For over a decade, FxScouts.co.za has been reviewing forex brokers and provided in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and South African markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Table Showcasing the Key Features of the Top Forex Brokers for Beginners

Broker | Broker Score | Official Site | Beginner Friendly | Min. Deposit | Beginner Course | Beginner Videos | Downloadable Ebook | Unlimited Demo | Support Hours | Total CFDs | Currency Pairs | Trading Cost | Platforms | Regulated | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 4.40 /5 Read Review | Visit Broker > 79% of retail CFD accounts lose money | Excellent | AUD 100 | Yes | Yes | Yes | Yes | 24/5 | 10162 | 70 | USD 7 | MT4, MT5, cTrader, IRESS |      | |

| 4.59 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | Excellent | ZAR 1900 | Yes | Yes | Yes | No | 24/5 | 930 | 63 | USD 9 | MT4, MT5, Avatrade Social, AvaOptions |        | |

| 4.61 /5 Read Review | Visit Broker > 89%74- of retail CFD accounts lose money | Excellent | USD 0 | Yes | Yes | No | No | 24/7 | 1275 | 100 | USD 10 | MT4, MT5, cTrader, TradingView |      | |

| 4.32 /5 Read Review | Visit Broker > 71.67% of retail CFD accounts lose money | Standard | USD 3 | Yes | No | No | No | 24/7 | 221 | 100 | USD 7 | MT4, MT5, Exness Terminal |      | |

| 4.45 /5 Read Review | Visit Broker > 75.33% of retail CFD accounts lose money | Excellent | USD 5 | Yes | Yes | No | No | 24/5 | 1554 | 57 | USD 6 | MT4, MT5 |      | |

| 4.56 /5 Read Review | Visit Broker > 70.81% of retail CFD accounts lose money | Excellent | USD 200 | Yes | No | No | No | 24/7 | 1744 | 64 | USD 8 | MT4, MT5, cTrader, TradingView |     | |

| 4.33 /5 Read Review | Visit Broker > 76% of retail CFD accounts lose money | Excellent | USD 5 | Yes | Yes | No | Yes | 24/7 | 254 | 37 | USD 7 | MT4, MT5 |     | |

4.39 /5 Read Review | Visit Broker > 78% of retail CFD accounts lose money | Excellent | USD 0 | Yes | Yes | No | No | 24/5 | 5211 | 57 | USD 7 | xStation5 |      | ||

4.68 /5 Read Review | Visit Broker > 70.3% of retail CFD accounts lose money | Excellent | ZAR 1500 | Yes | No | No | Yes | 24/5 | 1009 | 56 | USD 7 | MT4, MT5, markets.com |     | ||

| 4.53 /5 Read Review | Visit Broker > 72.90% of retail CFD accounts lose money | Excellent | ZAR 0 | Yes | Yes | Yes | Yes | 24/5 | 1230 | 53 | USD 10 | MT4, MT5, HFM Trading App |       |

What is a Forex broker?

Online Forex trading can only be done via a Forex broker. Because most of the currency traded globally comes from large institutions like banks that don’t deal with retail clients, Forex brokers facilitate the trades between these institutions and retail traders. Forex brokers buy up large currency positions and make them available to retail traders who can open accounts with just a few hundred dollars or less. Brokers also provide the software – called a trading platform – which connects the trader to the virtual network of computers that forms the Forex market.

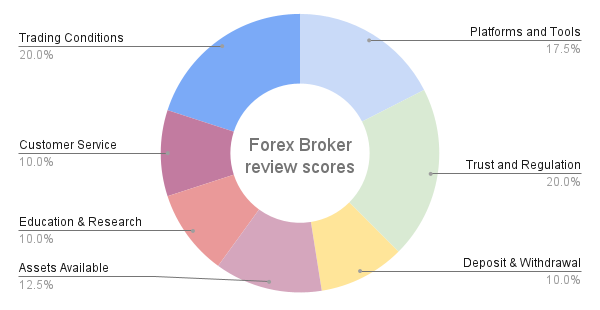

How we selected the Best Forex Brokers for Beginners

We have an experienced review team dedicated to evaluating the best brokers for beginners, so you don’t have to. Our team of experts meticulously examines each broker in 7 different areas using over 200 individual metrics. We invest hundreds of hours annually researching and scrutinising brokers, to ensure that we only recommend the best in the Forex industry.

