For over a decade, FxScouts.co.za has been reviewing forex brokers and provided in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and South African markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Best Crypto Brokers 2024

Broker | Broker Score | Official Site | Min. Deposit | Crypto Pairs | Fx Pairs | FSCA Regulated | Regulators | Platforms | Compare |

|---|---|---|---|---|---|---|---|---|---|

| 4.40 /5 Read Review | Visit Broker > 79% of retail CFD accounts lose money | AUD 100 | 11 | 70 | Yes |      | MT4, MT5, cTrader, IRESS | |

| 4.59 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | ZAR 1900 | 30 | 63 | Yes |        | MT4, MT5, Avatrade Social, AvaOptions | |

| 4.45 /5 Read Review | Visit Broker > 75.33% of retail CFD accounts lose money | USD 5 | 60 | 57 | Yes |      | MT4, MT5 | |

| 4.33 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | USD 5 | 100 | 37 | Yes |     | MT4, MT5 | |

| 4.56 /5 Read Review | Visit Broker > 70.81% of retail CFD accounts lose money | USD 200 | 18 | 64 | No |     | MT4, MT5, cTrader, TradingView | |

4.28 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | ZAR 500 | 42 | 82 | Yes |       | MT4, MT5 | ||

| 4.32 /5 Read Review | Visit Broker > 71.67% of retail CFD accounts lose money | USD 3 | 34 | 100 | Yes |      | MT4, MT5, Exness Terminal | |

4.33 /5 Read Review | Visit Broker > 89% of retail CFD accounts lose money | USD 0 | 14 | 85 | No |    | MT4, MT5, cTrader | ||

4.53 /5 Read Review | Visit Broker > N/A of retail CFD accounts lose money | AUD 100 | 100 | 55 | No |     | MT4, MT5, TradingView | ||

| 4.53 /5 Read Review | Visit Broker > 72.90% of retail CFD accounts lose money | ZAR 0 | 40 | 53 | Yes |       | MT4, MT5, HFM Trading App |

How we Reviewed the Best Crypto Brokers for 2024

At FxScouts, we have an experienced review team dedicated to evaluating Forex brokers, including their crypto offerings. Our team of experts meticulously examines each broker, analysing over 200 individual metrics, enabling us to confidently recommend only the top crypto brokers in the Forex industry.

We’ve selected the top crypto brokers in the industry based on several factors:

- Regulation: Regulation, especially with cryptocurrency trading, is very important. Reputable regulators include ASIC of Australia, MAS of Singapore and CySEC of Cyprus, among others. However, the Financial Conduct Authority (FCA) has barred all UK-based brokers from offering cryptocurrency CFD trading, because it is such a high-risk financial asset. Many unregulated offshore brokers also specialise in cryptocurrency trading, so always verify your broker’s regulation before making a deposit.

- Demo Accounts: This free account type should always be a starting point for any trader starting to trade crypto. Cryptocurrency is extremely volatile, and price patterns are much harder to predict, as limited fundamental data is available, and all trading is done by examining charts.

- Leverage: Leverage is typically much lower for cryptos than for other assets, around 5:1. While using too much leverage in highly volatile markets like crypto can wipe out a trading account, traders will still want to access some leverage. Check that the leverage amounts match your risk appetite.

- The Number of Crypto Pairs: Some cryptocurrency traders will be happy with fewer pairs, such as Bitcoin, Ethereum and Litecoin against the USD. However, some brokers offer a wider range of crypto CFDs, introducing more variety to your trading. Trading the same few crypto pairs will limit your trading opportunities, and you will need to find other asset classes, like Forex or commodities, to trade in parallel.

- Trading Fees: Brokers may introduce a fee for trading cryptocurrency in addition to the spread. Spreads on cryptocurrency can be a lot wider than on fiat currency pairs, which means that large changes in prices will need to happen for a trader to profit. Overall trading costs can vary widely, from US$5 to US$15 per transaction.

- Trading Platform: Our selected brokers offer user-friendly, reliable platforms like MT4, MT5, cTrader, or their own web-based platforms.

- Customer Service: A broker’s customer service should be responsive and available via various channels. Some brokers offer 24/7 customer service, which is a huge help for crypto traders who trade over the weekend.

- Educational Resources: Brokers offering educational resources can help beginners grasp crypto trading effectively.

FP Markets – 24/7 support, 12 cryptos, 5:1 leverage

Founded in 2005 in Australia, FP Markets is a well-regulated broker with 12 cryptocurrency pairs to trade, including Bitcoin, Ethereum, Ripple, Solana, and Bitcoin Cash, all crossed with the USD. Leverage is up to 5:1 for crypto trading, which is reasonable considering how volatile these assets are. FP Markets’ customer support is available 24/7 to help clients with any crypto trading queries.

