrawn. CM Trading also charges higher deposit and withdrawal fees than other brokers, which in combination with currency conversion fees, may discourage some South African traders.

On a positive note, CM Trading has a local South African customer service team that provides platform support and one-on-one training. South African traders will also benefit from local FSCA protection, which means that their money will be segregated at top-tier South African banks.

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | FSCA, FSA-Seychelles |

| 💵 Trading Cost | USD 15 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, WebTrader |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Good for beginners

- Great customer support

- Copy trading accounts

Cons

- Expensive withdrawals

- Local regulation only

CM Trading Overall Rating

CM Trading offers a varied account structure, with options like the Bronze, Silver, Gold and Premium accounts, addressing different trader needs with spreads starting at 1.50 pips for EUR/USD on its entry-level account. Despite its strong platform offerings, including MT4 and copy trading capabilities, CM Trading’s high deposit and withdrawal fees, coupled with a lack of educational and market analysis resources, make it a less desirable choice for beginner traders. Considering these factors, FxScouts rates CM Trading 3.48 out of 5.

Is CM Trading Safe?

Yes, CM Trading is safe for South Africans to trade with. It maintains regulation from the South African FSCA and the FSA Seychelles and segregates client money from its operational funds.

Regulation: Established in 2009 in Johannesburg, South Africa, CM Trading maintains regulation from its local authority, the FSCA, but is licenced under the name, Blackstone Marketing SA (PTY) LTD. Its rules are somewhat relaxed compared to those of the regulators in the EU and the UK. For example, while the FSCA ensures that brokers hold client funds in segregated accounts, they do not force brokers to provide negative balance protection or to comply with any leverage restrictions.

Safety Features of CM Trading:

- CM Trading segregates client funds from its operating capital in top-tier South African banks.

- CM Trading is subject to frequent audits of its finances and client operations.

- Unfortunately, South African clients of CM Trading do not have negative balance protection, but stop-out levels are set at 50% making it very unlikely that trading accounts will fall into a negative balance.

We confirmed each of the licences and regulations on the regulator’s online register. See below for details of CM Trading’s FSCA regulated entity:

CM Trading’s Trading Assets

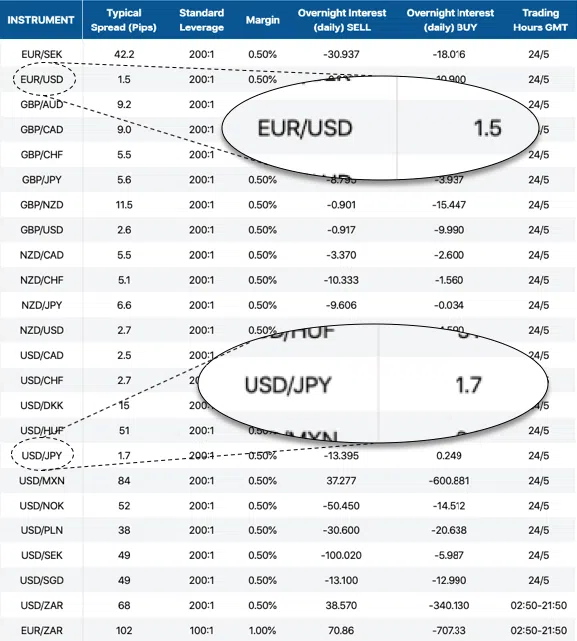

Although CM Trading has a reasonable range of Forex pairs available to trade, it has a limited number of equities and cryptocurrencies. Also, leverage on non-currency assets is low compared to other brokers.

Leverage: CM Trading’s leverage is limited to 50:1 on indices, whereas most other brokers will offer leverage of between 200:1 – 500:1. The same is true for cryptocurrencies, where leverage is only up to 5:1, whereas most other brokers will offer leverage of at least between 10:1 to 20:1.

Full List of Instruments and Leverage:

![]()

![]()

- Forex pairs: CM Trading’s Forex offering is around the industry average and includes majors, minors, and exotics such as the USD/ZAR. While this is a substantial number, other brokers will offer 60+ pairs to trade.

- Metals and Commodities: CM Trading offers silver and gold crosses with the USD as well as some of the most common commodities available, including oil, natural gas, sugar, cotton and wheat. This is an average selection of commodities compared to other brokers.

- Indices: CM Trading offers CFD trading on a small group of international indices, including the S&P 500, FTSE100, DAX30 and the JSE.

- Equities: CM Trading offers a smaller range of stock CFDs compared to other similar brokers, but they include popular US tech companies and multinational energy companies.

