-

Best Forex Brokers

Our top-rated Forex brokers

-

Brokers for Beginners

Start trading here

-

Forex Demo Accounts

Learn to trade with no risk

-

ZAR Trading Accounts

Save on conversion fees

-

Lowest Spread Brokers

Raw spreads & low commissions

-

ECN Brokers

Trade with Direct Market Access

-

No-deposit Bonuses

Live trading with no deposit

-

High Leverage Brokers

Extend your buying power

-

Islamic Account Brokers

Best accounts for Muslim traders

-

Market Maker Brokers

Fixed spreads & instant execution

-

All Trading Platforms

Find a platform that works for you

-

TradingView Brokers

The top TradingView brokers

-

MetaTrader4 Brokers

The top MT4 brokers in SA

-

MetaTrader5 Brokers

The top MT5 brokers in SA

-

cTrader Brokers

The top cTrader brokers in SA

-

Forex Trading Apps

Trade on the go from your phone

-

Copy Trading Brokers

Copy professional traders

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | FCA, CySEC, FSA-St-Vincent, FSC |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 400:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Forex, Cryptocurrencies, Metals, Commodities, Spread Betting |

Last Updated On May 8, 2023

75-90% of retail traders lose money trading Forex and CFDs. You should consider whether you understand how CFDs and leveraged trading work and if you can afford the high risk of losing your money. We may receive compensation when you click on links to products we review. Please read our advertising disclosure. By using this website, you agree to our Terms of Service.

Our verdict on ATFX

ATFX has taken the decision to cease providing services to retail clients with immediate effect. It is therefore unable to accept any applications. We recommend looking at BDSwiss and XTB as alternatives.

ATFX is a well-regulated STP broker founded in 2017 in London and has expanded rapidly over the last few years. Four account types are offered (including a commission-based Raw Account), but minimum deposits are high, and spreads are wide on all but the most expensive account types. MT4 is the only trading platform supported.

Education is excellent and market analysis is offered by the globally renowned Trading Central. Both deposits and withdrawals are free and Autochartist is offered for free on all account types.

| 🏦 Min. Deposit | USD 100 |

| 🛡️ Regulated By | FCA, CySEC, FSA-St-Vincent, FSC |

| 💵 Trading Cost | USD 10 |

| ⚖️ Max. Leverage | 400:1 |

| 💹 Copy Trading | Yes |

| 🖥️ Platforms | MT4 |

| 💱 Instruments | Forex, Cryptocurrencies, Metals, Commodities, Spread Betting |

Overall Summary

Account Information

Trading Conditions

Company Details

Pros

- Well regulated

- Wide range of assets

- Copy trading accounts

- Good range of accounts

Cons

- MT4 only

- High minimum deposit

Is ATFX Safe?

ATFX is a relatively new CFD broker, founded in London in 2017, but has expanded rapidly in recent years, winning widespread recognition from traders and its industry peers.

ATFX’ subsidiary companies are regulated by a number of different national authorities depending on your location:

- AT Global Markets LLC is a Limited Liability Company in Saint Vincent and the Grenadines with company number 333 LLC 2020.

- AT Global Markets (UK) Ltd is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom with registration number 760555.

- ATFX Global Markets (CY) Ltd is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under the license no. 285/15.

- AT Global Markets Intl Ltd is authorized and regulated by the Mauritius Financial Services Commission with license number C118023331.

The company’s subsidiary in the UAE, AT Capital Markets, briefly held a licence from the Abu Dhabi Financial Services Regulatory Authority (FSRA), but this was suspended and the company fined in December 2019 after it was found that the company had been conducting regulated activities before it was granted permission to do so. AT Capital Market’s CEO has since resigned from the company.

Since its inception in 2017, ATFX has won numerous awards including FX Broker of the Year, UK (The European Business Awards 2018), Best Forex CFD Broker (UK Forex Awards 2018), Most Transparent Broker (World Forex Awards 2019) and Best Online Trading Services (ADVFN International Financial Awards 2020).

All ATFX customers, no matter their location, benefit from segregated accounts. In the unlikely event of ATFX insolvency, segregated client funds cannot be used for reimbursement to ATFX creditors.