Crypto trading costs: FP Markets’ trading costs are low compared to other brokers, with a spread of 13.48 USD per BTC, and 4.45 USD per ETH.

FP MARKETS FEATURES

- FP Markets offers two account types – the commission-free Standard Account and the commission-based Raw Account, both with a minimum deposit of 100 AUD (or equivalent), but traders can only trade crypto on the Standard Account.

- Traders can choose between all FP Markets’ available platforms for crypto trading, including MT4, MT5, cTrader and TradingView platforms, and the FP Markets’ in-house app, which is easy to use and has an intuitive layout.

- FP Markets stands out for its low latency, lightning-fast trade execution, providing the ideal conditions for scalping and those using Expert Advisors (EAs).

Avatrade – User-friendly app, 20+ cryptos, low ETH trading costs

Regulated by multiple authorities, including the South African FSCA, Avatrade has 20 cryptocurrencies to trade. Unlike other brokers who only offer crypto/fiat pairs (i.e. BTC/USD), Avatrade also offers crypto-to-crypto trading on the most popular coins, including Bitcoin, Bitcoin Cash, Ethereum and Litecoin.

Crypto trading costs: Avatrade’s trading costs on cryptos are around the average charged by similar brokers, with a spread of 38 USD per BTC, but down to 3.65 USD per ETH traded, which is much lower than other brokers.

AVATRADE FEATURES

- One of the highlights at Avatrade is its innovative mobile app – AvaTradeGO. Reliable, award-winning, and user-friendly, AvatradeGO allows traders to trade crypto, view their trades at a glance, view live prices and charts, and efficiently manage their positions.

- Avatrade offers plenty of trading insights and up-to-date analysis on all instruments, including cryptos, through Trading Central, which integrates seamlessly with its platforms.

- Beginner traders will find a wealth of educational materials, including courses and videos focused specifically on how to trade cryptos.

XM – 58 Cryptos, High Leverage, Excellent Education

Founded in 2009, XM is regulated by some of the world’s top authorities and has a good reputation among traders worldwide. It offers trading on an impressive line-up of 58 cryptocurrencies, including popular coins such as Bitcoin, Ethereum, Tether, and Ripple, and more exotic ones such as 1INCH. XM offers leverage of up to 500:1 on cryptos, which is almost unheard of. Cryptos are notoriously volatile, so traders should take extreme caution if they trade with leverage this high.

Crypto trading costs: XM’s crypto trading costs are average for the industry on BTC/USD, with a spread that starts at 35.5 USD, but lower than average on ETH/USD, with a spread of only 2.75 USD.

XM FEATURES

- XM has a strict no-requotes and no-rejections policy, ensuring that 99.53% of all trades are executed in under a second across both the MT4 and MT5 platforms.

- XM offers 24/7 customer support, which is a huge bonus for crypto traders who may want to trade over the weekend.

- XM offers excellent trading education. This encompasses daily Q&A sessions, live education from Monday to Friday between 05:00 and 15:00 GMT, in-depth platform tutorials, educational videos, and webinars delivered by 67 industry experts in 19 languages on all trading topics, including cryptocurrencies.

FBS – FSCA-Regulated, Low ETH spreads

FBS is an FSCA-regulated broker with a large global client base, low costs and three trading accounts. It used to offer a dedicated crypto account, but this is now only available to traders in the EU. South African traders are limited to BTC, BCH, ETH, LTC and XRP, all crossed with the USD, though spreads are relatively tight. Traders can make withdrawals and deposits in cryptocurrency, and leverage on crypto pairs is fixed at 5:1.

Crypto trading costs: FBS has average trading costs on the BTC/USD, with a typical spread of 20 USD, though spreads are floating and sometimes get as low as 8 USD. Costs are much lower on the ETH/USD, with average spreads of 2 USD.

FBS FEATURES:

- Three trading accounts: Cent, Standard and Pro for traders of all experience levels

- Minimum deposit of only 5 USD, Forex spreads starting at 0.6 pips on the EUR/USD with no commission. MT4 and MT5 both available

- FBS Trader: Award-winning mobile app, featuring 24/7 customer support, technical charting tools, 100+ withdrawal and deposit methods.

