For over a decade, FxScouts.co.za has been reviewing forex brokers and provided in-depth analyses. Our extensive research and unique testing methodology ensures that all broker reviews are accurate and fair with hundreds of thousands of data points generated annually. Since 2012, we’ve tested over 180 brokers across global and South African markets. Our team of professionals are frequently cited in global and regional media, shaping market conversations and trends.

-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

2024 Best Forex Brokers in South Africa Compared

Broker | Regulated by the FSCA | Countries Regulated | Minimum Spread EUR/USD | Minimum Deposit | Trading cost/lot EURUSD | Broker Score | Broker Website | Select and Compare |

|---|---|---|---|---|---|---|---|---|

| Yes |      | 0 pips | AUD 100 | USD 7 | Visit Broker > | ||

| Yes |        | 0.90 pips | ZAR 1900 | USD 9 | Visit Broker > | ||

| No |      | 0 pips | USD 0 | USD 10 | Visit Broker > | ||

| Yes |      | 0.10 pips | USD 3 | USD 7 | Visit Broker > | ||

| Yes |      | 0.60 pips | USD 5 | USD 6 | Visit Broker > | ||

| Yes |     | 0 pips | USD 5 | USD 7 | Visit Broker > | ||

| Yes |     | 0.60 pips | ZAR 1500 | USD 7 | Visit Broker > | |||

| No |       | 0 pips | USD 5 | USD 10 | Visit Broker > | ||

| No |     | 0.10 pips | USD 200 | USD 8 | Visit Broker > | ||

| Yes |            | 0.60 pips | USD 0 | USD 6 | Visit Broker > | ||

| Yes |       | 0 pips | USD 100 | USD 6 | Visit Broker > | ||

| Yes |      | 0.40 pips | USD 100 | USD 14 | Visit Broker > | |||

| No |      | 0.80 pips | USD 0 | USD 7 | Visit Broker > | |||

| Yes |    | 0.60 pips | USD 25 | USD 6 | Visit Broker > | |||

| Yes |       | 0 pips | ZAR 500 | USD 8 | Visit Broker > | |||

| Yes |  | 0.60 pips | ZAR 500 | USD 10 | Visit Broker > | |||

| No |   | 0.10 pips | USD 0 | USD 8 | Visit Broker > | |||

| No |     | 0 pips | AUD 100 | USD 10 | Visit Broker > | |||

| No |      | 0.70 pips | USD 100 | USD 7 | Visit Broker > | |||

| Yes |       | 0 pips | ZAR 0 | USD 10 | Visit Broker > |

Best Broker Reviews 2024

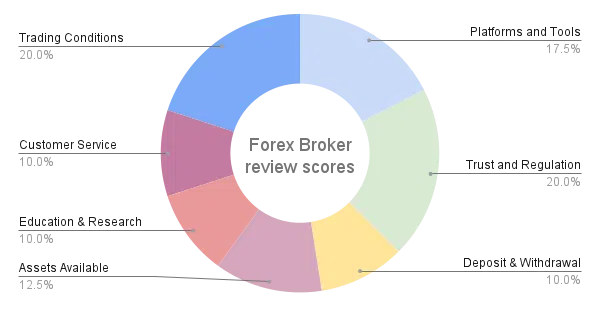

At FxScouts, we have an experienced review team dedicated to evaluating Forex brokers. Our team of experts meticulously examines each broker in 7 different areas, amassing an enormous amount of data in the process. With over 200 individual metrics analysed, we invest hundreds of hours annually researching and scrutinising brokers to ensure that we only recommend the best in the Forex industry.

Of these 7 areas, we always prioritise regulation and costs. These are our priorities because traders want to know that their broker is trustworthy and isn’t overcharging them. Brokers are always altering the products they offer, and we keep our reviews updated with the latest data available. You can find out more about our in-depth review process here.

These are the top Forex brokers in South Africa for 2024, as determined by our review process.

FP Markets – Low-Cost Trading and Advanced Tools

Who FP Markets is for: Traders looking for a competitive trading environment with low-cost options, advanced trading tools, and a number of platform options.