Overall, we would say that ATFX are a safe broker. It seems the licencing issue with the UAE authorities was an exceptional circumstance and regulatory oversight from the UK’s Financial Conduct Authority means that ATFX must maintain the highest standards of financial propriety.

ATFX Trading Conditions

ATFX is an STP broker, offering high speed market execution. Because orders are executed on the market, spreads are variable and will depend on liquidity and volatility.

Like most brokers ATFX offers several account types with slightly different trading conditions and deposit requirements. Spreads are not the tightest we have seen, especially considering the deposit requirements that ATFX expects from traders.

Account Types

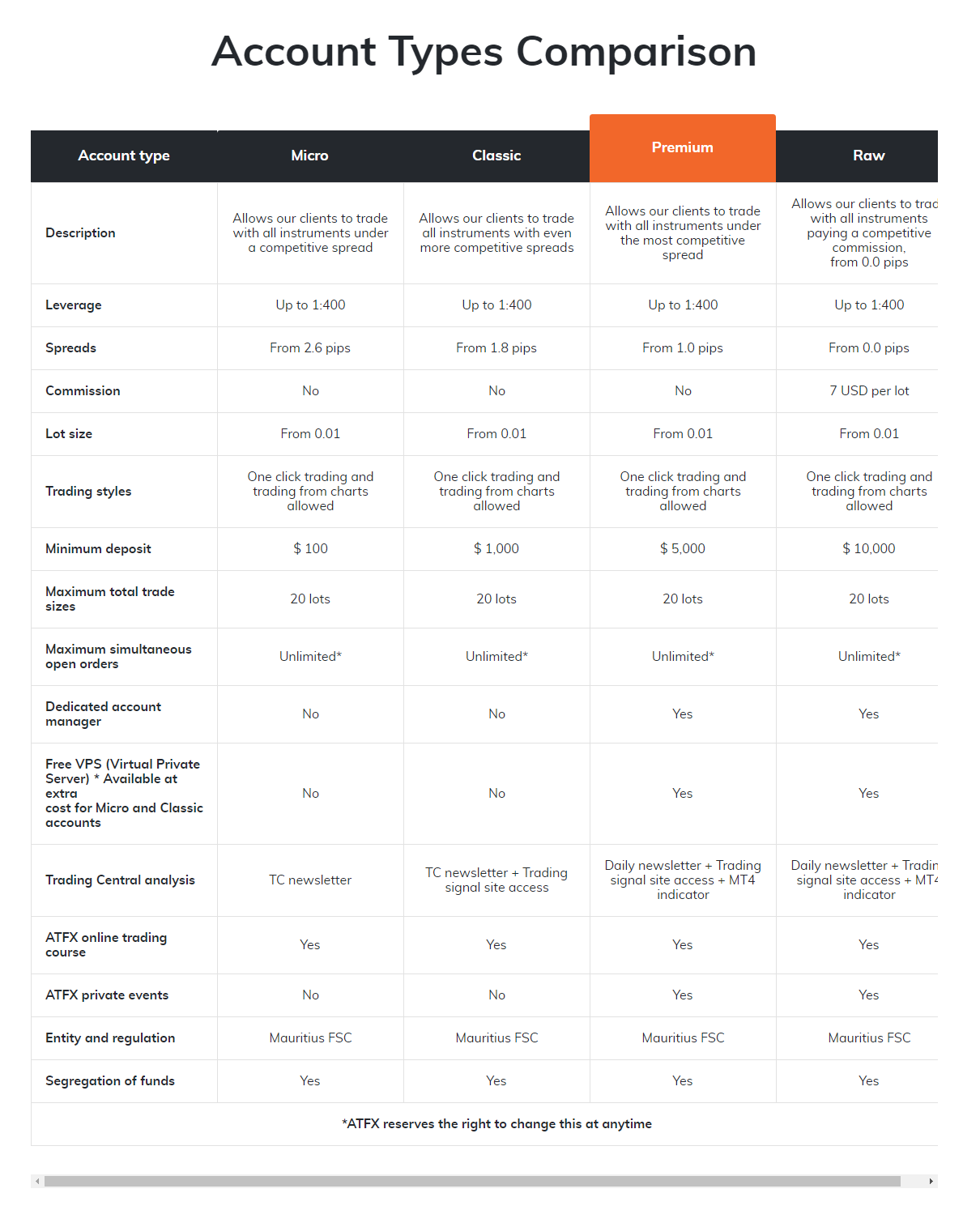

ATFX has four separate accounts types, the Micro, Classic, Premium and Raw. While all the accounts offer leverage up to 400:1 and a maximum trade size of 20 lots, they have radically different minimum deposits and spreads.