IC Markets – Best Crypto CFD Broker for Beginners

A beginner-friendly ASIC-regulated CFD broker, IC Markets offers trading on a wide range of instruments, including Forex, commodities, indices, bonds, and 18 cryptocurrency pairs. Cryptocurrency trading is offered 24/7 at IC Markets, alongside 24/7 customer support, which is great for weekend traders and beginners who are trying to find their footing. Leverage is up to 5:1, and all fees are included in the variable spreads.

Crypto trading costs: Unfortunately, IC Markets’ trading costs on cryptocurrencies are higher than average, with average spreads of 42 USD on the BTC/USD and 11.6 USD on the ETH/USD.

IC MARKETS FEATURES

- Wide range of trading platforms, including MT4, MT5, and cTrader, plus copy trading platforms such as Zulutrade, and Myfxbook Autotrade.

- Great education, including video tutorials, articles, frequent webinars, and IC Markets’ WebTV.

- Extensive market analysis materials, including fundamental analysis, technical analysis, and an up-to-date market news section.

Admirals – 42 Crypto Pairs, 100:1 Leverage

Admirals, also known as Admiral Markets, is an Australian broker offering trading on 32 cryptocurrencies. Cryptocurrency trading is offered on both the MT4 and MT5 trading platforms, but for the full range of 42 crypto pairs, traders must use the MT5 platform. Cryptocurrency assets include 32 crypto coins crossed with the USD or EUR and ten crypto cross pairs. The minimum deposit on the trading accounts is 500 ZAR or 25 EUR, leverage on crypto is up to 100:1, and trading is open 24/7 on pairs with EUR and digital crosses. No commissions are charged.

Crypto trading costs: At Admirals, trading costs on BTC/USD are very high, with the spread averaging 86 USD. Things are more reasonable on ETH/USD, with spreads averaging 4.7 USD.

ADMIRALS FEATURES:

- The Global Opinion toolset scans and contextualises millions of financial news stories and social media posts, providing traders with a dynamic view of market sentiment.

- Premium Analytics portal with market news, technical analysis, economic calendar and global sentiment indicators aggregated from over a thousand sources of financial media.

- Market execution and negative balance protection as standard on all trading accounts

Exness – High Leverage Crypto Trading

Founded in 2008, Exness is one of the largest brokers in the world and offers both market and instant execution accounts on the MT4 and MT5 platforms. Trading conditions at Exness are some of the best in the industry and include a low-cost Cent Account to help beginner traders get their footing. Exness offers a good range of crypto pairs, mostly Bitcoin, including BTC/ZAR and BTC/XAU. Also available are Ethereum, Litecoin, Ripple, and other speciality cryptocurrencies. The maximum leverage is 1:400, which is much higher than other brokers. Traders should know that trading with leverage this high on volatile assets like cryptocurrencies is risky.

Crypto trading costs: Exness’ trading costs are high for cryptocurrencies. Spreads average 64.6 USD on BTC/USD and 8.4 USD on ETH/USD.

EXNESS FEATURES

- Trade BTC/ZAR, being able to trade crypto crossed with the rand is unusual and may appeal to South African traders.

- Zero-spread crypto trading on the Pro Account. Instead, a small commission of 5.75 USD is charged.

- Social Trading app: Use Exness’ dedicated social trading mobile app to copy the trades of experienced traders

Fusion Markets – No minimum deposit, Low crypto trading costs

A well-regulated Australian broker, Fusion Markets offers 20 cryptocurrency pairs for trading, including Bitcoin, Litecoin, Ripple, and Ethereum. Maximum leverage for crypto pairs is 10:1, which is lower than some other brokers on this list but reasonable considering crypto volatility. Fusion Markets fully supports MT4, MT5, and cTrader, three of the world’s most popular trading platforms. Trading accounts have no minimum deposit requirements, and Fusion Markets is famous for having some of the lowest trading costs in the world for Forex trading.

Crypto trading costs: Fusion Markets’ trading costs are relatively low for crypto trading; the spread on the BTC/USD starts at 17 USD but averages 28 USD. ETH/USD trading costs are very low, starting at 2.7 USD and averaging 3 USD.

FUSION MARKETS FEATURES

- 24/7 customer service, great for weekend crypto traders

- Excellent market analysis for new trading ideas and free VPS hosting for clients that trade over 20 lots a month

- Three copy trading platforms: Fusion+ Copytrading, Myfxbook Autotrade and Duplitrade, are available for beginners who wish to copy the trades of more experienced traders

Eightcap – 100+ Crypto Pairs and Low Fees

A well-regulated Australian broker, Eightcap offers low-cost trading on a broad range of cryptocurrency pairs on the MT4, MT5 and TradingView trading platforms. With over 100 cryptocurrencies, Eightcap has one of the industry’s largest sets of crypto pairs, including crypto-crosses and indices. The maximum leverage on crypto pairs is 20:1, and the minimum deposit on all accounts is 100 USD.