- Cryptocurrencies: CM Trading offers a reasonable range of cryptocurrencies to trade, including some that are not found at other brokers such as Chainlink, Dogecoin, and Uniswap.

While some traders will be disappointed that CM Trading restricts leverage on its non-Forex CFDs, the range of assets available to trade is comparable to many other brokers and the number of cryptocurrencies available is more than is normally seen at other similar brokers.

CM Trading’s Accounts and Trading Fees

While CM Trading offers more account types than most brokers, we were disappointed that they have high minimum deposits and high trading costs – making them unsuitable for beginner traders and unpalatable for experienced traders.

Trading costs: It is difficult to find many advantages with CM Trading’s accounts. The entry-level account has both higher initial and ongoing costs than similar accounts at other brokers. CM Trading’s other accounts also request very high minimum deposits and don’t deliver the lower ongoing trading costs that more experienced traders would be looking for.

Account Trading Costs:

![]()

![]()

Spreads are wider than average at CM Trading. The average cost for trading one lot of EUR/USD among similar brokers is about 9 USD per lot. As you can see from the table above, this is only achievable with the Gold and Premium Accounts, which are prohibitively expensive to open for most traders – requiring minimum deposits of 10,000 USD and 100,000 USD respectively.

Bronze Account

CM Trading’s entry-level account, the Bronze Account, requires a minimum deposit of 100 USD and spreads average at 1.50 pips on the EUR/USD. As mentioned, the minimum deposit on this account is higher than other brokers’ entry-level accounts and the ongoing trading costs are higher too.

Silver Account

CM Trading’s most popular account, the Silver Account, requires a minimum deposit of 1000 USD. Spreads start at 1.2 pips, and traders are afforded one risk-free trade and the services of a personal assistant. Spreads on this account are still wider than one would expect for an entry-level account – despite the high minimum deposit.

Gold Account/Gold ECN Account

Traders can open a Gold Account with a very high minimum deposit of 10,000 USD. Spreads are down to 0.9 pips on the EUR/USD – which is about average for entry-level accounts at other brokers. Traders are afforded 3 risk-free trades, the services of a personal assistant, and volume cashback.

The Gold Account is also available as an ECN Account. Spreads start at 0.1 pips for the EUR/USD and a commission of 14 USD (round turn) per lot is charged per lot. While the spread of 0.1 pips is about average for an ECN account, the 14 USD round turn commission is very high when compared to other ECN brokers. Stop-out levels are at 50%, but no Islamic swap-free options are available on this account.

Premium Account/Premium ECN Account

With an incredibly high deposit of 100,000 USD, traders can open a Premium Account. Like the Gold Account, spreads are 0.9 pips on the EUR/USD, but traders have access to a trading specialist, news and analyses, and other special offers.

The Premium account is also available as an ECN Account. The ECN Platinum Account is a market execution account with spreads starting at 0.1 pips on the EUR/USD, and a commission of 10 USD (round turn) per lot traded.

Trading Costs Comparison:

![]()

![]()

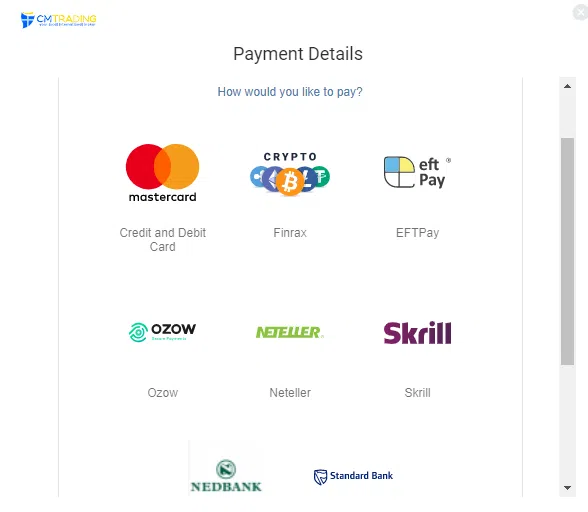

CM Trading Deposits and Withdrawals

CM Trading has a good range of deposit and withdrawal methods, but withdrawal times are slow and fees are high. We were also disappointed that CM Trading is not transparent about its currency conversion fees for transfers based in ZAR.

In line with Anti-Money Laundering policies, CM Trading does not accept payments from third parties and only accepts funds received directly from the named trading account holder.

Base Currencies: The CM Trading client portal allows traders to deposit funds in EUR and USD. Clients that fund accounts in other currencies, such as South African Rand, will be charged a margin at a rate of exchange determined by CM Trading. We were disappointed that this rate is not published, as traders want to know the costs of funding their trading accounts before they register an account.