Of these 7 areas, we focused on the broker’s regulation, trading platforms, educational resources, and customer service to ensure that they cater to beginner traders. You can find out more about our in-depth review process here.

FP Markets – Best Overall Broker for Beginners

Available 24/5 via live chat, email, and telephone in over 12 languages, FP Markets’ customer service helps beginner traders with all aspects of CFD trading, from setting up an account to navigating its platforms and any other technical queries. A large, globally renowned ECN/DMA broker, FP Markets is well-recognised by the Forex industry, having won numerous awards since its inception.

FP Markets offers competitive trading conditions on two live accounts on the MT4, MT5, cTrader and TradingView platforms, with spreads averaging at 1.2 pips (EUR/USD) on its commission-free Standard Account and 0.10 pips (EUR/USD) on its Raw Account in exchange for a commission of 6 USD (round turn) per lot traded. Both accounts also have a minimum deposit of 100 AUD (or equivalent), making them accessible to beginner traders. FP Markets’ education is one of the best in the industry, with videos, various courses, webinars, and podcasts.

Avatrade – Best Forex Broker for Beginners

A well-regulated market maker, Avatrade offers trading on multiple assets, including Forex, commodities, cryptocurrencies, ETFs, options, bonds, and vanilla options. With full support for leading trading platforms, including MT4, MT5, and its award-winning app, AvatradeGO, Avatrade provides one of the most user-friendly and innovative trading environments for beginner traders.

Voted Best Forex Trading App by the Global Forex Awards, AvatradeGO allows access to trader insights, connect with global trading markets, create watchlists, and view live prices and charts. It also offers a range of trading tools, including Autochartist, Duplitrade, and AvaProtect, its own state-of-the-art risk management system. Lastly, Avatrade’s educational and market analysis materials are comprehensive, well-structured, and in-depth, catering to traders of all experience levels.

Pepperstone – Low Cost ECN Accounts with No Minimum Deposit

Pepperstone offers an array of educational materials to help beginners get their trading careers underway. Its educational resources comprise free trading guides, articles on how to trade Forex and CFDs, various courses and videos. It hosts regular webinars, and archives of previous webinars are available for free on its website. Customer service is also available 24/7 in multiple languages to help beginners with any setup or technical queries.

As a leading international broker, Pepperstone offers support for the MT4, MT5, and cTrader platforms on two account types. Both accounts have no required minimum deposit, and Pepperstone’s trading costs are some of the most competitive in the industry. Spreads start at 1.00 pips on its commission-free Standard Account and averaging at 0.10 pips (EUR/USD) on the Razor Account in exchange for a commission of 7 USD per trade. Most trades are executed within 30 milliseconds, which is ideal for scalpers and those who run expert advisors.

Exness – L0w-Cost, Low-Risk Cent Account

Founded in 2008, Exness is a market maker that offers both market and instant execution accounts on both the MT4 and MT5 platforms. Trading conditions at Exness are some of the best in the industry and include a low-cost Cent Account to help beginner traders get their footing.

Exness offers two standard trading accounts and three professional accounts with a range of options for traders of all experience levels. Its beginner-friendly Standard Cent MT4 Account has a minimum deposit requirement of 1 USD and offers spreads starting at 0.3 pips on the EUR/USD. This is a great account for new Forex traders who want to learn the ins and outs of trading without too much risk. Customer support is also available 24/7 to help beginner traders set up accounts and assist with any technical queries.

XM – Daily Webinars, Platform Tutorials, Q&A Sessions

XM provides some of the best educational content and market analysis in the industry. Comprised of various sections, including its unique live education available Monday to Friday 05:00 – 15:00 GMT, daily Q&A sessions, educational videos, Forex webinars presented by 67 highly skilled experts in 19 languages, platform tutorials, and Forex seminars, traders will be well equipped to get their trading career underway.