Why we like FP Markets: As of January 2023, FP Markets acquired a licence from the national authority, the Financial Sector Conduct Authority (FSCA); this means that SA client funds will be segregated at South African banks and that traders will benefit from local protection. FP Markets’ low-cost trading accounts and range of third-party platforms, including the recent addition of cTrader, make it a popular choice for both experienced traders and serious beginners. Both its accounts have a minimum deposit requirement of only 100 AUD (or equivalent), and its commission-free Standard Account has a spread of 1 pip (EUR/USD), while its Raw Account has a spread that starts at 0 pips (EUR/USD) in exchange for a low commission of 6 USD (RT). FP Markets also has an impressive range of trading tools, including free Autochartist, VPS services, and the Trader’s Toolbox for an enhanced trading experience, and it also has one of the better education sections offered by Forex brokers.

FP Markets Drawbacks: With such a good offering, it’s difficult to find drawbacks, but South African traders are still onboarded through its Saint Vincent-regulated entity while FP Markets sets up the infrastructure to onboard clients through its FSCA-regulated entity.

AvaTrade – Best Mobile Trading App

Who AvaTrade is for: Traders who want a good broker with low costs, free withdrawals, ZAR trading accounts and a well-designed mobile trading app.

Why we like AvaTrade: AvaTrade’s biggest selling points are free deposits and withdrawals to South African bank accounts and low trading fees, with Forex spreads starting at 0.9 pips on the EUR/USD. While AvaTrade’s minimum deposit of R1500 (or 100 USD) isn’t the lowest you can find, it’s still low enough for most beginners. Traders on the move will like AvaTrade’s well-designed mobile app, AvaTradeGO, with its smart risk management tools and direct connection to AvaSocial, AvaTrade’s popular social trading system. Another highlight is the 13 cryptocurrency pairs available to trade at AvaTrade, more than most other brokers in South Africa. Cryptocurrency traders will also appreciate the dedicated 24/7 crypto trading customer support. It’s no secret that share CFDs are also very popular right now and AvaTrade has that sector covered too with 625 share CFDs to trade, including famous tech stocks like Google, Apple, and Amazon.

AvaTrade’s drawbacks: As we noted above AvaTrade has low trading fees, but they are not the lowest available in South Africa – some brokers have spreads down to 0.6 or 0.7 pips on the EUR/USD. And it’s possible to find much lower minimum deposits, all the way down to 3 USD in some cases. But most serious beginners will want a deposit of 100 USD or more anyway.

Pepperstone – Raw Spreads, Low Commission, Three Trading Platforms

Who Pepperstone is for: More experienced traders looking for a low-cost ECN broker with a choice of trading platforms.

Why we like Pepperstone: Pepperstone’s low-cost ECN trading service, fast trade execution, and range of third-party trading platforms has made it popular amongst experienced traders and serious beginners around the world. Pepperstone’s Standard Account has no commission and spreads start at 1.00 pips on the EUR/USD, making it one of the lowest-cost trading accounts available. For traders who prefer raw spreads, the Razor Account has spreads down to 0 pips on the EUR/USD and a commission of 7 USD per trade. More experienced traders who rely on scalping and bots for automated trading will appreciate that most trades on both of Pepperstone’s accounts are executed in less than 30ms. While it doesn’t offer its own trading platform, Pepperstone supports three third-party trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, which is easier to learn but shares all the sophisticated automation tools found in MT4 and MT5. Serious beginners looking for an ECN broker should take note that Pepperstone has scrapped its minimum deposit requirement, though it still recommends starting with at least 200 USD. Pepperstone’s also has one of the better education sections offered by an ECN broker.

Pepperstone drawbacks: Unlike most brokers, Pepperstone does not offer its own easy-to-use trading platform so beginners may find their early trading a bit intimidating. The steep learning curve will also include the need to calculate commission costs if they decide to go with the Razor Account. Both issues can be reduced by going with the cTrader trading platform, which has a flat commission structure and is easier to learn than MT4 or MT5.