Crypto trading costs: Eightcap has relatively low crypto trading costs, with minimum spreads on the BTC/USD at 12 USD and ETH/USD at 2 USD. Be aware that spreads are variable and can be much wider at times of high volatility.

EIGHTCAP FEATURES

- Crypto Crusher dashboard: A dedicated crypto trading dashboard, providing trading ideas and technical analysis on all cryptos available at Eightcap.

- TradingView trading platform: Trade directly on to the most sophisticated charting platform in the world

- Capitalise.ai: Automate your trading without the code, Capitalise.ai uses common English to create powerful trading bots.

HFM – 40+ cryptos, low trading costs, 1:50 leverage

A well-known and trustworthy broker with local regulation from the South African FSCA, HFM offers 40+ cryptocurrencies for trading, including Bitcoin, Ethereum, Ripple, Litecoin, and Dogecoin. Cryptos are crossed with the USD, EUR, and JPY, and traders can access leverage of up to 50:1 on some pairs.

Crypto trading costs: Spreads on cryptos are lower than other brokers, starting at 12 USD per unit of BTC and 4.1 USD per unit of ETH.

HFM FEATURES

- HFM offers MT4 and MT5 for both desktop and mobile, and its in-house app, which is highly customisable and has a sleek design and intuitive interface.

- HFM offers five account types, which is more than most other brokers, including a Cent Account with no minimum deposit requirement.

- Both the BTC/USD and the BTC/EUR are available on HFM’s dedicated copy trading account, HFCopy. This is good for traders who are new to the cryptocurrency market, which is notoriously volatile. Copying more experienced crypto-traders allows beginners to understand the risks of trading these markets while making a profit.

- HFM has an excellent library of educational and market analysis materials, available in written and video formats that are regularly updated.

History of Cryptocurrency

The concept of cryptocurrency emerged in the 1980s. The idea was to be able to transact in a currency or form of exchange that didn’t require centralisation and couldn’t be traced. An American cryptographer, David Chaum, created the first electronic form of payment, called DigiCash, which required software and encrypted keys to send and withdraw money.

Bit Gold was the next development, designed in 1998 by Nick Szabo. It required people to solve a puzzle to get the reward.

In the same year, Satoshi Nakamoto famously published a paper describing blockchain networks and their technology, which gave rise to Bitcoin. However, it was first mined in 2009 but had no value for the first few months after its inception. In April 2010, its value reached 14 cents, then surged to 36 cents in November 2010. Between February 2011 and April 2011, it traded at 1 USD, and by November 2013, it was trading at between 350 USD and 1200 USD.

Other forms of crypto were then created using blockchain technology, and we saw the rise of Ethereum, Dogecoin, Tether, XRP, Solana, PolkaDot, and many others, with new ones emerging regularly.

An introduction to cryptocurrencies

Cryptos such as Bitcoin and Ethereum have become popular with traders due to their volatility, which has delivered huge profits to some traders and investors.

The main choice facing traders who wish to enter the crypto sector is whether to use a broker or an exchange. The latter is a place where buyers and sellers meet to exchange cryptos for either fiat currencies* (such as the dollar) or for other cryptos, and where prices are based on market valuations. The exchange of fiat currencies and/or cryptocurrencies takes place directly between buyers and sellers, with the exchange operator providing the platform. This type of trading is most suitable for more advanced traders.

A broker, by contrast, acts as an intermediary but can also act as the other side of the trade, i.e. the counterparty. This type of trading is more suitable for beginners. Rather than selling cryptos directly to traders, brokers focus on allowing traders to speculate on cryptos using financial tools such as CFDs – a route into the crypto world that offers significant advantages. However, you should be aware that, with the rising interest in cryptocurrency trading, unregulated brokers have sprung up to take advantage of unprepared newcomers. We recommend that you always trade with a well-regulated broker.

The following subsections examine the main advantages of trading crypto CFDs:

- More suitable for beginners

CFD crypto brokers often provide a wide range of educational materials that help you learn all about cryptos and the various ways you can trade them, as well as successful strategies and how to implement them.

A broker will also allow you to open a demo account where you can trade with virtual money rather than your hard-earned savings. You can practise on these demo accounts until you feel that you understand the market, know how to trade successfully and feel comfortable enough to risk your own money.