Funds can be deposited using a wide range of payment methods, including credit cards, debit cards, payment wallets including Neteller and Fasapay, online banking, and bank wire transfer.

Once you have registered an account, you can deposit funds through the trading portal:

We tested deposits via credit card and found that our payment was processed instantly. However, it took 4 days for us to withdraw our money, which is exceptionally slow for the industry.

See below for more details on the various deposit and withdrawal methods:

![]()

![]()

CM Trading may charge for incidental banking-related fees such as wire charges for deposits/withdrawals and returned cheque fees.

Overall, we found that compared to other brokers, CM Trading’s deposit and withdrawal system is poor. Slow withdrawals coupled with non-specific conversion fees and high fees for both deposits and withdrawals will not make many traders happy and are not common in the industry.

CM Trading Mobile Trading Apps

CM Trading offers an average range of mobile trading apps when compared to other brokers

CM Trading App

CM Trading has only recently introduced its mobile trading app. We found that the app was easy to download and set up, but that it has very limited functionality compared to the apps we tested at other brokers. It allows basic trading on the charts, account management, and allows you to deposit and withdraw funds, but not much else. Traders can set take profit and stop loss levels, open and close positions, but there is no research available on the app. See below for a screenshot of the app:

Although the app is user-friendly, it did not sync with our MT4 account. Additionally, it is not customisable and does not have algorithmic trading functionality like MT4.

MT4

CM Trading offers support for the MT4 mobile trading app for Android and iOS. Traders should be aware that there is some loss in functionality when compared to the desktop trading platforms, including reduced time frames and fewer charting options, but traders can close and modify existing orders, calculate profit and loss, and trade on the charts.

Other Trading Platforms

CM Trading offers two trading platforms, CM Trading Webtrader and MT4, about average when compared to other brokers.

CM Trading Web Trader

The CM Trading WebTrader is available in browsers on both Mac and PC and synchronises with the CM Trading app. Although the web browser has slightly more functionality than the mobile version, more experienced traders will find it limiting. It has a trader sentiment display, 6 chart types, 9 timeframes, and multiple indicators, but unfortunately, not much more:

The platform also lacks many of the features available on MT4 such as automated trading and does not cater for third-party tools.

As a note, the CM Trading Web Trader allows traders to copy other traders’ trades on the CopyKat system. For more on CM Trading’s CopyKat copy trading system and other trading tools, click here.

MetaTrader 4

The benefit of CM Trading offering third-party platforms such as MT4 is that traders can take their own customised version of the platform with them should they choose to migrate to another broker. Additionally, there are thousands of plugins and tools available for both the MetaTrader platforms.

Trading Platform Comparison:

![]()

![]()

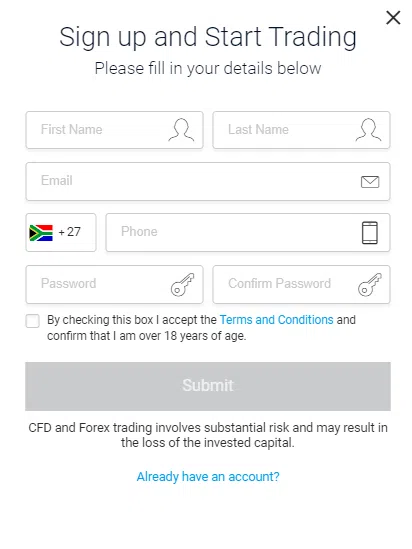

Opening an Account at CM Trading

The account opening process at CM Trading is user-friendly and our account was ready for trading within a matter of minutes. However, we were disappointed that you can only open a demo account once you have registered for a live account.

It took us about 5 minutes to open an account at CM Trading. Once we had registered an account we were immediately able to deposit funds and start trading. We were also pleased that customer service approved our documentation within a few hours.

All South Africans are eligible to open a trading account at CM Trading but will have to meet the minimum deposit requirement of 100 USD. Demo accounts are also available but only after you have registered for a live account. This is unusual amongst brokers and not good for beginner traders who wish to trade risk-free before opening a real account.

How to open an account at CM Trading:

- We clicked on the “Register” tab on CM Trading’s main page.

- CM Trading’s registration page required us to fill in our name, email address, date of birth, country of residence, and phone number and choose either a personal or corporate account. This is more information than is usually required by a broker at this stage – but you will eventually need to provide all these details at any broker as part of the verification process:

- Once our account was registered, we went through the KYC (Know Your Customer) verification process – this is required to prevent money laundering and meet regulatory standards.