Exness – $1 Minimum Deposit and 24/7 Customer Service

Who Exness is for: Beginner traders looking for a low-risk trading account with a 1 USD minimum deposit, low trading fees, and 24/7 customer service.

Why we like Exness: Exness has the best cent trading account for beginners in South Africa. Cent accounts allow micro lot trading, and the trading balance is displayed in cents, so a 20 USD deposit will be shown as 2000 cents. These features make cent accounts the cheapest trading accounts with the lowest risks. The Exness Standard Cent Account has a minimum deposit of only 1 USD and much lower trading fees than most cent accounts, with spreads as low as 0.3 pips. Costs are low on the funding side, too, with free deposits and withdrawals via online banking in South Africa, though this funding method has a minimum 3 USD deposit. Good customer service is essential for beginner traders, and Exness customer support is available throughout the weekend, 24 hours a day. Weekend support is good for beginners who work during the week, but it’s also helpful for cryptocurrency traders as the cryptocurrency market never closes.

Exness drawbacks: There are a couple of downsides to Exness’ Standard Cent Account: It’s only available on the MT4 trading platform, and trading is restricted to Forex pairs and precious metals. And despite Exness offering ZAR trading on its other accounts, the Standard Cent Account is only available in USD cents, EUR cents, GBP cents, CHF cents and AUD cents.

XM – Lowest Fees in South Africa

Who XM is for: South African traders who want a low-cost ZAR trading account on MT4

Why we like XM: The main draw at XM is the Ultra-Low Account, which has some of the lowest trading fees in the world. Available as a USD or Rand trading account, the Ultra-Low Account has spreads starting at 0.6 pips on the EUR/USD and no commission. Rand trading accounts are a good option for South African traders because there is no currency conversion with withdrawals or deposits from a South African bank account. The Ultra-Low Account has a minimum deposit of 50 USD (R700), but XM also has two accounts with a minimum deposit of 5 USD (R70) which may be more suitable for beginners. Beginners will also benefit from XM’s great education section and a demo account that never expires. XM clients will also benefit from a choice of the MT4 or MT5 trading platforms, and a selection of trading assets including commodities, precious metals, indices and 1200+ shares.

XM’s drawbacks: While the XM Ultra-Low Account is cheap in terms of ongoing trading fees it’s still relatively expensive to get started, with a minimum deposit of 50 USD. Traders can find multiple accounts in South Africa with minimum deposits of 5 USD or lower. Some traders may also be put off by XM’s lack of cryptocurrency to trade. Finally, those wanting to trade shares will be forced to use the MT5 platform.

FBS – High Leverage Trading and $1 Minimum Deposit

Who FBS is for: With a wide range of accounts, FBS will appeal to both experienced traders looking for high leverage and low fees or beginners looking for low minimum deposits and cryptocurrency trading

Why we like FBS: FBS’ strength is in its range of accounts, with trading conditions for all types of traders. Beginners will focus on its Cent Account with its 1 USD minimum deposit or the Micro Account with a 5 USD minimum deposit, more experienced traders will be interested in the ECN account with a 1000 USD minimum deposit, raw spreads, and a 6 USD commission. Other accounts include a Standard Account with 100 USD minimum deposit and Zero Spread Account with a 500 USD minimum deposit. Experienced traders will appreciate the high leverage available, with all accounts except the ECN account offering leverage of 3000:1. Beginners will also like the low trading fees on the entry-level accounts, with Cent Account spreads starting at 0.8 pips on the EUR/USD. Cryptocurrency trading is also a big draw here, with 37 cryptocurrencies available to trade, many more than most other brokers.