Micro Account: The Micro Account is ATFX’ smallest account, requiring a minimum deposit of only 100 USD. Spreads are wide on this account, starting at 2.6 pips, and no dedicated account manager is provided.

Classic Account: The Classic Account requires a minimum deposit of 1000 USD and spreads start 1.8 pips, still relatively wide for an account requiring this much initial investment. Like the Micro Account, no dedicated manager is provided.

Premium Account: The Premium Account offers spreads from 1 pip but requires a minimum deposit of 5000 USD to get started. Additionally, this account provides access to a dedicated account manager, free VPS and Trading Central.

Raw Account: The Raw Account is a commission-based account, providing access to raw spreads from as low as 0 pips. This account requires a minimum deposit of 10,000 USD and commission is charged at 7 USD per lot (3.5 USD per lot, per side). Like the Premium Account, you will also have access to a dedicated account manager, free VPS and Trading Central.

Spreads and Commission

As mentioned above, spreads are wide at ATFX. It is hard to tell what the average spreads are for each account type as only minimum spreads are published, and only for one of the accounts (but which one is not made clear). As per ATFX minimum spreads on the EUR/USD start at 1.5 pips and the AUD/USD at 2.2 pips.

Commission is charged only on the Raw Account and stands at 7 USD round turn.

Deposit and Withdrawal

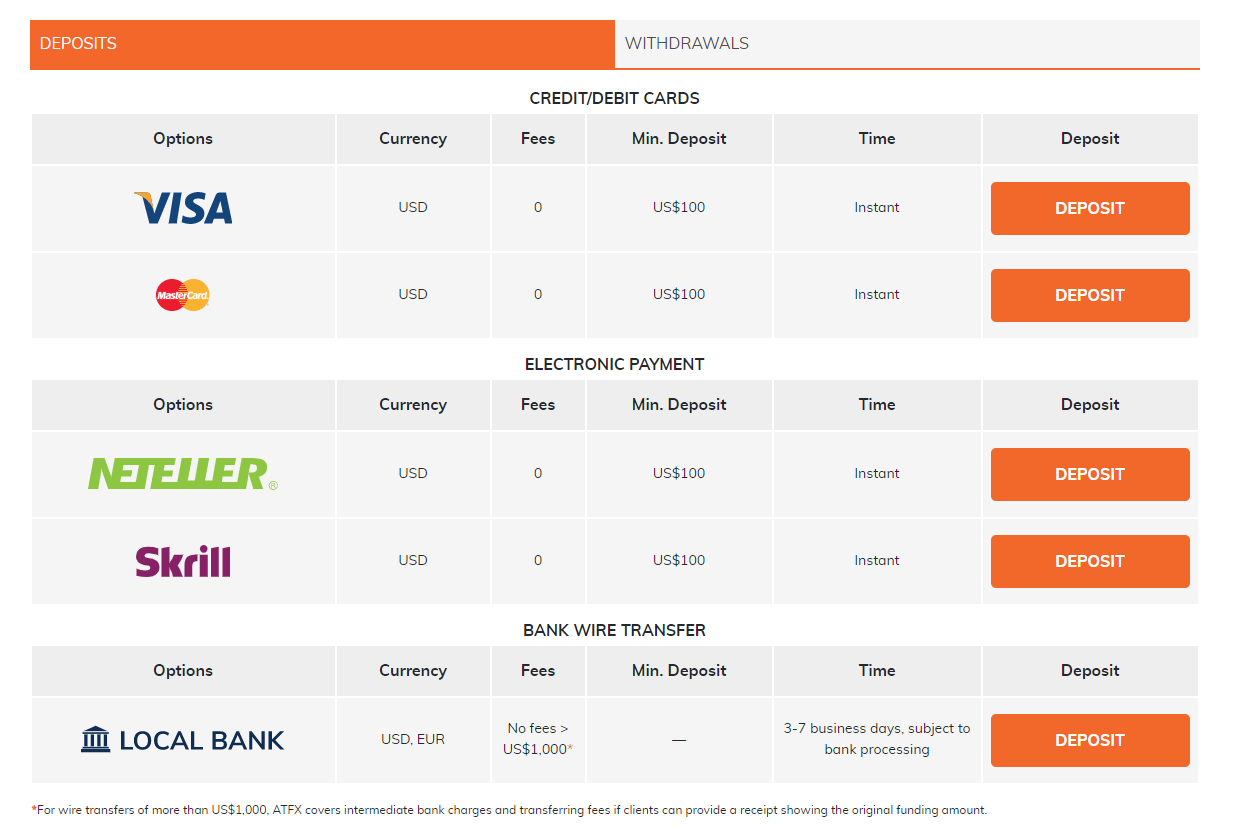

ATFX only allows deposits and withdrawals in USD (or EUR in the case the bank transfers) but charges no fees for either. In the case of bank transfers, your bank may charge you for transfers but ATFX will cover all bank fees for deposits of over 1000 USD. Like most brokers, withdrawals can only be made by the same method as the original deposit.

Deposit and withdrawal methods include:

- Visa/Mastercard: Free deposits and withdrawals. Minimum deposits of 100 USD. Deposits are instant, but withdrawals are subject to your bank processing time.

- Neteller/Skrill: Free deposits and withdrawals. Minimum deposits of 100 USD. Deposits and withdrawals are both instant.

- Bank Transfer: Free deposits and withdrawals, though your bank may charge you. No minimum deposit required. Both deposits and withdrawals will take between 3-7 business days.

Be aware that all funds deposited will be converted to USD and then back again into your local currency upon withdrawal.

ATFX for Beginners