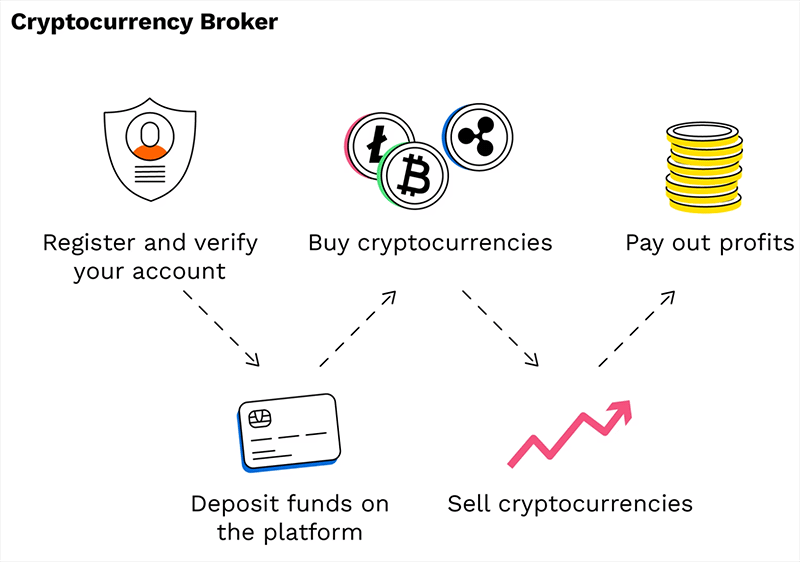

Figure 1: How to trade cryptos with a broker (Source: Bitpanda.com)

2. You can trade with leverage

When you trade cryptos using CFDs, you can exploit the concept of leverage to maximise your exposure and potential profits. That is because you only need to put down a relatively small amount of money (known as the margin) to make a trade, and the broker lends you the rest.

For example, if a broker offers a CFD leverage ratio of 2:1, you put down a margin of 50 per cent on each trade. If the price moves by 5 per cent, the CFD trader will actually make a profit of 10 per cent on that margin (or alternatively a loss of 10 per cent if the trade goes the wrong way). This means that CFD traders can earn a large amount of money quickly, but can lose money equally rapidly.

3. You can trade both ways

Trading cryptos using CFDs allows you to speculate on whether the price of a crypto will rise or fall. If you go “long”, you use a CFD to buy the crypto and will profit if its price goes higher. When you go “short”, you are effectively selling the crypto at one price in the belief that it will go lower. You can then buy it back and pocket the difference between the sell price and the buy price.

Imagine, for example, you open a position to short-sell Bitcoin (BTC) via CFDs. If Bitcoin is trading at US$40,000 and you are offered leverage of 2:1, you could open a position to sell 1 BTC with a deposit or margin of US$20,000. If the market falls, as you anticipated, to US$35,000, you could then close your position by buying 1 BTC. To calculate your profit, you would just have to take the difference between the opening and closing prices: in this case, US$40,000 minus US$35,000 = US$5000.

While some exchanges offer short-selling facilities, this involves borrowing the actual asset from the exchange or a third party and selling it on the market. If the market price did fall, you would then be able to buy the Bitcoin back at a lower price, return it to the owner, and profit from the change in price. You wouldn’t be offered margin, however.

4. You can hedge your positions

You can also use CFDs to protect your crypto positions. This involves opening trades so that a gain or loss in one position is offset by changes in the value of the other position. Using CFDs to hedge allows you to insure positions without owning the underlying crypto. This allows you to speculate on the price of the crypto without ever having to worry about opening an exchange account or creating a digital wallet.

Imagine you own 2 BTC, and, although you believe the asset’s price will rise in the long run, you are concerned about short-term volatility. Instead of selling BTC, you could open a CFD trade to short BTC. Once any negative price movement is over, you could close your direct hedge, and any profits you make would help offset any losses to your cryptocurrency holding. Alternatively, if the price of BTC rose, the profits from your holdings would offset any loss incurred by your BTC CFD.

4. They are more secure than trading cryptos directly on an exchange.

Trading cryptocurrency can be a risky business, and not just because of the volatility risk. If you trade cryptos directly, rather than through CFDs, you need to know they are stored safely. While broker’s accounts have insurance and other protections in place to keep your money safe, the same is not always true of digital currency exchanges. But, if you trade cryptos via CFDs, you need not be concerned about security since you never own the underlying asset.

5. They are very flexible.

An exchange allows you to buy and sell, for example, Bitcoin for dollars or to exchange it for another crypto, such as Ethereum. Different exchanges offer different trading pairs, so the one you choose is a matter of personal preference. But if, for example, you open an account in dollars, you can only trade related pairs, such as the US dollar against Bitcoin (USD/BTC) or the US dollar against Ethereum (USD/ETH). By contrast, if you use a broker, you deposit money into your account and can then use various trading pairs, not limited to the currency of deposit.