- CM Trading requires proof of identity: This can either be a passport or a government-issued identity card or a driver’s license.

- And proof of residence: This can be any utility bill or bank statement that was issued in the last three months and must show your name and full residential address. PO Boxes are not accepted

- Verification documents can be sent to CM Trading via two methods:

- By email to [email protected] with your trading account number as a reference in the subject of the email.

- By logging into your trading account and clicking on “My Account”. Select the type of document and click on “Browse” to upload your file. Files can be sent in JPEG/JPG/PDF/Word format.

Once all documents had been received, our accounts were ready for trading within a matter of minutes.

CM Trading’s Trading Tools

CM Trading offers a limited range of trading tools compared to other brokers, but it does offer copy trading via the CM Trading WebTrader platform.

CopyKat

CM Trading clients who opt to use the CM WebTrader platform will also receive access to CopyKat, CM Trading’s copy trading tool.

CopyKat allows you to observe professional traders’ deals and copy them in real-time but also allows for automated copying. The system is easy to use and supports one-click trading.

Guardian Angel

CM Trading runs a Smart Communication System for its customers called Guardian Angel, which provides support and direct messages concerning market trends and provides automated feedback on how you trade, highlighting market volatility indications and a stop loss calculator.

CM Trading Research and Analysis

CM Trading’s research and analysis is poor compared to other brokers operating in South Africa.

The analysis material at CM Trading is basic compared to most other brokers operating in the South African market. Analysis material includes a functional economic calendar, highlighting the major events of the day.

This is accompanied by a five-minute daily market review every morning before market-open, which highlights potential trading opportunities across the major financial markets for the coming day, and is generally well researched. All the video material is also available on CM Trading’s YouTube channel and is compiled by a team of in-house market analysts.

Market Research Comparison:

![]()

![]()

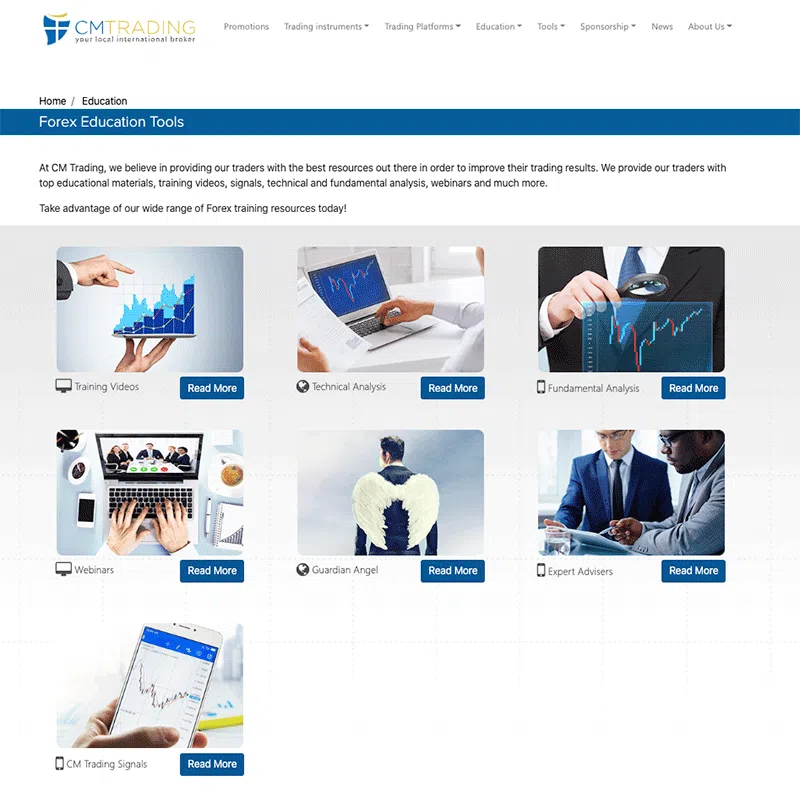

CM Trading’s Educational Content

The educational content available at CM Trading is comparable to that found at other South African brokers, but falls behind when compared to the education available at large international brokers. We were also disappointed that CM Trading’s demo account requires signing up for a real account first.

While most beginners will find the majority of CM Trading’s educational content useful, it does not cover many of the advanced topics that more experienced traders would find helpful. It includes regular webinars on a range of markets and live seminars – though these have been on pause since the beginning of the pandemic.

Training Videos

The backbone of the education section is a generic library of animated training videos, with subjects covering common Forex terms, social trading, the MetaTrader 4 platform, trading strategies, and trading psychology. While most of the training videos are aimed at beginner traders, lessons in technical and fundamental analysis and trading plans support more advanced learning. Other more advanced videos cover EAs to use with the MT4 platform and other methods of automated trading.