ATFX has invested heavily in a comprehensive set of resources for beginner traders. Its education section is well-structured, thorough, and genuinely useful for new traders. Market analysis is also present, though most of the analysis is provided by Trading Central, though this is not really a complaint as Trading Central is probably one of the best providers of market analysis in the world.

Educational Material

ATFX’s educational material can be found in its dedicated Forex Education Center. Here you will find Introduction Courses, In-depth Courses, and wide range of eBooks.

Introduction Courses: A selection of 6 courses covering Metatrader tutorials, an introduction to global economics and an overview of social trading. More impressive is the library of 28 videos providing a clear and concise introduction to Forex trading.

In-depth Courses: Once you have grasped the basics of the Forex market, this selection of courses is perfect for continuing your education. The cryptocurrency market, trading tools and trading strategies are all covered here.

ebooks: A small library of 14 short eBooks. A range of topics are covered here for those who want a deeper understanding of the topics covered in the courses. Topics include technical analysis, advanced strategies, trading psychology and capital management.

Analysis Material

ATFX has partnered with Trading Central, the world’s best market analysis resource. The technical strategies and professional data provided by Trading Central covers Forex, precious metals, commodities, and indices from sources such as Bloomberg, Thomson Reuters, and Dow Jones. ATFX also hosts video clips of Trading Central analysis, these are updated on an hourly basis.

While all ATFX account holders will have access to Trading Central, only those with Classic, Premium and Raw Account will get full access to Trading Central’s signals library.

ATFX also publishes its own quarterly market outlook, which is available to all visitors just by registering your email address.

Customer Support

Customer Support is available 24/7 via phone, email, and live chat. ATFX does not have a local support team or office in South Africa so the best method of contacting customer support would be via email or live chat.

ATFX Trading Platforms

Currently, ATFX only supports MetaTrader 4 (MT4). The MT4 trading platform is the most widely used Forex trading platform and can also be used to trade other instruments like commodities, cryptocurrency, stock index, and stock CFDs. Though it is now showing its age, MT4 is still popular for its auto trading features that enables algorithmic trading and strategy back testing with expert advisors (trading robots).