Trading cryptos via CFDs allows you to close a position anytime during the trading day. That means you can hold a position for as long as you want, be it seconds, minutes or hours – an important consideration given the severe price volatility cryptos can experience. Additionally, cryptocurrency trading is available 24/7, unlike Forex trading, which is only available during weekdays. You can even hold a position overnight, although there will be a charge for doing so. Moreover, many brokers offer a variety of options when it comes to trade size, allowing a wide range of traders to access the market. This includes beginners and casual traders seeking to experiment with investment strategies while limiting their risk by focusing on small trades.

6. They have huge profit potential

The crypto market is relatively new but has experienced significant volatility due to huge amounts of short-term speculative interest, making it highly attractive to traders. The higher the volatility, the greater the potential profits, while rapid intraday price movements can provide a range of opportunities for traders to go long and short. But remember, it is important to have a risk strategy in place. Fortunately, you can implement a variety of such strategies when using CFDs.

Figure 2: The volatile world of Bitcoin (US$), 2014 to end 2021 (Source: Crypto.com)

The disadvantages of trading cryptos

- They are extremely volatile

Just as the wild ride offered by cryptos offers traders huge potential for making profits, the flip side is equally true. Fortunately, trading cryptos via CFDs means taking out some form of insurance by hedging your positions, such as selling short and long, and instituting stop-loss orders.

2. Leveraging cryptos is extremely risky

While leverage magnifies the profit potential of trading cryptos, the reverse is also true: it significantly increases the risk that you could lose a lot of money. Indeed, the losses could exceed your initial deposit for an individual trade, which is why it is vital you consider the total value of the leveraged position before trading CFDs.

3. It is easy to take on too much risk

Because the cost of trading CFDs is low, due to leverage, it is easy for investors to be lulled into a false sense of security and take on more trades than is prudent. This can leave them overexposed to the markets at any given time, such that their remaining capital would be insufficient to cover losses across the portfolio. If multiple positions go wrong, it can spell financial ruin for those who adopt a less-than-cautious approach to CFD trading.

4. You do not own the cryptocurrency

This is another characteristic of CFDs that brings benefits but also disadvantages. Because you don’t own the underlying asset, you can’t gain from the benefits of ownership, such as the income provided at set periods by shares or bonds. Even if you factor in forthcoming dividend declarations when buying CFDs in shares, for example, you will only benefit at a fractional rate compared with the payout involved in actual share ownership.

5. It has limited advantages over time

Because of the above point and others, you should only view CFDs as a short-term trading strategy, rather than a long-term investment option. Overnight financing charges alone can render the cost of long-term ownership of long positions prohibitive.

6. There can be a counterparty risk when trading crypto CFDs

This relates to the risk that the counterparty to the trade, the broker in the case of CFDs, could default on the deal. Such risk is minimised by choosing a reputable broker in a well-regulated legal environment, but it still cannot be overlooked.

Cryptocurrency assets: how to trade cryptos

Just as when you trade any other currency, you trade cryptos in pairs, either against fiat currencies such as the US dollar or against another crypto. For example, you could trade Bitcoin against the euro (BTC/EUR) or against Ethereum (BTC/ETH).

The US dollar is by far the most traded fiat currency globally, and BTC/USD (where BTC is the base currency) is the most popular crypto-to-fiat pair. When, for example, the price of the BTC/USD pair is 40,000, it takes US$40,000 to buy one Bitcoin. According to the broker AvaTrade, this pair serves as the de facto gold standard for the cryptocurrency market, providing the price direction cue for virtually the entire crypto market.

The advantage of trading cryptos against major currencies like the dollar or the euro is that these are relatively liquid markets, so it is fairly easy to find a buyer and a seller for your trade. This in turn means that such markets are less volatile than other pairings (such as crypto-to-crypto pairs) and the spreads tend to be narrower.

FAQs

Is Trading Crypto Profitable?

Like all trading, if you’re on the right side of the market, you can make a profit. However, if you’re on the wrong side of the market with cryptocurrencies, you can lose a lot of money in a short period.

The cryptocurrency market is very volatile, and it’s not uncommon to see 20%, 30% and even 50% swings every single day. If you are day trading, this can translate to good profits if you can capitalise on the short-term fluctuations.

Is Crypto Trading Safe?