FBS drawbacks: As most traders will know, high leverage is a double-edged sword. While it can greatly increase profitability, it also greatly increases risk. An FBS trading account with only a few dollars in it but 3000:1 leverage can be wiped out in an instant. And while FBS lets clients use both the MT4 and MT5 trading platforms, its cryptocurrency products can only be traded using the FBS Trader mobile app. As many people already use their phones to trade this isn’t the end of the world, but the FBS Trader app is currently only available on Android devices, not iPhones.

markets.com – Great app, ZAR accounts, low costs

Who markets.com is for: Traders looking for an effortless trading app, ZAR trading accounts and low costs from an FSCA-regulated broker with a global presence

Why we like markets.com: The Markets.com app provides a smooth and stable trading experience with low fees and many trading tools. With built-in advanced charting, traders can easily access trendlines, channels, pitchforks, and Fibonacci Retracements. In the chart view, traders can see their orders, related instruments, and open positions with a single click. The app offers traders fast, commission-free trading with some of the lowest fees available. Spreads start at 0.60 pips on major FX pairs with no commission and leverage of 300:1. The large variety of tradeable instruments includes 700+ global shares, 60+ currency pairs, 30 global indices, 22 commodities, 77 ETFs, 25 cryptocurrencies, and four government bonds.

markets.com drawbacks: While many brokers have removed their minimum deposit requirements, markets.com still requires 1600 ZAR/100 USD to open an account. While this may not be a problem for most traders, some beginners may be put off.

Axi – Two Low-Cost MT4 Accounts, Great Trading Tools

| 🏦 Min. Deposit | USD 5 |

| 🛡️ Regulated By | FCA, CySEC, ASIC, DFSA |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 500:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Commodities, Cryptocurrencies, Stock CFDs, Forex, Indices, Metals, WTIs |

Who is Axi for: Traders who only use the MT4 trading platform and want an ECN broker with great trading tools but aren’t too bothered about trading shares.

Why we like Axi: Axi, formerly AxiTrader, stands out for three reasons: First off, it’s an MT4-only broker, so if you want to use any other trading platform, you can look away now. Secondly, it’s an ECN broker with low fees, no minimum deposit requirement, and two simple accounts, one with commission and one without. Finally, it has a fantastic collection of trading tools that it offers for free to its clients. While the MT4-only policy may seem like a drawback, it does allow Axi to focus on making its MT4 trading experience as profitable as possible. This includes Axi’s MT4 NexGen plugin which includes an advanced sentiment indicator, a correlation trader, and an automated trade journal. And while the fees on its accounts aren’t the lowest available, they are below the industry average. The Pro Account, in particular, is good value, with spreads averaging 0.1 pips on the EUR/USD and a 7 USD commission. Beginners and experienced traders alike will really appreciate Axi’s selection of powerful and free trading tools, including Autochartist, MyFxbook, and PsyQuation. Autochartist is a tool that automatically identifies trading opportunities, MyFxBook is one of the world’s most popular copy-trading platforms, and PsyQuation is an AI trade diagnostic that helps traders learn from their mistakes.

Axi drawbacks: The main and most obvious drawback here is Axi’s insistence on only providing support for the MT4 trading platform. Apart from putting some traders off, this also results in a smaller range of trading assets and Axi only recently added a handful of share CFDs to its product line-up. That said, Axi does have a good range of cryptocurrencies to trade. Another concern is that South Africans will be trading with Axi’s subsidiary based in St Vincent in the Grenadines (SVG). SVG does not regulate brokers so Axi’s South African clients will not have negative balance protection.

IC Markets – Streamlined Low-Cost Trading Across Popular Platforms

IC Markets stands out for its simplified account options and competitive trading conditions across three popular trading platforms.

Trading Instruments:

- Access to Forex, commodities, stocks, cryptocurrencies, indices, bonds, vanilla options, and ETFs.

Trading Platforms and Fees:

- MT4, MT5, and cTrader platforms.

- Raw Spread Accounts with a commission of 3 USD (cTrader) or 3.5 USD (MT4/MT5) and spreads averaging 0.1 pips on EUR/USD.

- Standard Account with no commission and spreads starting at 1 pip.

Regulation and Security:

- Regulated by ASIC (AFS License Number 335692) since 2007 and CySEC in the EU.

