For over a decade, FxScouts.co.za has been reviewing forex brokers and provided in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and South African markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Best Copy Trading Forex Brokers 2024

Broker | Broker Score | Official Site | Copy Trading | Min. Deposit | Max. Leverage (Forex) | Autochartist | Trading Central | Trading View | Total CFDs | Share CFDs | Commodity CFDs | Index CFDs | Currency Pairs | Regulators | Platforms | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.40 /5 Read Review | Visit Broker > 79% of retail CFD accounts lose money | Yes | AUD 100 | 500:1 | Yes | No | Yes | 10162 | 10000 | 11 | 17 | 70 |      | MT4, MT5, cTrader, IRESS | |

| 4.59 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | Yes | ZAR 1900 | 400:1 | No | Yes | No | 930 | 636 | 25 | 36 | 63 |        | MT4, MT5, Avatrade Social, AvaOptions | |

| 4.37 /5 Read Review | Visit Broker > 81% of retail CFD accounts lose money | Yes | USD 10 | 2000:1 | No | No | No | 1803 | 900 | 3 | 23 | 62 |     | MT4, MT5 | |

| 4.61 /5 Read Review | Visit Broker > 89%74- of retail CFD accounts lose money | Yes | USD 0 | 400:1 | Yes | No | Yes | 1275 | 1000 | 17 | 28 | 100 |      | MT4, MT5, cTrader, TradingView | |

| 4.32 /5 Read Review | Visit Broker > 71.67% of retail CFD accounts lose money | Yes | USD 3 | 0:1 | No | Yes | Yes | 221 | 70 | 0 | 11 | 100 |      | MT4, MT5, Exness Terminal | |

| 4.56 /5 Read Review | Visit Broker > 70.81% of retail CFD accounts lose money | Yes | USD 200 | 500:1 | Yes | Yes | Yes | 1744 | 1600 | 22 | 25 | 64 |     | MT4, MT5, cTrader, TradingView | |

| 4.44 /5 Read Review | Visit Broker > 75.6% of retail CFD accounts lose money | Yes | USD 5 | 500:1 | Yes | No | No | 188 | 50 | 14 | 32 | 70 |       | MT4 | |

4.37 /5 Read Review | Visit Broker > 71% of retail CFD accounts lose money | Yes | EUR 100 | 500:1 | Yes | No | Yes | 905 | 750 | 6 | 16 | 73 |   | MT4, cTrader, Skilling Trader | ||

4.39 /5 Read Review | Visit Broker > 71.58% of retail CFD accounts lose money | Yes | USD 100 | 200:1 | No | Yes | No | 2241 | 2090 | 0 | 19 | 70 |      | MT4, MT5, cTrader, FxProEdge | ||

| 4.53 /5 Read Review | Visit Broker > 72.90% of retail CFD accounts lose money | Yes | ZAR 0 | 2000:1 | Yes | No | No | 1230 | 111 | 5 | 24 | 53 |       | MT4, MT5, HFM Trading App |

Copy Trading in South Africa

Over the last few years, South Africa has seen an enormous rise in copy trading adoption, heightened further during the COVID-19 pandemic. According to Google data, searches in South Africa for “copy trading” surpassed that of developed nations, such as the US, by a whopping 800%. By way of explanation, South Africa faces enormous economic challenges, and for those looking to supplement their income, copy trading provides a relatively simple way to start Forex trading.

However, the allure of making high returns in a short period, plus the absence of stringent regulations in the past, has allowed scam brokers to abound.

Our mission is to educate traders about these brokers and only highlight those that ensure the safety of their clients’ funds. Below we have selected the best copy trading brokers for 2024.

Best Copy Trading Brokers 2024

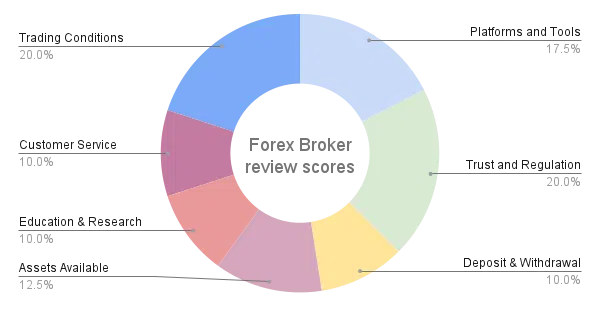

At FxScouts, we have an experienced review team dedicated to evaluating Forex brokers. Our team of experts meticulously examines each broker in 7 different areas, amassing an enormous amount of data in the process. With over 200 individual metrics analysed, we invest hundreds of hours annually researching and scrutinising brokers to ensure that we only recommend the best in the Forex industry.