Trading cryptocurrency is a very high-risk market. In part, this is because the market doesn’t have a long history, so we can’t refer to previous market behaviour, but also because it does not have the same oversight and controls as fiat currencies. This lack of control makes the market an unpredictable asset to trade.

Cryptocurrency CFD trading is also only as safe as your broker. The same rules apply when looking for a broker to trade crypto CFDs, as they do for fiat currencies. Finding a well-regulated broker, with an acceptable account choice, trading conditions and reputation is key to your trading safety.

When Can I Trade Cryptocurrency?

Because there is no actual cryptocurrency exchange, and all trades use a broker as a counterparty, cryptocurrencies can be traded 24/7. Crypto CFDs are the only assets that trade around the clock, seven days a week, 365 days a year, which is very rare in the financial world.

In contrast, the stock markets operate 8 hours a day; 5 days per week while the Forex market pauses trading over the weekend.

The main advantage of a 24/7 market is that you can buy and sell cryptocurrencies any time of the day, making them accessible to all traders.

Are Profits From Crypto Trading Taxable?

Like any other regular income, cryptocurrency trading is taxable. However, the cryptocurrency market remains a relatively new market, and because of that, there is also a lot of ambiguity in the laws.

If you’re transacting any cryptocurrency, you need to be aware of the tax consequences — no matter where you live. If you have significant money invested in cryptocurrencies, you should always seek guidance from a financial adviser when it comes to legal issues and taxes.

Cryptocurrency vocabulary

There is a wide range of new terms you should be aware of before you try trading cryptos. The main ones are listed below.

Altcoin

This refers to any type of crypto that is not Bitcoin. Altcoins share similarities with Bitcoin but can also vary in key respects, such as using a different mechanism to validate transactions.

Bitcoin

Bitcoin was the first crypto. It came into existence in January 2009, when an unknown author using the pseudonym Satoshi Nakamoto mined the genesis block.

The total value of the crypto market is now estimated at around US$2 trillion. Interest among small traders and investors took off in 2017, after the price of Bitcoin reached US$20,000 per coin.

Bitcoin Cash

Bitcoin Cash is a peer-to-peer crypto created in August 2017 as a “fork” (see below) of Bitcoin. While Bitcoin is believed to be too volatile to be useful as a currency, Bitcoin Cash is designed for transactions.

Block

Blocks are where the data related to the Bitcoin network are permanently recorded. Blocks contain the records of valid transactions that have taken place on the network, so a block is effectively like a page of a ledger or record book.

Blockchain

The blockchain is a digital form of record-keeping and the underlying technology behind cryptocurrencies. It is a system of recording information in a way that makes it difficult or impossible to change, hack or cheat the system. The blockchain is composed of sequential blocks that build upon one another, creating a permanent and unchangeable ledger of transactions.

Coin

A coin is a crypto or digital currency that is independent of any other blockchain or platform. As a single unit of currency, a coin can be traded for an agreed-upon value, depending on current market conditions. Some blockchains, like Bitcoin, have the same name for both the network and the coin.

Coinbase

Coinbase is an exchange that offers a secure online platform for buying, selling, transferring and storing digital currency. In April 2021, it became the first crypto exchange to go public on the NASDAQ.

Cold wallet/hardware wallet/cold storage

A cold wallet, also known as a hardware wallet or cold storage, is a physical device that offers a secure method of storing your crypto offline. Many look like USB drives.

Cryptocurrency

Cryptocurrency is decentralised digital money based on blockchain technology. The most well-known cryptos are Bitcoin and Ethereum, but there are more than 5000 different cryptocurrencies in circulation. Cryptos can be used to buy and sell things, as a long-term store of value, or for speculative purposes.

Decentralisation

In blockchain technology, decentralisation refers to the transfer of control and decision-making from a central authority to a distributed network, so reducing the level of trust that participants must place in one another. It also undermines the ability of one entity to exert authority or control over others. Blockchains require majority approval from all users to operate and make changes.

Decentralised finance (DeFi)

DeFi aims to provide financial services without intermediaries, such as banks or governments, using automated protocols on blockchains and stablecoins (see below) to facilitate fund transfers.

Decentralised applications (Dapps)

A decentralised application is an application built on a decentralised network that combines a smart contract, a programme that runs on blockchain, and a front-end user interface. The vast majority of dapp development is on the Ethereum blockchain. Dapps allow users to carry out transactions with each other without intermediaries.

Digital gold

This term can have two meanings. One is a form of digital money based on units of gold. However, cryptos are often referred to as digital gold because they share some of the characteristics of physical gold, having a limited supply and acting as a haven in times of trouble and a store of value and protection against inflation.