- Negative balance protection and segregated operational and client funds

IG – 17,000 CFDs and Low Costs

| 🏦 Min. Deposit | USD 0 |

| 🛡️ Regulated By | ASIC, BaFin, DFSA, CFTC |

| 💵 Trading Cost | USD 6 |

| ⚖️ Max. Leverage | 200:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4, L2 Dealer, ProRealTime |

| 💱 Instruments | Bonds, Commodities, Cryptocurrencies, Digital 100s, Stock CFDs, ETFs, Forex, Indices, Interest Rates |

Who IG is for: Most traders are drawn to IG by the huge range of CFDs available to trade, over 17,000 and counting. IG also caters well to beginner traders with an excellent trading academy, an easy-to-use trading platform, and low costs.

Why we like IG: With low fees, a huge range of tradeable markets, and regulation from 17 national authorities, including the South African FSCA, IG has one of the best Forex trading accounts in the world. While IG only has a single trading account, it has some of the lowest fees in the industry. There is no required minimum deposit, and no commission is charged on Forex trades. Trading fees change slightly depending on whether you use IG’s own trading platform or the MT4 trading platform. On IG’s own trading platform, spreads average 0.86 pips on the EUR/USD, but if you use MT4, then spreads average 0.75 pips on the EUR/USD. Markets to trade include commodities, indices, over 16,000 shares and ETFs, options, interest rates and bonds. IG also operates as a stockbroker, allowing clients to invest in thousands of shares and ETFs. This is an unleveraged investment, and commissions are charged on all share purchases.

IG Drawbacks: While IG has a great proprietary trading platform and offers MT4, many traders are now moving on to MT5 – which is unavailable here. Traders looking for raw spreads will also be forced to use IG’s own platform or L2 Dealer, a complex institutional-grade platform.

HFM (HotForex) – Best Low Cost Trading Account

Who HFM is for: Traders who want a Rand trading account with a low minimum deposit and fast and free withdrawals to South African banks.

Why we like HFM: HFM is a fantastic all-around broker, but its fast and free deposits and withdrawals and ZAR trading accounts are the highlights here. All three of its account types have the option of using Rand (ZAR) as the trading currency, but the standout is the Micro Account, with a 70 ZAR minimum deposit and decent trading fees starting at 1 pip spreads on the EUR/USD. Traders always want to deposit and withdraw their funds as fast and as cheaply as possible, and HFM excels over other brokers with instant deposits and 2-day withdrawals, all with no extra charge. Fast and free funding is available for clients with online bank accounts with African Bank, Bidvest Bank, Capitec Bank, FNB, Investec, Nedbank, Standard Bank, or TymeBank. Beginners and those with little time to trade should note that HFM also has two copy-trading accounts – clients can copy the trades of experienced and profitable traders. The three standard accounts have access to trading on Forex, cryptocurrencies, commodities, indices, shares, bonds, and ETFs, and with FSCA regulation since 2015, HFM clients can rest assured of local protection of their trading accounts.

HFM drawbacks: HFM is popular for its range of CFDs and while the Micro Account has a low minimum deposit, a starting spread of 1 pip is a bit higher than other brokers. Copy traders should also be aware that the HFCopy account is only available on the MT4 trading platform, and trading is restricted to Forex, indices, and gold.

Which is the best broker in South Africa?

The best brokers in South Africa are well-regulated and offer a low-cost, user-friendly trading platform suitable for both beginners and experienced traders. Following rigorous testing, we believe that AvaTrade is the best broker for South African traders. AvaTrade is regulated by some of the toughest global authorities, including the South African FSCA, providing security and confidence for its clients. And with ZAR trading accounts and free deposits and withdrawals from South African banks, South African traders don’t have to worry about conversion fees at any point. AvaTrade’s trading costs are low and commission-free, starting at 0.9 pips on the EUR/USD. We also love the AvaTradeGO trading app, with built-in risk-management tools and a really easy-to-use interface for new traders.

Which Forex broker has the best trading platform?