A well-regulated market maker with low-cost trading accounts, XM offers trading on multiple assets, including Forex, stocks, commodities, equities, precious metals, energies, and shares. Traders can choose between four live accounts on both the MT4 and MT5 platforms. XM boasts a strict no requotes and no rejections policy, and 99.53% of all trading orders are executed in less than one second.

IC Markets – Huge Education Hub, Low Costs and Three Trading Platforms

IC Markets is a well-regulated ECN broker that provides a welcoming environment for beginner traders. Many other ECN brokers fail to provide education and analysis materials, forcing traders to self-educate with third-party material. IC Markets’ extensive education hub is free to all visitors of the website and includes topics such as Forex Basics, Technical Analysis, Fundamental Analysis, Trading Psychology, Trading Strategies, and Risk Management, among others. Instructional videos are also available to help clients set up trading software. Furthermore, IC Markets has a dedicated support department operating 24/7 via email, live chat, and phone, helping beginner traders to set up accounts on the weekend.

IC Markets offers two Raw Spread Accounts and a Standard Account with variable spreads on the MT4, MT5, and cTrader platforms. The Raw Spread Accounts offer spreads averaging at 0.1 pips on the EUR/USD, which is one of the tightest spreads available, in exchange for a commission of 7 USD per trade. IC Markets pricing relies on 25 different liquidity providers ensuring deep liquidity and some of the lowest spreads in the industry.

FBS – $1 Minimum Deposit and Excellent Education

With very low minimum deposits, two low-risk accounts for beginners, and excellent education and market analysis, FBS is one of the best brokers for beginner traders. Beginners who don’t want to risk too much money will like FBS’ Cent Account, which has a 1 USD minimum deposit, and the Micro Account, with a 5 USD minimum deposit. Both accounts also feature low-risk trading, with trading in USD cents on the Cent Account and micro-lots unlocked on the Micro Account. Both accounts are also available as demo accounts and will only expire after 90 days of inactivity.

FBS is also one of the better brokers in terms of education and market analysis. The education section is comprehensive and well-structured, and the market analysis is up-to-date and well-explained. Beginners will also appreciate that FBS’ customer service is available 24/7 – a welcome development, where the norm is 24/5. This is especially helpful for beginner traders who want to set up trading accounts on weekends.

XTB – User-friendly Platform, Comprehensive Trading Academy

A well-regulated STP broker, XTB is the creator of the award-winning xStation 5 platform. With a user-friendly and intuitive design, it allows traders to track market movements accurately. It also offers powerful charting tools, one-click trading, real-time performance statistics, and a trader’s calculator.

XTB provides some of the best training materials available for beginners. Its Trading Academy is comprehensive, clear and concise, and structured like a course. It also offers one-on-one mentoring, dedicated account management, and 24/7 customer service allowing a smooth onboarding experience for beginner traders.

Markets.com – Great Trading App, Low Costs

The Markets.com trading app has been built from the ground up for iOS and Android, providing a responsive and stable trading experience. With built-in advanced charting, traders can see their orders, related instruments, and open positions with a single click. The mobile app offers traders commission-free trading with some of the lowest fees. Spreads start at 0.60 pips on major currency pairs and the range of tradeable instruments includes 1500+ global shares, global indices, commodities, ETFs and government bonds.

The Markets.com app trading tools menu features a range of tools that crunch big data from leading analysts, hedge funds, and commentators to give beginner traders a better insight into the market. Each tool has integrated buy and sell buttons so traders can act instantly upon the information presented.

HFM (HotForex) – Best Low-Cost Broker for Beginners

A global CFD broker, HFM offers trading on a number of instruments, including Forex, cryptocurrencies, metals, energies, indices, shares, commodities, bonds, and ETFs. Traders have the choice of five account types, with tight spreads, leverage of up to 1000:1, and minimum deposits starting at 70 ZAR (5 USD) on its entry-level account. With a local South African support team, HFM is a better option than many other international brokers for beginner South African traders who will need help getting started. HFM’s award-winning customer support is available 24/5 in over 27 languages via email, live chat, and telephone.