Of these 7 areas, we always prioritise regulation and costs. These are our priorities because traders want to know that their broker is trustworthy and isn’t overcharging them. Brokers are always altering the products they offer, and we keep our reviews updated with the latest data available. You can find out more about our in-depth review process here.

These are the top Copy trading brokers in South Africa for 2024, as determined by our review process.

FP Markets – Best Overall Copy Trading Broker

FP Markets offers copy trading on both the MT4, MT5, cTrader and TradingView platforms. Available from within the platforms are built-in copy trading functionalities in addition to an auto trading service through a third-party provider, Myfxbook Autotrade.

Myfxbook Autotrade allows traders to find, follow and copy successful traders automatically without the need to build their trading strategy or conduct research on the forex markets. This tool is particularly useful for people who are interested in the financial markets but lack experience and knowledge. Social traders can also diversify their portfolios by copying the trades of multiple providers that trade on different financial instruments.

Avatrade – Best Copy-trading App

AvaSocial Copy Trading App: With full support for various platforms, including MT4, MT5, the award-winning AvaSocial, Avatrade provides a user-friendly and innovative trading environment that allows beginner copy traders to profit from tested trading strategies of more experienced traders.

The Avasocial App helps traders to discover successful traders and qualified mentors, displaying their risk profile, experience, and trading style. Copy traders will receive continuous real-time updates about the state of their trades and can talk one-on-one to providers. Avatrade has also partnered with Mirror Trader and Zulutrade to offer a wider range of copy trading functionality. Mirror Trader allows investors to switch between manual copy trading, semi-automatic trading, or automatic trading when following a provider.

Leading CFD Broker: Avatrade is a leading global CFD market maker broker with excellent regulation offering trading on multiple assets, including Forex, cryptocurrencies, ETFs, options, bonds, and vanilla options on one live commission-free account with competitive trading conditions.

FXTM – Best Copy Trading Platform for Beginners

Copy Trading Platform: FXTM provides a powerful copy trading system called FXTM Invest, which is helpful for beginner traders who lack the expertise and skills in CFD trading. FXTM Invest allows investors to choose a strategy manager from a list of top-rated traders. Once an investor makes a minimum deposit of 100 USD, FXTM will activate the Investor account, and clients can then copy the trades of the strategy managers. With this system, investors can follow suitable strategies and receive a portion of the profits, and Strategy Managers can earn extra money by generating profits for their investors.

Beginner Education: FXTM also provides a lot of educational and market analysis materials to help beginner traders. The materials offer a good overview of Forex trading in guides and tutorials, articles, webinars, seminars, e-books, trading glossaries, and videos. Much like FXTM’s education section, its market analysis materials are comprehensive, frequently updated, and accurately analyse the markets.

Pepperstone – DupliTrade, Myfxbook and Signal Trading

Copy Trading Trading Systems: Pepperstone offers a selection of powerful third-party copy trading systems for traders to choose from, including MetaTrader Signals, Duplitrade, and Myfxbook.

- MetaTrader Signals takes the guesswork and emotion out of trading by allowing traders to access thousands of trading strategies and signals from traders in real-time. It also allows traders to diversify their trading and reduce their portfolio risk by using different signal providers with different approaches.

- Duplitrade allows traders to engage in automated trading, using signals from proprietary traders, which helps them build their trading knowledge and understand pro techniques.

- Myfxbook is an account mirroring service that allows traders to copy the trades of the top Forex traders. There are no performance or management fees, and Myfxbook provides accurate statistics, allowing traders to analyse and improve their performance quickly.

Trusted Forex Broker: A leading ASIC-regulated ECN/STP broker, Pepperstone offers trading on multiple assets, including Forex, indices, shares, commodities, cryptocurrencies, and indices. Known for its tight spreads, ultra-fast execution, and broad platform support, Pepperstone is one of the best Forex brokers in the world.

Exness – Copy-trading on Crypto

Copy Trading Accounts: Exness offers all clients a copy trading service on the MT4 platform where novice traders can copy the trades of more experienced strategy providers. When a strategy provider makes a profit for their followers, they earn a commission at a mutually agreed rate, between 0% – 50%.