AvaTrade’s Webtrader platform requires no downloads or installation and is available for all devices. We found that the web trader has a clean user interface and intuitive design and is easy to navigate and search for various instruments, making it a great option for beginner traders. WebTrader also has great features like AvaProtect, a risk reduction tool which allows you to protect your trades from losing. Trading Central, one of the most popular third-party trading tools on the market, is fully integrated into the platform and provides technical insight and instant pattern recognition.

Is Forex Trading Legal in South Africa?

Forex trading in South Africa is legal and regulated by the Financial Sector Conduct Authority (FSCA). The FSCA requires all Forex brokers operating in the country to hold a valid license and adhere to strict standards, including:

- Timely deposits and withdrawals

- Segregation of funds

- Capital adequacy to prevent defaults

The FSCA also have mechanisms in place for dispute resolution and investor compensation in case of broker defaults or fraud. These standards ensure that traders have access to a fair and transparent trading environment and are protected against fraud or unethical practices by their brokers.

The FSCA is the best regulator in Africa, and we consider brokers who have been licenced by the FSCA to be trustworthy for South African traders.

As well as the FSCA, other top-tier global regulators include ASIC, the FCA, and CySEC. Whether you decide to use a broker regulated by the FSCA or not, it’s important to remember that choosing a regulated broker is the best way to ensure your protection as a Forex trader.

Why is Regulation Important?

Regulation is essential for protecting your money and ensuring a fair and transparent trading experience.

When trading Forex, you want to be confident that your broker is operating legally and ethically and that your funds are being handled safely. Regulated Forex brokers must adhere to strict standards set by regulatory bodies, which include requirements for capital adequacy, segregation of client funds, and ongoing reporting and compliance. This means that your funds are protected, and your trading experience is fair.

Unregulated brokers are not forced to hold to the same standards. This can lead to a higher risk of fraud or unethical practices, which can result in financial losses for traders. Choosing a regulated Forex broker gives you peace of mind and security, knowing that your investments are protected and your trading experience is fair.

How are Forex Brokers Regulated in South Africa?

In South Africa, Forex brokers must be regulated by the Financial Sector Conduct Authority (FSCA), the regulatory body for non-banking financial services in the country.

The FSCA requires that only qualified persons with no criminal background can work for a Forex broker. It ensures that brokers segregate client funds from their own operational funds in South African banks. It also requires that Forex brokers are honest about their services and products with their clients and treat them fairly. Since 2019, the FSCA has required Forex brokers to hold an ODP (Over-the-Counter Derivative Provider) licence, which introduces stricter capital requirements and more regulatory scrutiny.

The FSCA has the power to take action against any Forex broker that is found to be in violation of its regulations, including revoking their license to operate. Find out more about the FSCA’s role in regulating South African Forex brokers here.

Scam Brokers and Reporting Regulatory Violations

If you are unsure about the reliability of your Forex broker, you can check our list of brokers to avoid. If you believe you have been scammed by your broker, the first thing to do is contact the FSCA. You can contact the FSCA’s complaints department here, and they can advise you on the next steps to take. We also have a report a scam broker form which we use to gather information so that we get the word out. Your personal details will not be shared externally.

Do I Need a Broker to Trade Forex?

Yes, you will need a broker to trade Forex. Connecting traders to the Forex market is an expensive and technically complex business. Most Forex brokers form a bridge between the global Forex market and Forex traders; these are called market makers. Market makers buy up large trading positions from the Forex market, which they sell to traders in smaller trade sizes.

Other brokers act as a go-between, taking orders from traders and sending them straight to the global Forex market. These are called ECN brokers or DMA brokers. Both types of Forex brokers require a lot of money to set up and need teams of highly qualified technicians to maintain their trading platforms.

How do Forex Brokers Make Money?

Market markers only make money from the spread – the difference between the buying and selling price of the currency pair. These brokers will be the counterparty to any trade, so they make money when clients lose trades.

ECNs have tight spreads but make money from commissions, which are charged every time a trade is opened or closed. This type of broker makes money whether a client wins or loses.

Which Forex Brokers are Best for Beginner Traders?