HFM also provides a world-class repository of educational and market analysis materials, including articles, video tutorials, and frequent webinars on current events, advanced trading strategies, and chart analysis. Traders who open a demo or live account will also gain access to the HFM e-Course, which outlines the basics of Forex theory and trading, reading and interpreting the charts, trading psychology, and technical analysis.

What is Forex Trading?

Forex trading is the buying and selling of different currencies on the foreign exchange market. The goal of forex trading is to profit from fluctuations in exchange rates between currencies. The Forex market is the biggest financial market in the world, with over 6.6 trillion USD traded every day. Because the Forex market is global and virtual, it operates 24 hours a day, 5 days a week – from the moment the Australian market opens on Monday morning until the New York market closes on Friday evening.

Why is Forex Trading Popular in South Africa?

Forex trading is popular in South Africa because of its advanced economy, robust regulatory environment led by the Financial Sector Conduct Authority (FSCA), and strong trading community. The flexibility of forex trading hours, access to a wide variety of currency pairs offered by local brokers, and ZAR trading accounts present numerous trading opportunities.

The thriving local forex trading community, with various forums and social media groups, fosters an environment of learning and support for traders. In essence, South Africa’s forex market combines a strong economic backdrop with an established regulatory framework and vibrant trading community, making it an excellent choice for beginning a forex trading journey.

Key Considerations for Beginners when Choosing a Forex Broker

- Regulatory Compliance:

Ensure the broker you choose is regulated by a reputable financial authority, like the Financial Sector Conduct Authority (FSCA) in South Africa. Regulation provides a level of security and ensures that the broker adheres to a set of standards, providing trader protection against fraudulent activities

- User-Friendly Trading Platforms

As a beginner, it’s essential to choose a broker that offers a user-friendly trading platform. The platform should be easy to navigate, with a clear layout and intuitive design. It should provide easy access to buy and sell orders, charting tools, market news, and other features necessary for trading. Moreover, the platform should offer seamless execution of trades and real-time price updates. The functionality and usability of the trading platform will have a significant impact on your trading experience.

- Comprehensive Educational Material

A forex broker that offers comprehensive educational resources can be highly beneficial for beginners. Look for brokers that provide a range of learning materials, such as e-books, webinars, tutorial videos, FAQs, and glossaries. These resources can help you understand forex trading concepts, strategies, market analysis, risk management, and more. Some brokers also offer dedicated learning centres or academies, which can be incredibly valuable for enhancing your trading knowledge and skills.

- Accessible Demo Accounts

Demo accounts are an invaluable tool for beginners. They allow you to practice trading strategies, understand how the forex market operates, and get familiar with the trading platform without risking any real money. Ensure that the broker you choose provides an easily accessible and fully functional demo account. Ideally, the demo account should closely mimic the conditions of a real trading account, offering a realistic trading experience.

- Low Minimum Deposit Requirement

As a beginner, it’s advisable to start with a broker that has a low minimum deposit requirement. This allows you to start live trading without making a significant financial commitment. Remember, as a new trader, the primary goal should be to learn and gain experience, not to make big profits. Once you gain confidence and experience, you can consider investing more money. Always remember that forex trading involves risks, and it’s possible to lose the money you invest.

- Reliable Customer Support:

For beginners, effective customer support can be crucial. Problems can arise anytime, and having a responsive local South African support team can make a significant difference. You want a broker that offers 24/7 customer support through various channels (e.g., live chat, email, and a local telephone number). Additionally, the support team should be knowledgeable and capable of resolving issues quickly and effectively.

- Transaction Costs:

Every time you trade, you will have to pay for either the spread or a commission, so it’s crucial to look for the most affordable and reliable brokers. When we evaluate brokers, one of the most important considerations is the trading costs, which can affect your profitability. Brokers such as Avatrade and Pepperstone are both good for beginner traders and provide a low-cost trading environment.

- Withdrawal and Deposit Methods:

Good forex brokers will allow you to deposit funds and withdraw your earnings hassle-free. Ensure the broker’s withdrawal and deposit methods are convenient and straightforward. Check for any fees associated with these transactions, as they can vary between brokers. Having accounts denominated in ZAR is also a bonus for South African traders who will be able to avoid paying currency conversion fees on deposits and withdrawals.