Ethereum

The second-largest cryptocurrency by trade volume, Ethereum is a decentralised, blockchain-based platform that facilitates the use of smart contracts and the creation of decentralised apps or “dapps”. It also has a native cryptocurrency called Ether (or “ETH”).

Exchange

An exchange is a digital marketplace where you can buy and sell cryptos.

Fork

A fork occurs when a blockchain’s users make changes to the rules (known as protocols) of the blockchain. This often results in the creation of two paths: one follows the old rules, while the other is a new blockchain that splits off from the previous one.

Gas

The term “gas” refers to the fee that must be paid to successfully conduct a transaction or execute a contract on the Ethereum blockchain platform.

Genesis block

The genesis block is the first block of a cryptocurrency ever produced.

HODL

This term is often interpreted as meaning “Hold On for Dear Life”. It originated from a user typo in an online Bitcoin forum in 2013 and refers to a buy-and-hold investment strategy executed in the belief that the cryptocurrency will increase in value over the long term.

Halving

Halving is a method of controlling the supply of Bitcoin (in contrast with traditional currencies like the US dollar, which are essentially unlimited in supply and lose value when governments print too much of them). Halving involves cutting in half the number of new units entering circulation. Bitcoin last halved on 11 May 2020, and the next halving is expected in 2024.

Hash

A hash is a function that generates a fixed-length character string from data records of any length. A data record can be a word, a sentence, a longer text or an entire file. A hash is used for security purposes and constitutes the backbone of crypto security.

Hot wallet

A hot wallet is a form of cryptocurrency storage that is connected to the internet and can be accessed through your computer or phone. Because they are online, hot wallets are more susceptible to hacking and cybersecurity attacks than offline wallets (also known as cold wallets – see above).

Initial coin offering (ICO)

An initial coin offering is a method of raising funds for a new cryptocurrency project. ICOs are similar to initial public offerings (IPOs) of stocks.

Market capitalisation

The market capitalisation of a cryptocurrency is the total value of all the coins that have been mined. It is calculated by multiplying the current number of coins by the current value of each coin.

Mining

Mining is the process whereby new cryptocurrency coins are created and the log of transactions between users is maintained.

Node

A node is a computer that connects to a blockchain network.

Non-fungible tokens (NFTs)

“Non-fungible” refers to something that is unique and cannot be replaced by something else. NFTs have unique identification codes and metadata that distinguish them from each other, and, unlike cryptos, they cannot be traded or exchanged at equivalency.

NFTs are most often held on the Ethereum blockchain. They can be used to represent real-world items such as artwork and real estate. NFTs are created through a process known as minting and, once minted, they cannot be deleted or edited. The value of NFTs is subjective and this is why they are usually issued through auctions on digital marketplaces.

Peer-to-peer

The term “peer-to-peer” refers to two users interacting directly without a third party or intermediary. A peer-to-peer platform is a decentralised platform that allows individuals to interact directly with each other.

Public key

A public key is a unique cryptographic code used to facilitate transactions between parties, allowing users to receive cryptocurrencies in their accounts. It is effectively a wallet address, and similar to a bank account number. It can be disclosed to other users so that they can send you money.

Private key

A private key is an extremely large encrypted code that allows direct access to your cryptocurrency. Like a bank account password, it should never be shared.

Smart contract

A smart contract is a program stored on a blockchain that runs when predetermined conditions are met. Smart contracts are typically used to automate the execution of an agreement, so that all participants can be immediately certain of the outcome without the involvement of any intermediary or loss of time. They can also automate a workflow, triggering the next action when the defined conditions have been met.

Stablecoin/digital fiat

A stablecoin is a digital currency that is pegged to a “stable” reserve asset like the US dollar or gold. Stablecoins are designed to reduce volatility relative to unpegged cryptocurrencies such as Bitcoin. They are also known as digital fiat.

Token

The word “token” has several meanings. It can be used as another word for a crypto, or to describe all cryptos other than Bitcoin and Ethereum, or as a name for certain digital assets that run on top of a crypto blockchain. Tokens have a huge range of potential functions, from helping make decentralised exchanges possible to selling rare items in video games. But they can all be traded or held like any other cryptocurrency.

Vitalik Buterin

Vitalik Buterin is the programmer who created Ethereum in 2015.

Wallet

A wallet is a place to store your cryptocurrency holdings. Many exchanges offer digital wallets. Wallets can either be hot (online, software-based) or cold (offline, usually on a device).

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the UK’s regulator, the FCA, or the Australian regulator, ASIC).

Our Rating & Review Methodology

Our Broker Awards and Forex Rankings Report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.