The one downside to CM Trading’s video library is that all the videos are only accessible through CM Trading’s own player, which is dated and has very limited functionality. This is frustrating, especially for those of us accustomed to YouTube and other popular players.

Webinars

CM Trading hosts weekly webinars on a range of subjects, recent webinars include the Psychology of Trading and Trading Cryptocurrencies. These webinars are simple to register for and, once more, you do not have to be a CM Trading customer to access them.

Video Chart Analysis

The chart analysis section is accompanied by a brief, yet useful, analytical breakdown of the major currency pairs. The video chart analysis on offer is straightforward and detailed and is helpful to both novice and expert traders.

Ebooks

CM Trading, through a 3rd party, offers a collection of eBooks covering Forex terms, trading psychology, basic and advanced technical analysis, and basic and advanced trading strategies. These are also available to non-customers but unfortunately non-downloadable. Much like with the Training Videos, CM Trading’s player is not a particularly easy way to digest new information, even in written format.

Demo Account

We were disappointed that opening a demo account at CM Trading requires registering for a live account first. But, once signed up, you’ll receive your login credentials the same day. We were provided with a virtual starting balance of 10,000 USD, which can be topped up on request. We could view charts, news, and analysis, get access to the full-featured MT4 and MT5 platforms, and experience real-time prices and real forex market volatility.

Education Comparison:

![]()

![]()

Customer Support

CM Trading’s customer support is about average when compared to other brokers

Customer support is available 24/5 via live chat, WhatsApp, email, via 11 different international phone numbers (in South Africa, Canada, Malaysia, UK, China, France, Brazil, Mexico, Saudi Arabia, Russia, and Bahrain) with full language support for each region. Additionally, CM Trading provides MT4 support to help beginner traders get started and one-on-one training is available to larger depositors.

Safety and Industry Recognition

Regulation: Established in 2012, CM Trading has quickly grown into the largest and most popular local broker in South Africa. It is authorised and regulated by the Financial Sector Conduct Authority (FSCA) South Africa and the Seychelles Financial Services Authority (FSA):

- BLACKSTONE MARKETING PROPRIETARY LIMITED is authorised by the FSCA, registration no. 2009/002519/23 (FSP No. 38782).

- GCMT LTD Trading as CM TRADING, is a Securities Dealer registered in Seychelles with registration number 8425982-1 and authorised by the Financial Services Authority (FSA) with licence number SD070.

South African clients of CM Trading will be trading with GCMT SA, which owns and runs the brand CM Trading, is a representative of Blackstone Marketing Pty Ltd, and has been regulated by the Financial Services Conduct Authority (FSCA) since 2012.

Awards:

CM Trading does not publish any awards it has received.

Overall, although CM Trading lacks oversight from any of the major regulators, it has a good reputation amongst its clients in South Africa and is widely recognised as a trustworthy broker.

Evaluation Process

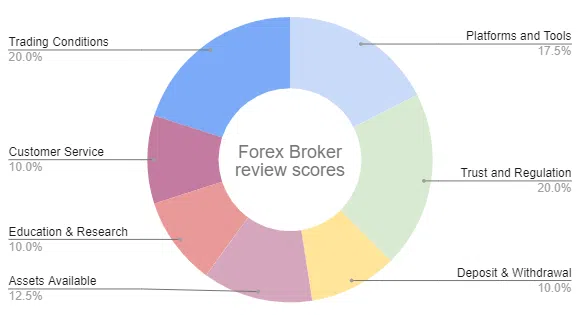

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker, and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded on 200+ metrics across seven areas of interest, and an overall score is calculated and assigned to the broker according to the diagram below:

CM Trading Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. CM Trading would like you to know that: Trading Foreign Exchange (Forex) and Contracts for Differences (CFD’s) is highly speculative, carries a high level of risk and may not be suitable for all investors. You may sustain a loss of some or all of your invested capital, therefore, you should not speculate with capital that you cannot afford to lose. You should be aware of all the risks associated with trading on margin.

Overview

CM Trading is one of the largest online Forex and CFD brokers in South Africa. Equipping clients with a free MT4 platform download and the CM WebTrader system in addition to an interesting range of trading tools, trading is offered on four live commission-free accounts, two that have ECN account options. Minimum deposit requirements are high compared to other brokers and spreads are wide, starting at 1.5 pips for the EUR/USD on its entry-level account. A significant drawback is the lack of educational and market analysis material, making it a poor choice for beginner traders.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how CM Trading stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.