Tips for Beginners to Get Started Forex Trading

- Use a Demo Account

Demo accounts are a crucial tool for any beginner in the forex market. These accounts allow new traders to practice trading without risking real money, providing a risk-free environment to understand how trading works. They offer real-time market scenarios, enabling traders to familiarise themselves with different trading platforms, implement various strategies, and understand trading operations like placing orders, setting stop losses, and making profits. Beginner traders should always start with a demo account before transitioning to a live trading account.

- Continual Learning and Regular Practice

Forex trading is not a set-it-and-forget-it activity. It requires constant learning and skill upgrading to stay abreast of changing market conditions. This can be achieved by attending webinars and seminars, enrolling in online courses, listening to podcasts, and staying updated with financial news. Traders should also learn technical analysis, charting, and the use of trading indicators. Practicing different strategies and learning from successful forex traders can contribute significantly to skill enhancement.

- Understanding Risk Management

Risk management is a key component of successful forex trading. It involves recognising potential risks and taking steps to mitigate them. This includes setting stop-loss orders to limit potential losses, using leverage wisely to avoid significant losses, and never investing more money than you can afford to lose. Diversification, trading only a small portion of your capital, and not getting emotionally attached to trades are also vital risk management strategies. Remember, the goal is not to win every trade, but to manage your risk so you can stay in the game for the long term.

- Following Market Trends

Understanding and following market trends is essential in forex trading. Trends give traders an idea of the direction in which the market is moving. Traders can use various technical analysis tools to identify trends, such as moving averages and trend lines. Following market trends and combining this strategy with other trading techniques can increase the likelihood of making successful trades. Additionally, staying updated with global news and economic indicators can provide insights into potential market trends. It’s important to note that trends can change quickly, so traders should be adaptable and ready to respond accordingly.

FAQs

How much money do I need to start Forex trading?

Some brokers in South Africa have minimum deposits of just R70, but we recommend starting with at least R3500 to avoid your account being wiped out if the market turns against you.

Most international brokers require a minimum deposit in USD, which can vary from as low as 5 USD to as high as 2000 USD, depending on the broker and the account type you are opening. In South Africa, some brokers will offer ZAR Accounts, which means that you can keep your trading balance in Rand. For ZAR Accounts, minimum deposits start as low as R70 and can rise to R1500 or R3000.

What are the risks involved in Forex trading?

Forex trading is a risky endeavour that can cause substantial losses if not managed properly. Some of the risks associated with Forex trading are market volatility, which can cause losses due to sudden currency fluctuations, and high leverage, which can intensify both gains and losses. The decentralization of the forex market also contributes to the risk, as it can lead to potentially fraudulent activities. Additionally, external factors like political instability, economic events, and natural disasters can dramatically affect currency values, adding to the inherent risks.

Can I make a living through Forex trading?

Yes, it is possible to make a living through forex trading, but it’s important to note that this is not easy and is not the norm. Successful forex trading requires a high level of knowledge and skill, as well as a comprehensive understanding of financial markets, macroeconomic indicators, and risk management. Forex traders must be prepared to spend a significant amount of time studying the markets, following international news, and developing and testing trading strategies. Consistent profitability requires time, patience, discipline, and continual learning.

How can I improve my Forex trading skills?

Improving your forex trading skills involves a combination of education, practice, strategy development, and emotional control:

- Continually educate yourself about the Forex market by attending webinars, listening to podcasts, and keeping up to date with geopolitical and economic news.

- You can also improve your skills by developing a strategy and fine-tuning it to suit your trading style and risk tolerance.

- One of the keys to improving as a Forex trader is to practice managing your emotions. Trading involves emotions like fear, greed, and stress, but the best Forex traders don’t allow their emotions to dictate their trading decisions.

- Lastly, learn from others by joining Forex trading communities and following more experienced traders to glean from their knowledge.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the UK’s regulator, the FCA, or the Australian regulator, ASIC).

Our Rating & Review Methodology

Our Broker Awards and Forex Rankings Report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

References

- Foreign exchange turnover in April 2019

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.