MT4 comes preloaded with over 30 technical indicators, while giving traders access to 9 different timeframes and several chart types. A lightweight platform, MT4 has enhanced trading speed, while remaining robust and stable on all systems and even over slower internet connections.

MT4 is available as a desktop download and as a web platform, running in browser. ATFX will also support the MT4 Android and iOS apps, for those who wish to trade on the move.

ATFX Trading Tools

As mentioned above, ATFX has partnered with Trading Central for market analysis, this includes providing traders with Trading Central’s MT4 Analysis indicators. In addition, all ATFX customers gain access to AutoChartist, a powerful pattern recognition tool that monitors all markets to find the best trading opportunities based on real-time technical analysis.

Trading Central

ATFX traders with Premium and Raw Accounts will get free access to the new Trading Central MT4 Analysis Indicators. This new MT4 trading indicator has been intricately created to make trading easier, intuitive, and more accessible than ever before.

- Receive consistent up-to date information from analysts you can trust

- Information can be viewed in multiple languages, catering for traders globally

- Stay informed with commentary and analytical forecasts

- Fill order based on Trading Central levels

AutoChartist

All ATFX customers get free access to AutoChartist. Autochartist uses an advanced recognition programme that allows it to identify chart patterns and key price levels across all major markets, including FX and CFD instruments. Both beginner and experienced traders can benefit from the features offered by Autochartist. Autochartist provides high-probability opportunities and helps predict upcoming trends with accuracy and speed.

![]()

![]()

Evaluation Method

We value transparency and openness in the way we review the partners. To bring transparency to the forefront, we have published our review process that includes a detailed breakdown of the ATFX offering. Central to that process is the evaluation of the reliability of the broker, the platform offering of the broker and the trading conditions offered to clients, which are summarised in this review. Each one of these is graded, and an overall score is calculated and assigned to the broker.

Risk Statement

Trading Forex is risky, and each broker is required to detail how risky the trading of Forex CFDs is to clients. ATFX would like you to know that: CFDs and Margin FX are leveraged products that carry a high level of risk to your capital. Trading is not suitable for everyone; losses can exceed deposits. You should only trade with money you can afford to lose.

Overview

ATFX is a relatively new broker, and this does show in some areas. While education and market analysis are strong, spreads are wide compared to other brokers of a similar type and only the MT4 trading platform is supported. While it is always great to see free deposits and withdrawals, we would also like to see more account types with lower minimum deposits. As it stands, most beginners would be restricted to the Micro Account, which has punishingly wide spreads. It is also a shame that the minimum deposit on the Raw Account puts it out of reach of most traders.

Editorial Team

Chris Cammack

Head of Content

Chris joined the company in 2019 after ten years experience in research, editorial and design for political and financial publications. His background has given him a deep knowledge of international financial markets and the geopolitics that affects them. Chris has a keen eye for editing and a voracious appetite for financial and political current affairs. He ensures that our content across all sites meets the standards of quality and transparency that our readers expect.

Alison Heyerdahl

Senior Financial Writer

Alison joined the team as a writer in 2021. She is the Senior Editor for FXScouts. She has a medical degree with a focus on physiotherapy and a bachelor’s in psychology. However, her interest in forex trading and her love for writing led her to switch careers. She has a passion for Forex trading and over a decade of editorial experience researching Forex and the financial services industry, producing high-quality content. She hosts a weekly podcast, “Let’s Talk Forex,” alongside her colleague, Chris, and has produced over 100 Forex educational videos for the FXScouts YouTube channel. She also writes weekly technical analyses and has tested and reviewed over 100 Forex brokers.

Ida Hermansen

Financial Writer

Ida joined our team as a financial writer in 2023. She has a degree in Digital Marketing and a background in content writing and SEO. In addition to her marketing and writing skills, Ida also has an interest in cryptocurrencies and blockchain networks. Her interest in crypto trading led to a wider fascination with Forex technical analysis and price movement. She continues to develop her skills and knowledge in Forex trading and keeps a close eye on which Forex brokers offer the best trading environments for new traders.

Compare Brokers

Find out how ATFX stacks up against other brokers.

Stay updated

This form has double opt in enabled. You will need to confirm your email address before being added to the list.