Exness offers two trading accounts for copy trading: the Social Standard Account and the Social Pro Account. The minimum strategy deposit on the market execution Social Standard Account is 500 USD, and 2000 USD on the instant/market execution Social Pro Account. Spreads start at 0.3 pips (EUR/USD) on the Social Standard Account and 0.1 pips (EUR/USD) on the Social Pro Account. Note that copy trading is only offered on Forex, metals, and cryptocurrencies.

IC Markets – Two Copy-trading Platforms, 24/7 Support

Copy Trading Platform Choice: IC Markets is one of the few brokers to support all three major trading platforms and two copy trader tools – Zulutrade and Myfxbook Autotrade.

- Zulutrade is a third-party copy trading tool that allows traders to choose between 100,000 signal providers from 192 countries. Zulutrade’s sophisticated algorithm ranks Signal Providers by analysing their overall performance, stability, exposure, and minimum equity required. It also offers Zuluguard, an advanced account protection feature that monitors traders’ performance 24/7 and protects copy traders’ invested capital.

- Myfxbook Autotrade allows traders to copy the trades of any system directly onto the MT4 platform. No volume-based fees are charged, and traders do not have to install any complex software – they connect their account to Myfxbook and select the system they would like to copy.

Beginner Friendly Broker: IC Markets is a beginner-friendly CFD broker offering trading on multiple instruments, including Forex, commodities, indices, bonds, digital currencies, stocks, and futures. It also offers excellent educational materials and 24/7 support to get beginner traders started.

Axi – MT4 and Three Copy-trading Platforms

| 🏦 Min. Deposit | USD 5 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, DFSA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, WTIs |

Free 3rd-Party Copy Trading Platforms: Axi also offers a selection of powerful copy trading tools and trading signals, allowing traders to copy trade using thousands of strategies on the MT4 platform. Axi supports:

- Myfxbook, a third-party automated analytics tool that allows traders to organise and monitor all trading accounts and systems in one centralised place

- Zulutrade and Duplitrade are popular third-party social trading networks that allow clients to copy top-performing traders irrespective of the broker.

Trusted ECN Forex Broker: An Australian ASIC and FCA-regulated ECN broker, Axi offers trading on 70 Forex pairs, precious metals, commodities, indices, and cryptocurrencies. By providing exclusive support for the MT4 platform, Axi offers an innovative and customisable MT4 experience, including a range of tools as part of its NexGen package. These include a sentiment indicator, a correlation trader, an intuitive terminal window, and an automated trade journal.

Skilling – cTrader Copy, 800+ Strategies and Providers

cTrader Platform: Available on the Skilling cTrader Copy platform, traders can choose from over 800 different strategies and providers to follow and copy. The in-depth performance statistics available allow you to research Strategy Providers and their track record of investments as well as review their performance results and trading style to determine the strategy most suitable to you.

Good for Beginners: Start, pause, or stop copying; Skilling Copy allows traders to edit their copying with a few simple clicks. You can also protect your funds with an Equity Stop Loss, limiting how much of your trading account you want to risk. Beginners will also be able to watch the actions of more experienced traders and learn trading ideas and strategies. Social trading is useful for traders who have no time for training or making independent investment decisions.

FxPro – Copytrading on Three Platforms

One of South Africa’s most popular brokers, FxPro has over 800,000 clients worldwide and offers copy trading on all three major trading platforms. While FxPro used to have its social-trading service called SuperTrader, this was shut down in 2017, possibly because the high minimum deposit of 2,000 USD dissuaded new clients from signing up. While it no longer offers a dedicated copy-trading service, FxPro does offer copy-trading via signal trading on MT4, MT5 and cTrader.

While MT4 and MT5 signal providers usually charge a monthly subscription for copiers – often in the region of 30 or 40 USD a month – signal providers using cTrader Copy instead charge a commission per million units traded. The current maximum allowable commission on cTrader Copy is 100 USD per million (10 USD per lot). Opening an MT4, MT5 or cTrader account at FxPro is a simple business and only requires a minimum deposit of 100 USD. Be aware that the cTrader account provides raw spreads but charges a 9 USD commission per lot traded.