The best brokers for beginners are well-regulated and have no minimum deposit requirement, ensuring security and a low cost of entry. Also important are low fees and negative balance protection, as these both help to lower risk. Responsive and knowledgeable customer support is essential. Customer service should be available 24/5 via email, live chat, and telephone, though 24/7 is better. Last but not least, beginners should look for a broker with a high-quality education section; this should feature articles, video tutorials, frequent webinars, advanced trading strategies, and chart analysis.

For more detail and to see which brokers we recommend for new traders, check out our dedicated page on the best brokers for beginners.

Which Forex Brokers have the Best Demo Accounts?

The brokers with the best demo accounts understand that beginners should not be forced into trading real money and that experienced traders should be able to test strategies as long as they want to. So the best demo accounts are not time-limited and replicate real market conditions as closely as possible. Beginners looking for a demo account will want a broker with good education, so they can learn about Forex trading as they practice.

For more detail and to see which brokers we recommend for demo trading, check out our dedicated page on the best demo accounts.

Which Trading Platforms do the Best Forex Brokers Offer?

The best Forex brokers generally offer Metatrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These are third-party trading platforms which you can install on your computer. They are fully customisable and have advanced charting tools, research tools, and options for automated trading or copy trading. Some brokers also have their own trading platforms, which are usually accessed via a browser or on your mobile phone. For more details on trading platforms and how they work, check out our guide on trading platforms.

Forex Risk Disclaimer

Trading Forex and CFDs is not suitable for all investors as it carries a high degree of risk to your capital: 75-90% of retail investors lose money trading these products. Forex and CFD transactions involve high risk due to the following factors: Leverage, market volatility, slippage arising from a lack of liquidity, inadequate trading knowledge or experience, and a lack of regulatory protection. Traders should not deposit any money that is not considered disposable income. Regardless of how much research you have done or how confident you are in your trade, there is always a substantial risk of loss. (Learn more about these risks from the UK’s regulator, the FCA, or the Australian regulator, ASIC).

Our Rating & Review Methodology

Our Broker Awards and Forex Rankings Report and Directory of CFD Brokers to Avoid are the result of extensive research on over 180 Forex brokers. These resources help traders find the best Forex brokers – and steer them away from the worst ones. These resources have been compiled using over 200 data points on each broker and over 3000 hours of research. Our team conducts all research independently: Testing brokers, gathering information from broker representatives and sifting through legal documents. Learn more about how we rank brokers.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers, and she now has over eight years experience in research and content development. She has tested and reviewed 100+ brokers and has a great understanding of the Forex trading world.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

References

These documents were used in the research and data collection for this page

- Financial Sector Conduct Authority (FSCA). (2022). Annual Report 2021/2022. Pretoria: Financial Sector Conduct Authority: https://www.fsca.co.za/Annual%20Reports/FSCA%20Annual%20Report%202021-2022.pdf

- Moneysmart.gov.au. (n.d.). Forex trading. Retrieved January 2023, from moneysmart.gov.au: https://moneysmart.gov.au/investment-warnings/forex-trading

- Financial Conduct Authority. (2022, December 1). Contract for differences. Retrieved January 2023, from FCA Financial Conduct Authority: https://www.fca.org.uk/firms/contracts-for-difference

- Cyprus Securities and Exchange Commission. (n.d.). Contracts for Difference (CFDs). Retrieved January 2023, from Cyprus Securities and Exchange Commission: https://www.cysec.gov.cy/CMSPages/GetFile.aspx?guid=b6cc8078-ad78-43b1-af3d-62723f48e85f

- Spotware. (n.d.). cTrader Overview. Retrieved January 2023, from Spotware: https://www.spotware.com/ctrader/trading/ctrader-trading-platform-overview

- Metaquotes. (n.d.). Metatrader 5 Trading Platform. Retrieved January 2023, from Metaquotes: https://www.metaquotes.net/en/metatrader5

- Metaquotes. (n.d.). Metatrader 4. Retrieved January 2023, from Metaquotes: https://www.metatrader4.com/en/trading-platform

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.