HFM (Hotforex) – Dedicated Copy Trading Account

Dedicated Copy Trading Account: Traders have the choice of five account types, including an exclusive HFcopy account. The HFcopy Account is available to both Strategy Providers and Followers who have joined HFcopy. Strategy Providers can open an HFcopy Account to build their inventory of Followers and trade on behalf of their Followers in exchange for a Performance Fee. Followers only pay Strategy Providers if their strategies are successful.

The HFcopy account offers slightly different trading conditions to HFM’s regular accounts, including a minimum opening deposit of 500 USD for Strategy Providers and 100 USD for Followers. HFcopy accounts are only denominated in USD and offer commission-free trading with spreads starting at 1.0 pips on the EUR/USD.

What is Copy Trading?

Copy trading is a type of online trading that allows individuals to automatically copy the positions opened and managed by another selected trader, known as a strategy provider. This innovative approach allows users to mirror the trades and strategies of experienced and successful traders.

With copy trading, each time the strategy provider makes a trade, the same trade is executed in the copier’s account. The copier does not need to do anything manually; everything is handled automatically by the trading platform.

This trading method can benefit beginners who are still learning about the markets and developing their own trading strategies. It also serves as a time-saving tool for experienced traders who may not have the time to follow the markets as closely as they would like.

The copy trading process typically involves just a few clicks to choose a trader to copy, after which the system takes care of the rest. The trades are copied proportionally, meaning that even if you have a smaller account, you can still follow the trades of a strategy provider with a much larger account.

However, while copy trading can be beneficial, it’s crucial to remember that all trading involves risk. It’s possible to lose money and make it, and the past performance of a trader is not necessarily indicative of their future results. Therefore, it’s always wise to do your due diligence, understand the trader’s strategy, and consider the level of risk you are comfortable with before starting copy trading.

The Difference Between Social Trading and Copy Trading

While both social and copy trading leverage online community-based platforms, they differ substantially in their processes and levels of engagement.

Social Trading

Social trading is a holistic approach that encourages direct interaction between traders within an online network. Much like a traditional social media network, users can follow others, communicate, share insights, and discuss trading strategies. Some platforms also facilitate live feeds where traders can post updates about their trading activities, insights about market conditions, or explain their strategy’s rationale.

By providing a platform for discussion and direct observation, social trading serves as a learning ground where less experienced traders can learn from seasoned ones. Social trading is not just about replicating trades; it’s about discussing why specific strategies are employed, interpreting market events with your peers, and building your trading competence over time.

Copy Trading

Copy trading, on the other hand, is a more passive form of trading. Here, traders can select one or more experienced traders to follow. The system then automatically replicates the strategy provider’s trades into the copier’s account. This feature eliminates the need for continuous market monitoring and manual execution of trades, as it’s all handled by the platform.

The primary benefit of copy trading is its simplicity and convenience. You essentially delegate the trading decisions and actions to the trader you’re copying. This approach can be advantageous if you lack trading experience, struggle to keep up with market fluctuations, or simply don’t have the time to trade actively.

However, copy trading does not involve the same level of engagement and learning opportunities as social trading. You follow the trader’s actions but may not necessarily understand the reasoning behind those decisions unless the copied trader provides these insights on the platform.

Both social and copy trading offer unique advantages and cater to different trading styles. Your choice between the two (or a blend of both) would depend on your trading knowledge, available time, risk appetite, and interest in actively engaging with the trading community.

Choosing a Trader to Follow

One of the most crucial steps in copy trading is the selection of a trader to follow. Here’s how you can make an informed choice:

- Analyse Trading Performance: Review the trader’s historical performance. While past performance does not guarantee future success, it can give you an idea of their trading strategy’s effectiveness over time.

- Understand their Strategy: What markets does the trader focus on? How much risk do they take? Make sure their strategy aligns with your trading goals and risk tolerance.

- Check their Risk Score: Most platforms provide a risk score for each trader. A lower score typically indicates a safer, more conservative approach to trading.

- Review their Follower Count: A high follower count can indicate trust from other users, although it’s still essential to conduct your own analysis.

How to Get Started with Copy/Social Trading

Step 1: Sign Up: Register on your chosen platform by providing the necessary information. This process may include verifying your identity.

Step 2: Familiarise Yourself with the Platform: Copy-trading is available via signals on the popular MT4 and MT5 trading platforms. The cTrader trading platform has a more accessible copy trading function called cTrader copy. There are also some dedicated copy trading platforms like Zulutrade, Duplitrade and Myfxbook Autotrade, though these require a subscription fee. Whichever platform you use to copy trade, you will need to spend time exploring the platform and its features.

Step 3: Choose a Trader to Follow: Utilize the process described in the section above to select a trader whose strategy aligns with your investment goals.

Step 4: Begin Trading: You can start by either copying trades or engaging in discussions within the trading community. It’s recommended to start with a smaller investment and gradually increase it as you gain experience and confidence.

Frequently Asked Questions for Beginners

What is the minimum investment required for copy/social trading?

The minimum investment varies across platforms. For instance, on some platforms, you can start copy trading with 200 USD, while others may allow you to start with as little as 1 USD.

Is copy trading legal in South Africa?

Yes, copy trading is legal in South Africa. Copy trading and social trading are considered self-directed by the FSCA in South Africa, as traders who use this function always select the trading system to copy. Prior to the explosion in social trading, copy trading was only available via a managed account. Managed accounts require a power of attorney and a large account balance, and so are unpopular amongst typical retail traders.

What occurs if the trader I’m copying discontinues trading?

If the trader you’re copying decides to stop trading, your account will not open any new trades. You will then need to select a new trader to follow.

Can I terminate copy trading at any point?

Yes, you can stop copying a trader at any time, and you should continuously monitor your trades’ performance and make adjustments as needed.

How much control do I have over my trades when I’m copy trading?

Although the trades are automatically replicated from the trader you’re copying, you still retain control over your own account. You can manually close trades, pause copy trading, or stop copying a trader at any time.

Can I copy multiple traders at the same time?

Yes, most platforms allow you to copy multiple traders simultaneously. This can be beneficial as it allows you to diversify your portfolio across different trading strategies.

Can I start copy trading with a demo account?

Many trading platforms offer a demo or practice account where you can use virtual money to copy trades. This can be a good way to understand how copy trading works and test out different traders’ strategies before investing real money.

What are the costs associated with copy trading?

Costs can vary between platforms. Some platforms charge a fixed fee, some charge a percentage of profits, and others may apply spreads on trades. Always check the cost structure of your chosen platform.

How are the copied trades sized in my account?

Trades are usually copied in proportion to the amount of money you have allocated to copy a particular trader. For example, if the copied trader opens a trade using 10% of their balance, then a trade for 10% of the amount you allocated for copying them will be opened in your account.

What should I do if the trader I’m copying is consistently losing money?

If the trader you’re copying is not performing as expected, it’s essential to reassess your decision. You might choose to stop copying them and select another trader, or you might decide to pause copying and monitor their performance for a while. Remember, it’s crucial to regularly review the performance of the traders you’re copying.

Can I interact with the traders I’m copying?

On some platforms, you can communicate with other traders, ask questions, and share strategies. This feature is more commonly available on social trading platforms, and beginners may find it beneficial as it allows you to learn more about trading strategies and market conditions.

Although copy and social trading might seem overwhelming initially, with the right knowledge and approach, you can leverage the experience and strategies of successful traders. While this opportunity offers an expedited learning curve for beginners and a chance to diversify strategies for seasoned traders, it’s crucial to remember that all trading involves risk. Just because a trader has been successful previously does not mean they will continue to make a profit, so never trade with money that you cannot afford to lose.

How do I compare copy trading brokers?

When selecting a copy trading broker, prioritising regulation is crucial as it safeguards your funds. Evaluate the associated costs if the broker’s copy-trading service uses platforms such as Zulutrade, Duplitrade, or Myfxbook. Opt for a system that provides comprehensive metrics of traders you could emulate, including risk indicators and profitability. Ensure your broker offers a broad range of traders to follow, ensuring diverse choices. It’s also essential to have a system that enables trade filtering based on your risk and return preferences, offering flexibility. Avoid brokers that lock you into copy trading for a set period. You should be able to stop copying trades instantly. Be aware of the fee structure, whether it’s a flat, success-based fee or a broker subscription; all costs should be clear and upfront. Lastly, consider the specific broker accounts that offer copy trading, their required minimum deposit, and their trading costs before committing.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the UK’s regulator, the FCA, or the Australian regulator, ASIC).

Our Rating & Review Methodology

Our Broker Awards and Forex Rankings Report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.